Introduction

Michael Jude Reyes, frequently called Jude Reyes, works as the co-leader of Reyes Holdings, a quietly powerful, family-run distribution company that grew from a single Schlitz beer dealership in 1976 into a global logistics and beverage group. The Reyes siblings developed the firm by focusing on operational excellence, smart acquisitions (especially the 1998 purchase of Martin Brower), and a deliberate choice to stay privately owned. This approach let them reinvest capital for steady growth and secure major deals with leading brands like McDonald’s and Coca-Cola. Today, the Reyes family’s ventures cover beer delivery, foodservice supply, bottling, fleet operations, and storage sites and are often valued at nearly $40 billion in annual revenue. This summary explains how Jude Reyes helped shape the business, the key choices that increased its size, the strengths and weaknesses of a privately held distribution giant, and the practical lessons that entrepreneurs and supply-chain experts can use. Essentially, Jude Reyes shows how careful planning in logistics can create remarkable results, turning modest origins into a strong enterprise that supports much of America’s consumer goods movement. His guidance demonstrates the value of persistence, operational innovation, and long-term planning in building lasting worth.

Quick Facts

- Full name: Michael Jude Reyes.

- Born: 1955 (Washington, D.C.).

- Education: Bachelor’s degree, Wofford College.

- Title: Co-Chairman, Reyes Holdings.

- Known for: Building Reyes Holdings into a top private distribution and logistics firm (reported ≈ $40B sales).

- Residence: Palm Beach, Florida (private).

How a Small Schlitz Distributorship Became a Global Business

The 1976 start of learning by doing

In 1976, Jude Reyes, his brother J. Christopher (Chris) Reyes, and their father bought a small Schlitz beer distributor in Spartanburg, South Carolina. This purchase was simple: an entry into the drinks industry that allowed them to learn operations, transport, inventory control, and the tricky details of keeping shops stocked on time. The first focus was on performing the basics well: improving delivery routes, training drivers, and building strong bonds with suppliers. These core practices became the repeatable system they later expanded. Through direct participation, the family understood the subtleties of supply chain flow, from handling perishable items to facing rules in alcohol distribution. This learning phase was key, as it gave a strong respect for efficiency and dependability, values that shaped the company’s path. By serving local market needs, they improved skills in client service and problem-solving, forming a base for later growth. The period showed them that winning in distribution depends on careful focus on detail and flexibility for unexpected issues, like changing demand or shipping delays.

Building a repeatable distribution playbook

From that modest inception, the siblings formulated a strategy manual that could be implemented in novel regions:

- Uniformize vehicle upkeep and path scheduling.

- Instruct drivers on client interaction and shipment precision.

- Consolidate purchasing to secure superior rates.

- Employ mergers to enhance concentration (additional patrons per path) and diminish expense per unit transported.

This strategy manual converted minor regional triumphs into broader territorial and eventually countrywide expansion. It emphasized scalability, where core processes were refined through data-driven iterations, allowing the company to adapt to diverse geographies without losing operational integrity. For instance, standardizing fleet maintenance reduced downtime and maintenance costs, while centralized procurement leveraged volume for better negotiations with vendors. The playbook also incorporated feedback loops from field operations, ensuring continuous improvement. This approach not only minimized risks associated with growth but also maximized profitability by creating synergies across locations. Over time, it became a blueprint for sustainable scaling, influencing how the company approached larger opportunities and integrated new acquisitions seamlessly into its ecosystem.

The Big Leap Martin Brower

Why the Martin Brower deal mattered

The 1998 procurement of Martin Brower represented a pivotal shift. Martin Brower was and continues to be a primary international logistics ally for McDonald’s, delivering the firm a dependable supply network that links providers to eateries. Through obtaining Martin Brower, Reyes Holdings attained instant worldwide magnitude, a enduring pact with a results-oriented patron, and profound knowledge in hospitality logistics. That transaction assisted Reyes in transitioning from a substantial U.S. beer distributor to an international logistics manager. The deal’s significance extended beyond immediate revenue; it introduced sophisticated supply chain practices that elevated the company’s overall capabilities. By inheriting Martin Brower’s established infrastructure, Reyes gained access to advanced technologies for tracking and optimization, which were previously out of reach for a regional player. Moreover, the acquisition diversified revenue streams, reducing reliance on the volatile beer market and opening doors to stable, high-volume contracts in the fast-food sector. This strategic pivot underscored the value of aligning acquisitions with long-term customer relationships, setting a precedent for future expansions.

