Introduction

People search “Michael Dell vs Michael Bloomberg” when they want a clear, data-friendly comparison of two billionaires whose organizations shaped technology, finance, and public life. Michael Dell launched a direct-to-consumer PC business in a dorm room and scaled it into an enterprise infrastructure leader. Michael Bloomberg built a subscription data platform the Bloomberg Terminal and later translated that influence into politics, media, and large-scale philanthropy. This article reframes that comparison using principles familiar to natural language processing (NLP): entity extraction (who are the actors), attribute vectors (net worth, philanthropy focus, leadership style), similarity measures (where they overlap vs diverge) and a classification-style conclusion (which lessons map to which founder archetype).

Using straightforward language, we’ll map facts to features: early life signals, business-model embeddings, philanthropy topics, controversy markers, and practical Leadership heuristics. You’ll also get timelines, a side-by-side table, FAQs (unchanged), and practical takeaways for founders, students, and investors. This is an SEO-aware, reader-first guide designed for clarity and long-form depth.

Quick Summary

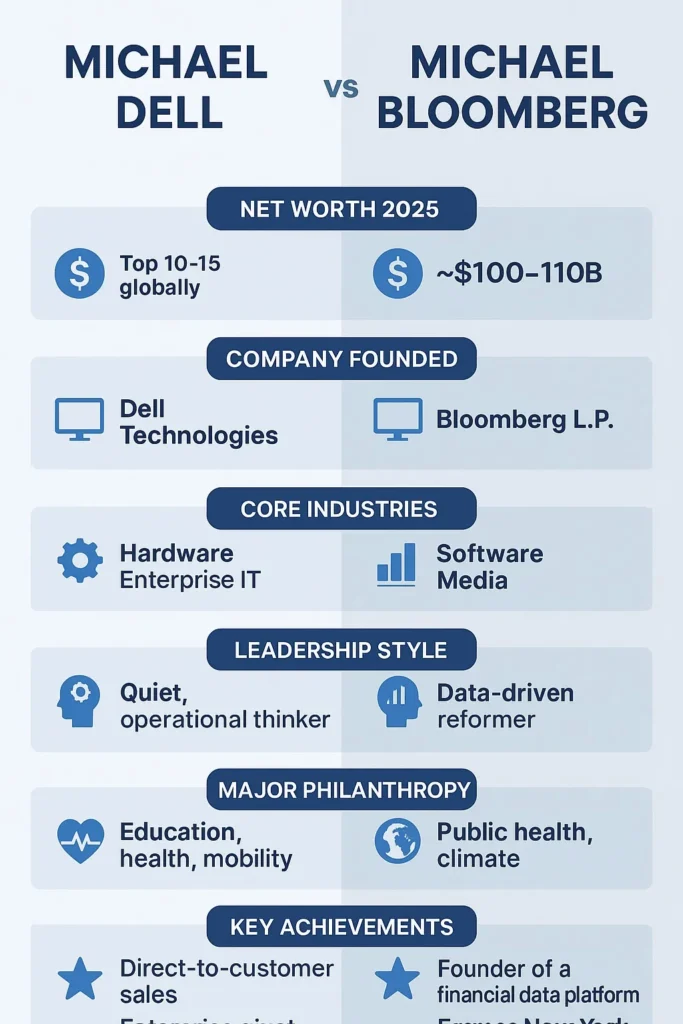

- Entity A Michael Dell: Operator-founder, product & supply-chain expert, enterprise IT pivot. Philanthropy: children, education, economic mobility. Net worth: within top global ranks in 2025 (varies by tracker).

- Entity B Michael Bloomberg: Platform-founder, subscription/data-media powerhouse, former mayor with large civic philanthropy oriented to public health and climate. Net worth: roughly $100–110B in 2025 (varies by tracker).

- Core difference: Dell = systems and operations; Bloomberg = platform economics and policy influence.

- Why it matters: Two replicable founder archetypes with different strategic implications for scaling, public impact, and philanthropy.

Quick Facts

Michael Dell Quick Profile

- Full name: Michael Saul Dell

- Born: February 23, 1965 (Age 60 in 2025)

- Birthplace: Houston, Texas, USA

- Role (2025): Founder, Chairman & CEO of Dell Technologies

- Net worth (2025): Frequently appears within the top 10–15 globally (depends on private-asset valuations and public-market movements)

- Known for: PC revolution, enterprise infrastructure, large-scale philanthropy

Michael Bloomberg Quick Profile

- Full name: Michael Rubens Bloomberg

- Born: February 14, 1942 (Age 83 in 2025)

- Birthplace: Boston, Massachusetts, USA

- Role (2025): Founder of Bloomberg L.P.; former NYC Mayor; global philanthropist

- Net worth (2025): Approximately $100–110 billion (tracker-dependent)

- Known for: Bloomberg Terminal, data & media empire, civic leadership

Side-by-Side Comparison Table

| Category | Michael Dell | Michael Bloomberg |

| Born | 1965 (Houston) | 1942 (Boston) |

| Main Business | Dell Technologies hardware + enterprise IT | Bloomberg L.P. software + data + media |

| 2025 Role | Founder, Chairman & CEO | Founder; philanthropist; former mayor |

| Net Worth 2025 | Top 10–15 (tracker variance) | ~$100–110B |

| Business Model | Product + services + supply chain | Subscription software + data + news |

| Public Service | No elected office | Mayor of NYC (2002–2013) |

| Philanthropy Focus | Education, health, mobility | Public health, climate, education |

| Signature Controversy | Corporate governance, privatization | Policing policies, political spending |

Why Compare Them?

