Introduction

When studying extreme wealth, the most useful lessons do not come from flashy entrepreneurs or celebrity billionaires. They come from quiet dynasties that shape the global economy behind the scenes. Few comparisons reveal this better than John Mars vs Lukas Walton.

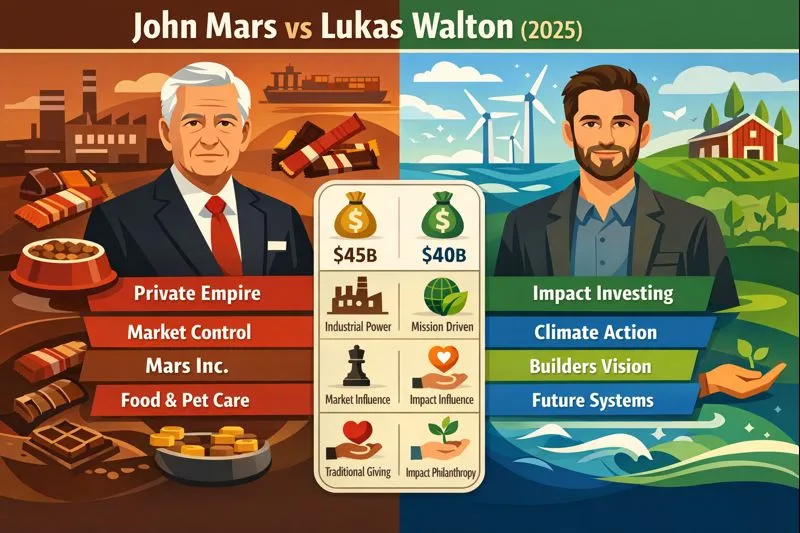

Both men inherited enormous fortunes from legendary American business families. Yet their Philosophy Of Money, power, and responsibility could not be more different.

John Mars represents the traditional model of industrial capitalism. He helped guide Mars, Inc., one of the largest privately owned companies on Earth. His influence flows through grocery shelves, pet-food supply chains, global manufacturing, and long-term family governance. He avoids publicity, rarely speaks publicly, and believes in control through ownership and scale.

Lukas Walton, by contrast, represents a new generation of billionaire heirs. Instead of running Walmart, he channels capital into climate solutions, ocean protection, regenerative agriculture, and impact investing. Through Builders Vision, he blends philanthropy, investment, and policy influence to shape how the future economy works.

This pillar article explains who they are, how they gained power, how they use money, and whose influence may matter more over the next decade. It is written in simple English, backed by credible sources, and structured for SEO, research, and clarity.

Quick Take

Business & Market Power: John Mars

He controls a massive private company that dominates candy, snacks, and pet-care markets worldwide. His power comes from industrial ownership and scale.

Public Influence & Future-Shaping: Lukas Walton

He directs capital toward climate systems, conservation finance, and new economic models. His power comes from ideas, capital design, and narrative leadership.

Quick Facts

| Item | John Mars | Lukas Walton |

| Full name | John Franklyn Mars | Lukas Walton |

| Born | October 15, 1935 | 1986 (commonly reported) |

| Age (2026) | 89 | ~38–39 |

| Main role | Chairman / major owner of Mars, Inc. | Founder & funder of Builders Vision |

| Net worth (2026 est.) | ~$42–45 billion | ~$39–41 billion |

| Core focus | Food, snacks, pet care, private ownership | Climate, oceans, regenerative agriculture |

| Wealth style | Concentrated private control | Diversified, mission-aligned capital |

Childhood & Early Life Roots That Shape Leaders

John Mars Raised Inside an Industrial Empire

John Mars was born into one of America’s most disciplined and private business families. The Mars family culture emphasized three things above all else: quality, secrecy, and long-term thinking.

From childhood, John Mars learned that real power does not need attention. Mars, Inc. avoided stock markets, media interviews, and public drama. Decisions were made quietly, carefully, and with decades in mind.

This environment shaped a leader who trusted family governance, operational excellence, and slow but steady growth. Education and early exposure to international business gave him a global mindset, but always within a private framework.

Key influences from early life:

- Strong belief in family ownership

- Preference for privacy over publicity

- Focus on product excellence and scale

- Long-term capital allocation

Lukas Walton Privilege Meets Purpose

Lukas Walton grew up surrounded by wealth as the grandson of Sam Walton, founder of Walmart. From an early age, he had access to resources that most people never experience.

However, his upbringing occurred during a time when climate change, inequality, and environmental degradation were becoming central global concerns. His education at liberal-arts institutions exposed him to environmental science, ethics, and public policy.

Instead of stepping into Walmart’s corporate leadership, Lukas Walton chose a different path: using capital as a tool for planetary protection.

