Introduction

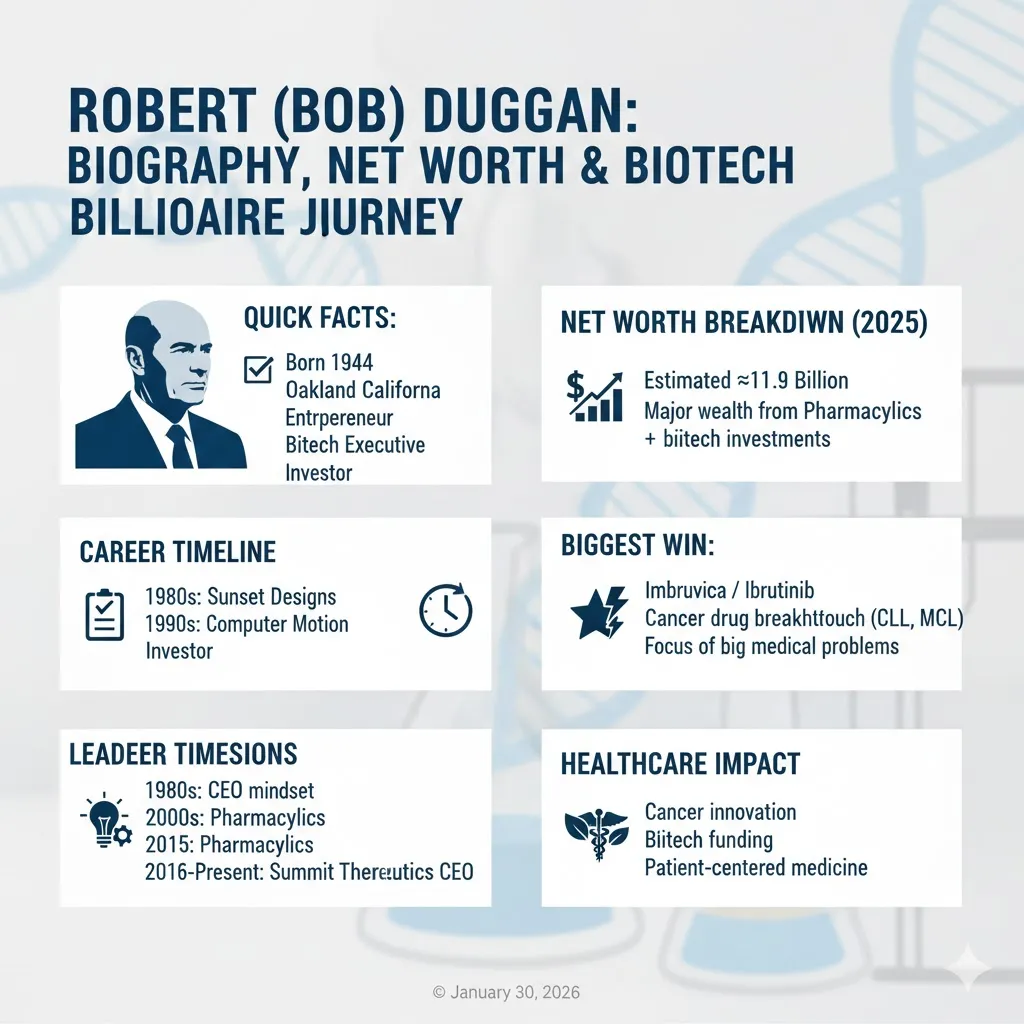

Robert “Bob” Duggan is a name that reverberates in the biotechnology and healthcare-investing world. He is widely recognised for turning a small cancer-drug developer into a transformative deal, and for his bold moves across a variety of industries from retail consumer goods to surgical robotics to biotech. Today, Duggan stands as one of the few entrepreneurs who not only built companies but orchestrated multi-billion-dollar exits.

His story matters because it offers a window into how vision, timing, operational involvement, and strategic exits combine to create outsized value. In this article, you’ll get a detailed, up-to-date biography of Duggan: his early life, career milestones, major achievements, estimated net worth, personal context, leadership lessons, a timeline of life events, and answers to common questions. If you are interested in how biotech billionaires are made and what lessons one can draw for entrepreneurship or investing, you’re in the right place.

