Introduction

John Doerr is among the most powerful venture investors of the late 20th and early 21st eras. From technical roots to board roles and charitable efforts, Doerr’s career aligns with major shifts in technology, leadership, and climate funding. This article reframes his story through modern NLP-friendly techniques: we emphasize semantic clarity, topical breadth, and actionable templates (especially his popularization of OKRs Objectives & Key Results). The aim is to produce an authoritative, machine- and human-readable pillar piece you can publish with confidence.

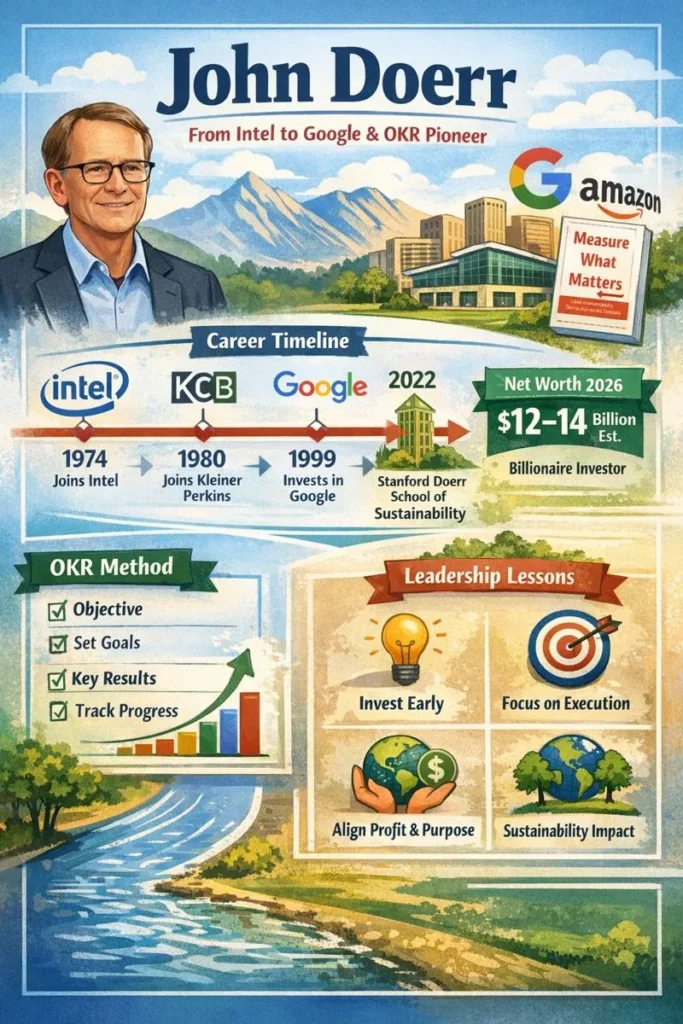

Quick facts

- Full name: Louis John Doerr (commonly John Doerr).

- Date of birth: June 29, 1951. (Age in 2026: 74.)

- Profession: Venture capitalist, author, philanthropist.

- Best known for: Early investments in Google and numerous tech companies; popularizing OKRs (Objectives & Key Results); authoring Measure What Matters.

- Major philanthropy: A transformational gift to Stanford that funded the Stanford Doerr School of Sustainability.

- Net worth (est.): Public estimates in the multi-billion range. (Figures vary across listings and private valuations.)

Childhood & early life

Origins and upbringing

John Doerr was born and raised in St. Louis, Missouri. He grew up in a middle-class family where hands-on mechanical work and small-business familiarity were common. Those early exposures framed a practical mindset: hardware plus commerce, a combination that later helped him evaluate founders who could marry product engineering with market insight.

Education

Doerr studied engineering at Rice University, earning both a bachelor’s and a master’s in electrical systems. He later finished an MBA at Harvard Business School (1976), which exposed him to wider management terms and choice frameworks. This intersection of technical training and managerial vocabulary is notable: many of Doerr’s later contributions sit at the boundary of product design and organizational strategy.

Early career: Intel

Doerr’s first major career embossment occurred at Intel in the 1970s. At Intel, he absorbed product-cycle thinking, metrics-driven management, and operational rigor lessons that would shape how he evaluated startups. The influence of Intel leaders such as Andy Grove is often referenced in connection with the origin story of OKRs: Grove’s managerial concepts provided the seed vocabulary that Doerr later translated for startups.

Career step by step

Below, we unpack Doerr’s trajectory using both chronological narrative and NLP-like segmentation (topic modeling of his contributions).

