Introduction

Robert Pera is an American engineer-turned-speculator who founded Ubiquiti in 2005 to make popular, high-showing wireless networking apparatus. He guided the company through an IPO in 2011 and obtain the Memphis Grizzlies in 2012. By 2025 Pera is widely concede as one of the affluent tech founders, with the majority of his approximate fortune tied to his controlling stake in Ubiquiti.

Quick facts

| Item | Detail |

| Full name | Robert J. Pera. |

| Born | March 10, 1978. |

| Known for | Founder & CEO of Ubiquiti; owner of the Memphis Grizzlies. |

| Net worth (2025 est.) | ≈ $24 billion (Forbes, Sept 2025). |

| Major stake | Controls a very large share of Ubiquiti (reported ~90%). |

| Education | UC San Diego B.S. Electrical Engineering; B.A. Japanese; M.S. Electrical Engineering. |

| Company IPO | Ubiquiti went public in 2011. |

| Bought Grizzlies | October 2012 (NBA approval later in 2012). |

Early life simple story

Robert Pera grew up in the San Francisco Bay Area during a pivotal era for computing and networking. Raised in and around Silicon Valley, he experience personal computers and early network technologies as they were becoming normal in an environment that fostered curiosity about devices and systems.

As a teen, Pera taught himself empirical computer repair and development and ran a small computer-services verge business. This early ambitious experience delivered practical lessons: determine problems quickly, speak with clients, and manage modest cash flow. He also played high-school ball; a subsequent heart issue heckle athletics for a time but contributed to his maturity and perseverance.

Education

Pera studied at UC San Diego, where he completed an undergraduate degree in electrical engineering and a bachelor’s in Japanese, then pursued a master’s focused on digital communications and radio frequency (RF) systems. The combination of technical depth and cross-cultural competence mattered for two reasons:

- Engineering foundation: RF, signal processing, and communications coursework gave Pera the technical vocabulary and skills to design and evaluate wireless hardware.

- Global fluency: Japanese language skills eased interactions with suppliers, manufacturers, and engineering teams in East Asia, where much hardware sourcing occurs.

This blend of technical expertise and cultural literacy proved to be a practical advantage for building a hardware company that sources components globally.

From Apple engineer to founder: the idea that became Ubiquiti

Before launching Ubiquiti, Pera worked at Apple on wireless hardware. There he gained hands-on experience with Wi-Fi chipsets, radio front-ends, antennas, and the real-world compromises engineers make for cost, reliability, and manufacturability. Two themes stood out from that period:

- Wireless silicon and RF techniques were improving rapidly, but many commercial products didn’t exploit the full capability of the chips or antennas because of conservative engineering choices, pricing layers, or expensive distribution models.

- There was significant demand for long-range, low-cost wireless connectivity in places with limited wired infrastructure ISPs, service providers in developing regions, educational networks, and rural broadband projects.

In 2005 Pera left Apple and founded Ubiquiti Networks with modest seed capital. His early thesis was uncomplicated: build technically rigorous, firmware-enhance radios and access points, minimize gratuitous distribution and marketing overhead, and rely on assimilation and vocal technical section for adoption. The first Ubiquiti products highlight long-range point-to-point wireless links that offered enterprise-class production at fiercelylower price points than incumbent solutions.

How Ubiquiti grew simple and powerful choices

Ubiquiti’s Growth wasn’t accidental. It was the result of deliberate product-architecture choices and a nontraditional go-to-market model. Below are the core strategies that enabled scale.

Product-first and firmware-driven

Ubiquiti treated hardware as an extensible platform: devices shipped with upgradable firmware so features, performance enhancements, and bug fixes could be delivered without hardware replacement. This approach increased device longevity, reduced churn, and turned each device into an evolving product. Customers benefited from continued functional improvements, and the company could iterate on product behavior after deployment.

Low marketing, high community

Rather than invest heavily in traditional marketing and mass retail, Ubiquiti cultivated a community of integrators, network professionals, and technically savvy hobbyists. Online forums, knowledge-sharing, and community-generated tutorials served as organic marketing channels. This strategy lowered customer-acquisition cost and produced strong word-of-mouth credibility among the professional buyer segment people who care more about documented performance than brand advertising.

Lean operations and margins

Ubiquiti operated with lean corporate overhead, prioritized engineering spend, and optimized its supply chain. By avoiding bloated sales and marketing budgets, the company could price products competitively while keeping healthy gross margins, a critical advantage in hardware where margins are often squeezed by distribution and retail. The lean posture enabled reinvestment in R&D and selective product line expansion.

