Introduction

Robert Kraft is an American billionaire businessman, global sports figure, and longtime owner of the New England Patriots, widely recognized for transforming the franchise into one of the most successful dynasties in NFL history. As the founder, chairman, and CEO of The Kraft Group a diversified corporation involved in packaging, real estate, sports, entertainment, and venture investments, Kraft built his empire through long-term strategy, disciplined acquisitions, and a keen understanding of brand value.

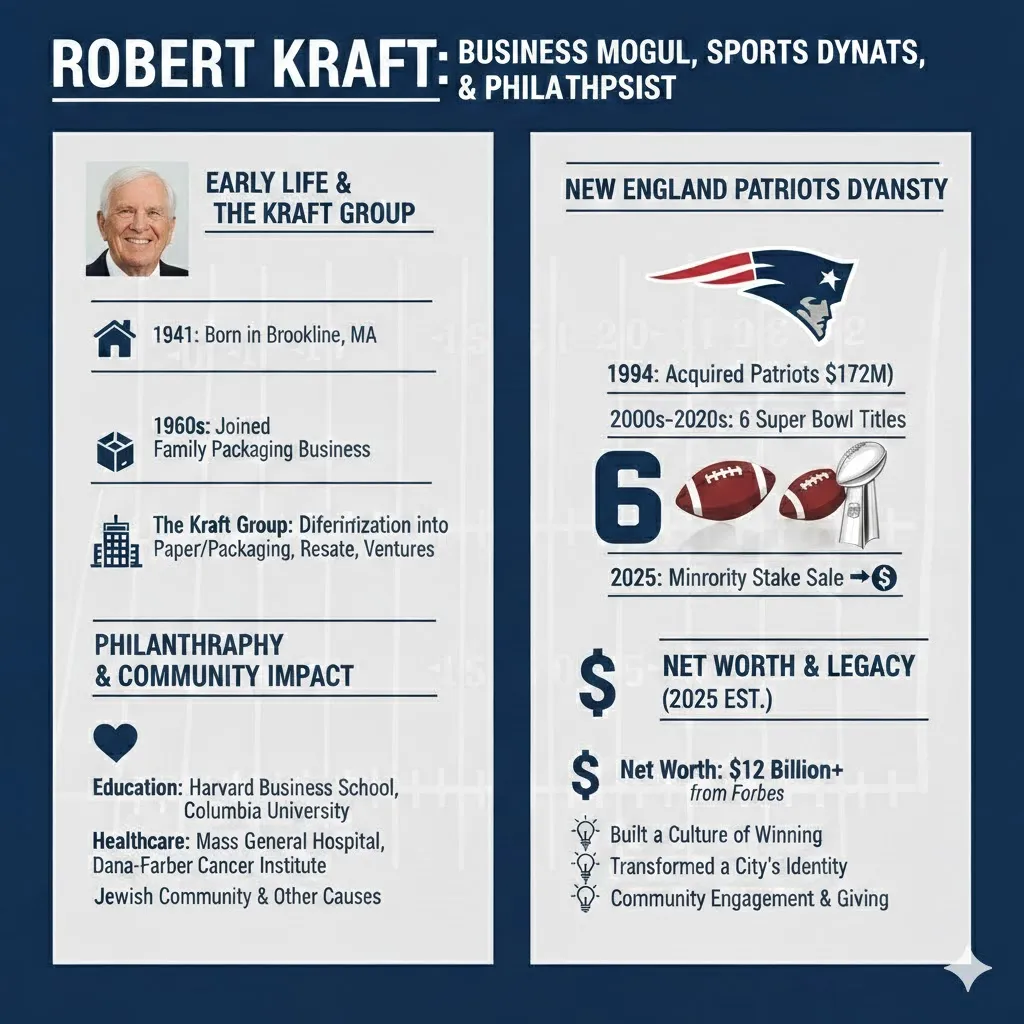

Born in Brookline, Massachusetts, Kraft rose from modest beginnings to become one of the most influential leaders in modern sports and business. Under his ownership, the Patriots won six Super Bowls, while his companies expanded globally across manufacturing and media. Beyond business, Kraft is also known for his extensive philanthropy, supporting education, healthcare, youth programs, and Jewish community initiatives.

