Introduction

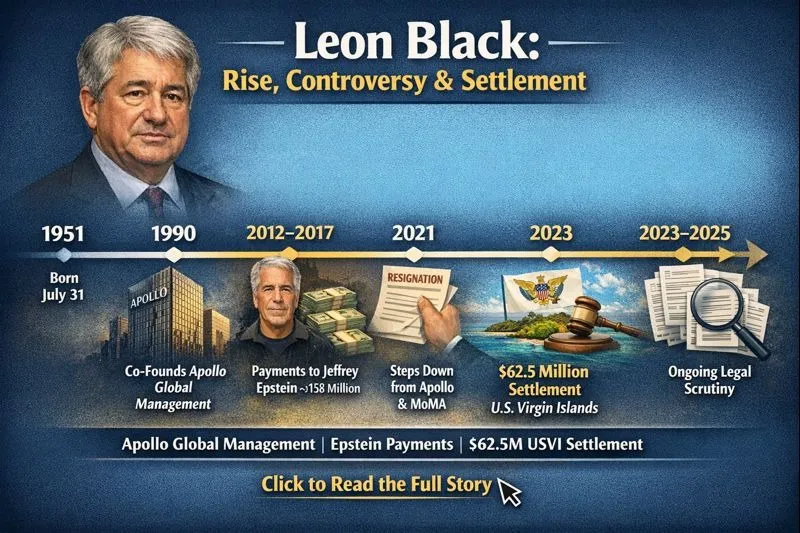

Leon Black sits at the intersection of high finance, public philanthropy, and intense public scrutiny. This article reframes his life and controversies using clear, searchable language and an NLP-inspired structure so readers and search engines can quickly parse the facts, the timeline, and the lessons. Whether you’re a journalist, investor, board member, student, or curious reader, this piece gives a single place to find: who he is, how he built Apollo Global Management, what the reporting shows about the Jeffrey Epstein payments, the legal outcomes to date (including the $62.5M U.S. Virgin Islands settlement), and what institutions should learn from the fallout.

Quick summary

Think of this section as a compact feature vector that a classifier would use to tag a document about a public figure.

- Full name: Leon David Black.

- Born: July 31, 1951.

- Known for: Co-founder and architect of Apollo Global Management — a major private equity and alternative-asset manager.

- Controversy feature: Documented payments to Jeffrey Epstein that prompted corporate governance reviews, resignations from cultural posts, and civil settlements.

- Notable settlement: $62.5 million paid to the U.S. Virgin Islands (2023) to resolve certain civil claims arising from investigations tied to Epstein.

- Public valuation token: Listed by wealth trackers such as Forbes; net worth estimates vary over time and with private valuations.

Who is Leon Black? profile tokenization

In NLP, tokenization splits a sentence into meaningful units. Here we tokenize Leon Black’s career into discrete elements:

- Tokens: early life: Born 1951; education at Dartmouth College; MBA from Harvard Business School.

- Tokens: early career: accounting and leveraged finance experience (Drexel and related firms) that produced initial skill vectors in deal structuring.

- Tokens: founder : Co-founded Apollo Global Management in 1990; role: principal architect and deal partner.

- Tokens: public roles: Held leadership and board positions at cultural institutions (notably MoMA) and engaged in philanthropy.

- Tokens: Controversy payments to Jeffrey Epstein (2012–2017 reported range) that produce strong negative sentiment features in public corpora.

How he built Apollo Global Management, a generative model of firm growth

Model analogy: think of Apollo as a generative model that sampled investment opportunities and then used leverage (borrowed capital) to create amplified returns. The training data were decades of distressed assets, structured credit, and buyouts.

Key architectural components:

- Pretraining (experience): Leon’s early finance roles provided domain knowledge — the equivalent of pretraining on domain-specific corpora (leveraged buyouts, distressed debt).

- Model initialization (1990 founding): Apollo’s initial parameter set included partners with complementary expertise and seed relationships with institutional capital (pension funds, endowments).\

- Optimization (strategy): Apollo optimized returns through leverage, operational fixes, and opportunistic buying: analogous to gradient steps, iteratively improving a loss function (return objectives).

- Scaling (fees and AUM): As assets under management (AUM) grew, Apollo’s parameter space expanded with new funds, strategies (credit, private equity, real assets), and fee streams, producing compounding revenue dynamics.

