Introduction

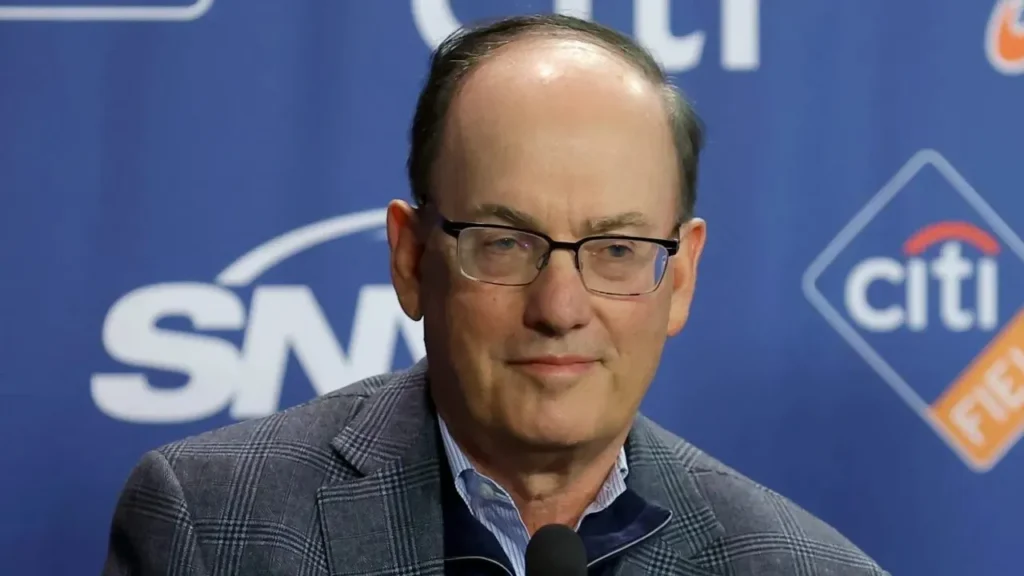

Steve Cohen is one of the most consequential figures in modern finance. His life reads like a study in ambition, skill, controversy, and reinvention. From trading desks to founding one of the most influential hedge funds of its generation, to navigating legal and reputational crises, to rebuilding a diversified investment platform and becoming a major sports owner Cohen’s story contains lessons about risk, leadership, governance, and legacy.

Quick Facts

| Item | Detail |

| Full Name | Steven A. Cohen |

| Date of Birth | June 11, 1956 |

| Age (2025) | 69 (turning 70) |

| Birthplace / Hometown | Great Neck, New York |

| Education | BSc in Economics, Wharton School, University of Pennsylvania |

| Main Professions | Hedge fund manager, investor, sports franchise owner |

| Major Firms | S.A.C. Capital Advisors (former), Point72 Asset Management (current) |

| Sports Ownership | Majority owner of the New York Mets (since 2020) |

| Estimated Net Worth (2025) | ~ US$21.3 billion |

| Assets Under Management (AUM) | Point72 ~ US$36–40 billion (approx.) |

Early Life & Background

Family & Upbringing

Steven A. Cohen grew up in Great Neck, New York, one of eight children in a family where work ethic and hustle were central. His father ran a small costume factory and his mother taught piano a mix of commerce and culture. Cohen’s early environs highlight competition, focus, and practical problem solving.

He was drawn to games and activities that sharpened chancy thinking: card games like poker and bridge, where pattern recall, reading behavior, and risk-estimation are key. These youthful habits augur a later aptitude for rapid decision-making and probabilistic bets in markets.

Education & First Steps

Cohen studied finance at the Wharton School and graduated in 1978. While still a student, a friend helped him open his first fee account with roughly $1,000, a bold move that signaled early purpose. After college he joined Gruntal & Co., where he spent more than a decade on an unshared trading desk gaining hands-on event managing capital and learning the mechanics of worth trading.

These years served as on-the-job training in market microlevel, trade execution, and building a high-performance trading mindset.

Career Journey

Gruntal & Co.: The Training Ground

At Gruntal, Cohen traded firm capital and learned how to combine fundamental analysis with fast execution. He developed a trader’s intuition: spotting mispricings, adjusting position size, and managing short-term risk. That multi-year apprenticeship gave him both confidence and the network of people who would later staff his own firm.

Launching S.A.C. Capital (1992)

In 1992 Cohen founded S.A.C. Capital Advisors, positioning it as an aggressive, research-driven equity trading operation. The firm hired numerous analysts and traders, built intensive information routines, and used outsized conviction positions to generate profits. Over the late 1990s and early 2000s, S.A.C. rose to dominance, delivering exceptional returns and attracting vast capital.

Growth & Reputation of S.A.C.

