Introduction

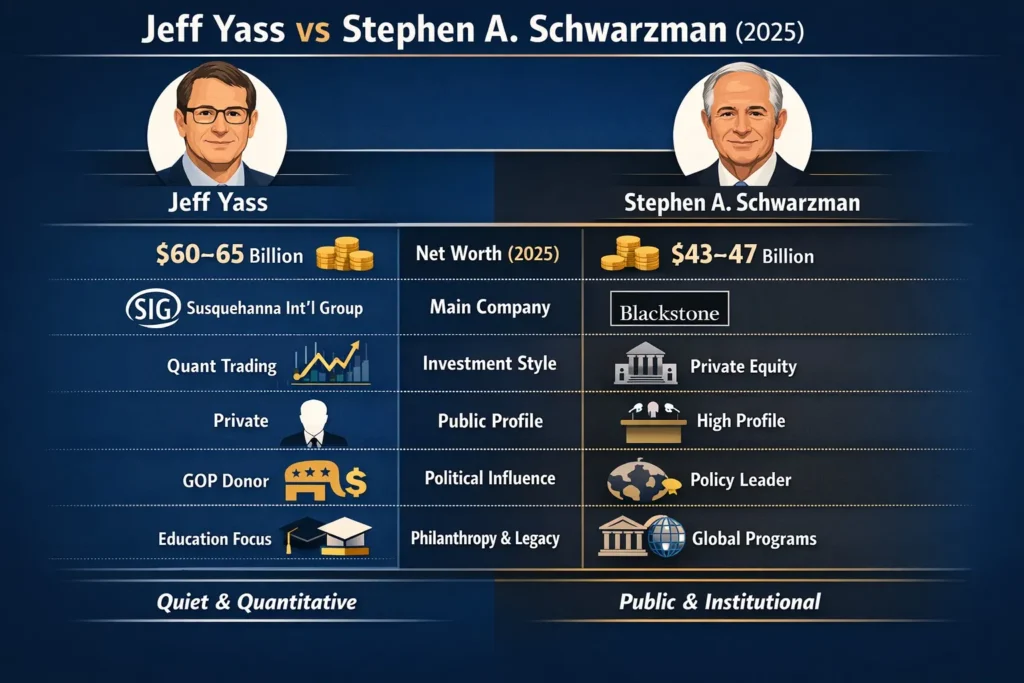

In global finance, there are many billionaires but very few who shape markets, politics, and institutions as deeply as Jeff Yass and Stephen A. Schwarzman. Comparing Jeff Yass vs Stephen Schwarzman is not just about who is richer in 2025; it is about understanding two completely different paths to power, influence, and long-term wealth.

Both men are American billionaires. Both built world-class financial empires from scratch. And both quietly influence how capital moves, how companies grow, and how policy debates unfold. Yet their styles could not be more different.

Jeff Yass represents quiet, mathematical power. He built his fortune through quantitative trading, options pricing, and market-making at Susquehanna International Group (SIG). His firm trades mainly with its own money, stays out of the spotlight, and relies on probability, data, and risk control rather than headlines. Despite being one of the richest investors in the world, Yass avoids publicity while exerting major influence behind the scenes especially in politics and education reform.

Stephen A. Schwarzman, on the other hand, represents visible, institutional power. As the co-founder and CEO of Blackstone, the world’s largest alternative asset manager, Schwarzman built his empire through private equity, large acquisitions, real estate, and credit investing. He is a public figure, a frequent voice at global economic forums, and a major philanthropist known for initiatives like Schwarzman Scholars. His influence comes from scale, leadership, and institutions that manage trillions of dollars.

Quick facts

| Category | Jeff Yass | Stephen A. Schwarzman |

| Full name | Jeffrey Steven Yass | Stephen Allen Schwarzman |

| Date of birth | January 12, 1958 | February 14, 1947 |

| Age (2025) | 67 | 78 |

| Birthplace | Queens, New York, USA | Huntingdon Valley, Pennsylvania, USA |

| Nationality | American | American |

| Profession | Trader, investor, billionaire | Private equity executive, investor |

| Main company | Susquehanna International Group (SIG) | Blackstone Inc. |

| Education | Binghamton University (math & econ) | Yale (BA), Harvard Business School (MBA) |

| Net worth (2025 est.) | ~ $59–65 billion (private holdings heavy) | ~ $43–47 billion (Blackstone-linked) |

| Known for | Quantitative trading & market making | Private equity, buyouts, alternative asset management |

| Public profile | Extremely private | Highly visible and public-facing |

Who is Jeff Yass an “inference engine” of markets

Early life and education

Jeff Yass grew up in Queens, New York. He studied mathematics and economics at SUNY Binghamton and later undertook advanced work at NYU. If you tokenize that biography into milestone tokens, you get early math-focused tokens that map naturally to quantitative finance careers.

Founding Susquehanna International Group

In 1987 Jeff Yass co-founded SIG. In algorithmic terms, SIG is a closed-source proprietary model: it trains on its own capital, optimizes for execution, and exposes only high-level performance metrics to the public. SIG’s architecture centers on options pricing expertise, market microstructure understanding, and continuous model updating a robust, production-grade trading stack.