- Fine-tuning (later decades): Additional strategies, public listings, and diversification acted like fine-tuning to new market regimes.

Result: a high-capacity investment platform whose public and private results made its founders wealthy while exposing the organization to reputational and governance risk when leadership controversies emerged.

Major wins, art, and philanthropy positive sentiment features

From a sentiment-analysis perspective, many of Leon Black’s public signals were positive prior to the Epstein revelations:

- Business performance: Apollo’s growth, fee generation, and institutional client base produced favorable financial sentiment.

- Philanthropy: Donations to healthcare, education, and arts produced positive reputation tokens; leadership roles in museums added cultural capital.

- Art collecting: Large art purchases and donations contributed to civic and cultural visibility.

These positive features formed a dense cluster in pre-controversy embeddings, which later had to be balanced against negative signals from legal and ethical scrutiny.

The Jeffrey Epstein payments story sequence labeling and anomaly detection

This section is the crux of the biography and must be described carefully. Using sequence-labeling metaphors:

- Input sequence: Public records, bank transfers, emails, interviews, legal filings, and independent reviews.

- Labeling task: Assign labels such as payment_to_Epstein, purpose_reported, investigation_triggered, reputational_hit, and legal_settlement.

- Anomaly detection: Large payments to a convicted sex offender are outlier events relative to expected advisor relationships for a senior executive; once flagged, they trigger downstream audits and media attention.

What were the observed tokens

Multiple reputable reports and an independent law firm review documented that Leon Black made substantial payments to Jeffrey Epstein in a period commonly cited as 2012–2017. The well-cited figure from an early independent review was about $158 million for advisory and other services. That figure became a major negative token in the Public Corpus and elevated the story in news ranking models.

Why were the payments a classification problem

For reputational classification, payments to Epstein shifted Black’s label from primarily business leader/philanthropist to subject of investigation. The surprise came from:

- Epstein’s criminal conviction and public notoriety (context tokens include “convicted sex offender”).

- The magnitude of the payments relative to typical compensation for financial or tax advice.

- The lack of public transparency initially was about the precise services, recipients, and routing of funds.

Subsequent probes and updated signals (2023–2026)

Later inquiries, including civil investigations and Senate reporting, surfaced additional details and suggested that transfers might extend beyond the $158M figure previously reported. In July 2023, a high-visibility civil settlement was recorded: a $62.5M payment to the U.S. Virgin Islands, resolving certain civil claims without a criminal conviction. That settlement is a resolved token in the litigation sequence, but later reporting and investigatory findings (including 2026 coverage) continued to add new tokens (additional transfers, questions about banking routes), keeping the document’s attention weights high in 2024–2026 news feeds.

Legal cases, settlements, and investigations timeline as time-series data

Treat this section like a time-series log where events are timestamped and outcomes are states in a finite-state machine.

- 2019: Jeffrey Epstein’s arrest and subsequent death produce massive news attention; media begin correlating his network with high-profile associates.

- 2020–2021: Independent law firm reviews (one widely reported was by Dechert) examine Leon Black’s relationship with Epstein; reporting highlighted a $158M payment figure (2012–2017). Pressure mounts for resignations and governance changes. Black steps back from leadership roles and resigns from some cultural boards. Apollo’s governance is adjusted; Black eventually leaves active roles.

- 2021: Announcements and departures crystallize his reduced public responsibilities at Apollo.

- 2023: Civil litigation culminates in a $62.5M settlement with the U.S. Virgin Islands over claims tied to Epstein-related investigations. Some other lawsuits are dismissed or stayed, producing a mixed legal state.

- 2023–2026: Additional reporting including Senate inquiries and press investigations — suggests further scrutiny and possible additional transfers beyond initial reported amounts. This produced renewed legal and reputational attention into 2026.

State diagram perspective: each event transitions public status from uncontroversial → flagged → investigated → settled/litigated → ongoing scrutiny.

Net worth and financial footprint (2026 estimate) valuation embeddings

Estimating net worth for private-market principals is akin to reconstructing a latent variable from sparse signals (fund holdings, management fees, reported holdings, public investments).

