Introduction

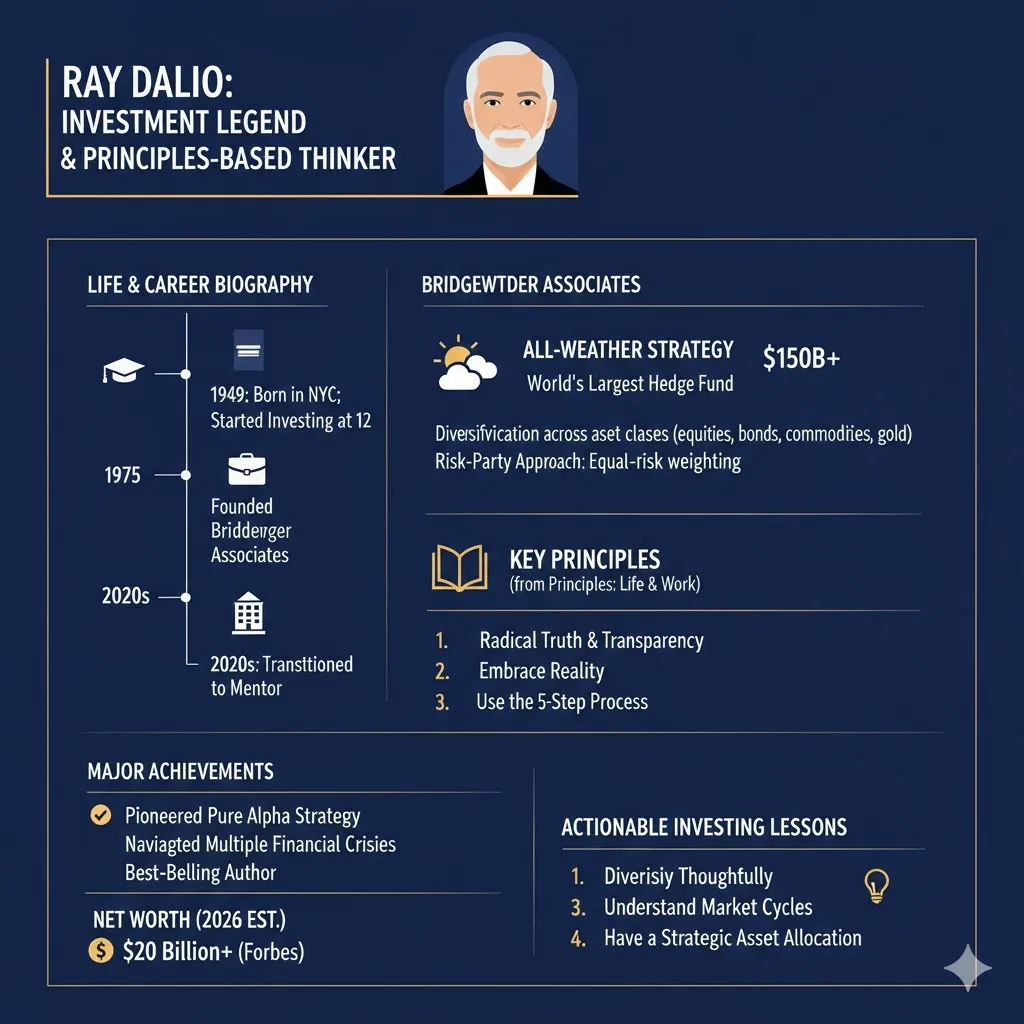

Ray Dalio is widely known as a groundbreaking figure in modern finance. As the founder of Bridgewater Associates, he changed how institutional investors handle risk, economic trends, and structured decision processes. His influential book, Principles: Life & Work, introduced his ideas of radical honesty, merit-based thinking, and systematic principles, not just for investors but also for executives, entrepreneurs, and organizational leaders.

This 2026-updated profile looks at Dalio’s path from modest roots to global recognition. We explore his personal history, career path, innovative investment methods, financial position, personal philosophy, controversies, and practical lessons that can inform your choices today. Whether you are a budding investor, business executive, or interested reader, this article offers a thorough, organized view on why Ray Dalio’s guidance remains highly relevant in 2026.