What changed after Martin Brower

- Worldwide presence: Reyes now possessed activities in numerous nations via Martin Brower.

- Patron rigor: McDonald’s mandates stringent benchmarks — punctual, comprehensive, and exact shipments which compelled Reyes to elevate their processes.

- Novel competencies: Climate-regulated storage, intricate manufacturing logistics, and international provider synchronization.

These transformations reshaped the company’s operational DNA, fostering a culture of precision and innovation. The global footprint enabled economies of scale in procurement and Technology Deployment, while the demanding McDonald’s standards drove investments in quality control systems and employee development programs. New capabilities like temperature-controlled logistics opened avenues for handling diverse product lines, from frozen foods to beverages, enhancing cross-business efficiencies. Post-acquisition, Reyes Holdings saw accelerated growth, with integrated systems allowing for better forecasting and reduced waste. This era marked the company’s maturation into a multifaceted logistics powerhouse, capable of servicing complex, international supply chains with reliability and foresight.

Expanding Into Coca-Cola Bottling

Strategic entry into the Coca-Cola system

Commencing in the mid-2010s, Reyes Holdings proceeded to broaden within the Coca-Cola framework initially via preliminary agreements and regional inclusions (2014 forward), subsequently incorporating bottling and distribution zones across various U.S. areas. This upward integration permitted Reyes to oversee additional segments of the value sequence: beyond mere distribution, encompassing bottling and production transportation as well. The Coca-Cola Corporation recognized and publicized multiple initiatives where Reyes assumed fresh zones and obligations. This entry was meticulously planned, involving thorough due diligence on market potential and integration feasibility. By securing territories, Reyes not only expanded its geographic coverage but also strengthened its position as a trusted partner within the Coca-Cola ecosystem. The move capitalized on existing distribution expertise, allowing for seamless incorporation of bottling operations and creating opportunities for vertical synergies that improved overall efficiency and profitability.

Why bottling matters

Bottling is resource-heavy yet provides enhanced profit oversight and nearer product oversight. For Reyes, bottling fit their approach: combine a production stage with delivery to build a tighter, efficient supply chain and capture profit that might otherwise go to an outside party. This merge cut middlemen, lowering expenses and improving control over quality and schedules. Bottling work required large initial spending on machines and plants, but the long-term gains included better margins through direct making and tailored packaging options. It also let Reyes react more quickly to market needs, like seasonal shifts or new product releases. In the end, this growth strengthened the company’s competitive edge by creating a stronger and self-reliant supply chain system.

