Introduction

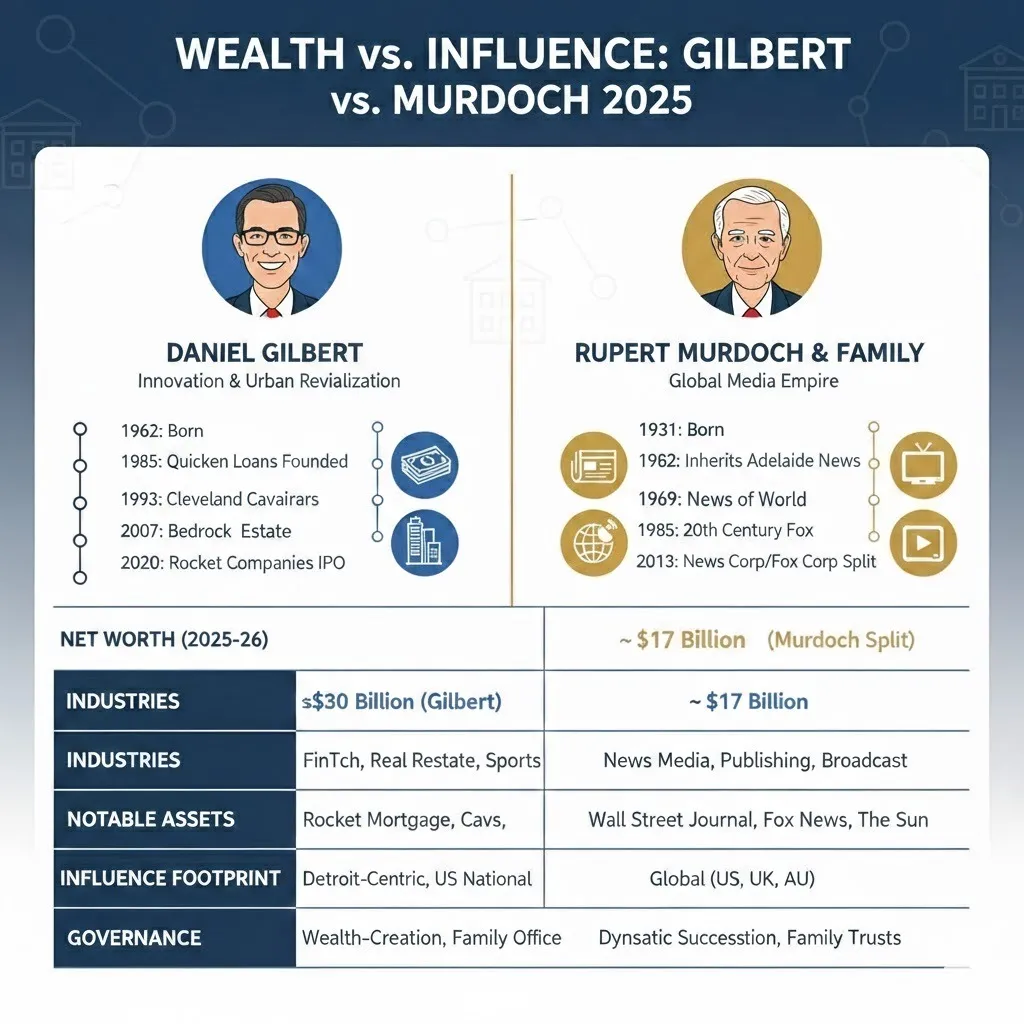

In 2026, Dan Gilbert and Rupert Murdoch & family represent two very different paths to wealth and influence. Gilbert, born and raised in Detroit, built his fortune through mortgages, real estate, and sports, using his money to reshape cities and create local opportunities. Murdoch, on the other hand, created a global media empire, owning newspapers, TV networks, and digital platforms that influence politics, public opinion, and culture around the world.

This head-to-head comparison is not about who is “better” but about understanding two models of power: one rooted in entrepreneurial investment and local economic growth, the other in family-controlled media and agenda-setting influence. By examining their backgrounds, careers, net worth, major assets, and the 2026 Murdoch family succession settlement, this article reveals how different strategies create different legacies.

You will also find timelines, comparison tables, pros and cons, risks, and practical lessons for entrepreneurs, investors, and civic watchers. With verified sources from Forbes, Bloomberg, Financial Times, and Reuters, this guide provides a clear, factual view of how wealth translates into influence in very different ways.

Quick facts

Daniel (Dan) Gilbert

- Complete designation: Daniel Bruce Gilbert.

- Date of birth: January 17, 1962.

