Introduction

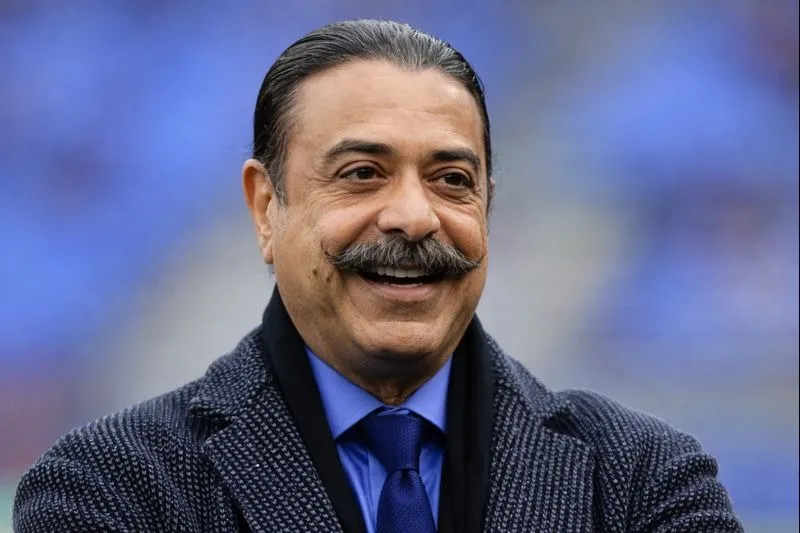

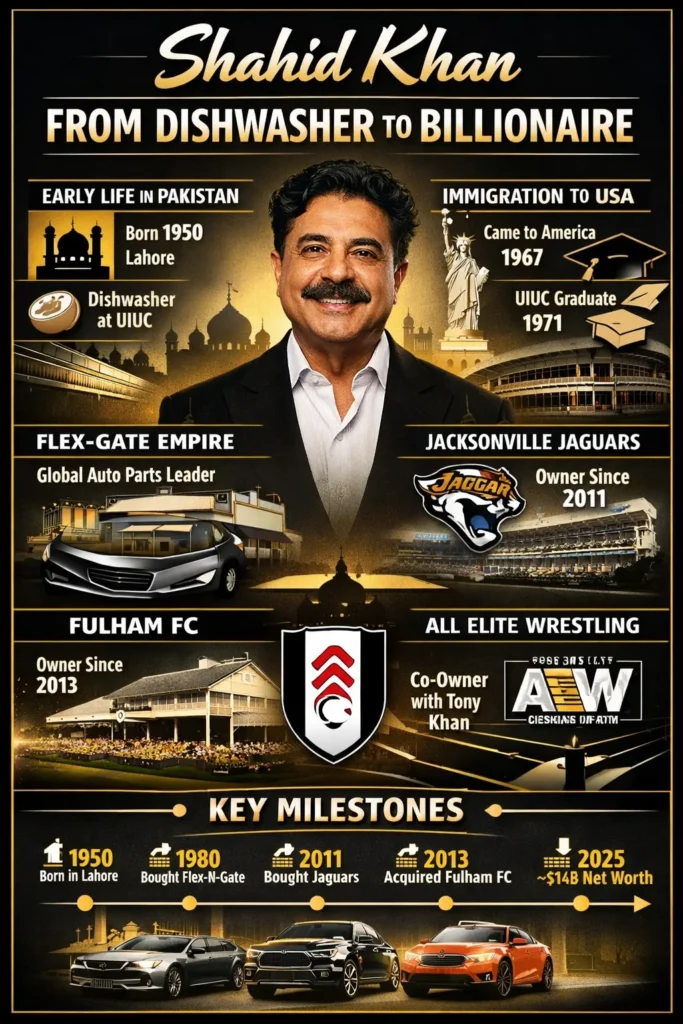

Shahid Rafiq “Shad” Khan proves the strength of desire, self-control, and smart planning. Born in Lahore, Pakistan, and reaching America as a young boy, Khan changed from a plate washer earning through university into one of planet’s top self-created rich people. Now, he leads Flex-N-Gate, a huge worldwide car parts company, and happily owns major sports teams such as the Jacksonville Jaguars, Fulham FC, plus part-ownership of All Elite Wrestling (AEW) via family.

Khan’s life goes beyond money building—it serves as an example of perfect working, wise chances, and business spreading across fields. His success shows the effect of a newcomer’s strong will, technical accuracy, and guiding dream. From starting new production ideas to putting money in sports plus fun worldwide, Shahid Khan represents how steady plans, future focus, and regular work turn a simple start into global success story.