Quick Facts

| Field | Detail |

| Full Name | Robert W. “Bob” Duggan, |

| Date of Birth | 1944 (exact date not universally published) |

| Age (2026) | Approximately 81 years old |

| Birthplace | Oakland, California, USA |

| Nationality | American |

| Profession | Entrepreneur, investor, biotech executive |

| Religion / Belief System | Publicly associated with the Church of Scientology. |

| Zodiac Sign | (If born in 1944, exact date unknown, so zodiac sign unspecified) |

Childhood & Early Life

Robert Duggan grew up in Oakland, California, as the third of five siblings. His father was an Irish newcomer who became a manufacturing engineer in America; his mother worked as a nurse.He has shared that his family earnings were limited (“about $800 a month… we searched around the house for missing coins, dimes, and nickels”).In high school at St. Francis High School (Mountain View, California), he played quarterback and served as captain of the football squad, saying: “Guys push your body… we are not dropping this game.”Duggan studied at the University of California, Santa Barbara (UCSB) and later at UCLA, focusing on business and economics.His first entrepreneurial interest appeared as a teen mowing lawns, when he noticed that extra care (edges cut neat, walk-through with the owner) brought better results. He notes that the lesson stayed with him.

Career Journey

Early Ventures & Diversification

Long before biotech, Duggan built experience across divergent industries:

- He invested approximately US$100,000 into Sunset Designs, maker of Jiffy Stitchery kits, and helped grow it to about 80% market share before it was sold for about US$15 million in the mid-1980s.

- He co-founded (or helped found) ventures such as Paradise Bakery & Café (a cookie/bakery business) and later a major outdoor-media transition venture in Eastern Europe via Metropolis Media.

- Duggan invested in technology and robotics early: He was Chairman & CEO of Computer Motion (1997-2003), which later merged with Intuitive Surgical.

Biotech Breakthrough: Pharmacyclics

Where Duggan’s career turned into headline-making territory was with Pharmacyclics Inc.. From 2008 to 2015 he served as Chairman, CEO, and largest investor.

Under his leadership, the company developed the cancer drug Ibrutinib (brand name Imbruvica), a breakthrough treatment for B-cell cancers (e.g., chronic lymphocytic leukemia, mantle cell lymphoma).

In May 2015, Pharmacyclics was sold to AbbVie Inc. for approximately US$21 billion in cash and stock.

This deal is widely cited as one of the key events that made Duggan a biotech billionaire.

Post-Pharmacyclics & Current Focus

After that landmark exit, Duggan turned his focus toward new life sciences opportunities:

- Since 2015, he has acted as CEO of Duggan Investments, a venture-capital and public-stock firm focused on “patient-centered innovative solutions for complex age-related illnesses.”

- He became Executive Chairman and later CEO of Summit Therapeutics Inc. (joined board December 2019, CEO April 2020), where he is guiding antibiotic and cancer programs..

- He also worked as Chairman of the Board of Pulse Biosciences Inc. since November 2017, another biotech company concentrating on new technologies.

Major Works & Achievements

- Leading Pharmacyclics to commercialise Imbruvica and to a ~US$21 billion exit.Receiving high honours: e.g., the French Republic’s Légion d’honneur in 2000, and a U.S. Congressional Medal of Merit.

- Significant philanthropy: He is a Trustee at UCSB, and funded chairs in mathematics/sciences/religious studies at UCSB.

- For his leadership in building and scaling companies, he is frequently described as a visionary investor-operator.

Net Worth & Financial Status

Estimating Net Worth for someone like Duggan (with large private holdings and biotech investments) has a degree of uncertainty. One source lists his net worth at ~US$11.92 billion.

Income Sources

- Returns from the sale of Pharmacyclics to AbbVie.

- Equity stakes in Summit Therapeutics, Pulse Biosciences, and other life sciences ventures.

- Early ventures exist in technology/consumer businesses.

