Introduction

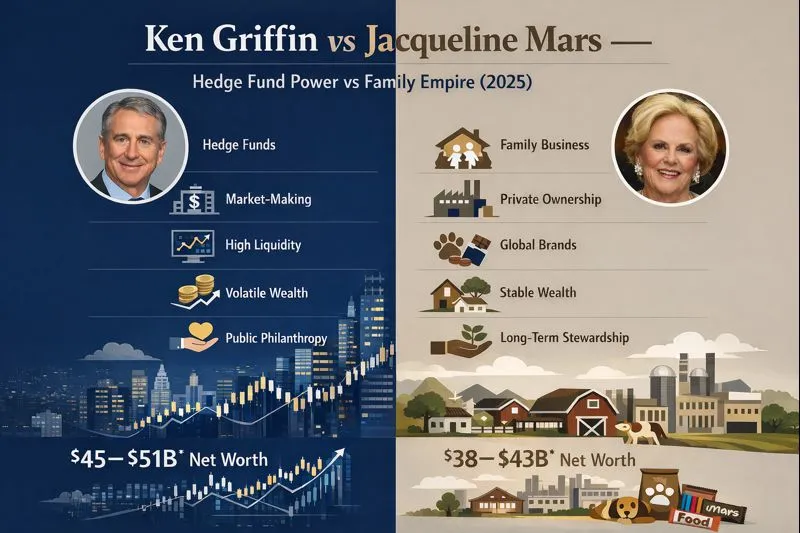

In the global billionaire landscape of 2025, few comparisons are as revealing as Ken Griffin vs Jacqueline Mars. Both command enormous wealth and influence, yet their fortunes are built on opposite economic foundations. Griffin is a modern financial architect, founder and CEO of a hedge-fund empire whose value is shaped daily by market movements, liquidity, and risk management. His success reflects speed, scale, and constant engagement with global capital flows.

Jacqueline Mars represents a contrasting form of power: wealth accumulated and protected across generations. As a leading shareholder in Mars, Inc., her fortune is tied to privately held consumer brands in chocolate, food, and pet care businesses designed to endure economic cycles rather than trade within them. Stability, privacy, and stewardship define this model.

Together, Griffin and Mars highlight a defining tension in contemporary capitalism: short-term market efficiency versus long-term brand resilience. Their stories show how vastly different strategies can lead to comparable levels of wealth while shaping influence, risk, and legacy in profoundly different ways.

Table Quick comparison

| Metric | Ken Griffin | Jacqueline Mars |

| Estimated net worth (2025) | ~$45–$51B (varies by list; Forbes real-time often shows >$50B). | ~$38–$43B (private holdings in Mars, Inc.; estimates vary). |

| Primary source of wealth | Founder & CEO Citadel (hedge fund & market-making). | Heir / shareholder Mars, Inc. (confectionery, pet-food, many brands). |

| Public profile | High visible donor, active collector, public investor. | Low private, family-focused philanthropy, equestrian patronage. |

| Liquidity & volatility | Higher liquidity and volatility (market exposure). | Lower day-to-day volatility, less liquidity (private company). |

| Typical reader intent served | “How did he make money?” “Citadel AUM.” | “How big is Mars, Inc.?” “How does the Mars family manage wealth?” |

Why this comparison matters

Search intent clusters for “Ken Griffin vs Jacqueline Mars” fall into three main types:

- Ranking intent:“Who is richer right now?” (transient, depends on market snapshots).

- Causation intent:“How were their fortunes created?” (causal narratives: trading systems + fees vs brand + manufacturing + distribution).

- Normative/lesson intent: “What can we learn about power, stewardship, and legacy?” (applied lessons for founders, investors, and family offices).

Short bios

Ken Griffin canonical facts

- Full name: Kenneth Cordele Griffin.

- Born: October 15, 1968 (DOB used in entity normalization).

- Known for: Founder & CEO of Citadel (investment firm) and owner of Citadel Securities (market-making).

- Education: Harvard University (economics).

- Profile highlight: High-profile philanthropy, large purchases of historical documents and art (visible reputation investments).

Jacqueline Mars canonical facts

- Full name: Jacqueline Badger Mars.

- Born: October 10, 1939.