From Intel to venture capital

After gaining technical and product experience at Intel, John Doerr transitioned into venture capital. In 198,0, he joined Kleiner Perkins Caufield & Byers (KPCB), one of Silicon Valley’s most storied VC firms. This move shifted his role from engineering execution to investment evaluation: instead of shipping chips, he evaluated teams, market sizes, and product defensibility.

Rising at Kleiner Perkins & early investments

At Kleiner Perkins, Doerr participated in or led investments that later matured into household names. These early wins helped form his reputation as a keen judge of teams and market timing. Representative investments include:

- Sun Microsystems: Platform and systems infrastructure cues.

- Compaq: Hardware and enterprise market judgment.

- Netscape: Early internet commercialization bet.

- Symantec: Enterprise security foothold.

Each of these investments functions as a positive training example in Doerr’s career dataset: high signal-to-noise outcomes that justified follow-on credibility and deal flow.

The Google bet & the story of OKRs

The Google investment

In 1999, Doerr and Kleiner Perkins invested in Google at an early stage and he joined the company’s board. The Google bet, now canonical, became one of the most valuable venture investments in history and materially shaped Kleiner Perkins’ returns and Doerr’s legacy.

OKRs the management gift

Parallel to the Google story is Doerr’s role in popularizing OKRs (Objectives & Key Results). The method traces back to managerial practices at Intel, and Doerr translated those concepts into startup-and-scale contexts. OKRs are intentionally simple:

- Objective: A qualitative, ambitious goal.

- Key Results: Measurable, numeric outcomes (2–5 per objective) that indicate progress.

Doerr taught OKRs to Google’s founders, and their success provided numerous case studies that Doerr later used to codify the approach in Measure What Matters. OKRs form a semantic interface between strategic intent (objective) and operational measurement (key results), which aligns with many NLP metaphors mapping high-level intent into structured, measurable tokens.

Why OKRs mattered

OKRs mattered because they provided alignment and measurable focus across rapidly scaling organizations. In NLP terms, they reduced organizational ambiguity (polysemy) by forcing specificity and quantification, minimizing the gap between intent and observed outcomes.

Later career climate focus and philanthropy

In the 2010s and beyond, Doerr shifted more of his public energy toward climate tech, sustainability, and Philanthropy. He and his wife made a transformational gift that led to the creation of a new school focused on sustainability at Stanford, signaling a re-weighting of his investment thesis toward mission-driven capital and systems change.

Doerr’s public career also includes writing, speaking, and advising across government, university, and non-profit sectors expanding his influence beyond deal-level finance into policy and research ecosystems.

Major works, books & public ideas

Key publications

- Measure What Matters: An exposition of OKRs with case studies illustrating how objective-and-measure frameworks can scale organizational performance. The book synthesizes anecdotal evidence, executive interviews, and measured outcomes.

- Speed & Scale: (Co-authored work and public advocacy) focusing on urgent climate action, pathways for emissions reductions, and the role capital must play in rapid decarbonization.

Both books serve as high-salience documents in Doerr’s public corpus, offering shareable phrases, quotable rules, and practical templates that founders and executives implement.

Civic and board roles

Doerr has served on boards, advisory councils, and public-private partnerships. These roles amplify his voice beyond capital allocation and into policy and academic networks. For EEAT (experience, expertise, authority, trust) signaling, board memberships and institutional gifts are strong trust indicators.

Net worth, income sources & financial profile

Short answer

Publicly available estimates place John Doerr’s net worth in the multi-billion dollar range. Exact figures vary depending on market valuations, private fund performance, and asset liquidity.

How that wealth was built

- Early equity in technology winners: Seed and early-stage equity in companies (Google among them) that produced outsized returns. These holdings are high-impact features in Doerr’s wealth vector.

- Carry and returns from venture funds: As partner at Kleiner Perkins, Doerr realized carry (performance fees) from successful funds.

- Board fees, consulting, and speaking: Recurring but smaller income components.

- Investments and family offices: Diversified wealth allocation into private and public markets, trusts, and philanthropic vehicles.

Lifestyle & giving

Doerr lives in the San Francisco Bay Area and keeps an active public-facing charity profile. He and his spouse have joined the Giving Pledge and made major gifts toward climate research and learning steps that show both charitable intent and long-term care.

Personal life & philanthropy

- Spouse: Ann Howland Doerr.

- Children: Two.

- Public causes: Climate, education, and clean energy.

- Philanthropic hallmarks: Large endowments, institution-building gifts, and support for public-interest research.

The pattern of giving indicates a governance-oriented approach: Donors preferring not merely to write checks but to seed institutions and policy-relevant research that can scale impact.