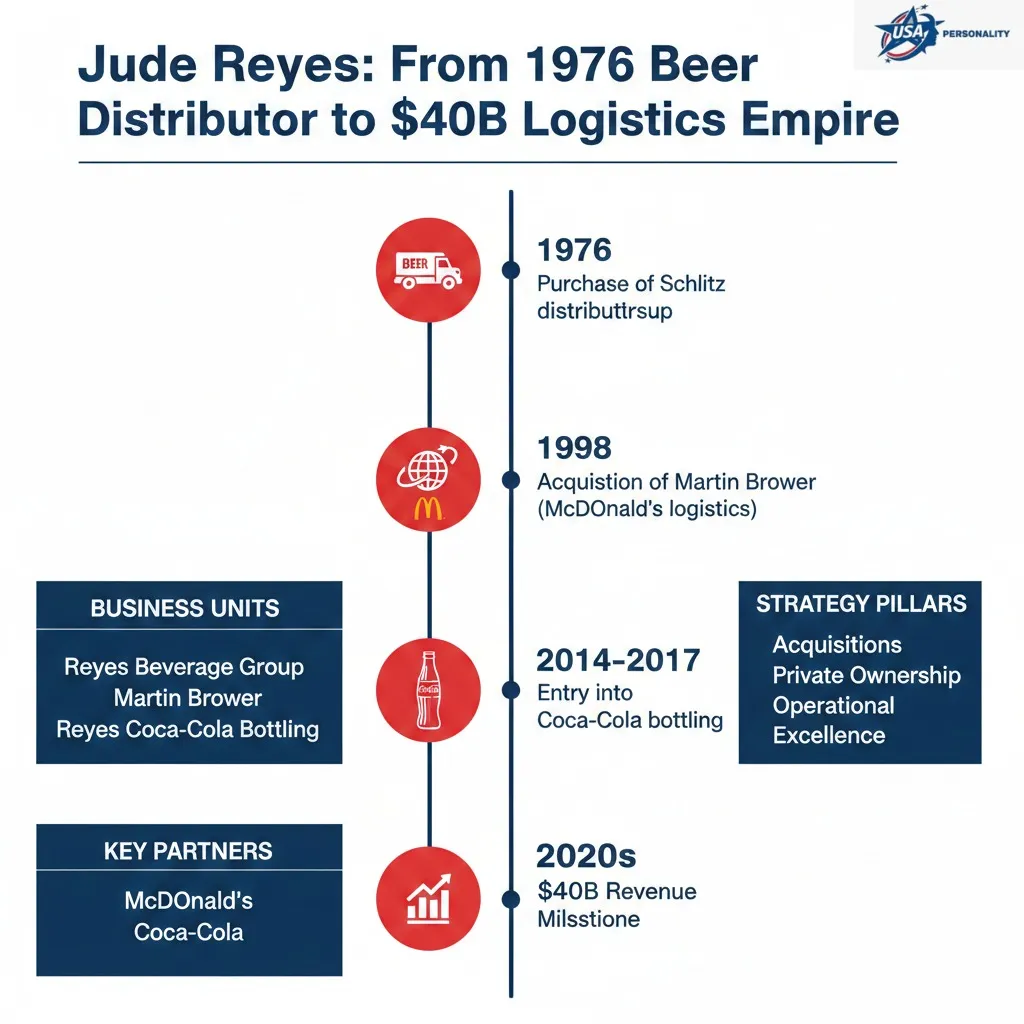

Reyes Holdings Today A Family of Businesses

Reyes Holdings is not merely one entity. It’s a collection of interconnected operating units that collectively deliver a comprehensive logistics framework. Below is a straightforward comparative chart to clarify this structure.

Comparison Table: Reyes Holdings Business Units

| Business Unit | Core Function | Global Reach | Key Customers |

| Reyes Beverage Group | Beer distribution (U.S.) | Nationwide U.S. | Local retailers, bars, restaurants |

| Martin Brower | Global restaurant logistics | Global | McDonald’s |

| Reyes Coca-Cola Bottling | Bottling & regional distribution | Select U.S. regions | Coca-Cola system |

| Reyes Fleet & Logistics Services | Fleet management, warehousing | North America & beyond | Reyes units & third parties |

This unified paradigm boosts path concentration, lowers unit expenses, and elevates transition expenses for significant patrons. The integration fosters shared resources, such as unified IT platforms for inventory tracking, which streamline operations across divisions. By operating as a cohesive family, the businesses mitigate risks through diversification while amplifying strengths like route optimization and customer service. This model has proven resilient, adapting to economic shifts and technological advancements, ensuring sustained growth and market leadership in logistics.

Leadership Style Jude Reyes, the Operator

Hands-on, metrics-driven, and conservative

Portraits of Jude Reyes portray him as an executive who favors practical involvement over publicity, data over jargon, and extended-term strategizing over fleeting fiscal successes. The Reyes executive approach underscores:

- Functional indicators: punctual shipments, completion percentages, stock precision.

- Staff development: consistent assistance relies on skilled operators and depot personnel.

- Cautious growth: procurements enhance proficiency and concentration instead of risky branching.

This approach shows a practical mindset based on real-world action, where choices rely on actual evidence instead of guesswork. Jude’s involved style makes sure that strategic ideas turn into practical plans, with regular checks to keep focus. Data-driven choices encourage responsibility and constant improvement, while caution protects against stretching too far, keeping funds for high-value chances.

Private ownership as a tool

Maintaining private control has empowered Reyes to recycle profits, evade Wall Street demands, and chase deliberate, tactical procurements. That administrative selection is integral to how the firm achieved magnitude without forfeiting oversight. Private status affords flexibility in capital allocation, enabling investments in long-gestating projects like facility upgrades without quarterly reporting pressures. It also cultivates a family-centric culture, emphasizing legacy and stewardship over short-term gains. This governance model has been instrumental in navigating economic cycles, allowing the company to weather downturns and capitalize on acquisitions when competitors are constrained.

Financial Scale The $40 Billion Figure Explained

Numerous credible commercial publications cite Reyes Holdings at approximately $40 billion in annual earnings in latest analyses. Forbes and similar media highlight the firm’s extent alongside workforce numbers that extend into the tens of thousands. These substantial income metrics mirror the organization’s extensive coverage across beverage dissemination, foodservice transportation, and bottling functions. Although precise annual income may fluctuate and non-public entities disclose variably compared to listed corporations, the $40B metric is routinely referenced in 2024–2026 journalism.