- Known for: Heir / major shareholder of Mars, Inc., one of the world’s largest private food & pet-care companies.

- Education: Bryn Mawr College (anthropology).

- Profile highlight: Private, family-led philanthropy and equestrian interests.

Build narratives timeline vectors

I convert each biography into a simple timeline vector (year → primary action), then narrate the financial model implied by that trajectory.

Ken Griffin timeline vector

- 1980s–1990s: Early quant trading; Harvard dorm trades → founding Citadel (1990).

- 1990s–2000s: Build quantitative teams, invest in infrastructure and research.

- 2010s–2020s: Expansion into market-making via Citadel Securities; major philanthropic gifts and high-visibility acquisitions.

Model interpretation :

- Features: High-frequency trading, fee-based recurring revenue (management + performance fees), market-making spreads.

- Behavioral pattern: High optionality, leverage on human capital and technology, public reputation investments.

Jacqueline Mars timeline vector

- 1911 → 1970s: Company founding and multi-generational growth (family business).

- 1970s–2000s: Jacqueline works in Mars roles; transitions into stewardship and board roles.

- 2000s–2020s: Family maintains private ownership; focuses on brand investments, acquisitions, and long-term governance. Recent large deals highlight capacity for scale while remaining private.

Model interpretation:

- Features: Private equity concentrated in consumer brands, predictable revenue streams, governance via family trusts and private boards.

- Behavioral pattern: Low-frequency major events (acquisitions, governance shifts), long-run brand Investment.

Deep comparison

Below I convert qualitative claims into feature-level comparisons, suitable for both human readers and quick automated parsing.

Source of returns

- Griffin: Trading profits, management fees, performance fees, proprietary strategies, capital markets operations.

- Mars: Operational profits from confectionery, pet care, snacking, licensing; reinvested profits and strategic acquisitions.

Liquidity & volatility

- Griffin: Higher liquidity exposure; daily mark-to-market P&L; net worth variable with market moves.

- Mars: Lower daily volatility; net worth estimate depends on private-company valuations and periodic transactions (less frequent mark-to-market).

Public influence and PR

- Griffin: High uses publicity strategically (gifts, collections).

- Mars: Low intentional privacy; philanthropy often channeled through private foundations.

Intergenerational risk

- Griffin: Transition to multi-generational wealth depends on family office design and allocation; more liquid allocations ease transfers but introduce market risk.

- Mars: Company-level governance and family trusts are structured to preserve legacy and business continuity.

Regulation & reputation

- Griffin: Public role invites regulatory scrutiny (market structure, trade practices).

- Mars: Reputational risk linked to product safety, supply chains, and brand controversies; less regulatory visibility due to private status but greater consequences if brand trust erodes.

Assets and investment

Ken Griffin representative exposures

- Financial exposures: Citadel fund stakes, venture/private investments, hedged portfolios.

- Real assets: High-value real estate (urban penthouses, estates), planned large residential projects; also high-end collectibles.

- Philanthropic assets: Donations and named buildings, cultural exhibition loans.

Jacqueline Mars representative exposures

- Company equity: Large ownership percentage in Mars, Inc. (the core asset).

- Real assets: Family estates, equestrian farms.

- Trusts & private vehicles: Designed for stewardship and tax/gift planning; investments may include diversified portfolios but company equity often dominates.

Why net-worth estimates differ

Major ranking services use different signals:

- Public equity observable pricing (used for public-company executives) precise and frequent.

- Private-asset valuation models (used for private-company owners) use revenue multiples, comparable transactions, and occasional disclosures to estimate equity value.

- Timing & methodology: Forbes real-time snapshots may differ from Bloomberg or other indices due to differing update cadences and assumptions. Result: numbers vary; always check the timestamp and valuation notes.

Lessons about money, power, and legacy

I convert the lessons into short, prescriptive “if–then” rules for easier NLP parsing and human consumption.

Lessons from Ken Griffin

- If you want speed and scale, then invest in technology + talent and accept market volatility.

- If you want influence through visibility, then use strategic philanthropy and public acquisitions.

- If you are managing large liquid wealth, then formalize risk controls and robust family-office governance.

Lessons from Jacqueline Mars / Mars family

- If you value continuity, then prefer private governance and long-run brand investment.