What SIG does

SIG specializes in market making, options trading, high-frequency and quantitative strategies, and ETF market making. In an NLP analogy, SIG is a low-latency inference pipeline optimized for microsecond decisions with very tight risk constraints and backdating regimes. It focuses on hedged strategies and repeated micro-profits across a very large volume.

Why SIG matters

SIG is a major node in global liquidity provision. Like a high-performance tokenizer combined with clever embeddings, it transforms fragmented signals into consistent returns. Its secrecy is deliberate: proprietary models and capital deployment are a competitive edge.

Wealth & holdings (2025 snapshot)

Yass’s net worth in 2025 is concentrated in private holdings, SIG equity, and reported stakes in private tech. Estimates place him in the tens of billions often quoted around $59–65B. Much of this is illiquid, so treating Net Worth as an embedding magnitude requires caveats about valuation noise.

Influence and political activity

Yass is a large, behind-the-scenes donor to conservative politics and education reform (particularly school choice). His political contributions function like targeted gradient updates to policy space: small, precise, and intended to change specific outcomes (education policy, regulatory stances) rather than to build a public brand.

Who is Stephen A. Schwarzman a transformer of institutions

Early life & education

Stephen Schwarzman comes from the postwar Philadelphia suburbs, studied at Yale, and earned an MBA from Harvard. Those educational tokens align with a high priority for institutional finance and executive networks.

Founding and scaling Blackstone

In 1985 Schwarzman co-founded Blackstone with Peter G. Peterson. Blackstone’s trajectory is an instructive example of converting merchant-banking talent into an AUM-scaling platform. From modest beginnings, Blackstone grew into an alternative asset management giant that, by 2025, represents institutional-scale capital deployment across private equity, real estate, credit, and infrastructure. Think of Blackstone as an explainable, multi-module architecture whose modules manage long-horizon assets and relationships with large institutional clients.

Wealth & public profile

Schwarzman’s net worth is tied heavily to Blackstone equity, carried interest, and dividends, with estimates commonly around $43–47B in 2025. Unlike SIG’s private ledger, Blackstone is public, therefore Schwarzman’s wealth signals are more transparent and auditable through filings.

Why he matters (systemic explanation)

Schwarzman built institutions that absorb capital at scale and influence markets via strategic ownership and operational change. Blackstone’s playbook is to seek governance levers inside target firms, engineer operational improvements, and exit at a return multiple a long-context optimization solved across years rather than milliseconds.

Net worth who has the larger magnitude in 2025?

Net worth estimates vary by source and valuation approach. For 2025, the widely cited picture looks like:

- Jeff Yass: Often estimated around $59–65B, with a heavy concentration in privately held positions and SIG ownership. Valuations can swing because private assets and stakes in high-growth tech firms or private companies can re-value quickly.

- Stephen Schwarzman: Estimated around $43–47B, largely linked to Blackstone’s public share price and the economics of carried interest and advisory fees.

NLP note on uncertainty: In probabilistic modeling terms, Yass’s net worth posterior has heavier tails because of private holdings and valuation extrapolation; Schwarzman’s posterior is narrower because public market data provides clearer signals.

Bottom line: By many 2025 lists, Jeff Yass registers as the higher nominal net worth, though both occupy the highest percentiles in American wealth.

How they make money two architectures

Below is a side-by-side, then a systems explanation.

At a glance

| Topic | Jeff Yass | Stephen Schwarzman |

| Core method | Quantitative trading & market making | Private equity buyouts & asset management |

| Capital base | Mostly proprietary | Institutional capital (pension funds, sovereign wealth) |

| Time horizon | Short-to-medium (trades) | Long-term (years/decades) |

| Public exposure | Low | High |

| Risk approach | Hedging & statistical risk models | Leverage + operational control |

| Visibility | Private | Public |

Jeff Yass probability-first, latency-sensitive

Yass’s strategy is deeply mathematical. SIG’s decision system emphasizes rigorous probability estimation, precise hedging, and continuous calibration. These elements reduce dependency on macro narratives; instead, gains accrue from structural edges in pricing, information asymmetry, and execution.

Stephen Schwarzman structural intervention, governance-first

Schwarzman’s approach emphasizes acquiring ownership stakes, changing governance, and optimizing capital structure. These are long-horizon interventions that depend on operational execution and macroeconomic cycles. Blackstone layers leverage (credit) to amplify returns and relies on deep sectoral diligence plus network effects (relationships with limited partners, access to deal flow).

Contrast in risk and return profiles

- Yass/SIG: Lower per-event exposure, frequently hedged, returns driven by many small, diversified bets.

- Schwarzman/Blackstone: Concentrated deals, higher event-level risk but potentially larger asymmetrical payoffs when operational improvements are successful.

Public profile, politics, and influence attention weights explained

Jeff Yass heavy in gradient updates, light in display

Yass uses donations to shift policy gradients especially on education and school choice. These investments function like sparse, high-magnitude parameter updates targeted at specific policy modules. Despite large financial clout, his social activation (public-facing attention) is limited.