Quick Facts

| Item | Detail |

| Full Name | Raymond Thomas Dalio |

| Date of Birth | August 8, 1949 |

| Age (2026) | 76 years old |

| Birthplace | Jackson Heights, Queens, New York City, U.S. |

| Nationality | American |

| Profession | Investor, hedge fund founder, author, philanthropist |

| Known For | Establishing Bridgewater Associates, writing Principles, pioneering risk-parity and All-Weather frameworks |

| Education | BS in Finance (C.W. Post College) & MBA (Harvard) |

Childhood & Early Life

Ray Dalio grew up in a middle-income Italian-American family in Queens, New York. His father, Marino Dalio, was a jazz player performing on clarinet and sax in Manhattan clubs, while his mother, Ann, managed the household.At age 8, his family moved to Manhasset on Long Island. Even as a young boy, Dalio worked various small jobs such as caddying, lawn cutting, snow clearing, and delivering newspapers. These early tasks not only built a strong work ethic but also introduced him to wealthy Wall Street figures who visited the golf club.At 12, he invested the $300 he earned from caddying into Northeast Airlines. When the airline merged with another company, his investment grew threefold, an early, powerful lesson in finance and compound returns.

He went to Herricks High School before earning a Bachelor of Science in Finance from C.W. Post College (Long Island University) and an MBA from Harvard Business School, graduating in 1973. These experiences, early investing exposure, curiosity, and formal schooling set the stage for his systematic, principle-based method toward investing and life choices.

Career Journey

Founding Bridgewater Associates

In 1975, after short stints on Wall Street (including Shearson Hayden Stone) and trading commodities, Dalio started Bridgewater Associates from his two-room Manhattan apartment. The company first focused on investment advice and risk management for institutional clients. By the early 1980s, Bridgewater moved to Westport, Connecticut, as its client base grew.

Rise to Prominence & Innovation

Dalio rose to fame through his global macro investing method, studying broad economic patterns like GDP growth, inflation, and currency changes. He created the well-known risk-parity and All-Weather portfolio approaches. Under his guidance, Bridgewater grew into one of the world’s largest hedge funds, managing tens of billions in assets for pension plans, sovereign funds, and university endowments.

Culture, Principles & Transition

Beyond investing, Dalio emphasized a radical transparency and ideal meritocracy culture at Bridgewater. Here, decisions were driven by evidence, not hierarchy. Mistakes were openly discussed, and systematic decision-making tools helped reduce bias.

In March 2017, Dalio stepped down as Co-CEO, shifting his role toward mentorship, strategic oversight, and philanthropy.

2024–2026 Updates

In July 2026, Dalio sold his remaining Ownership stake in Bridgewater, marking the conclusion of a long-term transition plan.He also accepted advisory roles globally, such as collaborating with Indonesia’s sovereign wealth fund, highlighting his evolution from hands-on fund manager to strategic advisor and macroeconomic thinker.

Major Works & Achievements

- Books & Publications: Principles: Life & Work (2017) outlines Dalio’s philosophy on leadership and decision-making.Other notable works include Principles for Navigating Big Debt Crises (2018) and Principles for Dealing with the Changing World Order (2021).

- Investment Innovations: He developed the All-Weather portfolio and risk-parity frameworks, reshaping institutional risk allocation.

- Recognition: Named among Time magazine’s “100 Most Influential People in the World.”

- Philanthropy: His family foundation has contributed significantly to education, ocean research, and social causes.

- Cultural Impact: Dalio’s principles of meritocracy and transparency are studied globally in business schools and leadership programs.

Investment Philosophy & Key Frameworks

Viewing the Economy as a Machine

Dalio likens the economy to a complex machine, where factors like debt, spending, production, and inflation interact systematically.Understanding these interactions allows investors to anticipate macroeconomic outcomes. His widely acclaimed essay and video, How the Economic Machine Works, explain this in simple terms.

Risk Parity & All-Weather Strategy

Risk parity seeks to distribute risk evenly across asset classes rather than allocate capital traditionally (e.g., 60% stocks, 40% bonds).For example, balancing volatility across stocks, bonds, and commodities helps stabilize returns under varying market conditions.

Bridgewater’s All-Weather strategy is designed to perform in inflation, deflation, growth, and recession. A typical allocation might include:

| Asset Class | Approximate Allocation |

| Stocks | 30% |

| Long-term Bonds | 40% |

| Intermediate Bonds | 15% |

| Commodities | 15% |

“Focus on balancing risk rather than chasing high returns.”

Principles for Life & Work

Dalio emphasizes writing down principles, honest feedback, believability-weighted decisions, and learning from mistakes. These concepts are extensively detailed in his book Principles: Life & Work.

Awareness of Macro & Debt Cycles

Dalio stresses the importance of understanding long-term debt cycles (50–100 years) and shorter business cycles (5–8 years) for investors and policymakers.He argues that many crises originate from debt imbalances and that investors should plan accordingly.

