Introduction

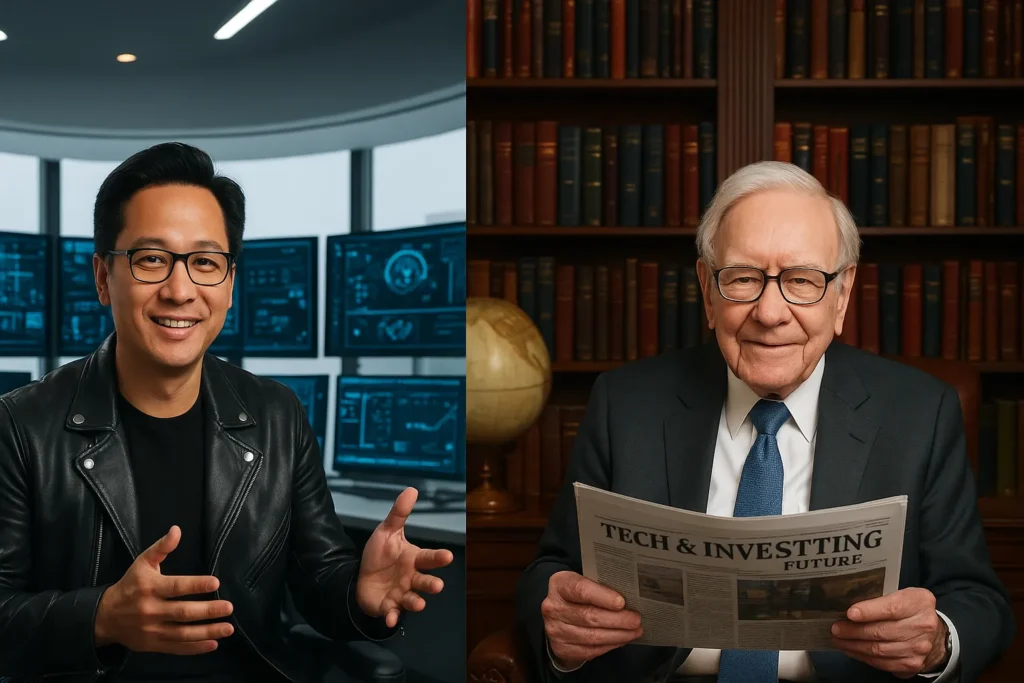

When someone searches “Jensen Huang vs Warren Buffett”, they’re usually asking for more than a scoreboard of net worth. They want a clean, practical contrast between two ways to build vast, durable fortunes: the founder-engineer who scaled a technology platform into the centre of a global AI stack, and the capital allocator who turned disciplined, long-horizon investing into a compounding machine. This pillar article is written in NLP-friendly form: clear entities, intent-focused headings, short paragraphs, and explicit signals for search engines and humans alike.

Comparative Snapshot

Primary intent: Compare two distinct wealth-creation models and extract transferable lessons.

Entities: Jensen Huang, NVIDIA, CUDA, GPUs, Warren Buffett, Berkshire Hathaway, insurance float, capital allocation.

Timeframe: Focused through 2025.

Quick Comparison Table

| Category | Jensen Huang | Warren Buffett |

| Born | 1963 (Taiwan → U.S.) | 1930 (Omaha) |

| Role | Founder & CEO NVIDIA | Chairman & CEO Berkshire Hathaway |

| Wealth Driver | AI chips, GPUs, software ecosystems | Insurance float, whole-company acquisitions, large equity stakes |

| Wealth Dynamics | Concentrated, high volatility | Diversified, steady compounding |

| Primary Strength | Product vision + engineering execution | Capital allocation + risk management |

| Key Risk | Geopolitics, semiconductor cycles | Scale limits; lower short-term upside |

| Leadership Style | Hands-on, technical, rapid decisions | Delegative, principle-cantered, patient |

| Moat | CUDA developer lock-in + silicon expertise | Insurance float + durable operating brands |

Executive Summary

- Jensen Huang built wealth by founding and leading a technology platform company NVIDIA whose hardware + software stack (notably GPUs and CUDA tooling) became indispensable for modern AI workloads. His approach emphasizes technical foresight, developer ecosystems, rapid iteration, and concentrated equity exposure.

- Warren Buffett built wealth via disciplined capital allocation at scale: buying entire businesses or significant equity stakes, reinvesting free cash flow, and using insurance float to create cheap investable capital. His framework emphasizes margin of safety, downside protection, and patience.

