Introduction

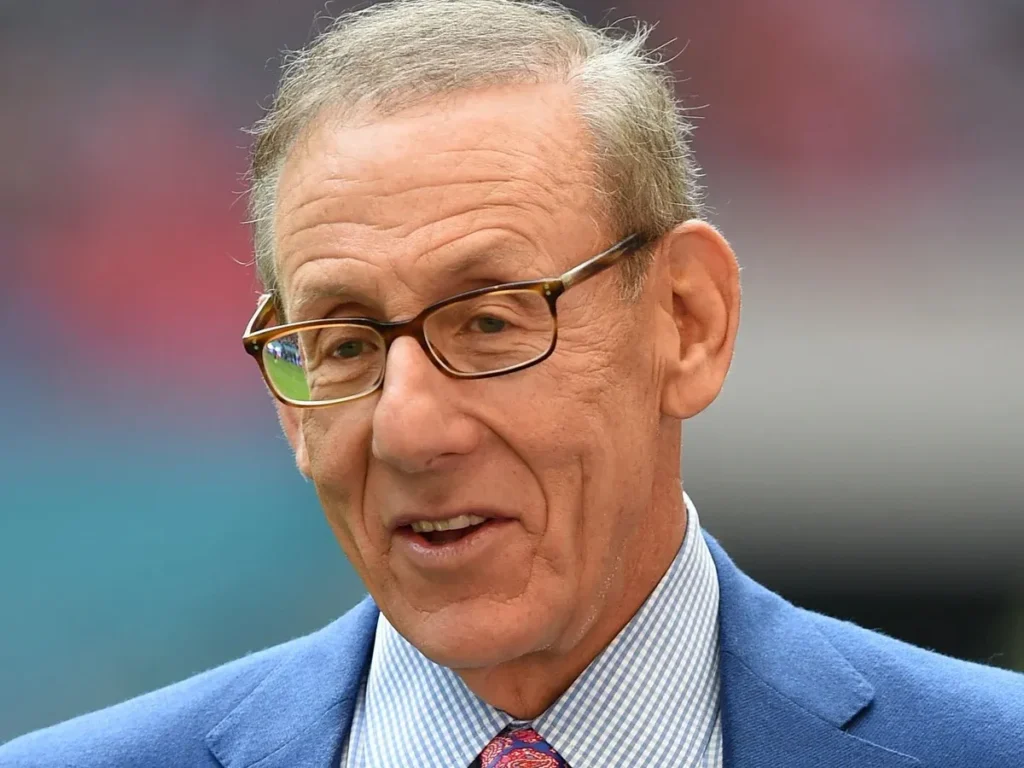

Stephen M. Ross is one of the most control real-estate power agent in modern America. From reshaping Manhattan’s skyline with Hudson Yards to revisiting luxury, sports, and urban living through Related establishment, Ross has built more than property he has built entire environs. As owner of the Miami Dolphins and Hard Rock Stadium, his reach expand from global growth and growth to sports and culture. In the mid-2020s, Ross began diverting capital and strategy toward Florida through Related Ross, waving a broader transfer toward the Sun Belt. Admired for his generosity and ambition yet pursued for his political ties and urban impact, Ross stands as an explained figure in how private capital shapes public space in the 21st century.

