Introduction

Peter Thiel is a high-account tech lender, entrepreneur, and public rational. He helped create PayPal, invested early in Facebook, and co-develop Palantir, a company that builds data-analysis policy for government and merchant clients. Known for antagonist thinking, Thiel often bets on plan and teams that others leave. He combines venture capital, personal funding, and political giving to authority technology, policy, and debate about the eventually. In short: he’s a billionaire lenderwhose choices ripple through tech and diplomacy.

Quick facts

| Field | Quick detail |

| Full name | Peter Andreas Thiel. |

| Born | October 11, 1967 (Frankfurt, West Germany). |

| Known for | Co-founder of PayPal, early investor in Facebook, co-founder and long-term backer of Palantir. |

| Primary roles | Entrepreneur, venture capitalist, philanthropist, political donor. |

| Net worth (2025 estimates) | Rough range often reported: ~$16B–$23B (varies by tracker and method). |

Childhood & early life

Peter Thiel was born in Frankfurt, West Germany, and moved to the United States as a child. He grew up in Foster City, California, near San Francisco. As a youngster he appreciated games of logic like chess and fell in love with reading and ideas that would structure his later profession. Thiel studied philosophy at Stanford University and later collected a law degree. While at Stanford he co-founded The Stanford Review, a student paper that shows his cognitive teaching and interest in debate. These early adventures, study, editorial work, and intense interest shaped Thiel’s antagonistic approach and his willingness to back bold bets.

How he built his career step by step

The PayPal story

In the late 1990s Thiel co-develop Confinity, which later became PayPal, an online settlement company that clarify sending and receiving money over the internet. When eBay bought PayPal in 2002 for roughly $1.5 billion, Thiel and other creators obtained both capital and powerful networks. The PayPal alumni sometimes called the PayPal Mafia went on to start and fund many authoritative tech firms. For Thiel, the PayPal exit was a float pad: it gave him the economic freedom and reliability to back other creators and to form venture funds.

Early big bet: Facebook

In 2004 Thiel made a high-leverage early investment in Facebook, reportedly around $500,000 for a meaningful equity stake and a board seat. That small seed investment grew dramatically as Facebook became a dominant social platform. Thiel’s Facebook stake converted PayPal-era success into generational wealth and positioned him as a shrewd early backer of consumer technology.

Palantir private intelligence tech

Thiel co-founded Palantir Technologies, a company focused on building software that helps organizations integrate, analyze, and interpret huge data sets. Palantir sells to both government agencies and private firms; it’s well-known for tools used in national security and law enforcement, as well as in finance and healthcare. Palantir highlighted Thiel’s interest in companies that operate at the intersection of advanced technology and public purpose and it drew attention (and scrutiny) because of its government contracts.

Major investments and funds

Peter Thiel is not only an individual investor; he is a founder and backer of several investment firms that channel capital into startups and scale-ups across sectors.

Key vehicles he uses

- Founders Fund : A San Francisco-based venture capital firm that invests across stages, often in ambitious projects (space, AI, biotech, defense, etc.).

- Mithril Capital : Targeted at later-stage and growth investments.

- Valar Ventures: focused on opportunities outside the U.S. and on global expansion.

These vehicles let Thiel pursue a portfolio that spans risk profiles: early, high-upside startups; later-stage companies that need more capital; and international plays that diversify geography and regulation.

What he likes to fund

Thiel’s investment pattern shows clear theme preferences:

- Frontier tech: Artificial intelligence, synthetic biology, and advanced software.

- Space and hard-tech: Companies building hardware, launch systems, and long-term infrastructure.

- Defense and national-security adjacent tech: Firms with dual-use applications or government customers.

- Crypto and blockchain: Both tokens and companies in the cryptocurrency ecosystem.

- Fintech and payments infrastructure: The plumbing of modern financial services.

These preferences come from a worldview that prizes big technological leaps and long-term advantage.

Example: Bitmine stake

In mid-2025 a public filing disclosed Thiel’s stake in Bitmine Immersion Technologies (reported as 9.1%). The revelation received market notice, and the stock behaved to the news. This move ornament his continuing interest in corporation tied to satoshis mining and to businesses that hold crypto assets on their stability sheets.

Politics: donations, influence, and controversies

Peter Thiel is a great political donor and a powerful cognitive donor. He contributes to political crusade, funds think tanks, and supports enterprises that align with his long-term vision for alteration and national competitiveness. His Political Participation is a big part of why he is a public figure far-off from the startup world.