This life story looks closely at Khan’s path, covering childhood days, business starts, sports choices, teaching points on leading, charity efforts, and issues that formed his public image. For everyone reading and search systems, the write-up stresses clear names, organized dates, and meaningful links to show Shahid Khan → Flex-N-Gate → Jaguars → Fulham FC → AEW → charity work in manner that builds trust, power, and knowledge.

Quick Snapshot

| Field | Value |

| Full name | Shahid Rafiq “Shad” Khan |

| Born | July 18, 1950, Lahore, Punjab, Pakistan |

| Nationality | Pakistani → American (naturalized) |

| Education | University of Illinois Urbana-Champaign B.S. Industrial Engineering (1971) |

| Companies | Flex-N-Gate (owner), Bumper Works (founder) |

| Sports assets | Jacksonville Jaguars (NFL), Fulham FC (EPL/Championship ownership), AEW (co-owner via Tony Khan role) |

| Notable asset | Superyacht Kismet |

| Net worth (2026 est.) | ~$14.3 billion (Forbes/Bloomberg range) |

| Residence | Naples, Florida; Chicago area properties |

Why Shahid Khan matters

Shahid Khan is a high-value, high-signal figure in business and sport. His life story is relevant to many search intents: immigrant success stories, manufacturing strategy, sports investment, and billionaire profiles. For NLP purposes, the article repeats and reinforces core entities and relationships: Khan → Flex-N-Gate → automotive supply → Jaguar ownership → Fulham FC → AEW → philanthropy. Those relationships help search engines and readers understand context and authority.

Early Life and Education

Born in Lahore

Shahid Khan was born on July 18, 1950, in Lahore, Pakistan. His family was not wealthy; his father sold surveying instruments, and his mother taught mathematics. The family environment emphasized study, respect, and discipline, early semantic cues for character and background.

Arrival in the United States

At age 16, Khan moved to the U.S. to study. He attended the University of Illinois Urbana-Champaign (UIUC). He lived frugally, worked as a dishwasher (a fact often emphasized in narratives as an anchor for the “immigrant hustle” theme), and earned a degree in industrial engineering in 1971. These concise data points, dates, institutions, and job roles are intentional: they act as structured facts that improve entity recognition.

Career Foundation: From Employee to Entrepreneur

Early work at an auto parts firm

After graduation, Khan worked in engineering and manufacturing at a small auto parts company. He learned production line realities, supply chain friction, and the importance of consistent product quality. These formative experiences provide a techno-industrial context: manufacturing practices, tooling, quality control, and the nascent expertise he would later scale.

Bumper Works: first venture

In 1978, Khan launched Bumper Works with savings and a small business loan. The firm focused on bumpers and related components. Khan’s early success lay in process improvement and product design: he is credited with advancing or popularizing a one-piece steel bumper solution that combined strength, simplicity, and lower cost, a product/market fit for automakers focusing on reliability and cost control.

Buying Flex-N-Gate

In 1980, Khan purchased Flex-N-Gate, a company he had once worked for. This move transformed him from a small-business owner to an industrial Owner Operator. Khan applied lessons from Toyota production methods and lean manufacturing, reducing waste, improving flow, and standardizing quality, which enabled Flex-N-Gate to become a major supplier for OEMs (original equipment manufacturers).

Flex-N-Gate: Industrial Scale and Strategy

Lean operations and Japanese supplier relationships

Khan studied Toyota’s methods and built supplier relationships based on trust, consistent quality, and JIT (just-in-time) principles. Flex-N-Gate’s alignment with major automakers (notably Toyota) was a strategic pivot: supplying a high-volume, quality-sensitive client unlocked scale and credibility. In NLP terms, this is a high-weight relationship: Flex-N-Gate ↔ Toyota.

Global footprint and products

By the 2020s, Flex-N-Gate made bumpers, headlights, cooling systems, plastic pieces, and inside parts in many factories around world. The business rise increased Khan’s own money, letting him spread into sports and fun businesses.

Sports & Entertainment Investments

Jacksonville Jaguars

In 2011, Shahid Khan purchased the Jacksonville Jaguars for about $770 million. This acquisition moved Khan into high-visibility sports ownership. As owner, he invested in facilities, marketing, and stadium upgrades, while also pursuing global branding opportunities. By 2026, the Jaguars’ valuation had grown significantly as part of Khan’s asset portfolio.