Today, Kraft remains a central force in both the NFL and American business, shaping policy, investing in innovation, and continuing to lead The Kraft Group into new phases of growth. His story blends entrepreneurship, strategy, controversy, and impact making him one of the most studied and discussed owners in professional sports.

Early life & education

Robert Kenneth Kraft was born on June 5, 1941, in Brookline, Massachusetts. If you treat his early biography as a provenance record in a corpus, those roots encode the initial conditions for later vectors of action: family small-business exposure, early observations of transactional operations, and a cultural bias toward thrift and reinvestment. In NLP parlance, this is the input distribution that will shape the downstream model (his career trajectory).

Kraft matriculated at Columbia University for his undergraduate studies and later attended Harvard Business School, receiving an MBA. In machine learning terms, these formative datasets — rigorous academic training plus real-world examples functioned as feature engineering: they shaped his capacity to identify arbitrage opportunities, optimize resource allocation, and generalize tactics across domains. The structured education gave him both theoretical priors and a practical toolkit for enterprise-level decision-making.

Simple takeaway (semantic summary): Kraft’s early life supplied low-variance signals (family business norms + elite education), which he used as prior beliefs when exploring high-variance investment spaces.

Building a business empire, The Kraft Group as an enterprise knowledge graph

From packaging to multi-domain holdings

Kraft’s commercial origins lie in packaging and commodities. He expanded control of Rand-Whitney (a packaging firm) and launched trading and distribution ventures in timber, pulp, and paper through companies such as International Forest Products. When represented as a knowledge graph, nodes include packaging, trading, commodities, real estate, and sports edges are transactions, acquisitions, and capital flows. The Kraft Group, formalized in the late 1990s, serves as a multivalent parent node that aggregates these assets.

The Kraft Group is a holding-structure ontology

By consolidating diverse ventures under a parent holding company, Kraft effectively created an enterprise ontology: distinct business units (paper & packaging, real estate, private equity, sports) with shared governance rules and centralized capital allocation. This architecture allowed capital to be shifted across nodes to optimize expected value and mitigate idiosyncratic risk.

Acquisition heuristics buy latent value, not just surface signals

Kraft’s approach resembles a value-investing algorithm: instead of buying high-profile brands solely for their headline recognition, he purchased assets with multiple monetization modalities, e.g., stadium-adjacent land and parking revenue. In feature terms, he selected attributes with high signal-to-noise for cash-flow persistence: recurring revenue streams, defensible moats (control of game-day infrastructure), and optionality (land that can be redeveloped).

Simple takeaway: The Kraft Group is a multi-node knowledge graph where Kraft’s acquisition strategy prioritized assets with multiple monetization edges.

Entering sports acquisition signal processing and buying the Patriots

Early sports moves low-cost experiments to accrue domain knowledge

Before purchasing an NFL franchise, Kraft used smaller sports investments as experimentation data to learn operational mechanics: ticketing dynamics, sponsorship vectors, and local fanbase engagement. Think of these as exploratory trials to estimate the likelihoods and variances of success in sports enterprise.

Owning the stadium is a structural arbitrage

A decisive early move was securing land and operating rights tied to stadium infrastructure, especially parking and game-day concessions. In revenue-model terms, the stadium and its peripheral real estate constitute structural arbitrage: they are monetizable regardless of on-field performance and improve enterprise valuation through diversified revenue streams.

Buying the New England Patriots (1994) is a long-horizon bet

In 1994, Kraft acquired the New England Patriots. Framed as a transaction, it was a buy-low, scale-up bet: cost at the time ($172 million) relative to the franchise’s subsequent monetization and brand appreciation was low variance in hindsight but high variance prospectively. This purchase represents an important transition in Kraft’s portfolio, moving from industrial and real-estate nodes into a high-profile, media-influenced node.

Simple takeaway: Kraft bought an undervalued franchise and layered business-oriented optimizations to enhance its long-term valuation.

The Patriots’ dynasty organizational modeling, culture, and causal chains

Assembling human capital: Belichick, Brady, and the coaching-player factor

Two pivotal human nodes in the Patriots’ Success graph were Bill Belichick (head coach) and Tom Brady (quarterback). Kraft’s role resembled a meta-manager: he provided capital, institutional support, and strategic hiring latitude. In causal modeling, he supplied enabling variables hiring, facility investment, and administrative continuity while Belichick and Brady executed high-impact, shorter-horizon operations.