What he gives money to

- Political candidates and PACs: Thiel has carried individual applicant and political action commissions that reflect conventional or libertarian-leaning positions.

- Think tanks, research projects, and ideas: He funds organization and programs that explore technology policy, national protection, and enterprise.

- Legal and strategic litigation: On occasion Thiel has funded legal efforts that align with his views; a notable example that drew heavy public notice was his funding support related to lawsuits against a media organization.

Why this matters

Wealth enables access. When wealthy individuals fund campaigns, research, and litigation, they can change which ideas get traction, which policies are debated, and which leaders gain resources. For critics, this concentration of influence raises questions about democratic fairness and transparency. For supporters, it’s a mechanism to accelerate ideas that would otherwise struggle for funding.

Big controversies

- Gawker litigation: Thiel secretly backed a lawsuit that led to a high-profile legal victory and the ultimate insolvency of a media outlet. Supporters argued the action was legal and was about solitude; critics said it epitomize how money can be used to quietness the press.

- Political endorsements and rhetoric: Some of Thiel’s public declarations and his support for several political actors have attracted dispute and debate inside and outside the tech section.

- Palantir’s government contracts: Palantir’s work with law implementation and reason agencies raised concerns from civil-rights groups worried about solitude and civil liberties.

Net Worth 2025 how much is he worth?

Estimating the net worth of a billionaire like Peter Thiel is an exercise in approximation. Public figures’ wealth is often tied up in private companies, carried interest in funds, and long-term investments that lack easy market prices. Different trackers use different methods, which is why estimates differ.

Public estimates

Various wealth-tracking organizations and financial media place Thiel’s 2025 net worth within a broad range often cited in reporting as roughly $16 billion to $23 billion, depending on what is counted and how private holdings are valued.

Why estimates vary

- Private-company valuation uncertainty: Holdings in companies that are not fully public (or have restricted shares) are harder to value.

- Market volatility: Public stock holdings fluctuate with the market. A large block of publicly traded shares can swing the estimate significantly from day to day.

- Illiquid assets & funds: Investments structured as funds of funds, carry, or long-term commitments are complex to price, and methodologies differ across trackers.

- Recent disclosed stakes: New public filings (for example, in 2025) that disclose stakes in smaller public companies can change short-term estimates.

What drives Thiel’s wealth

- Early equity from PayPal and his early Facebook stake.

- Ownership and carried interest through Founders Fund, Mithril, and Valar.

- Stakes in private firms, including Palantir, and other direct investments.

- Real assets and possibly stakes in alternative assets, such as cryptocurrency exposure.

Bottom line: In 2025, multiple reputable trackers put Peter Thiel broadly in the $16B–$23B range. Exact ranking and figures differ across publications because of valuation approaches.

Personal life & public image

- Marital status: Thiel married Matt Danzeisen in 2017. He tends to keep his personal life private.

- Private but public-minded: Thiel is private about daily life, but open about ideas he publishes essays, funds research, and speaks at events.

- Public image: Views vary. Admirers call him a visionary investor and builder who bets on the far horizon. Critics call him secretive and worry about the societal effects of some of his projects and political moves. Palantir, for example, has been praised for solving tough data problems and criticized for privacy implications.

Style of thinking what Peter Thiel believes

Thiel’s worldview can be summarized as a set of recurring themes:

- Contrarian investments: Look where many others are unwilling to look. Seek opportunities that seem overlooked.

- Long time horizons: Favor decades-long bets rather than short-term trades. Invest in projects that require patient capital.

- Concentration over diversification: Prefer a small number of large, high-conviction positions instead of many small bets.

- Institution building: Not just companies, but institutions funds, schools, research projects that can outlast individual startups.

- Skepticism about slow growth: Thiel frequently laments what he sees as stagnant innovation in certain economies and argues for more daring technological ambition.

These principles explain why he funds AI research, biotech, space ventures, defense-related startups, and political projects aimed at shaping the institutional landscape.