From an NLP perspective, comparing Michael Dell vs Michael Bloomberg is like comparing two class prototypes: each founder represents a different centroid in feature space. Dell clusters around operations, manufacturing, and supply chain features; Bloomberg clusters around platform economics, information services, and civic engagement. Their differences teach practical lessons about product-market fit, scale levers, governance trade-offs, and how wealth transforms into societal influence.

This comparison helps:

- Startup founders decide which capabilities to prioritize.

- Business students understand distinct scaling strategies.

- Philanthropy professionals map giving strategies to outcomes.

- SEO readers get a clear, long-form guide they can trust.

Michael Dell Full Detailed Profile

Early Life & Dorm-Room Origin Story

Michael Dell grew up in Houston and showed early technical curiosity. At 19, he began assembling and selling personal computers from his University of Texas dorm room. The core idea of eliminating retail middlemen and offering customization became a high-signal differentiator in a noisy marketplace. In feature terms: Dell’s early Product-Market fit was a blend of low-cost distribution, supply-chain optimization, and customer-centric configuration options.

Key highlights as feature tokens

- Direct-to-consumer model

- Custom-built hardware for price/feature tradeoffs

- Tight supply-chain control

- Rapid fulfillment cycles

These tokens formed the embeddings that made Dell a market leader through the 1990s.

Career Growth & Transformation of Dell Technologies

Dell moved from PCs into enterprise servers, storage, software, and managed services. That shift is analogous to a model retraining on new data: the original weights (hardware & operations) were retained while new layers (enterprise sales, service contracts, cloud infrastructure) were added. Strategic moves included major M&A and, crucially, taking the company private in 2013, a transformation that reduced short-term market noise and allowed longer-term optimization.

Leadership style

- Operational efficiency (low-latency decision loops)

- Long-term strategic thinking (Private Ownership as regularization)

- Risk-managed acquisitions (selective capacity expansion)

Major Wins From Michael Dell

- Direct-to-Customer Disruption: Reduced distribution layers and unlocked price competitiveness.

- Enterprise Pivot: Diversified revenue streams beyond consumer PCs.

- Large-Scale Philanthropy: Publicized philanthropic commitments center on children’s education and economic mobility (notably a major family pledge in 2025).

Philanthropy & Social Impact

The Michael & Susan Dell Foundation emphasizes evidence-based programs for education, health, and economic mobility. Their giving strategy resembles an A/B testing program: pilot interventions, measure outcomes, scale those that demonstrate measurable impact.

Primary program areas:

- Early-childhood education

- Digital access and technology in schools

- Economic-mobility initiatives

Public Controversies

Dell’s controversies are largely corporate: debates over governance, the implications of privatization, and market consolidation. In a sense, these are adversarial examples illustrating the tension between scale and market concentration.

Michael Bloomberg Full Detailed Profile

Early Life & Bloomberg L.P. Rise

Michael Bloomberg began on Wall Street, and after a job loss at Salomon Brothers, he built what would become Bloomberg L.P. in 1981. The Bloomberg Terminal consolidated real-time market data, news, analytics, and messaging, producing high switching costs and dense network effects.

Core product features

- Real-time finance data streams

- Integrated communication & analytics

- High switching costs (customer lock-in)

- Recurring subscription revenue

These product features made Bloomberg a critical infrastructure in global finance.

Business Model & Global Impact

Bloomberg’s business model is classic platform economics: subscription fees create predictable revenue, network effects increase value per user, and content + analytics create high margins. The company’s media arm expanded narrative reach beyond terminals into global journalism.

Public Service & Mayor of NYC

Bloomberg served as Mayor of New York City (2002–2013), bringing a data-driven governance philosophy that translated private-sector analytics into urban policy. His tenure emphasized public health, data dashboards, bike lanes, and initiatives aimed at modernizing municipal operations.

Leadership characteristics

- Data-driven reformer

- Policy experimentation mindset

- Willingness to invest in institutional capacity

Bloomberg’s Philanthropy

Bloomberg Philanthropies funds public-health campaigns, climate projects, education reform, road safety, and civic innovation. The organization often targets policy levers, funding programs that can change regulations, public norms, or government capacity.

Examples of giving patterns:

- Large grants to public-health institutions

- Investments in civic data and open government

- Climate finance and urban resilience programs

Controversies

Bloomberg’s controversies include debates about policing during his mayoralty, concerns about billionaire political influence, and scrutiny over political spending. These issues highlight the governance trade-offs whenprivate wealth enters the public sphere.

Where Michael Dell and Michael Bloomberg Differ Most

Business Model

- Dell: Tangible product + services; scale through manufacturing efficiency and enterprise contracts.