Relevance in 2026

Given today’s economic environment, debt, low yields, geopolitical tensions Dalio’s frameworks remain highly relevant:

- Prepare for multiple economic scenarios (inflation, deflation, currency changes)

- Balance risk across assets instead of overexposing to one area

- Analyze past cycles to guide positioning rather than chasing trends

Financial Status & Net Worth

As of 2026, Ray Dalio’s net worth is estimated at approximately US$15 billion, primarily accrued from Bridgewater, strategic investments, and diversified holdings.Beyond wealth, Dalio’s influence and thought leadership in finance and macroeconomics contribute to his enduring impact.

Personal Life

Dalio has been married to Barbara Dalio for over 40 years.They have four children; tragically, their eldest son, Devon, passed away in 2020. Dalio practices Transcendental Meditation, attributing his disciplined decision-making and calm under pressure partly to meditation. He resides in Greenwich, Connecticut, balancing high-level finance with reflection, philosophy, and philanthropy.

Timeline of Life Events

| Year | Milestone |

| 1949 | Born August 8 in Jackson Heights, Queens, NYC |

| ~1961 | Buys first stock (Northeast Airlines) using caddying earnings |

| 1971 | Graduated with a BS in Finance from C.W. Post College |

| 1973 | Earns MBA from Harvard Business School |

| 1975 | Founds Bridgewater Associates in Manhattan |

| 2017 | Publishes Principles: Life & Work; steps down as Co-CEO |

| Founded Bridgewater Associates in Manhattan | Sells remaining stake in Bridgewater, completes ownership transition |

Pros & Cons

Pros

- Innovator in macro-based, systematic investing with global impact

- Clearly articulated principles for decision-making, leadership, and organizational design

- Integrates finance, cycles, and societal awareness

- Lifelong learner with lessons that extend beyond finance

Cons

- Radical transparency culture may feel strict or overwhelming

- Large funds face occasional underperformance; scale can be a limitation

- Macro-cycle guidance can seem abstract to small investors

- Some principles are challenging to implement outside specialized institutional contexts

Motivational Lessons You Can Apply

- Document your principles: Create written guidelines rather than relying solely on intuition.

- Embrace reality: Acknowledge truths, not biases. Feedback loops are essential.

- Think systemically: Understand patterns in markets, organizations, and life.

- Diversify risk: Don’t focus exclusively on returns; prepare for multiple scenarios.

- Value relationships and meaningful work: Prioritize human connections and purposeful goals.

- Learn from mistakes: Treat errors as data points for improvement.

Applying Dalio’s Investment Concepts in 2026

Identify All Risks

Instead of asking, “Which stocks should I buy?”, analyze the portfolio’s exposure to inflation, deflation, interest rate changes, geopolitical shocks, and currency risk.

Diversify with Risk in Mind

A sample “mini All-Weather” allocation for moderate investors:

- 40% global equities

- 30% long-term government bonds

- 20% commodities or real assets

- 10% cash or short-term instruments

Rebalance & Avoid Herd Mentality

Regularly check allocations and avoid overconcentration in one asset. Dalio cautions against emotional attachment to investments.

Maintain a Decision Framework

Write your investing principles, e.g., maximum allocation thresholds, risk-reward calculations, and contingency plans.

Study History & Cycles

Analyze past economic crises, currency fluctuations, and debt cycles to stress-test your portfolio.

Controversies & Criticisms

- Risk parity strategies have occasionally underperformed and face structural limitations. ([thehedgefundjournal.com][19])

- Bridgewater’s intense culture is challenging for some employees.

- Macro-forecasting is inherently uncertain; Dalio focuses on probabilities, not guarantees.

FAQs

A: Founder of Bridgewater Associates, author of Principles, and pioneer of macro-investing and risk-parity strategies.

A: Around US$15 billion, primarily from Bridgewater and investments.

A: Yes, he sold his remaining stake in July 2026 and stepped back from operational duties.

A: Principles: Life & Work, Principles for Navigating Big Debt Crises, Principles for Dealing with the Changing World Order.

A: While designed for institutional portfolios, its principles of diversification and balanced risk can guide individual investors.

Conclusion

Ray Dalio’s path from a young stock-buyer in Queens to the founder of one of the world’s largest hedge funds highlights the significance of systematic thinking, principle-based Leadership, and macroeconomic awareness. His enduring legacy is not just wealth, but frameworks that enable individuals and organizations to navigate uncertainty and make informed decisions.

Reflect on Dalio’s story: write your own principles, create feedback systems, and prepare for multiple potential futures. Whether investing, managing a business, or planning your life, Dalio’s lessons offer universal guidance.