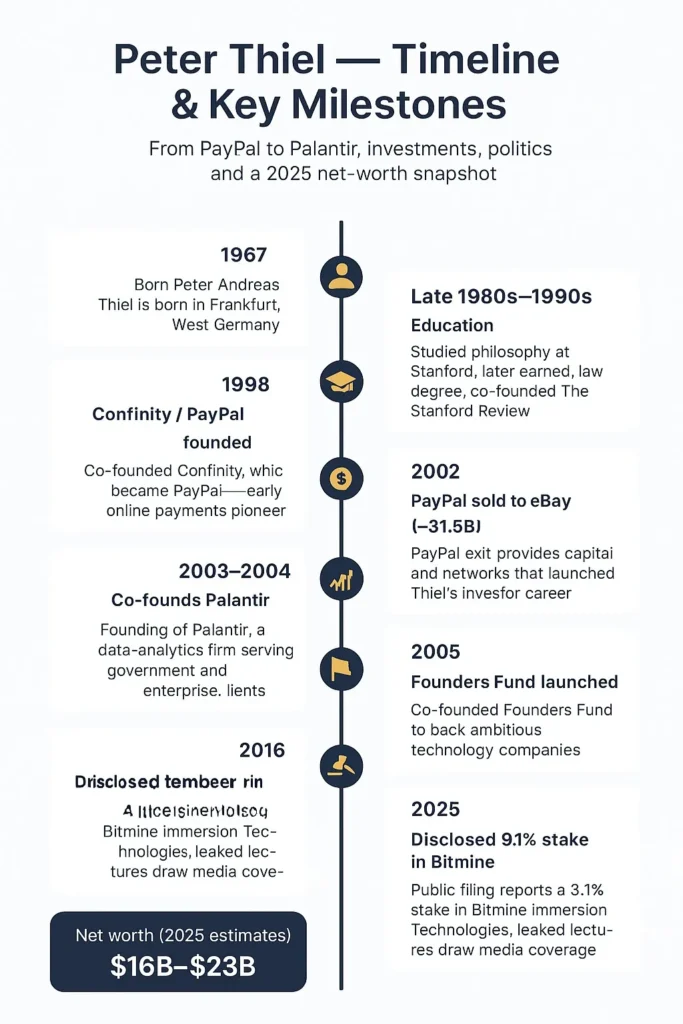

Timeline key milestones

| Year | Big event |

| 1967 | Born in Frankfurt, Germany. |

| Late 1980s–1990s | Studied at Stanford; early legal and tech work. |

| 1998 | Co-founded Confinity → which became PayPal. |

| 2002 | PayPal sold to eBay (≈ $1.5B). |

| 2003–2004 | Involved in founding Palantir; early investor in Facebook (2004). |

| 2005 | Co-founded Founders Fund. |

| 2010s | Built out investments in multiple sectors; public profile grows. |

| 2016 | Confirmed he backed litigation connected to Gawker case. |

| 2025 | Reported disclosure of 9.1% stake in Bitmine Immersion Technologies (public filing); his lectures and public remarks generate media stories. |

Pros & Cons

Pros

- Sees high-upside opportunities early and decisively.

- Backs founders who pursue ambitious technology.

- Uses networks and capital to scale companies and projects.

Cons

- Secretive funding raises concerns about accountability and influence.

- Work with government clients (via Palantir) invites legitimate civil-liberties scrutiny.

- Strong political positions and funding choices polarize opinion.

FAQs

A: Yes. He confirmed he helped fund the litigation that led to Gawker’s bankruptcy.

A: Estimate range. Common reports list him between $16B and $23B in 2025. Numbers change by source and time.

A: Yes he is a co-founder and remains connected to Palantir as a leader and adviser.

A: AI, biotech, space, defense, fintech, and crypto. He uses funds like Founders Fund and Mithril.

A: Reported leaked lectures showed Thiel using strong religious and apocalyptic imagery to warn about political danger and threats to the U.S., sparking media coverage and debate.

Conclusion

Peter Thiel is a figure of contrasts: an aspiring, contrarian investor who helped create some of the most prominent tech companies of the past 25 years, and a private, politically active billionaire whose choices often spark acute public debate. From his early role at PayPal and a timely seed in Facebook, to his hand in founding Palantir and building firms like Founders Fund and Mithril, Thiel has repeatedly shown a willingness to back high-risk, high-reward ideas. That instinct for concentrated, long-dated bets explains much of his success and much of the attention he attracts.

At the same time, Thiel’s political giving, strategic litigation support, and work with government clients create real ethical and civic questions. His influence stretches beyond balance sheets into public policy, media ecosystems, and institutional design. For some people that influence is inspiring a necessary push for bold technological progress. For others it’s worrying an example of how private capital can shape public life without the kinds of checks that democratic systems normally provide.

Estimating his 2025 Net Worth remains imprecise: reputable trackers place him in a broad $16B–$23B range, but valuation depends on private holdings, market moves, and how one counts fund interests and illiquid assets. What is clearer is the pattern: Thiel favors frontier technology, long-term institutional bets, and strategies that seek outsized returns rather than broad diversification.