- The two are complementary models for readers: founders and product leaders should study Huang’s platform and go-fast tactics; investors, boards, and long-term allocators should study Buffett’s valuation discipline and capital allocation rules.

Net Worth & Market Context

- Huang’s net worth derives primarily from NVIDIA equity; rapid stock moves tied to AI demand mean large swings in personal wealth.

- Buffett’s net worth is a function of Berkshire’s operating profits and investment portfolio; it’s comparatively steady but subject to market valuation changes.

- Corporate signals (2025): NVIDIA’s data-centre revenues and AI-related product lines drove outsized growth through 2024–2025; Berkshire’s annual reports continue to emphasize insurance float, operating company cash flows, and large, patient equity positions.

Timelines Key Milestones

Jensen Huang The Engineer-Founder

- 1984–1993: Engineering education and early semiconductor exposure.

- 1993: Co-founds NVIDIA.

- 1999: GeForce launch (gaming GPU mainstream).

- 2006: CUDA rollout software + developer lock-in begins.

- 2012–2016: Deep learning revival validates GPUs for training.

- 2019–2024: NVIDIA positions as central to AI infrastructure.

- 2025: Platform-led company with data-centre dominance and diversified product integrations.

Warren Buffett The Capital Allocator

- 1940s–1950s: Early entrepreneurial activity; intensive reading and study of value investing.

- 1956: Buffett Partnership begins.

- 1965: Control of Berkshire Hathaway.

- 1967–1990s: Insurance float model solidifies; major acquisitions (See’s, GEICO).

- 2000s–2020s: Expansion into rail (BNSF), utilities, and large public equity holdings (historically Apple among them).

- 2025: Berkshire remains a diversified conglomerate with large cash buffers and a consistent capital allocation philosophy.

Business Models Compared NVIDIA vs Berkshire Hathaway

NVIDIA High-Velocity Technology Platform

Nature: Chip design + software + systems. NVIDIA sells silicon and sells developer productivity through libraries, SDKs, and optimized stacks.

Value creation drivers

- Product advantage: Leading-edge GPU architectures tailored for parallel compute.

- Ecosystem lock-in: CUDA interfaces and libraries accelerate developer adoption and raise switching costs.

- Revenue leverage: High margins in specialized silicon; software adds recurring streams.

Capital flows: Heavy R&D, capex for cooperation, selective M&A to obtain IP or systems ability; share buy off when capital allocation favours returning cash.

Risks: Conductor cycles, competition, supply-chain constraints, and geopolitical export controls.

Berkshire Hathaway Slow, Wide, Durable mixture

Nature: Holding company of operating businesses plus large equity portfolio.

Value creation drivers:

- Insurance float: Receive instalment in advance, invest until claims become payable cheap grip.

- Operating cash flow: Railroads, value, and retail businesses generate expected cash.

- Capital issue: Buy whole businesses when they’re wonderfully priced; buy equities when values align.

Capital flows: Retain operating cash for renew, use float for investments, deploy through acquisitions or holdings.

Risks: Diminishing opportunities at scale, slower growth, macro market shocks.

Leadership & Decision-Making How They Think

Jensen Huang The Architect of Rapid Scale

- Engineering-first mindset: Deep technical intuition drives product roadmaps.

- Founder control: Centralized vision allows quick pivots and fast product cycles.

- Narrative & talent: Combines storytelling with operational rigor to attract top engineers and partners.

- Approach: Highlight speed, optionality, and platform effects.

Warren Buffett The Quiet Master of Patience

- Calculated approach: Heavy reading, careful thought, and clear investment criteria.

- Segregated operations: Berkshire buys businesses and lets competent managers run them.

- Capital protection: Avoid permanent impairment of capital; focus on intrinsic value and margin of safety.

- Approach: Emphasize temperament, long-term compounding, and rules over impulses.

Simple contrast: Huang bets on rapid, structural change in technology and concentrates risk; Buffett spreads risk across durable cash-generating businesses and buys patience.

Capital Allocation Playbooks

NVIDIA / Huang Reinvest to Accelerate

- Reinvestment priority: R&D and product cycle funding to maintain silicon lead.

- Targeted acquisitions: Fill capability gaps (software, networking, systems).

- Share repurchases: Opportunistic, when buybacks increase per-share value.

- Goal: Grow platform adoption and lock in ecosystems before competitors.

Berkshire / Buffett Float + Value + Patience

- Float deployment: Insurance premiums fund long-term investments.