Stephen Schwarzman high visibility, high scrutiny

Schwarzman engages publicly: high-profile philanthropy, prominent speaking appearances, advisory roles, and institutional donations (e.g., university programs). His public visibility converts to soft power and reputation capital, but also invites regulatory and media scrutiny.

How influence maps to model interpretability

A private donor like Yass operates as a hidden parameter in many policy models; a public donor like Schwarzman is a visible node whose actions are part of the observable training data used by journalists, regulators, and historians.

Philanthropy and legacy two update mechanisms

Jeff Yass

Philanthropic focus: education reform and school choice. Contributions are often channeled into advocacy networks and specific policy initiatives rather than public monuments or named global programs. In knowledge-management terms, Yass’s donations are targeted function updates to the education-policy subgraph.

Stephen Schwarzman

Philanthropic focus: higher education, large institutional gifts, and the Schwarzman Scholars program. These are durable, named programs that function like public checkpoints: they persist in public memory and influence institutional curricula, leadership development, and cultural capital.

Legacy contrast

Yass’s legacy is movement-oriented and policy-focused (changing how systems behave); Schwarzman’s legacy is institution-oriented and architected for public remembrance.

Leadership style and company culture activation functions and gradients

SIG (Yass)

Culture: technical, meritocratic, and secretive. Hiring focuses on math, CS, and options specialists. Decision-making is decentralized across desks but governed by shared risk systems and a culture of performance measurement.

Blackstone (Schwarzman)

Culture: deal-driven, institutionally oriented, focused on governance and investor relationships. Decision-making is hierarchical but uses strong talent development and public investor relations strategies.

Head-to-head strengths and weaknesses

Jeff Yass Strengths

- Highly data-driven and nimble.

- Revenue diversification across many trading strategies.

- Low public exposure reduces reputational risk.

Jeff Yass Weaknesses

- Lower public legacy (fewer named institutions).

- Holdings in geopolitically sensitive private companies can generate policy risk.

Stephen Schwarzman Strengths

- Institutional scale and global brand.

- Durable philanthropic footprint; public legacy.

- Ability to deploy capital in very large, transformative transactions.

Stephen Schwarzman Weaknesses

- High public profile = higher regulatory and reputational exposure.

- Private equity cycles can lead to larger swings in valuation and headline risk.

Timeline of major life events

Jeff Yass

- 1958: Born in Queens, NY.

- 1987: Cofounded Susquehanna International Group (SIG).

- 2010s–2020s: SIG’s market making and options expertise expand; private tech stakes grow.

- 2024–2025: Notable political donations and behind-the-scenes influence.

Stephen Schwarzman

- 1947: Born in Pennsylvania.

- 1970s: Early finance career, Harvard MBA.

- 1985: Cofounded Blackstone.

- 2007: Blackstone IPO; major institutional expansion thereafter.

- 2020s: Blackstone exceeds $1 trillion AUM across strategies; Schwarzman’s philanthropic programs grow.

Side-by-side comparison

| Factor | Jeff Yass | Stephen Schwarzman |

| Net worth (2025 est.) | ~ $59–65B (private-heavy) | ~ $43–47B (Blackstone-linked) |

| Core business | Quant trading & market making | Private equity & real assets |

| Public visibility | Very low | Very high |

| Political style | Behind-the-scenes donations | Public institutional influence |

| Philanthropy | Focused on education reform | Large institutional gifts & scholarships |

| Risk model | Hedged, probability-driven | Leverage + operational improvement |

Lessons each teaches

- From Jeff Yass: Systems, discipline, and probabilistic thinking build repeatable processes, measure risk actively, and optimize for consistent edge. In NLP terms: prefer robust generalization over brittle memorization.

- From Stephen Schwarzman: Institutions matter. To influence at scale, assemble teams, institutionalize knowledge, and invest in durable structures (universities, scholarship programs). In NLP terms: if you want to persist across time, build persistent checkpoints and public artifacts that future agents can retrieve.

- Shared lesson: Multiple architectures can solve the same societal optimization problems. Quiet, technically optimized actors and public, institution-building actors both shape outcomes; understanding both is essential for policymakers and market participants.

FAQs

A: Most lists in 2025 show Jeff Yass ahead of Stephen Schwarzman in net worth. Estimates vary (Yass ~ $59–65B; Schwarzman ~ $43–47B).

A: Through Susquehanna International Group (SIG) quantitative trading, options, and market making.

A: Co-founding Blackstone and building it into a global alternative asset manager. He is also known for big philanthropic projects like Schwarzman Scholars.

A: Jeff Yass is a bigger political donor behind the scenes. Schwarzman is politically active publicly, often through policy work and institutional giving.

A: Neither is inherently safer. Trading can be smoother with hedges but is exposed to rapid market shocks. Private equity can make big returns but is cyclical and tied to leverage and public policy.

Conclusion

Jeff Yass vs Stephen Schwarzman highlights two radically different paths to billionaire power in global finance. Both men shaped markets and institutions, yet one built wealth through quiet, data-driven trading while the other rose through public Leadership and large-scale private equity. This comparison reveals how influence can be achieved through both discretion and visibility in modern finance.