Introduction

Think of Henry R. Kravis as a seminal “architect” in the finance model zoo, a lead engineer who helped design a new algorithm (private equity) that transformed how enterprises are sampled, scored, optimized, and deployed. In classic NLP terms, Kravis co-designed a high-impact “model architecture” (KKR) that formalized the leveraged buyout (LBO) pattern; that pattern is as influential in corporate finance as transformer architectures are in language models.

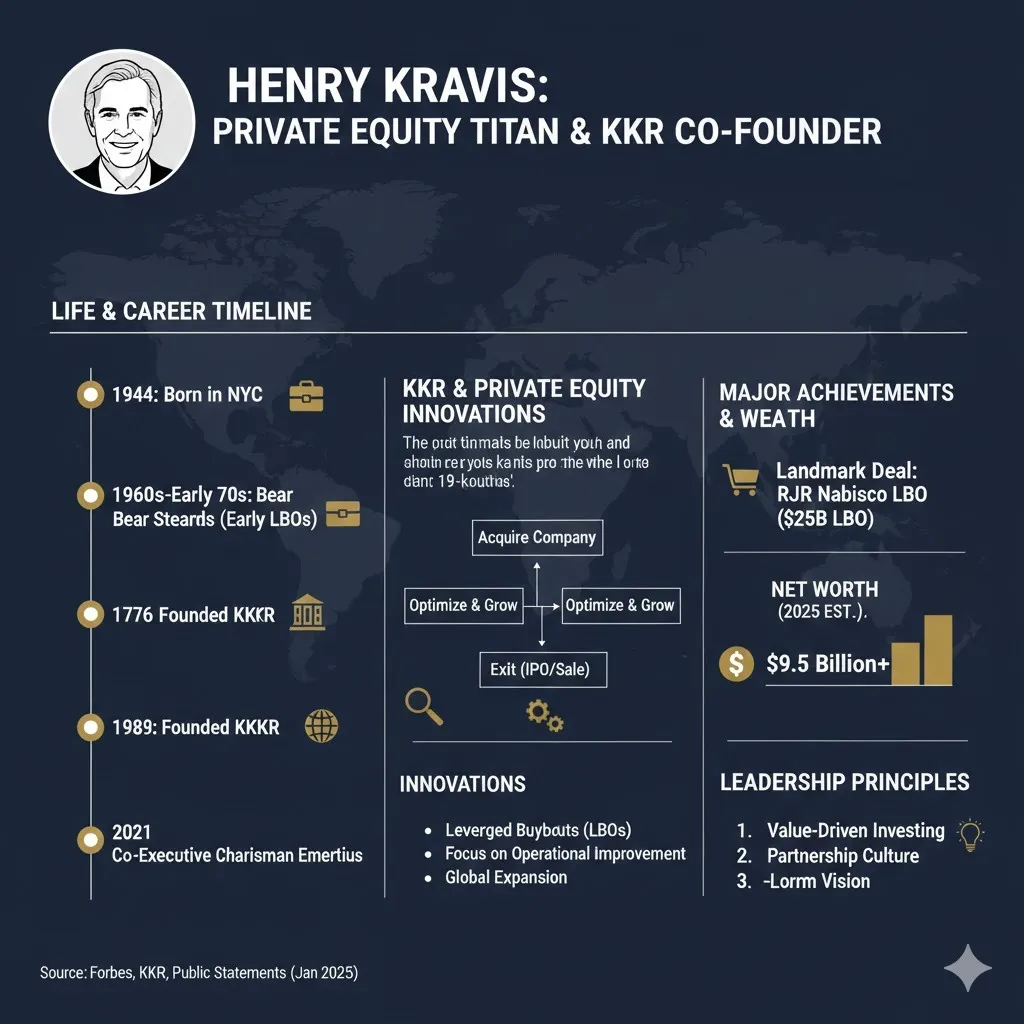

Key public facts worth anchoring up front: Kravis co-founded KKR (Kohlberg Kravis Roberts & Co.) in 1976 and currently serves as Co-Executive Chairman. He was born on January 6, 1944, in Tulsa, Oklahoma. The most famous cultural example tied to Kravis is the RJR Nabisco leveraged buyout, an event chronicled in Barbarians at the Gate and studied as a landmark LBO. By 2026, mainstream wealth trackers estimate Kravis’s net worth in the low-to-mid tens of billions (Forbes lists an estimate in 2026). He’s also known for philanthropy, like the Henry R. Kravis Prize in Nonprofit Leadership.