Championship outcomes replicable processes or singular events?

Under Kraft’s leadership, the Patriots won Six Super Bowls. From an NLP-analytic perspective, success can be decomposed into process features: robust scouting pipelines, adaptive game plans (policy updates), data-driven personnel decisions, and a culture that minimized transaction costs. Whether a dynasty can be replicated is a function of whether these processes are institutionalized (low variance) rather than depending on unique agent-specific events (high variance).

Business infrastructure investing in professionalization

Kraft invested in staff, scouting systems, and training facilities. These are model-optimization steps: they improve the franchise’s ability to discover and deploy talent and reduce the noise in decision-making. In operational terms, they raised the organization’s performance ceiling and stabilized output across seasons.

Recent performance perturbations (2024–2026)

After a prolonged era of stability and success, the Patriots experienced turbulent seasons. Transition effects (loss of a star agent like Brady, strategic pivoting, or model drift) can generate performance drops. Kraft himself acknowledged these challenging seasons, treating them as stochastic deviations rather than a structural failure of the underlying model.

Simple takeaway: The Patriots’ dynasty emerged from a combination of institutional investments (infrastructure and talent pipelines) and key agent-level performance; variance is inherent in sport, so cycles are expected.

2026 minority-stake sale transaction semantics, valuation signal, and governance

What happened is a concise, structured fact summary

In 2026, the Kraft family sold a combined 8% of the New England Patriots, 5% to Dean Metropoulos and 3% to the investment firm Sixth Street, yielding a valuation signal near $9 billion. The Kraft family retained controlling interest and governance rights.

Why this sale matters capital, partners, and strategic optionality

Small stake transactions accomplish multiple objectives:

- Liquidity: They translate private equity embedded in the franchise into deployable capital.

- Partnership: Strategic investors can offer domain expertise or capital access for large projects (stadium upgrades, media ventures).

- Valuation signaling: The transaction provides a market-consistent valuation benchmark, which can calibrate future financing or corporate strategy.

From a governance standpoint, minority stakes that do not alter control can still influence governance via advisory roles or board seats, depending on contractual terms.

Macro context, league rules, and the private-equity wave

The move fits within a broader trend: sports franchises increasingly permit minority investments to recharge capital without ceding control. Changes to league policies and investor appetites have created a secondary market for these minority tranches, which were previously constrained.

Simple takeaway: Selling a minority stake is a capital-efficient move that preserves control while enabling strategic financial flexibility.

Beyond football philanthropy, brand embeddings, and societal signals

Philanthropic architecture mapping as social capital

Kraft’s charitable giving spans education, health care, youth sports, and Jewish community initiatives. These donations function as social-capital investments: they build reputational proxies, create networks, and generate community-level externalities. Philanthropy can also be modeled as a directed graph of initiatives, beneficiaries, and long-term outcomes.

Support for Jewish causes, community embedding, and focused grants

A large part of Kraft’s giving emphasizes Jewish programs, Israel-related initiatives, and Jewish educational institutions. In socio-cultural embeddings, this creates strong community alignment and philanthropic attribution signals.

Business diversity robustness through portfolio allocation

The Kraft Group’s ongoing investments across real estate, manufacturing, and finance are portfolio diversification tactics. Cross-domain exposure reduces idiosyncratic risk and enhances structural resilience against sectoral shocks.

Simple takeaway: Kraft’s public philanthropy and diversified investments are both value-driven and prudent from a portfolio-management standpoint.

Controversies & criticisms adversarial examples in a public career

2019 solicitation charges a widely reported legal episode

In 2019, Kraft faced charges related to solicitation from a Florida day spa. The incident generated negative media attention and raised questions about accountability for high-profile individuals. The legal process and public reaction created stark contrasts in how personal conduct intersects with public roles.

Impact on public perception & institutional honors

Controversies influence classifiers that predict civic honors, e.g., Hall of Fame consideration. Voters and committees often use a mixture of achievement signals and character assessments. For some, personal controversies reduce the likelihood of receiving honors; for others, professional achievements outweigh off-field incidents. Both evaluation frames are valid, and the debate persists.

Owner credit vs. operational credit disentangling causal responsibility

A recurring critique is that owners are over-credited for on-field success, which is produced by coaches, players, and operational staff. An interpretable model should attribute outcomes across contributing agents: owners provide resources and governance, coaches create strategy, and players execute. Proper credit attribution requires careful causal decomposition.