S.A.C. became synonymous with speed, secrecy, and performance. The firm’s success created reverence and scrutiny. Sources described S.A.C. as an “alpha factory” a place that turned talent, data, speed, and decisive bets into returns. That model delivered enormous gains but also concentrated risk, both financial and regulatory.

Insider-Trading Scandal & Settlement

The very practices that powered S.A.C. also exposed it. Investigations into insider trading culminated with S.A.C. pleading guilty in 2013 and agreeing to roughly US$1.8 billion in fines and forfeitures. As part of a negotiated settlement, Cohen was barred from managing outside investor money for two years. The scandal and its consequences marked a public nadir for Cohen’s career and forced structural change.

Rebirth: Point72 & Reentry

Cohen used the setback to rebuild. He reconstituted his operation as Point72 Asset Management, first as a family office managing his own capital (2014), then gradually expanding processes, compliance, and governance. Point72 invested in diverse strategies, discretionary equities, quantitative systems, macro, private investments, and ventures.

By 2018 Point72 began accepting outside capital again, signaling a full operational revival under stronger internal controls and more robust risk frameworks.

Strategic Shifts into 2024–2025

Leading into 2024–2025, Cohen made two notable strategic shifts:

- Moving away from personal trading Cohen announced in 2024 he would stop trading his own book, moving to an oversight and strategy role.

- Expanding into new asset classes Point72 increased its footprint in private credit, technology/AI investments, and venture-style opportunities. In early 2025 the firm publicly launched a private credit strategy, reflecting a diversification away from pure public market alpha-hunting.

These changes reflect both maturation of the organization and a pragmatic response to a changing market environment.

Investments, Strategy & Key Moves

Understanding how Cohen allocates capital explains much about both his risk appetite and how Point72 operates.

Core Investment Philosophy

Cohen’s investment approach can be summarized in a few interlocking principles:

- Edge through research: Investments must be rooted in an informational advantage or rigorous insight.

- Speed and conviction: When confident, act decisively. Timing and execution are crucial.

- Diversify strategy types: Combine discretionary stock-picking with quant, macro, private credit, and venture.

- Governance and risk controls: Post-S.A.C., institutional safeguards are central.

- Talent-first culture: Hire skilled analysts, quants, and traders and let them operate within structured guardrails.

Point72: Strategy Buckets

Point72 is intentionally multi-bucket:

- Discretionary equities (fundamental research-based positions)

- Systematic/quant (data-driven models and signals)

- Macro/global strategies (rates, FX, commodities)

- Private credit and alternative lending (originating and holding credit positions)

- Venture and growth investments (early-stage and scale-stage bets via Point72 Ventures)

- Special situations / event-driven trades

This diversification reduces dependence on a single alpha source and builds resilience across market cycles.

Recent Strategic Moves & Talent Shifts

In 2025 Point72 made several operational moves:

- Launched a private credit unit to lend to companies outside the public markets.

- Hired experienced portfolio managers and relocated talent to strengthen regional hubs (e.g., London).

- Saw leadership churn in capital development but continued to invest in technology and research infrastructure.

Those shifts align with a broader hedge-fund industry trend: building fee-stable businesses that capture yield and returns across a range of market environments.

Example: Reading 13F Filings

Although Point72’s full portfolio is opaque, 13F filings provide clues to public equity exposures. Analysts use these disclosures to infer sector bets, frequently noticing concentration in areas like technology, healthcare, and industrials depending on market opportunity.

Net Worth & Financial Profile (2025)

Estimated Net Worth

As of mid-2025, several outlets estimated Cohen’s net worth at approximately US$21.3 billion. This estimate aggregates his stake in Point72, personal investments, sports ownership, and private assets. Net worth naturally fluctuates with market valuations, firm performance, and realized gains.

Point72: AUM & Firm Value

Point72’s reported Assets Under Management (AUM) are in the tens of billions, commonly cited in a range around US$36–40 billion. The firm’s growth, fee streams, and investment returns contribute materially to Cohen’s personal wealth.

Major Holdings & Asset Mix

Cohen’s wealth is split across several pillars:

- Equity stake in Point72: And associated carried interest.

- Public and private investments: Across sectors.

- Sports franchise ownership: The New York Mets (acquired in 2020 for an amount in the neighborhood of US$2.4 billion).

- Art and collectibles: A high-value art collection featuring major modern and contemporary works.

- Real estate and other private holdings.

Comparative Context

- Among sports owners, Cohen ranks near the top in net worth.

Compared to hedge-fund peers, he is among the wealthiest but not the very topmost globally. - Compared to his earlier private fortunes during S.A.C., his wealth today is more diversified and institutionalized.