Note: Since Reyes operates privately, specific income and earnings particulars are not disclosed as thoroughly as for public entities. The $40B metric derives from trustworthy commercial reporting and firm declarations to associates. This opacity is a hallmark of private firms, yet it doesn’t diminish the company’s impressive scale, which is validated through industry benchmarks and partner testimonials. The figure encompasses synergies from diverse units, illustrating how integrated operations drive revenue Efficiency and market dominance.

Net Worth & Public Listings

Jude Reyes’s personal wealth

Projections of Jude Reyes’s individual fortune differ by source, but publications like Forbes and Bloomberg rank him among tycoons owing to his equity in Reyes Holdings. Forbes’s 2026 reports position the Reyes siblings on affluent rosters, although non-public assessments can vary with fresh transactions and economic surroundings. These estimates consider the company’s valuation, family ownership structure, and comparable industry multiples. While exact figures remain elusive due to privacy, the billionaire status underscores the wealth generated from strategic business building, serving as inspiration for aspiring entrepreneurs in logistics and beyond.

The Operational Engine What Makes Reyes So Efficient?

Shared assets and cross-business advantages

Reyes harnesses magnitude benefits by distributing resources among its divisions:

- Vehicle pools & personnel support both the drink and culinary paths when feasible.

- Depots manage transfer operations for varied merchandise categories, boosting usage.

- Innovation: unified path orchestration and cargo enhancement cut vacant travel.

These shared elements create multiplicative efficiencies, where investments in one area benefit others, such as using advanced telematics for fleet-wide optimization. Cross-business synergies reduce redundancies, lower overheads, and enhance responsiveness to demand spikes, solidifying Reyes’ position as an efficiency leader.

Customer performance contracts

Prominent patrons like McDonald’s necessitate rigorous service pacts. Fulfilling those sustains prolonged deals and guarantees reliable income flows that validate outlays in frameworks and resources. These contracts often include performance incentives, aligning supplier and customer goals for mutual success. Compliance drives ongoing improvements, from AI-driven predictive analytics to sustainable practices, ensuring Reyes remains indispensable in competitive landscapes.

Pros & Cons

Pros

- Functional rigor and implementation.

- Profound alliances with premier patrons (McDonald’s, Coca-Cola).

- Non-public reinvestment for extended vistas and asset-intensive initiatives.

- Variation across drinks, production, and culinary reduces volatility exposure.

These strengths compound over time, creating barriers to entry through scale and expertise. The model’s emphasis on execution ensures consistent performance, while diversification buffers against sector-specific downturns.

Cons

- Focus hazard: reliance on enormous patrons may prove perilous if pacts alter.

- Resource demands: vehicle fleets and production sites necessitate persistent, substantial funding.

- Reduced openness: as a non-public entity, outside evaluators depend on media accounts and optional revelations.

Mitigating these involves robust contingency planning, diversified revenue pursuits, and transparent internal governance to navigate potential pitfalls effectively.

Timeline of Key Milestones

- 1955 — Michael Jude Reyes is born in Washington, D.C.

- 1976 — Purchase of Schlitz distributorship in Spartanburg (start of Reyes Holdings’ story).

- 1998 — Acquisition of Martin Brower (major strategic turning point).

- 2014–2017 — Letters of intent and territory acquisitions within the Coca-Cola system; launching Reyes Coca-Cola operations in parts of the U.S.

- 2020s — Company reported as generating tens of billions in revenue, widely cited around $40B.

This chronology illustrates a deliberate progression, with each milestone building on prior successes to propel the company forward.

Practical Lessons for Entrepreneurs & Supply-Chain Pros

If you aspire to emulate elements of the Reyes strategy, here are explicit, applicable measures:

Master the core operation first

Prior to amplification, validate the procedure regionally: transport duration, exactness, and patron assistance. This foundation ensures scalability without foundational flaws, allowing for confident expansion.

Use acquisitions to add capabilities, not just revenue

Acquire entities that bridge deficiencies (e.g., a production facility, a transportation collaborator with a key patron), not those pursuing notoriety. Focus on strategic fit to enhance core competencies and create lasting value.

Make capital investments where ROI is measurable

Vehicle enhancements, depot mechanization, and path applications yield rapid returns in dissemination when you quantify expense per unit. Prioritize quantifiable outcomes to justify expenditures and track progress.

Keep customers close

Enduring pacts with substantial patrons provide assurance to allocate heavily in frameworks with prolonged recovery spans. Nurture these relationships through exceptional service and proactive communication.