Expansion of product lines

From its initial point-to-point radios, Ubiquiti enlarge into Wi-Fi systems, head switches, security cameras, observation platforms, and cloud-based management tools. That product diversity converted a attentive radio vendor into a broader networking platform: customers could buy access points, switches, and authority designed to interoperate, managed from a centralized console. This ecosystem effect increased the lifetime value of consumer who acquire various product families.

Public company, founder control, and ownership

Ubiquiti’s IPO in 2011 provided capital and public market exposure. Importantly, Pera structured his holdings to retain substantial voting control after the company went public. Analysts and commentators note that Pera maintained a supermajority-style influence over the company’s direction, a governance posture that allowed for patient, product-focused decision-making even as the company answered to public shareholders.

That concentrated control carries trade-offs. On the positive side, founder-led voting power can support long-term investments that sacrifice short-term earnings for stronger product differentiation. On the negative side, heavy founder control centralizes risk leadership missteps or governance misalignments can produce outsized impacts, and succession planning becomes a critical concern. When most of a founder’s wealth is concentrated in company stock, corporate events and stock-price volatility also translate quickly into personal wealth swings.

Why founder control matters: concentrated voting power can insulate product decisions from quarterly pressure, but it also concentrates operational and governance risks that higher oversight might otherwise mitigate.

The Memphis Grizzlies sports meets data

In October 2012, Robert Pera completed the purchase of the Memphis Grizzlies. Sports ownership is a different kind of enterprise: it blends high-visibility brand management, community relations, civic investment, and long-term franchise value creation.

Pera approached the Grizzlies with the same infrastructure and systems mindset that characterized his technology work. The ownership era emphasized facility improvements, increased investment in sports science and analytics, and community programs through the Grizzlies Foundation. Rather than seek flashy short-term moves, Pera focused on organizational stability, data-informed player development, and incremental improvements that compound over time. That strategy aligns with the patient, long-horizon view evident in his management of Ubiquiti.

Net worth 2025 where the money is

Estimating a billionaire’s net worth requires caution: public tallies are approximations that rely on share prices, disclosed stakes, and public filings. In 2025, multiple business publications reported that Robert Pera’s net worth was approximately $24 billion (Forbes, Sept 2025). The vast majority of that figure is concentrated in his ownership of Ubiquiti shares; Ubiquiti’s share-price appreciation since late 2023 contributed materially to the headline net worth number. Bloomberg and other wealth trackers similarly account for Pera’s concentrated equity position when compiling their indexes.

Important caveat: Public net-worth estimates do not capture all private assets, debt, tax strategies, or off-market holdings. They are useful shorthand for relative wealth but not definitive accounting.

Stock-performance note: Analysts and investor narratives in recent coverage pointed to strong returns for Ubiquiti shares in the 2023–2025 window, with some pieces describing multi-hundred-percent rallies for timeframes spanning late 2023 onward. These kinds of percentage statements are sensitive to the exact start and end dates, so cite precise dates when publishing.