Lifestyle

While detailed lifestyle information is limited (as he keeps much private), it is known he is a surfer (which he has spoken about), is involved in philanthropy, and focuses on innovation in health care more than flashy public celebrity.

Personal Life

Duggan was married to Patricia J. “Trish” Hagerty (whom he met at UCSB), and together they have eight children. They later divorced in 2017.

He is known to enjoy surfing both as a youth in California and later in places such as Hawaii, Costa Rica, and Nicaragua.

On the more personal side, he is involved in philanthropic giving and has publicly shared his mission to “make a difference for the better” through his ventures.

Motivational Lessons

Here are key lessons you can draw from Robert Duggan’s journey:

- Start small, scale boldly: Duggan’s early lawn-mowing business taught him the value of extra effort, which translated into his business mindset.

- Stay operationally involved: He didn’t just invest; he ran companies (CEO of Pharmacyclics) and helped shape strategy and culture.

- Be willing to diversify: His career spans consumer goods, tech, medical devices, and biotech. The common thread is value creation through change.

- Focus on meaningful problems: In biotech, he chose large unmet-need areas (cancer, aging diseases) where success brings both social and financial rewards.

- Exit strategy matters: The $21 billion exit at Pharmacyclics underscores that building a path of acquisition or scale can unlock enormous value.

“The mission to make a difference for the better has been a game-changer for me and my companies.” Bob Duggan

Timeline of Life Events

| Year | Milestone |

| 1944 | Born in Oakland, California. |

| 1960s-70s | Early entrepreneurial ventures: lawn mowing, consumer businesses. |

| Mid-1980s | Sunset Designs’ sale after dominating the needlepoint-kit market. |

| 1997-2003 | CEO of Computer Motion, merging with Intuitive Surgical. |

| 2008-2015 | Chairman & CEO of Pharmacyclics; led Imbruvica commercialisation. |

| May 2015 | Pharmacyclics sold to AbbVie for ~US$21 billion. |

| November 2017 | Chairman of Pulse Biosciences. |

| December 2019 | Joined the Board of Summit Therapeutics. |

| April 2020 | Became CEO of Summit Therapeutics. |

Pros & Cons

Pros

- Extensive experience in several sectors: consumer, technology, life sciences.

- Demonstrated History of growing and energizing businesses.

- Concentration on important, high-impact medical fields.

- Hands-on leadership instead of only passive investing.

Cons

- Big fluctuations in biotech risk: drug approvals, regulatory hurdles, competition.

- Focused exposure: outcomes rely mostly on a few high-risk bets.

- Less publicly known media stories compared to other biotech leaders makes verification and transparency tougher.

FAQs

A: Robert “Bob” Duggan is an American entrepreneur and biotech investor, best known for leading Pharmacyclics and engineering its sale to AbbVie, and for subsequent life sciences investments.

A: His major financial success came through his leadership and ownership stake in Pharmacyclics, which was sold for approximately US$21 billion in 2015.He also holds/held stakes in other life science ventures.

A: Precise numbers vary; one estimate lists his net worth at about US$11.9 billion.Good returns. However, some reports place it higher (up to ~US$16 billion) depending on how equity is valued.

A: Duggan has operated in consumer goods (needlepoint kits, bakery), technology/medical devices (surgical robotics), and biotech/pharmaceuticals.

A: Key takeaways include the importance of operational leadership, choosing meaningful problems, building companies with exit potential, and being willing to diversify while staying focused on value creation.

Conclusion

Robert (Bob) Duggan’s path from teen lawn-mowing hustler to biotech billionaire is not only a tale of financial gain; it’s a guide for how combining hands-on leadership, broad experience, high-impact purpose, and smart exit planning can produce remarkable results.

He didn’t just buy stocks; he created companies, managed them, and set them up for major value growth. For entrepreneurs, investors, or healthcare pioneers, Duggan’s journey offers advice: focus on unmet needs, engage deeply, expand carefully, and always watch the final goal (whether it’s a sale or wide deployment).

His influence is still growing, especially in life sciences, where the programs he drives may shape the next ten years of innovation. If this profile was useful, feel free to share it, leave a question in the comments, or check out our other articles on biotech Leadership and startups.