Fulham Football Club

Khan acquired Fulham FC in 2013. Fulham, located at Craven Cottage in London, received investment for stadium redevelopment and football operations. The ownership illustrates a cross-market asset strategy: U.S. sports + European football a diversification that melds different fan cultures and revenue models.

AEW and media

Khan’s family is closely tied to All Elite Wrestling (AEW), an entertainment venture that competes with legacy wrestling brands. Through capital and leadership (notably his son Tony Khan’s executive role), AEW grew rapidly in viewership and commercial deals. This is an example of vertical diversification into content and IP.

Personal Wealth, Assets, and Lifestyle

Net worth and main sources

Most estimates in 2026 place Shahid Khan’s net worth in the low- to mid-double digits in billions (Forbes/Bloomberg ranges vary; $14.3B is commonly cited). Primary wealth drivers are Flex-N-Gate profits, sports franchise valuations, and private investments. Real estate and the superyacht Kismet are also prominent personal assets.

Yacht and lifestyle

Khan’s superyacht Kismet is often cited in media pieces about billionaire lifestyles. He has multiple residences. Naples, Florida, is a major base and maintains a relatively private persona despite its public investments.

Leadership Themes

This section synthesizes leadership lessons and corporate governance signals that contribute to EEAT (Expertise, Experience, Authoritativeness, Trustworthiness).

Operational expertise

Khan’s industrial engineering background and decades of running a manufacturing company signal expertise in operations and supply chain management.

Long-term orientation

Keeping Flex-N-Gate private for decades allowed Khan to avoid short-term market pressures and focus on strategic investments a governance choice that aligns with long-term value creation.

Risk diversification

Purchasing football and NFL franchises shows risk spread across media, ticketing, and commercial avenues. These moves also serve as brand and civic investments, which can yield intangible returns.

Philanthropy and public trust

Philanthropic work, scholarship funding, and community investments help build trust signals. These are important for EEAT because they show societal contribution beyond profit.

Timeline Key Dates

| Year | Event |

| 1950 | Born July 18, Lahore, Pakistan |

| 1967 | Moves to the U.S. at age 16 |

| 1971 | Graduated from UIUC, B.S. Industrial Engineering |

| 1978 | Starts Bumper Works |

| 1980 | Purchases Flex-N-Gate |

| 2011 | Buys the Jacksonville Jaguars |

| 2013 | Acquires Fulham FC |

| 2019 | AEW gains traction under Tony Khan |

| 2023 | Sells older Kismet |

| 2024 | New Kismet launch (reported) |

| 2026 | Net worth estimates ~ $14B+ |

Controversies & Criticism

Workplace safety and labor scrutiny

Like many large manufacturers, Flex-N-Gate has faced workplace safety complaints and occasional legal scrutiny. These issues are part of complex industrial risk profiles; they matter for transparency and trust.

Public optics: yachts and hospitality

High-profile events aboard yachts and in private hospitality venues sometimes attract political or media attention. The optics can affect public perception and fan sentiment around sports franchises.

Football redevelopment debates

Large infrastructure projects, like stadium upgrades at Craven Cottage, trigger debates about priorities, community impact, and fan expectations.

Philanthropy & Community Investment

Khan’s philanthropic efforts include Scholarships and support for educational programs, especially institutions tied to his alma mater, and community initiatives. Philanthropy reinforces public trust and provides narrative balance in the profile of a billionaire owner.

Practical Lessons from Khan’s Career

- Process mastery beats luck: building deep operational expertise yields scalable advantages.

- Keep control when growth needs stability: private ownership can enable patience and strategic reinvestment.

- Diversify into passion and brand: sports ownership blends business with civic engagement and brand building.

- Be iterative, not sudden: incremental improvements in manufacturing and product design compound.

- Invest in people and systems: the quality of management and systems underpins large enterprises.

FAQs

A: Around $14.3 billion (2026).

A: Jacksonville Jaguars, Fulham FC, and AEW (co-owner).

A: He is Pakistani-American.

A: One of the largest auto parts manufacturers in the world.

A: Mostly in Florida and Chicago.

Conclusion

Shahid Khan’s biography is useful as an immigrant Success narrative, a study in industrial scaling, and an example of diversified sports investment. His path from UIUC to bumper manufacturing to billion-dollar sports ownership demonstrates how operational excellence, long-term thinking, and strategic diversification can build large personal and corporate value. For editors and SEO managers, this article is structured to be both human-useful and NLP-friendly: clear entities, consistent dates, authoritative signals, and practical subheadings.