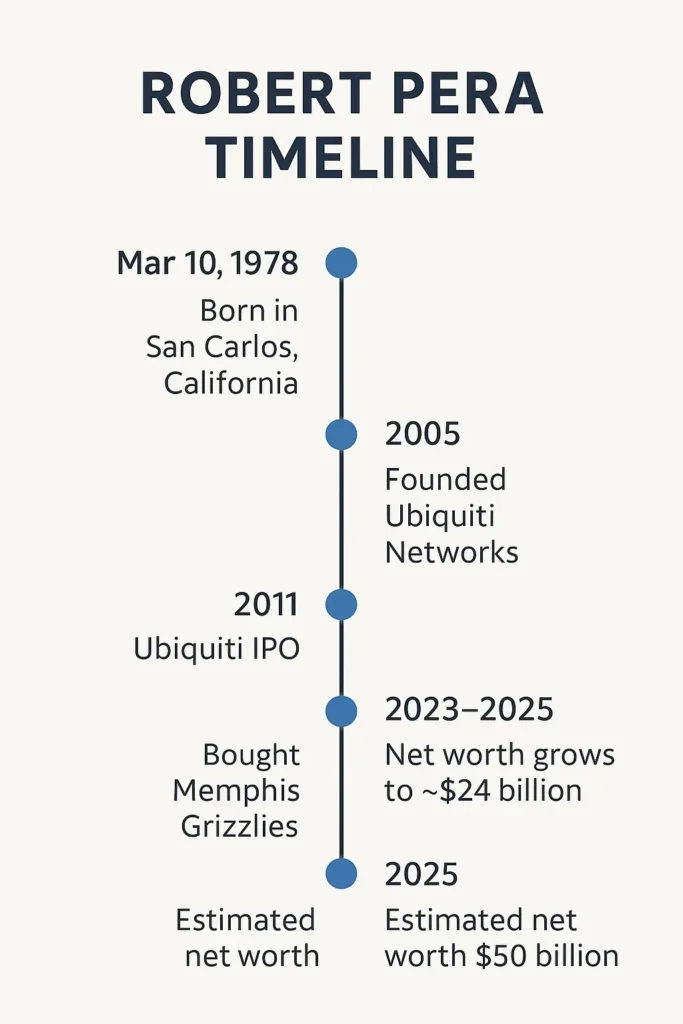

Simple timeline

| Year | Event & context |

| 1978 | Born March 10 in the Bay Area. Early exposure to personal computers and networking. |

| 1990s | Ran a small computer-services business in high school; early technical entrepreneurship. |

| 2000s | UC San Diego degrees in electrical engineering and Japanese; later an MS focused on RF and communications. Early engineering roles, including time at Apple. |

| 2005 | Founded Ubiquiti Networks, focusing on affordable long-range wireless equipment and firmware-driven devices. |

| 2011 | Ubiquiti IPO company goes public while founder retains strong control. |

| 2012 | Purchases the Memphis Grizzlies (transaction announced and approved in 2012). |

| 2023–2025 | Period of notable stock appreciation and increased media coverage; public estimates placed Pera’s net worth near ~$24B (Sept 2025). |

Pros and Cons

Pros

- Engineering-first decisions: Product choices were informed by deep technical understanding rather than purely by market positioning. That often yields better performance per dollar.

- Lean, efficient business model: Minimizing marketing and retail costs enabled aggressive pricing while preserving margins.

- Community-driven distribution: Engaged users and integrators did part of the marketing work, creating authentic technical endorsements.

- Founder control for long-horizon thinking: Strong founder influence permitted investment choices not strictly tied to quarterly metrics.

Cons

- Concentration of wealth: Heavy exposure to a single public company increases personal financial volatility. Good results amplify wealth rapidly, but negative shocks can be damaging.

- Founder-centralization risk: When the founder’s vision dominates governance, it can reduce institutional checks and complicate succession.

- Hardware market volatility: Hardware companies face supply-chain disruptions, tariffs, and rapid competitive shifts that can compress margins suddenly.

Ubiquiti product playbook

Goal: a concise roadmap that explains how Ubiquiti’s product and distribution model works in plain language.

- Hardware: Build price-competitive, high-performance radios, access points, and edge devices targeted at integrators, SMBs, and service providers.

- Firmware & software cadence: Deliver continuous firmware updates that add features, security patches, and performance tweaks.

- Centralized management: Provide a controller or cloud console for multi-site device orchestration, monitoring, and alerts.

- Distribution channels: Prioritize online direct sales, integrators, and specialized resellers instead of broad retail.

- Community support: Maintain a public knowledge base and forums where users can share solutions, easing support load and creating social proof.

When combined, these elements create a lower acquisition cost and higher lifetime value model for networking hardware companies.

FAQs

A: Robert J. Pera is an American engineer and entrepreneur. He founded Ubiquiti and owns the Memphis Grizzlies.

A: Mostly from his large ownership stake in Ubiquiti Inc., which sells networking hardware and software globally. Stock gains have driven much of his estimated net worth.

A: He agreed to buy the team in October 2012; the sale was approved by the NBA later that year.

A: Major outlets estimated his net worth around $24 billion (Forbes, Sept 2025). Estimates vary based on stock prices.

A: Ubiquiti uses low marketing, community-led distribution, and software-extendable hardware to keep costs down and product value high.

Conclusion

Robert Pera’s story shows how deep technical focus, disciplined execution, and long-term vision can create massive global impact. From his early experiments in radio design to founding Ubiquiti and building one of the world’s most efficient networking companies, Pera proves that innovation doesn’t need hype, it needs clarity, engineering, and consistency. His Ownership of the Memphis Grizzlies also reflects a belief in structure, analytics, and community rather than short-term fame.

As of 2025, Pera’s estimated net worth of $24 billion makes him one of the richest self-made engineers in tech. Yet he remains notably private focused on technology, performance, and sustainable systems. His journey offers a timeless lesson: if you build real value and stay focused on fundamentals, global recognition and wealth can follow naturally.