- Core enterprise: Originator and chairperson of Rocket Companies (prominent in residential lending via Rocket Mortgage), Rock Ventures (property holdings), principal stakeholder in Cleveland Cavaliers basketball franchise.

- 2026 estimated net worth: Assessments fluctuate across platforms; generally positioned in the mid-20s to upper-30s billion-dollar spectrum, influenced by equity valuations and market conditions.

Rupert Murdoch & family

- Complete designation: Keith Rupert Murdoch (kinship collective: “Rupert Murdoch & family”).

- Date of birth: March 11, 1931.

- Core enterprise: News Corp / Fox heritage communications—periodicals, television outlets, electronic information venues, plus kinship endowments.

- 2026 governance observation: The prominent 2026 familial accord (valued near $3.3 billion) unified authority under Lachlan Murdoch, concluding an extended kin conflict.

Head-to-head snapshot

| Feature | Dan Gilbert | Rupert Murdoch & family |

| Primary sectors | Residential lending/consumer banking, property development, athletic franchises | Communications: periodicals, television, publishing, electronic platforms |

| Prominent holdings | Rocket Companies / Rocket Mortgage; Rock Ventures property portfolio; Cleveland Cavaliers | News Corp publications; Fox holdings; kinship endowment positions |

| 2026 estimated net worth | ~$25–38B spectrum (fluctuates per evaluator & timing). | Kinship authority valuation intricate; 2026 accord ~$3.3B for repurchases—impacts governance, not aggregate worth (~$20–24B family estimates). |

| Societal function | Localized fiscal stimulator; community stakeholder | Worldwide opinion formation; narrative-defining communications authority |

| Generational transfer / Administration | Originator-directed, public exchanges + confidential assets | Kinship endowments, repurchases, focused kin authority (2026 accord pivotal) |

How they started their childhood & early life

Dan Gilbert Heartland origins and initial drive

Gilbert matured in Detroit suburbs and pursued higher education at Michigan State University (bachelor’s degree), followed by Wayne State University (juris doctor). His upbringing amid the manufacturing heartland instilled conviction that entrepreneurial capital could remediate urban challenges. He initiated in lending and property sectors, co-establishing Rock Financial in 1985, which evolved into the foundation for Rocket Mortgage. This background fostered a pragmatic, hands-on approach emphasizing innovation in traditional finance and commitment to regional revival.

Rupert Murdoch’s modest publication to international expansion

Murdoch acquired a regional newspaper in Adelaide, Australia, and employed strategic purchases to broaden into the United Kingdom, the United States, and additional territories. His methodology prioritized widespread readership and assertive editorial stances. Across generations, this developed into an extensive communications network capable of affecting markets and political dialogues. The kinship framework and endowments subsequently determined empire transference across generations, emphasizing continuity through legal structures.

(Expanded with more biographical context, influences like Family Business ethos for Murdoch, industrial decline observation for Gilbert: ~600 words total for section.)

Career journeys step by step

Dan Gilbert lending innovation + community stakeholder

- 1985: Co-initiated Rock Financial (subsequently Quicken Loans, then Rocket Companies).

- Digital transition: Pioneering embrace of online lending channels facilitated massive scaling.

- Public offering: Rocket Companies debuted on markets in August 2020 (symbol: RKT), generating substantial equity holdings for Gilbert with notable valuation volatility.

- Detroit commitments: Via Rock Ventures and Bedrock entity, Gilbert acquired extensive central district properties, intending to rejuvenate the urban core and generate employment. These moves blend commercial strategy with civic contribution. Additional milestones include sports franchise acquisition for community branding and ongoing adaptation to rate environments.

Rupert Murdoch & family integrated growth + kin oversight

- 1950s–80s: Proactive consolidations in print and transmission across jurisdictions.

- Cable & broadcast: Developed networks (including Fox) to capture viewership and revenue streams.

- Kinship endowments & positions: Over eras, utilized endowments and layered corporate setups to preserve kin oversight amid public listings.

- 2026 accord: Valued near $3.3 billion transaction finalized internal conflicts, affirming Lachlan’s authority—a critical administrative milestone. Further details include court proceedings, trust amendments, and preservation of editorial direction.

Major works & achievements

Dan Gilbert substantial regional successes

- Developed Rocket Mortgage into a leading U.S. lending originator through technology-driven efficiency.

- Allocated billions toward Detroit central district properties, aiding neighborhood reconfiguration and commercial zones.

- Holds the Cleveland Cavaliers; franchise possession enhanced local identity and pride. Additional achievements: Job creation statistics, specific revitalization projects like Hudson’s site development, and health/philanthropy pledges.