Quick facts

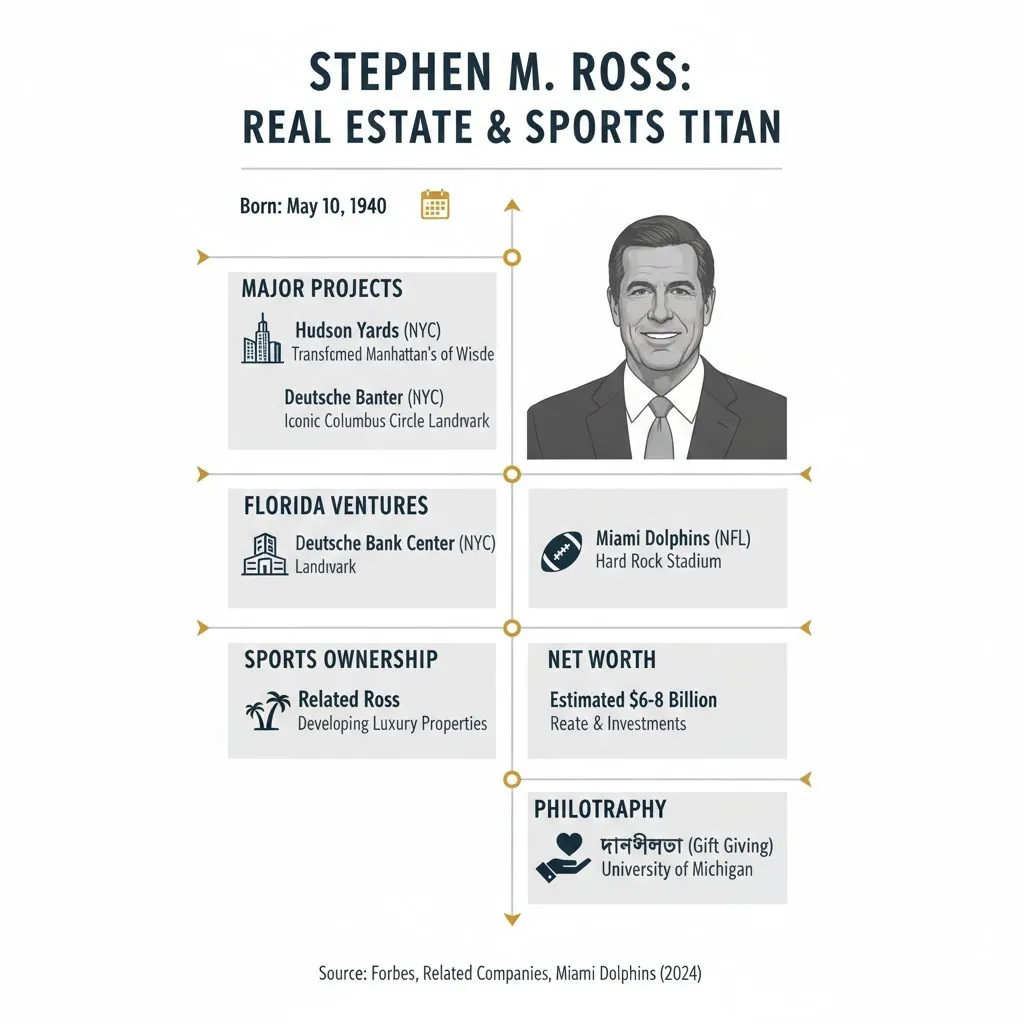

| Item | Detail |

| Full Name | Stephen M. Ross |

| Born | May 10, 1940 (Detroit, Michigan) |

| Age (2026) | 84–85 |

| Known for | Founder of Related Companies; owner of Miami Dolphins |

| Major projects | Hudson Yards, Deutsche Bank Center (former Time Warner Center) |

| New venture (2024–25) | Related Ross (Florida) |

| Main businesses | Real estate, sports, hospitality, investments |

| Estimated net worth | Multi-billion (private holdings make exact figures uncertain) |

Childhood and education

Stephen Ross grew up in Detroit in a modest, working-class household. He demonstrated early interest in business and law. Ross earned a BBA from the University of Michigan, studied law (JD) at Wayne State University, and completed an LLM in taxation at NYU. His legal and tax training became a plan advantage when he moved into real estate: apprehension tax incentives, public financing, and organize deals allowed him to build a aggressive edge in project finance and housing initiatives.

Career story: how he built Related Companies

Early years: start small, think big

In 1972, Ross founded Related Companies. The firm’s untimely work consisted on sponsor and tax-credit housing. Those initial projects were modest in scale but taught Ross how to navigate multiplex capitalize, government programs, and manufacture logistics. He learned to gather capital, work with public mastery, and deliver projects on time skills that scaled well into larger enlargement.