Stay disciplined about diversification

Incorporate neighboring enterprises that permit cost spreading (e.g., communal depots across merchandise ranges) instead of disconnected fields. This approach maintains focus while broadening resilience.

These lessons, drawn from Reyes’ playbook, offer timeless guidance for building robust supply chain ventures, emphasizing execution, strategy, and patience.

Example: How a Route Optimization Win Scales

Consider a solitary urban area where Reyes manages 100 paths and each path incurs $200/day. Minor enhancements that conserve 5% per path accumulate:

- Daily expense prior: 100 × $200 = $20,000

- 5% conservation/day: $1,000 preserved/day

- Yearly (250 operational days): $250,000 preserved in one urban area

Amplifying comparable conservations across multiple urban areas swiftly finances larger ventures like a production facility. This example demonstrates the power of incremental improvements in high-volume operations, where small percentage gains translate to substantial financial impacts. In practice, Reyes employs data analytics to identify such opportunities, iterating on algorithms for route efficiency, fuel savings, and labor optimization. Scaling these wins not only boosts margins but also funds innovation, creating a virtuous cycle of growth and reinvestment. For supply chain professionals, this underscores the importance of leveraging technology for micro-optimizations that drive macro-scale advantages.

FAQs

A: Estimates vary. Sources like Forbes and Bloomberg list Jude Reyes among billionaires based on his stake in Reyes Holdings; published figures change with time and valuation methods.

A: Reyes Holdings acquired Martin Brower in 1998, a key move that expanded Reyes into global restaurant logistics.

A: No. Reyes Holdings is privately held, which allows long-term planning and private reinvestment.

A: Jude Reyes earned a bachelor’s degree from Wofford College.

A: Recent coverage commonly reports Reyes Holdings with roughly $40 billion in sales and tens of thousands of employees across its businesses. Exact figures vary because the company is private.

Strategic Comparison Acquisition Types

| Type | Why buy | Example | Benefit |

| Customer access | Win large account or contract | Martin Brower (McDonald’s) | Immediate scale, stable revenue |

| Vertical integration | Capture more margin | Coca-Cola bottling acquisitions | Control product-to-shelf flow |

| Geographic expansion | Add route density | Regional beer distributorship buys | Lower delivery cost per case |

This table highlights how targeted acquisitions align with business objectives, driving efficiency and growth in the distribution sector.

Industry Impact & Why It Matters

Reyes Holdings demonstrates that dissemination frequently overlooked by end-users can constitute a massive enterprise when managed as an integrated system. Their fusion of communal resources, profound patron pacts, and prudent procurements forged an organization that’s challenging to supplant. For the transportation sector, Reyes serves as a blueprint in magnitude, upward merging, and non-public funding tactics. The company’s influence extends to shaping industry standards for reliability and innovation, influencing competitors and suppliers alike. By prioritizing sustainability and technology, Reyes contributes to broader supply chain resilience, particularly in volatile global markets. Its success story inspires a reevaluation of distribution’s strategic importance, proving that behind-the-scenes operations can generate immense economic value and stability.

Risks & What to Watch For

- Pact alterations: If a primary patron modifies tactics (e.g., increased internal transportation), it might diminish earnings.

- Oversight or monopoly examination: Vast non-public consolidations occasionally draw authoritative attention, especially when dominating significant supply sequence portions.

- Interruption: Emerging final-mile approaches or mechanization might transform dissemination finances.

Addressing these requires vigilant monitoring, diversified strategies, and agile adaptation to maintain competitive edge and mitigate uncertainties.

Conclusion

Jude Reyes’ narrative exemplifies how consistent, pragmatic efforts evolve into monumental achievements. From a 1976 Schlitz distributorship to a multifaceted familial corporation, the Reyes methodology was invariably unflashy: it was systematic, data-oriented, and perseverant. Crucial tactical maneuvers, notably the 1998 Martin Brower procurement and the mid-2010s broadening into Coca-Cola production and zones, converted functional superiority into international magnitude. Persisting under private dominion permitted the firm to recycle funds and operate without exchange pressures. The takeaway for business initiators: dominate a function, utilize procurements to augment proficiency (not excess), and permit solid performance to accumulate gradually. If you’re interested in transportation or establishing a resilient enterprise, Jude Reyes and Reyes Holdings furnish a lucid, replicable guide. This journey not only highlights the rewards of disciplined growth but also the profound impact of family-driven leadership in scaling complex operations. In an era of rapid disruption, Reyes’ model stands as a testament to the enduring power of operational mastery and strategic patience, offering valuable insights for navigating Modern Business landscapes with confidence and foresight.