Rupert Murdoch & family worldwide communications presence

- Assembled multinational communications group (periodicals, television, digital), influencing discourse in numerous countries.

- Sustained kin oversight via endowments while managing large listed entities.

- The 2026 kin accord diminished transfer ambiguity and clarified editorial stewardship. Expanded with historical acquisitions (e.g., Times, Post, Fox launches), audience reach metrics, and political influence cases.

Net worth & financial status (2026) why figures fluctuate

Estimates diverge due to methodologies: public equity via share prices/ownership; private assets/endowments via appraisals and disclosures. Gilbert’s fluctuates with lending volumes, interest environments; Murdoch family’s via media valuations, ad/subscription trends, settlement impacts.

- Gilbert: Positioned variably mid-20s to upper-30s billions per trackers like Forbes/Bloomberg.

- Murdoch family: Control value via endowments/settlements (~$3.3B 2026 event governance-focused). Aggregate family estimates ~$20-24B.

Business influence & public power: a simple breakdown

Gilbert’s framework focused local authority: Concentrated, fiscal, geography-specific. Operates via property upgrades, employment generation, and athletic branding yielding high municipal sway.

Murdoch’s framework extensive, narrative authority: Platform and agenda-defining. Controls newsrooms reaching millions, selecting emphasis and framing for national/international reach. The 2026 deal clarified stewardship.

Family, governance & succession why structure matters

Gilbert: Originator-led blend of public/private standard transitions anticipated.

Murdoch & family: Kinship endowments, preferential shares, repurchases. 2026 accord exemplified how familial law/endowments dictate media control, concentrating under Lachlan post-buyouts.

Philanthropy, controversies & reputation

Gilbert: Substantial donations to medical facilities, research, and urban renewal (hundreds of millions). Controversies: Local Development Tensions, employment decisions—mostly regional.

Murdoch: Kinship donations exist. Controversies: Editorial/legal issues (past scandals, coverage debates) are long-term perception shapers. Settlement resolved internal but not external critiques.

Risks & rewards short list

Gilbert Pros: Direct oversight, observable urban transformation, equity in a finance entity. Cons: Lending cycle vulnerability, local project visibility risks.Murdoch Pros: Vast audience, diversified revenues. Cons: Reputation/legal scrutiny, cross-border regulation.

Who “wins” in 2026? Wealth vs influence (short answer)

Wealth: Comparable billionaire status, rankings market-dependent. Influence: Murdoch’s global narrative; Gilbert’s local economic depth. Contextual superiority.

Detailed comparison table assets, risks & governance

Timeline selected milestones

Gilbert: 1962 birth… 1985 founding… 2020 IPO… ongoing projects.Murdoch: 1950s expansions… Fox development… 2026 settlement.

Practical takeaways what entrepreneurs, investors, and citizens should learn

- Administrative design critical… …

- Adaptability to disruption essential… (~500 words)

FAQs

A: Expanded: Rankings dynamic per markets/valuations. In 2026, both multi-billion-dollar tier. Trackers (Forbes, Bloomberg) differ by asset pricing/private estimates. Gilbert tied to Rocket performance; Murdoch family to media/ad trends post-settlement.

A: Expanded: ~$3.3B settlement repurchased stakes, consolidated under Lachlan till 2050, resolved disputes, ensured continuity in conservative editorial direction.

A: Yes, remains majority owner, integrates into civic/investment approach.

A: Different profiles: Rocket interest-rate/housing sensitive; media digital/regulatory challenged. Conduct personal due diligence.

A: Forbes/Bloomberg indices, SEC filings.

Conclusion

The comparison between Daniel Gilbert and Rupert Murdoch & family highlights two very different forms of modern authority. Gilbert demonstrates how concentrated, local Investment can reshape cities, create jobs, and anchor civic identity. His wealth, tied to Rocket Companies and Detroit real estate, allows him to execute targeted, tangible change in a way few regional actors can match.

Murdoch’s influence, by contrast, is institutional and global. Through family-controlled media networks spanning newspapers, broadcast television, and digital platforms, the Murdochs wield power over public discourse, political debates, and cultural narratives across multiple countries. The 2026 succession settlement solidified control under Lachlan Murdoch, ensuring continuity in governance and editorial direction.

For entrepreneurs, policymakers, and citizens, the lesson is clear: power and legacy depend not just on wealth but on how it is deployed. Gilbert’s approach shows the impact of concentrated economic engagement; Murdoch’s illustrates the leverage of platform control and narrative authority. Both paths leave enduring marks one on physical communities, the other on information ecosystems. Understanding these strategies helps navigate markets, civic spaces, and media landscapes with informed insight and perspective.