- If you want to avoid quarterly pressure, then remain private or build structures that insulate operational decisions from short-term investor demands.

- If you want intergenerational preservation, then codify values and succession in trusts and boards.

Who should care

- Students & investors: learn Griffin for market structure and risk management; learn Mars for brand economics and private-company governance.

- Wealth managers & family offices: model hybrid portfolios combine liquid returns for flexibility with private equity for long-term preservation.

- Founders: evaluate trade-offs early: Public Growth vs private control.

Head-to-head detailed table

| Feature | Ken Griffin (Hedge-fund model) | Jacqueline Mars (Private-company heir) |

| Earnings source | Trading profits, fees, performance, market-making. | Company profits, brand licensing, recurring consumer sales. |

| Liquidity | Higher | Lower |

| Volatility | Higher | Lower |

| Visibility | High | Low |

| Philanthropy style | Public, strategic | Private, family-led |

| Governance | Corporate & fund structures | Family trusts & private boards |

| Best for | Quick growth, public influence | Long-term preservation, brand stewardship |

Ken Griffin Pros & Cons

Pros

- High growth potential: Active trading and market-making allow faster wealth expansion in strong markets.

- Strong public influence: Significant role in global finance, policy discussions, and philanthropy.

- Liquidity advantage: Assets are easier to move, reinvest, or deploy quickly.

Cons

- Market volatility risk: Net worth fluctuates with financial markets and trading cycles.

- High public exposure: Media, political, and regulatory scrutiny is constant.

- Complex operational risk: Hedge funds require continuous performance and risk management.

Jacqueline Mars Pros & Cons

Pros

- Stable, long-term wealth: Private consumer brands generate steady cash flow.

- Privacy and control: Minimal public scrutiny and strong family governance.

- Intergenerational legacy: Businesses designed to last across decades, not quarters.

Cons

- Lower short-term growth : Private ownership limits rapid value spikes.

- Limited liquidity : Wealth is harder to convert into cash quickly.

- Succession dependence : Long-term success relies on effective family governance.

FAQs

A: Both are billionaires in the low-to-mid $40 billion range in 2025. Rankings change with market moves and valuation methods check the date and source.

A: Citadel earns management and performance fees and investments, while Citadel Securities earns trading revenue as a market maker. These businesses create recurring income and market-linked value, so Griffin’s net worth can move with trading results.

A: No. Mars, Inc. is a private company. That means the family’s holdings are valued with private-company methods, not daily stock prices.

A: Private-company wealth (Mars) tends to be more stable day-to-day because it depends on consumer sales, not market swings. Hedge-fund wealth (Griffin) can grow faster but is more volatile.

A: Yes in principle, but that would change control and possibly the company’s long-term focus. The Mars family generally avoids public listings for control reasons, and large transactions are rare and often structured to preserve family stewardship. Recent major acquisitions show Mars’s ability to act at scale while remaining private.

Short case studies

Griffin’s public gifts & reputation strategy

What happened: Griffin has made very large charitable gifts and purchased rare U.S. historical documents and art to shape a public legacy.

Takeaway: High visibility can amplify influence but also invites scrutiny and public debate about wealth and civic role.

Mars’s private continuity & acquisition power

What happened: Mars has made major acquisitions while remaining private, signaling deep balance-sheet capacity and long-run strategic focus. This includes multi-billion-dollar deals to expand into new categories.

Takeaway: Private control allows strategic acquisitions and a long-term product-first mindset, but it requires governance structures that can act at scale while keeping family alignment.

Conclusion

Both Ken Griffin and Jacqueline Mars are standard exemplars of extreme wealth, but they realize different systemic choices: Griffin a high-velocity financial businessman who built a technology-and-people engine that thrives on market motion and public visibility; Mars a keeper of an industrial, consumer business enhanced for brand durability and generational continuity. Which model is “better” depends entirely on your objective: if you prize speed, elective, and public authority, Griffin’s route is instructive; if you prize stability, privacy, and long-term brand supervision, the Mars family model is the blueprint. Watch Net Worth snapshots to realize short-term ranking changes, but study the structural differences to learn justifiable lessons about building, protecting, and transport wealth across generations.