Quick Facts

| Attribute | Detail |

| Full name | Henry Roberts Kravis |

| Born | January 6, 1944 (Tulsa, Oklahoma). |

| Education | Claremont McKenna College (BA), Columbia Business School (MBA) |

| Known for | Co-founder of KKR (1976). |

| Famous deal | RJR Nabisco leveraged buyout (1988). |

| Net worth (2026 est.) | Forbes 2026 estimate: ~$13.3B (reported). |

| Role (2026) | Co-Executive Chairman, KKR. |

| Philanthropy | Henry R. Kravis Prize in Nonprofit Leadership (Claremont/CMC). |

Early Life & Education: the data-collection phase

In NLP pipelines, the first step is data acquisition: you gather raw text and metadata. Kravis’s early life functioned as his input corpus. Born in Tulsa, Oklahoma, his formative years and education (Claremont McKenna, then Columbia Business School) supplied the foundational features of work ethic, network, and early exposure to finance that would later be engineered into more complex strategies.

Where other engineers might curate data sets, Kravis curated mentors: at Bear Stearns, he worked closely with Jerome Kohlberg Jr. and George R. Roberts, which is analogous to a junior engineer joining an experienced lab and learning an architecture that will later be forked and scaled.

Career Path model architecture and early training

Pre-training (Bear Stearns): Kravis joined Bear Stearns after his MBA, learning the primitives of leveraged buyouts, how to structure debt-heavy acquisitions where an asset’s future cash flows would service the borrowed capital. This is like learning tokenization and basic optimization before applying deep learning.

Model fork & architecture decision (1976): In 1976, Kravis, Roberts, and Kohlberg left Bear Stearns to form KKR (an independent architecture). That move is analogous to forking an open-source model and training it on proprietary data with a new objective function. KKR’s original “loss function” was to generate outsized returns using leverage, operational fixes, and eventual exits.

Scaling: Over subsequent decades, KKR evolved from a single LBO model to an ensemble: credit strategies, infrastructure, growth equity, real estate, and more. In ML terms, they moved from a single-task model to a multi-task, multi-modal system that reduces dependence on one asset class and improves generalization.

The RJR Nabisco Deal a case study

Dataset: RJR Nabisco (1988), a conglomerate with consumer foods and tobacco lines. Task: purchase a large, public company using LBO techniques. Adversarial conditions: intense bidding war, public scrutiny, and regulators; heavy leverage in an era without the modern risk controls of later years.

Result: KKR won a pitched bidding contest; the transaction became the era’s largest LBO and a case study in both technique and the ethical economics of private equity. The episode is comprehensively chronicled in Barbarians at the Gate.

Takeaway as an ML lesson: When you push model capacity (huge leverage), you may also increase variance (financial instability under stress). The RJR dataset shows how high capacity without robust regularization (risk buffers, covenant protections) can cause systemic strain.

Henry Kravis’s Private Equity Playbook, an NLP pipeline mapping

Below is Kravis’s operational playbook reframed as an NLP system design and training regimen. Each step maps to a familiar machine Learning Operation, so readers who know ML/NLP can internalize the finance tactic as engineering practice.

Data Sourcing → Find companies with stable cash flow

In ML: collect datasets with consistent labels. In private equity, target businesses with reliable EBITDA and predictable free cash flow. Stable signals reduce risk and improve the predictability of returns.

Feature Engineering → Assess leverage capacity

In ML: craft features that permit stronger learning signals. In PE: calculate how much debt the target can safely carry given its cash generation and capital needs. Use scenario stress-testing (shock simulations) to determine safe leverage bands.

Acquire Control → Buy influence or full control

In NLP: choosing whether to fine-tune a pre-trained model fully or sparsely. In PE: acquiring control lets you change architecture (management, processes) rather than only passively holding stock.

Management & Model Updates → Build or replace management

Equivalent to model retraining or replacing layers. Operational changes (new executives, better KPIs) are the gradient steps that increase performance.

Cost Optimization → Prune unnecessary operations

In ML: prune redundant neurons or compress models. In business: cut non-value activities, improve margins, and remove noise that reduces signal.

Growth Investment → Add capacity where the signal is positive

Like increasing training data or model size selectively. Invest in R&D, CapEx, or digitalization where ROI is clear.

Incentive Alignment → Loss function design for management

Attach equity, carry, or performance metrics so managers’ objectives align with long-term returns — this is designing a loss function that embeds desired behavior.

Exit Strategy → Define evaluation & deployment

From day one, plan whether the exit is IPO, sale to a strategic buyer, or sale to another financial sponsor. This defines the deployment and inference stage.