- Data sources: Wealth trackers such as Forbes, corporate filings where applicable, public disclosures (e.g., tax filings for philanthropic vehicles), and market estimates of funds.

- Uncertainty: Much of the value is illiquid private fund stakes, carried interest, and deferred compensation, which creates high variance in point estimates.

- Reported fact: Major outlets continue to list Leon Black as a billionaire, but the exact number fluctuates with fund valuations and market conditions; treat any single figure as an estimate with a confidence interval rather than a deterministic truth.

Lessons for boards, investors, and museum interpretability and governance

Analogous to model interpretability, institutions need transparency and robust vetting pipelines:

- Donor/investor vetting (input sanitation): Treat large donations and advisory relationships like external inputs; validate provenance and legal exposure before accepting.

- Documentation (audit trails): Keep detailed records (contracts, invoices, ROIs) so future auditors can reconstruct purpose and authority.

- Independent reviews (no leakage): Appoint truly independent reviewers with no conflicts avoid circular reporting or “peer” selections that reduce credibility.\

- Transparent communication (model explainability): When controversies arise, communicate clearly and promptly, providing interpretable explanations rather than opaque statements.

- Governance controls (rate limiting): Boards should have pre-defined protocols for escalation and removal to avoid ad-hoc decisions under pressure.

These are practical governance features that minimize the risk of reputational overfitting and allow organizations to generalize through crises.

Timeline quick table

| Year | Event (compact) |

| 1951 | Leon Black Born on July 31. |

| 1970s–80s | Early finance career (accounting, leveraged finance). |

| 1990 | Co-founds Apollo Global Management. |

| 2012–2017 | Reported payments to Jeffrey Epstein (initially tallied at about $158M). |

| 2021 | Steps down from active Apollo leadership; resigns from oMA chair. |

| 2023 | $62.5M settlement with U.S. Virgin Islands (civil). |

| 2023–2026 | Mixed legal rulings; ongoing press & investigatory coverage, including reports of additional transfers. |

Pros & Cons

Pros

- Architect of a major asset manager (Apollo) with significant industry influence.

- Substantial philanthropic giving to health, education, and arts positive public tokens.

- Experience and network that built large institutional relationships and products.

Cons

- Large payments to Jeffrey Epstein created major reputational damage and triggered investigations.

- Legal battles and settlements attracted sustained negative media attention.

- Institutional fallout (resignations, governance shifts) reduced some legacy roles and public trust.

A neutral classifier would weigh these clusters and output a probabilistic reputational score that’s dynamic and sensitive to new evidence.

FAQs

A: Early independent reviews and media reporting identified roughly $158 million in transfers during a period roughly framed as 2012–2017. Subsequent reporting and investigatory work through 2023–2026 has suggested there may have been additional transfers beyond that early tally. Think of the initial $158M as a first-pass estimate from a noisy dataset; later investigations added more data points that refined and in some cases complicated that estimate.

A: When the Epstein payments surfaced publicly, corporate governance and investor risk modeling demanded remediation. Boards and stakeholders decided leadership changes were the appropriate governance response to stabilize the firm and preserve investor confidence. In short, the emergent reputational signal required organizational reconfiguration, and Black reduced or relinquished his operational roles.

A: Yes. In July 2023, he reached a civil settlement with the U.S. Virgin Islands for $62.5 million, resolving certain claims connected to the investigations. This was a civil resolution, not a criminal conviction.

A: Public wealth trackers such as Forbes list him among billionaires, but specific valuations vary with private fund performance and market conditions. Net worth estimation in this context is an inference problem with significant uncertainty; treat published figures as point estimates with varying confidence.

Conclusion

Leon Black is a quintessential example of a high-achieving entrepreneur in the world of private equity. He co-founded Apollo Global Management, built it into a major investment powerhouse, and contributed significantly to Philanthropy and the arts. However, his legacy is complicated by the Jeffrey Epstein payments, which triggered legal scrutiny, civil settlements (including the $62.5 million U.S. Virgin Islands settlement), and resignations from prominent cultural roles.

From a 2026 perspective, his career illustrates both the heights of strategic financial acumen and the enduring impact of reputational risk. Boards, investors, and institutions can learn from his story: thorough vetting, transparent documentation, and strong governance structures are essential for navigating high-stakes financial and philanthropic relationships.