Growing the business: from rentals to mixed-use

During the 1980s and 1990s, Related shifted into higher-end apartment buildings, mixed-use developments, and complex urban projects. The company’s strategy combined residential units, commercial space, retail, and public realms into unified master plans. This integrated approach proved attractive to institutional partners, lenders, and residents — and helped Related capture outsized value by controlling multiple revenue streams in single developments.

Hudson Yards: the big headline project

Hudson Yards is the single most visible symbol of Ross’s ambition and scale. Built on Manhattan’s far West Side, Hudson Yards is a roughly 28-acre mixed-use campus that includes office towers, residential buildings, retail space, cultural elements, and public plazas. The project required complex land deals, massive engineering (building over rail yards), and layered financing including equity, debt, and tax-increment strategies.

Why Hudson Yards matters:

- It demonstrated that Related could manage extremely large, long-term, and technically difficult projects.

- It packages offices, homes, retail, and public space to capture diverse revenue.

- It reshaped perceptions about private development’s role in city building and sparked debates about urban design, public access, and economic distribution.

Other major projects

Beyond Hudson Yards, notable Related developments include:

- Deutsche Bank Center (formerly Time Warner Center) at Columbus Circle — a mixed-use complex combining luxury residences, offices, retail, and performance venues.

- A national portfolio of rental housing, often mixing market-rate and affordable units to balance mission and margins.

- Hospitality partnerships and lifestyle investments that complement real estate projects with brands for fitness, retail, and hospitality.

Sports, entertainment & RSE Ventures

Miami Dolphins & Hard Rock Stadium

Ross acquired majority ownership of the Miami Dolphins in 2008–09 and controls Hard Rock Stadium. For Ross, team ownership isn’t just sports fandom, it’s an extension of his real-estate logic: stadiums enable ancillary development (hotels, retail, entertainment districts) and create recurring, branded experiences for fans. While sports investments can grow in value, they also invite intense public scrutiny and political entanglements.

RSE Ventures

In 2012, Ross co-founded RSE Ventures, an investment firm that backs companies in sports, media, and lifestyle sectors. RSE’s portfolio has included technology startups, sports media platforms, and consumer brands. RSE reflects a broader thesis: leverage domain expertise in sports and entertainment to create scalable, high-growth businesses beyond core real estate.

Philanthropy and civic work

Ross is a major donor to universities and research institutions. The University of Michigan’s business school carries his name after a transformational gift. He funds medical research, urban sustainability efforts, and civic programs that aim to improve cities. Ross also helped launch the Ross Initiative in Sports for Equality (RISE), a nonprofit designed to use sports as a platform for social change and racial equity. Philanthropy both reflects personal priorities and shapes public perception of his legacy.

2024–25 Pivot Related Ross and the Florida strategy

Why Florida?

In 2024–25, Ross launched Related Ross, a Florida-focused real estate operation targeting West Palm Beach, Palm Beach County, and other Sun Belt markets. Reasons for the shift include:

- Population and economic growth in Florida: migrations from higher-cost states have pushed demand for housing, retail, and commercial space.

- Tax considerations: Florida’s favorable tax environment appeals to capital and private individuals.

- Market opportunity: new development corridors and regional infrastructure projects offer development pipelines that differ from older coastal mega-cities.

What the pivot indicates

This “second act” shows adaptability: Ross is reallocating capital toward growth regions and diversifying geographic risk. For an octogenarian developer, the move proves strategic curiosity and a willingness to reposition the family office and operating companies to capture shifting demographics and investment flows.

Net worth & how Ross makes money

Estimating a private developer’s net worth is always approximate. Public lists may show a range; the true value depends on privately held assets, debt levels, and market valuations.

Main income and wealth sources

- Development profits: Selling or leasing newly developed buildings.

- Rental income: Ongoing cash flow from residential and commercial portfolios.

- Equity appreciation: Long-term value growth of properties and stakes in private firms.