Portfolio Diversification → Use ensembles

Spread across sectors and geographies to lower correlation risk. In ML, ensembles reduce variance and boost robustness.

Reputation & Governance → Model explainability & compliance

Preserve relationships with lenders and regulators; maintain reputational capital, think explainability, audits, and compliance in ML systems.

How KKR evolved from a single-task to a multi-modal platform

KKR’s lifecycle mirrors the evolution of ML ecosystems: from a single high-performance model (LBOs) to a platform approach managing multiple asset classes (credit, infrastructure, real estate, growth equity). This transition improved stability across market cycles and allowed more diverse revenue streams (management fees, carried interest, credit yields).

By the 2010s, KKR had become a publicly listed firm (IPO in 2010) and by the 2020s had built sizable AUM distributed across strategies. That institutionalization is analogous to deploying a model in production with monitoring, multiple endpoints, and new business verticals.

Major Achievements & Honors

- Co-founding KKR in 1976 (architecture creation).

- Executing transformative deals, including the RJR Nabisco buyout (1988) a high-variance, high-impact instance.

- Building KKR into a global asset manager with multi-modal strategies. (documented in the financial press).

- Founding the Henry R. Kravis Prize in Nonprofit Leadership philanthropic model release.

Net Worth & Money: Henry Kravis’ net worth 2026

Wealth trackers differ in their methodologies (public stock holdings, estimated carry, illiquid assets). As of 2026, Forbes lists Henry Kravis with an estimated net worth of roughly $13.3 billion (Forbes 2026 ranking). Use these figures as estimates, not precise valuations: private holdings and carried interest valuation assumptions can shift net worth rapidly.

Personal Life profile features

Kravis’s personal life is quieter than his professional life in public reporting. He has been married (currently reported to Marie-Josée Kravis), experienced family tragedy (loss of a son), and maintains strong ties with academic and cultural institutions. These personal variables inform his philanthropic choices and public positioning.

Philanthropy & Legacy model contributions to society

Kravis’s philanthropic architecture includes the Henry R. Kravis Prize in Nonprofit Leadership (established 2006), gifts to Claremont McKenna College, Columbia Business School, and cultural/medical institutions. This philanthropic work acts as a model interpretability output: sharing best practices, funding leadership, and creating reproducible lessons for the nonprofit sector.

Pros & Cons

Pros

- Pioneered private equity models that unlocked capital and operational fixes.

- Scaled a firm into a major global asset manager with diversified strategies.

- Supported nonprofits and educational institutions.

Cons:

- High leverage increases systemic fragility in downturns (variance spike).

- Short-term cost-cutting post-acquisition can cause social externalities (layoffs).

- Public perception and regulatory scrutiny often follow high-profile LBOs.

Timeline: important model checkpoints

- 1944 Henry R. Kravis was Born.

- 1967 Graduated from Claremont McKenna.

- 1969 MBA, Columbia Business School.

- 1976 KKR was founded (architecture created).

- 1988 RJR Nabisco LBO (landmark case).

- 2010 KKR IPO (firm moves to public markets).

- 2021 Kravis steps down as co-CEO and is Co-Executive Chairman.

- 2026 Active as Co-Executive Chairman; public filings and press notes continued involvement.

Controversies & Criticisms: adversarial examples

High-profile buyouts like RJR invited critique: the use of excessive leverage, significant restructuring, and sometimes layoffs created political and public backlash. Critics view certain LBOs as extracting value at the expense of workers; defenders claim operational discipline and long-term gains. These tensions mirror algorithmic debates: model utility vs. distributional harms.

FAQs

A: Henry R. Kravis is an American businessman and investor. He co-founded KKR, which helped create the modern private-equity industry.

A: Estimates for Henry Kravis’ net worth in 2026 place him at about $13.3 billion (Forbes 2026 list). These numbers change with markets.

A: The RJR Nabisco deal (1988) was a huge leveraged buyout that became famous and was written about in Barbarians at the Gate. It illustrated both the power and risks of LBOs.

A: As of 2026, he is Co-Executive Chairman of KKR.

A: A prize that rewards leaders in the nonprofit sector for outstanding work and impact; managed through Claremont McKenna College and related foundations.

Conclusion

Viewed as an engineer or data scientist, Henry Kravis is the Founder of a high-impact architecture that introduced a repeatable training regimen for corporate transformation. His approach illustrates the tradeoffs inherent in pushing model capacity (leverage) to achieve higher performance (returns). The subsequent institutionalization of KKR into a diversified platform is an instructive arc: start with a clear hypothesis, iterate operationally, diversify to reduce idiosyncratic risk, and embed governance to manage externalities.