Simple takeaway: Public careers with major accomplishments are often accompanied by controversies; evaluating legacy requires balancing achievements with conduct.

Hall of Fame: the debate cast as a ranking problem

The Hall of Fame is a classifier with many features

The Hall of Fame selection process resembles a classifier that ingests features like achievements, influence, character, and impact. Kraft’s candidacy triggers different weightings: his ownership-driven achievements (six Super Bowls) score highly on achievement and impact; off-field controversies reduce character scores. The combined scoring remains ambiguous, which explains the ongoing debate.

Why voters hesitate at thresholds and human priors

Voters intentionally apply human priors (norms about character), which makes Hall’s votes less deterministic than pure-statistical selection. This introduces subjectivity into what would otherwise be a data-driven ranking.

Simple takeaway: Kraft’s candidacy crosses conflicting signal vectors; statistical impact is high, but character-related priors reduce consensus.

2026 snapshot net worth, roles, and forward paths

Net worth and wealth composition

By 2026, Kraft is among the wealthiest private citizens in the U.S., with net worth primarily driven by The Kraft Group and Sports Ownership. Wealth estimation is an aggregation problem that depends on private company valuations, public asset proxies, and disclosed transactions such as the 2026 minority sale.

Roles & day-to-day functions

Kraft serves as Chairman and principal Owner of the Kraft Group and remains active in philanthropic governance, strategic oversight, and occasional public representation for the team. In organizational graphs, he remains a high-influence node with multiple outgoing governance edges.

Future possibilities, optionality after the minority sale

With new minority partners and added capital, prospective projects could include stadium modernization, community investment programs, or enhanced player development systems. The ownership structure after 2026 preserves decision-making majorities while expanding fiscal optionality.

Simple takeaway: Kraft remains a central figure whose influence is amplified by new financial flexibility and enduring leadership roles.

Why Robert Kraft matters: interpretability, lessons, and legacy

- Long-term vision as an optimization heuristic. Kraft’s pattern indicates a consistent preference for assets that appreciate with time, a low-churn, compounding approach comparable to a long-term optimizer in a reinforcement learning setup.

- Buying underlying value vs. surface prestige. He often targeted assets with intrinsic, monetizable components (land, parking, infrastructure) rather than paying for only brand reputation. This principle aligns with value investing and careful feature selection.

- Cross-domain leverage. Kraft shows how skills in manufacturing and real estate transfer to sports: governance, capital allocation, and stakeholder management are domain-general competencies that can be reweighted to new contexts.

- Philanthropic signaling and social returns. His giving patterns build reputational capital and practical benefits for beneficiaries, which is part of his broader public footprint.

- Complexity of legacy. Success and controversy co-exist. A rigorous evaluation of legacy requires multi-dimensional scoring that accounts for achievement, conduct, and institutional impact.

Simple takeaway: Kraft’s life is a multi-feature case study for long-term strategic investing, organizational design, and the complex interplay between public success and private behavior.

FAQs

A: Robert Kraft is an American entrepreneur and investor who chairs The Kraft Group and is the principal owner of the New England Patriots. He built an industrial and real estate empire that underlies his sports ownership.

A: Kraft purchased the New England Patriots in 1994 for $172 million.

A: The Patriots won six Super Bowls during Robert Kraft’s ownership era.

A: In 2019, Kraft was charged in connection with alleged solicitation; the case attracted broad media coverage and raised public debate.

A: In 2026, the Kraft family sold an 8% combined stake in the Patriots (5% to Dean Metropoulos and 3% to Sixth Street), implying a valuation in the area of $9 billion, while retaining majority control.

Conclusion

Robert Kraft’s story is more than the success of one businessman; it is the evolution of a leader who combined vision, discipline, and long-term strategy to build an empire that spans packaging, real estate, global trade, and one of the most successful franchises in NFL History. From founding The Kraft Group to shaping the New England Patriots dynasty, his journey shows how smart investments, consistent leadership, and strong values can transform an industry.

Even in 2026, Kraft remains a powerful figure whose influence extends beyond sports into philanthropy, community development, and Business Innovation. Whether you’re studying entrepreneurship, leadership, or the modern NFL business model, Kraft’s life offers a blueprint for thinking big, acting boldly, and investing for the future.