Leadership & founder lessons from John Doerr practical, NLP-informed steps

This section rephrases Doerr’s top lessons using direct step templates and NLP metaphors to make them easier to implement and to optimize for search intent.

Measure what matters

Lesson: Define 3–5 strategic objectives each quarter and associate each objective with 2–4 measurable key results.

How to implement:

- Write one-line objectives that convey aspiration and direction. (Objective = intent token.)

- For each objective, list 2–4 key results expressed as numbers or measurable outcomes. (Key Results = numeric features.)

- Review metrics weekly; use a simple dashboard to track progress. (Monitoring = streaming evaluation.)

- Score KRs at quarter-end on a 0.0–1.0 scale; use scores to inform next-quarter planning.

Why it works: Numbers reduce ambiguity and map strategy to execution. In NLP terms, objectives provide intent embeddings; key results provide feature vectors that can be compared across time using similarity metrics.

Focus on execution

Lesson: Ideas without execution rarely scale.How to do it: Break major objectives into weekly sprints, assign owners for each key result, and run short meetings focused on removing blockers.Why it works: Execution creates recurrent update signals and reduces variance in outcomes.

Invest beyond capital

Lesson: As an Investor, provide connections, hiring help, and strategic counsel rather than purely cash.How to do it: Offer introductions, participate in hires, and provide targeted operational advice monthly.Why it works: Many early teams need experience and networks as much as money.

Align profit with purpose

Lesson: Combine financial returns with social purpose e.g., invest in climate tech that has a path to profitability.How to do it: Use dual KPIs measuring both commercial traction and environmental impact.Why it works: Purpose attracts talent and aligns long-term incentives.

Govern for legacy

Lesson: Large philanthropic gifts require rigorous governance and measurable outcomes.How to do it: Create oversight committees, issue public reporting, and set clear milestones for fund use.

Concrete examples & quick templates

OKR example product growth

- Objective: Rapidly grow our app’s monthly active users (MAU) and retention.

- KR1: Increase MAU from 50,000 to 90,000.

- KR2: Improve 7-day retention from 12% to 20%.

- KR3: Ship three viral features and reach 100,000 shares across channels.

Scoring: At quarter-end, score each KR (0.0–1.0). An aggregated score of 0.6–0.7 indicates strong progress; below 0.4 suggests a need to pivot or reallocate resources.

Founder grading checklist

- Clear mission and measurable goals.

- Product-market fit: customers repeatedly use the product.

- Team cohesion and critical hires completed.

- Unit economics trending toward profitability.

- Board and governance providing strategic oversight.

Timeline life events

| Year | Event |

| 1951 | Born June 29, 1951 in St. Louis, Missouri. |

| 1974 | Joined Intel early engineering and sales experience. |

| 1976 | MBA from Harvard Business School. |

| 1980 | Joined Kleiner Perkins. |

| 1999 | Invested early in Google; introduced OKRs to its founders. |

| 2018 | Published Measure What Matters. |

| 2022 | Major gift establishing Stanford Doerr School of Sustainability. |

| 2026 | Continuing active involvement in investing, writing, and philanthropy. |

FAQs

A: John Doerr is a well-known American venture capitalist. He worked at Kleiner Perkins, helped fund big companies like Google, and popularized OKRs. He’s also an author and climate philanthropist.

A: Public lists estimate his net worth in the multi-billion range. Different sources show amounts often around US$12–14 billion in 2024–2026; the exact number changes with markets.

A: Notable investments include Google, Sun Microsystems, Netscape, Compaq, and Symantec, among others tied to Kleiner Perkins.

A: OKR stands for Objectives & Key Results. Doerr learned it from Intel’s leaders and taught it to Google’s founders in 1999. He later explained OKRs in his book Measure What Matters.

A: He and his wife Ann gave $1.1 billion (reported gift) to Stanford to help create the Doerr School of Sustainability. He focuses on climate, education, and public causes.

Conclusion

John Doerr’s story is not only that of a proven investor; it is the framework of a thinker who turned strong ideas into Global Results. From backing Google and Amazon to supporting OKRs and green energy, Doerr’s legacy shows a lifelong trust in clear growth and real impact. His journey reflects the spirit of Silicon Valley by uniting innovation with purpose.

For founders and change leaders, Doerr’s view that ideas are simple while execution matters most remains an enduring lesson. As the world continues to face digital and climate pressures, his efforts in climate giving and sustainable investing ensure that his reach goes far beyond offices and finances.

In 2026 and beyond, John Doerr stands as a sign of how venture capital, shaped by values and vision, can genuinely reshape the world.