Personal Life, Philanthropy & Legacy

Personal Life & Art

Cohen has been married twice; with Alexandra Garcia (married 1992), he shares family life and philanthropy. He resides primarily in Greenwich, Connecticut, a cluster for finance-sector families. He is an avid collector of contemporary art, at times spending hundreds of millions on single works and building a collection valued in the hundreds of millions to a billion dollars.

One widely reported anecdote involves Picasso’s Le Rêve, a painting Cohen had an interest in that illustrates how art, money, and public attention intersect in the lives of modern collectors.

Philanthropy & Foundations

The Steven & Alexandra Cohen Foundation channels Cohen’s giving. Major focus areas include:

- Veterans’ health and services (notably the Cohen Veterans Network)

- Medical research and neuroscience

- Education and workforce development

- Arts and cultural institutions

Cumulative philanthropic giving totals in the hundreds of millions; large single gifts include a six-figure to seven-figure donation to institutions like community colleges and museums.

Public Image & Controversies

Cohen’s reputation is complex:

- The 2013 insider-trading scandal remains a prominent chapter in his biography.

- His comeback narrative rebuilding Point72 and strengthening compliance has softened parts of the stigma for some observers.

- Local and firm-level controversies and legal actions (e.g., employment claims) continue to arise and are part of the modern public record.

Observers describe Cohen as both fiercely competitive and intensely private: an individual capable of both aggressive action and careful institution-building.

Timeline of Key Events

| Year | Event / Milestone |

| 1956 | Born June 11 in Great Neck, NY |

| 1978 | Graduated Wharton, joins Gruntal & Co. |

| 1992 | Founds S.A.C. Capital Advisors |

| 2000s | S.A.C. reaches peak operations and influence |

| 2013 | S.A.C. pleads guilty to insider trading; pays ~US$1.8 billion; Cohen barred from managing outside money for 2 years |

| 2014 | Founding/restructuring into Point72 (family office) |

| 2018 | Point72 reopens to outside investors |

| 2020 | Acquires majority of the New York Mets |

| 2024 (Sep) | Cohen stops trading his own book at Point72 |

| 2025 | Launch of private credit strategy and continued strategic hires/expansion |

What You Can Learn: Lessons & Takeaways

There are practical lessons from Cohen’s arc that apply to investors, founders, and leaders:

- Resilience matters. After a serious professional setback, rebuilding with discipline and governance is possible.

- Institutionalize success. An enduring firm needs systems, controls, and distributed talent not only a star individual.

- Diversify intelligently. Spreading capability across strategies reduces exposure to any single market shock.

- Talent is leverage. Recruiting and retaining exceptional people is the core engine of alpha generation.

- Public trust is fragile. Regulatory and ethical lapses have long-lasting consequences; remediation requires tangible change.

- Legacy is multi-dimensional. Financial success, cultural contributions (art), philanthropy, and sports ownership all factor into modern legacy.

FAQs

A: As of September 2024, Cohen stopped trading his own book. He now focuses on strategy, oversight, and leadership.

A: S.A.C. pleaded guilty in 2013 and paid ~US$1.8 billion (split between fines and forfeiture). Cohen was banned from managing outside money for 2 years, and S.A.C. as previously structured was shut down.

A: Estimated around US$21.3 billion, according to Forbes and several financial sources.

A: The acquisition gives him exposure beyond finance, into prestige, long-term assets, branding, and an emotional platform. He sees sports franchises as a way to diversify and leave a legacy.

A: Today, his firm (Point72) is investing across multiple strategies: equities (discretionary), quant, macro, private credit, venture / growth, and alternative strategies.

Conclusion

Steve Cohen’s story is a study in contrast to extraordinary skill and ambition, a public fall, and an intended exception. From the rapid-fire trading culture of S.A.C. Capital to the regulated, multi-strategy platform of Point72, and from high-stakes markets to ownership of the New York Mets, his career shows how talent, resources, and constant focus can build and rebuild enormous control. His journey also reminds us that victory without strong governance can be fragile, and that rallying often requires modesty, systems, and long-term thinking.

Today Cohen sits at the convergence of finance, culture, and Charity: a billionaire investor who has shifted from hands-on trading to supervising a broader enterprise, while channeling considerable resources into veterans’ healthcare, scientific research, and the arts. His net worth and firm scale reflect both past alpha and modern diversity, but the more important legacy may be the uninteresting lessons on how to turn individual edge into organizational permanence, and how to balance aggressive capital assignment with compliance and reputation management.

For investors, founders, and leaders, Cohen’s path offers three practical takeaways: (1) regulate your advantages so they outlast any single person, (2) diversify logically across strategies and asset classes to weather shifts, and (3) treat trust as capital rebuilding credibility requires limpid systems, sustained charity, and consistent behavior over time.