- Whole-company buying: Acquire firms with predictable cash flows and good management.

- Buybacks sparingly: Only when intrinsic value exceeds market price and buybacks create shareholder value.

- Goal: Preserve capital and compound returns steadily.

Risk Profile & Macro Exposure

NVIDIA / Huang High Sensitivity

- Market drivers: AI adoption tempo and cloud spending.

- Supply constraints: Foundry capacity and packaging bottlenecks.

- Geopolitical exposure: Export controls and regional tensions affect addressable markets.

- Competitive pressure: Custom silicon from hyperscale’s or rivals.

Berkshire / Buffett Lower Sensitivity

- Diversification: Multiple operating sectors cushion single-industry shocks.

- Cash reserves: Large liquidity enables opportunistic purchases in downturns.

- Scale limits: Finding outsized returns at Berkshire’s size is challenging.

Side-by-Side Financial Picture

| Metric | NVIDIA (Huang) | Berkshire Hathaway (Buffett) |

| Revenue growth (recent) | Very fast AI-driven | Steady operating + investment income |

| Volatility | High | Low–Medium |

| Main cash source | Product sales, data-centre chips | Operating businesses + investment returns |

| Balance strategy | Heavy R&D & platform investment | Hold cash + deploy via acquisitions/market buys |

Tactical Takeaways for Founders, CEOs & Investors

- Match strategy to horizon. Short-to-medium horizon: product velocity (Huang). Multi-decade horizon: durable compounding (Buffett).

- Build a real moat. Product + developer lock-in trumps features. Seek defensibility that compounds.

- Concentration vs diversification. Know when to double down (edge) and when to diversify (preserve).

- Create optionality. Platforms and ecosystems multiply upside compared to single-point products.

- Prioritize focus. Fewer, disciplined initiatives beat scattered efforts.

- Read & learn. Deep domain knowledge (technical or financial) materially improves decisions.

- Avoid the incomprehensible. Don’t bet on businesses you don’t understand.

- Think ecosystem, not features. Lock-in ≈ recurring value and pricing power.

- Hire for talent density. Small, high-skill teams scale better than large, diffuse teams.

- Communicate clearly. Investors and customers reward clarity of vision and metrics.

- Use capital return wisely. Buybacks and dividends should be tools, not PR.

- Bet big with conviction. When you have durable advantage and margin of safety, act decisively.

Example Scenarios When to Use Which Playbook

You’re a start-up founder

Adopt Huang’s playbook: move fast, secure developer mindshare, and build platform lock-in.

You’re a family office or long-term investor

Adopt Buffett’s playbook: seek durable cash-generating companies and use downturns to buy attractively.

You run a scaling tech company with cash

Blend both: invest in product and platform; keep disciplined capital allocation rules for excess cash.

Pros & Cons

Jensen Huang

Pros

Inventive technologist; bold risk-taker; modify NVIDIA into the core of the AI economy; strong product-first leadership; unusual ability to spot multi-decade tech shifts.

Cons

High-risk bets can strain resources; heavy reliance on cyclical chip order; fast scaling creates operational pressure; understood as macho in contention.

Warren Buffett

Pros

Legendary value investor; rare authority and patience; consistent long-term returns; trusted leadership style; master of capital allotment across diverse industries.

Cons

A cautious approach can miss high-growth tech trends; slower decision cycles; Berkshire’s size limits giant returns; strategy depends heavily on stable, likely markets.

FAQs

A: No. They operate in different industries; the comparison is about two ways to create wealth, not direct commercial competition.

A: Because his wealth is tied to NVIDIA stock, which is sensitive to AI cycles and semiconductor markets.

A: Because it’s spread across many businesses with steady cash flows and king-sized investment allocations via Berkshire.

A: It depends on risk tolerance and horizon. NVIDIA offers higher upside and higher risk; Berkshire offers steadier long-term compounding.

A: Buffett influenced generations of investors with value investing. Huang, as a leader in AI computation, may shape decades of technological infrastructure. Both exert profound but different influences.

Conclusion

Jensen Huang and Warren Buffett speak for two converse but equally powerful paths to building wealth and influence. Huang thrives in fast-moving, high-risk scientific frontiers, turning NVIDIA into the engine of the AI era. Buffett, by contrast, grasped patience, discipline, and value fund to create one of the most durable Empires in money history. Their success proves that there is no single formula for leadership, only clarity of vision, unity, and the courage to play the game in a way that equals your power.