Key influences from early life:

- Early exposure to inherited responsibility

- Education focused on environmental and social issues

- Desire to define success beyond retail profits

- Willingness to experiment with new financial models

Career Journey How They Used Inheritance

John Mars Builder of a Private Global Giant

John Mars spent his career inside the family business, learning operations from the ground up. Over decades, he helped expand Mars, Inc. far beyond candy.

Under family Leadership, Mars became a global powerhouse across:

- Confectionery

- Snacks

- Food ingredients

- Pet care (a massive profit engine)

The company made strategic acquisitions, entered new markets, and invested heavily in manufacturing and distribution. All of this happened without going public.

Leadership style:

Quiet, disciplined, risk-aware, and deeply long-term.

Lukas Walton From Heir to Impact Architect

Lukas Walton chose capital deployment over corporate management. Through Builders Vision, he structured a platform that operates like:

- A family office

- A philanthropic foundation

- An impact investment firm

Builders Vision commits hundreds of millions and potentially billions of dollars toward projects that fight climate change and restore ecosystems. It often uses Blended Finance, combining grants, guarantees, and investments to unlock private capital.

Leadership style:

Mission-driven, public-facing when useful, and focused on system-level change.

Major Works & Achievements

John Mars

- Chairman and major owner of Mars, Inc.

- Helped maintain private ownership through massive expansion

- Oversaw diversification into pet-care dominance

- Supported major global acquisitions

Lukas Walton

- Founder and backer of Builders Vision

- Financed large-scale climate and ocean initiatives

- Promoted innovative tools like debt-for-nature swaps

- Influenced impact-investing best practices

Net Worth & Financial Status (2025)

| Category | John Mars | Lukas Walton |

| Estimated net worth | $42–45B | $39–41B |

| Wealth source | Mars, Inc. (private) | Walmart-linked assets + Builders Vision |

| Liquidity | Low | Higher |

| Risk profile | Concentrated | Diversified |

Key takeaway:

Mars has a marketcommand. Walton has capital flexibility.

Sources of Wealth Explained Simply

Mars, Inc. Concentrated Control

Mars owns hundreds of brands and controls global supply chains. Private ownership allows bold long-term decisions without shareholder pressure.

Walton Capital Distributed Influence

Lukas Walton spreads capital across investments, grants, and policy-linked initiatives, maximizing influence across multiple systems.

Philanthropy & Impact Investing Side-by-Side

| Area | John Mars | Lukas Walton |

| Style | Quiet philanthropy | Strategic, public initiatives |

| Focus | Education, culture, community | Climate, oceans, agriculture |

| Model | Traditional grants | Grants + impact investing |

| Advocacy | Minimal | Active |

Leadership Style & Public Image

John Mars

- Rare interviews

- Family governance

- Influence through operations

Lukas Walton

- Selective public engagement

- Thought leadership in climate finance

- Influence through ideas and capital design

Pros & Cons

John Mars

Pros

- Massive scale

- Market dominance

- Stability

Cons

- Concentrated risk

- Limited public influence

Lukas Walton

Pros

- Diversified assets

- Future-focused impact

- Policy influence

Cons

- Less direct market control

- Long timelines for results

Timeline of Key Life Events

John Mars

Explore how John Mars and Lukas Walton compare in wealth, influence, and legacy in 2026.

- 1935: Born

- 1960s–2000s: Mars expansion

- 2010s–2020s: Continued acquisitions

Lukas Walton

- 1986: Born

- 2010s: Enters philanthropy

- 2018–2024: Builders Vision growth

Real Examples & Mini Case Studies

Mars Acquisition Strategy

Acquisitions expand shelf space, supply power, and brand dominance without public scrutiny.

Builders Vision Ocean Finance

Debt-for-nature swaps protect oceans while restructuring sovereign debt — a model of financial innovation.

FAQs

A: John Mars is usually slightly richer, but rankings change yearly.

A: Through ownership of Mars, Inc.

A: No. He focuses on Builders Vision.

A: Climate, oceans, regenerative agriculture, and blended finance.

A: Market control brings dominance; mission investing shapes the future.

Conclusion

The comparison of John Mars vs Lukas Walton is not just about who is richer. It is about two very different models of power in the modern world.

John Mars shows the strength of private industrial control. By keeping Mars, Inc. family-owned and out of public markets, he protects long-term planning, operational discipline, and global scale. His influence is quiet but deep. Every time people buy candy, snacks, or pet food, they touch the system he helped build. This is power through Ownership and markets.

Lukas Walton, on the other hand, represents a new kind of billionaire influence. He does not rely on factories or store shelves. Instead, he uses capital design, philanthropy, and Impact Investing to influence climate policy, conservation finance, and the future economy. Through Builders Vision, he tries to change how money works for the planet. This is power through ideas, systems, and mission-driven capital.

In the short term, market control wins. Companies like Mars generate cash, jobs, and global reach that few institutions can match. But in the long term, system-shaping capital may matter more. Climate, food systems, and oceans will define the next century, and Lukas Walton is placing money exactly there.