- Sports ownership: The Miami Dolphins’ franchise value and related media/revenue streams.

- Investment vehicles: Returns from RSE Ventures and other private investments.

- Hospitality & brand partnerships: Licensing and co-development deals with lifestyle brands.

Why public estimates vary

- Many holdings are private or structured through partnerships that obscure direct ownership.

- Real-estate valuations move with market cycles and liquidity.

- Leverage amplifies or reduces net equity depending on debt levels and refinancing.

Controversies & public scrutiny

High-profile success invites scrutiny. Ross has appeared in headlines for:

- Political donations that produced public backlash and calls for accountability.

- Public relations moments connected to the Dolphins or stadium decisions.

- Questions about equity and access in mega projects critics argue projects like Hudson Yards highlight wealth concentration and the limits of private developers’ contributions to public benefit.

A candid article should name and summarize controversies while balancing achievements. Transparency matters for readers who want the full picture.

Personal life

Ross maintains residences in New York and Florida. He is married with children and participates in philanthropy and civic leadership. He values legacy building and has spoken publicly about the importance of giving back, city planning, and education.

Timeline key life events

| Year | Event |

| 1940 | Born May 10 in Detroit |

| 1962 | BBA, University of Michigan |

| mid-1960s | JD at Wayne State; LLM in Taxation at NYU |

| 1972 | Founded Related Companies |

| 1980s | Expansion into luxury and mixed-use projects |

| 2008–09 | Bought Miami Dolphins & Hard Rock Stadium |

| 2012 | Co-founded RSE Ventures |

| 2013 | Major philanthropic pledges |

| 2024 | Launched Related Ross (Florida-focused) |

| 2026 | Ongoing pivot and Florida activity |

Examples & case studies

Example 1: From subsidized housing to luxury towers

Ross’s company began in smaller, public finance deals. Profits and deal structuring experience built the runway to larger projects. This trajectory shows how technical skill in tax and financing can scale into large-scale urban development.

Example 2: Sports + real estate synergy

Owning the Miami Dolphins allowed Ross to think about stadium upgrades, adjacent development, and fan experiences that generate additional revenue. Sports ownership can be a lever for placemaking if managed carefully and transparently.

What entrepreneurs can learn from actical steps

- ?Learn deeply: Ross combined law, tax, and finance knowledge to structure deals better than many competitors.

- Start focused: Small, early wins fund credibility and bigger opportunities.

- Diversify: Branching into sports, hospitality, and investments spreads risk and uncovers synergies.

- Think long-term: Major projects can take a decade or more; patience and capital structure matter.

- Invest in reputation: Philanthropy and civic engagement build social capital that carries long-term value.

- Be adaptive: Ross’s Florida pivot shows you should follow demographic and tax signals rather than stay bound to legacy geographies.

FAQs

A: Exact numbers are not public because many of his assets are private. Public estimates have placed him in the multi-billion dollar range. His net worth changes with real estate values and investments.

A: He made money as a real estate developer through Related Companies. He built apartments, offices, and big mixed-use projects. He also owns the Miami Dolphins and invests via RSE Ventures.

A: Related Ross is a new firm Ross launched in 2024 to focus on development in Florida. It matters because it signals a big business shift and opportunity in the fast-growing Florida market.

A: His biggest projects include Hudson Yards in New York, the Deutsche Bank Center at Columbus Circle, and many rental and mixed-use buildings across the U.S.

A: Yes. He has given large donations to universities (including the University of Michigan) and to urban sustainability and research organizations. He also started RISE (Ross Initiative in Sports for Equality).

Conclusion

Stephen M. Ross embodies how practical knowledge, reciprocity, and long-term vision can transform modest starts into empire-scale businesses. His pivot toward Florida with Related Ross is pivotal because it signals where major capital and development activity may flow next, and because it can change local economies, housing supply, and civic architecture. For students of urban planning, investors, and policy makers, Ross’s moves are informative: they embellish how private capital, public policy, and place-making intersect, better or inferior.