- Bloomberg: Intangible platform + subscription; scale through customer retention and network effects.

Public Influence

- Dell: Influence primarily through corporate leadership and philanthropy.

- Bloomberg: Influence through civic office, public policy, media, and philanthropic grants.

Philanthropy Style

- Dell: Programmatic, child-focused, outcome-measured giving.

- Bloomberg: Policy-oriented, aimed at changing systems (health, climate, urban policy).

Head-to-Head Comparison

Business Resilience

- Dell: Resilience tied to enterprise IT demand, diversified hardware and services. The model benefits from long-term contracts but faces cyclical hardware demand.

- Bloomberg: Resilience linked to high-margin recurring revenue and essentiality in finance; resilient to economic cycles but sensitive to technology shifts and new market entrants.

Leadership Approaches

Michael Dell

- Quiet, operational, inconsistent with media spectacle.

- Builds systems, optimizes processes, values long-term positions.

Michael Bloomberg

- Public communicator and reformer.

- Uses data to justify policy moves; invests in public campaign-like philanthropic efforts.

Net Worth Comparison

- Michael Dell: Often shows up in top-tier billionaire lists (top 10–15). Because significant parts of his wealth are tied to Dell Technologies (a mix of public and private assets), estimates vary by source.

- Michael Bloomberg: Commonly reported around $100–110 billion in 2025, landing him consistently in the top 15–25 globally. Net-worth tracking is noisy; treat numbers as approximate vectors rather than exact scalars.

Timeline Comparison

Michael Dell

- 1965: Born.

- 1984: Starts PC business.

- 1990s–2000s: Global PC growth and enterprise expansion.

- 2013: Takes Dell private.

- 2013–2020s: Reorganizes around enterprise infrastructure.

- 2025: Major family philanthropic pledge announced.

Michael Bloomberg

- 1942: Born.

- 1981: Founds Bloomberg L.P.

- 2002–2013: Mayor, NYC.

- 2010s–2020s: Intensified philanthropy in public health and climate.

- 2024–2025: Continued philanthropic commitments to health and education.

Leadership Lessons

From Michael Dell

- Build efficient systems: Operational excellence can be a defensible moat.

- Think long-term: Taking strategic actions (like going private) can free you from short-term market pressure.

- Stay flexible: Move across adjacent markets (hardware → enterprise services).

- Use data for improvement: Measure outputs, iterate on processes.

From Michael Bloomberg

- Design for network effects: Products that get more valuable as more users join are sticky and sustainable.

- Make decisions with data: Use empirical evidence to justify big organizational moves.

- Invest in public good: Philanthropy can be a strategic target for policy levers to create system-level change.

- Communicate clearly: As a public figure, message discipline and narrative matter.

Philanthropy Deep Dive

Strategic orientation

- Dell: Programmatic invests in measurable interventions targeting children and economic mobility.

- Bloomberg: Systems-level funds initiatives that change public policy or institutional capability (health systems, climate initiatives).

Measurement & scaling

- The Dell model favors randomized pilots and outcome measurement similar to evidence-based interventions in the social sciences.

- Bloomberg Philanthropies often emphasizes policy diffusion and scale by influencing legislation, municipal practices, and global norms.

Public debate and critique

- Both face critique about the role of billionaires in public life, but critiques differ: Dell is criticized primarily on corporate-market grounds; Bloomberg faces direct questions about democratic influence and policy decisions.

Recent Headlines

- Michael Dell: Notable family pledge in 2025 aimed at creating investment accounts for children, a large-scale educational and economic mobility initiative.

- Michael Bloomberg: Continued large-scale gifts to educational and public-health institutions and ongoing investments in climate and civic technology.

FAQs

A: Their rankings change daily. Dell often appears in the top 10–15, while Bloomberg is usually around $100–110B.

A: Dell: $6.25B pledge in 2025.

Bloomberg: Multiple billion-dollar gifts to public health & education.

A: No.

A: Hardware or enterprise founders → Dell

Software, network, media, or data founders → Bloomberg

Conclusion

Michael Dell and Michael Bloomberg represent two distinct archetypes of modern billionaire founders. Dell’s Trajectory is a lesson in operational rigor: start with a high-signal product-market fit, scale supply chains, and diversify into enterprise services. Bloomberg’s path demonstrates the power of platforms and recurring revenue: build indispensable tools, monetize via subscriptions, and then leverage wealth for public policy influence and civic projects.

Viewed through an NLP lens, the comparison becomes a vector-space exercise: measure attributes (net worth, philanthropy topics, Leadership style), compute similarity (overlap in areas like education and public health), and classify the founders into actionable archetypes for entrepreneurs. Both models are valid, both have trade-offs, and both leave useful patterns for anyone thinking about building companies, shaping public policy, or giving at scale.

For practitioners: choose the strategy aligned with your product’s signal structure (tangible operations vs. networked information), plan governance and measurement, and be deliberate about long-term impact. The core lesson is simple: clarity of architecture (systems for Dell; platform for Bloomberg) plus disciplined execution wins.