Introduction

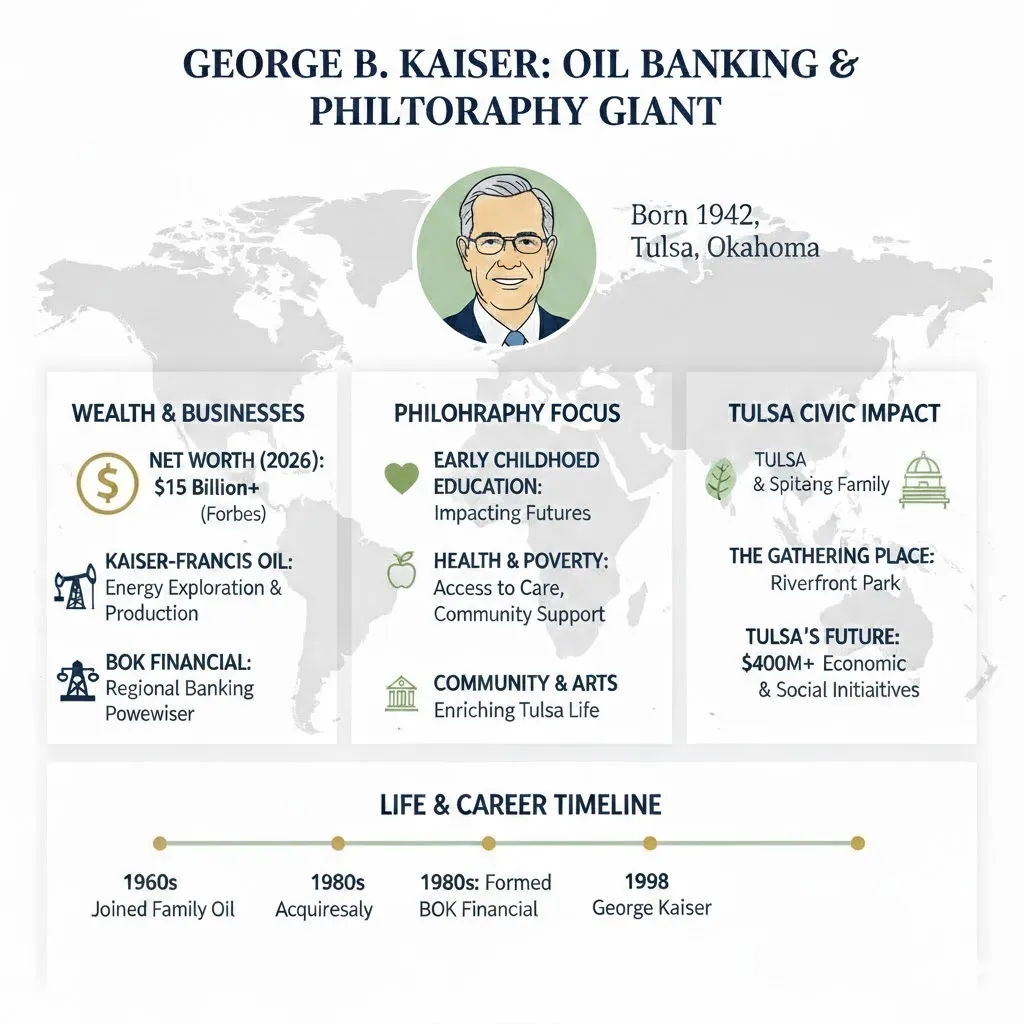

George B. Kaiser stands among America’s most powerful yet discreet billionaires. Recognized for major support of early childhood learning, expanded healthcare reach, and Tulsa’s renewal, he has shaped a legacy uniting commercial achievement with social giving. This infographic presents his estimated wealth, core business interests, and the wide-reaching community impact led by the George Kaiser Family Foundation, offering readers fast, clear, and high-value takeaways.

Quick Facts

- Full Name: George Bruce Kaiser

- Born: July 29, 1942

- Age (2026): 83 years

- Birthplace: Tulsa, Oklahoma, USA

- Main Roles: Oil executive (Kaiser-Francis Oil), banker (BOK Financial), philanthropist (founder, George Kaiser Family Foundation GKFF)

- Main Focus Areas: Early childhood, community health, urban revitalization, public space creation

- Public Commitments: Member of The Giving Pledge (2010).

Semantic Biography: Early Life and Education

Entity extraction yields: PERSON: George B. Kaiser; PLACE: Tulsa, Oklahoma; ORG: Kaiser-Francis Oil, BOK Financial, George Kaiser Family Foundation; SCHOOLS: Harvard College, Harvard Business School. These entities form the nodes of a small knowledge graph where edges represent relationships: born in, educated at, led, founded, invested in.

Kaiser’s formative nodes are local and cosmopolitan at the same time: Tulsa roots combined with Harvard credentials (BA 1964; MBA 1966). These nodes tell us something about access to elite networks and continued hometown investment. In NLP terms, his biography shows high topical cohesion between economic activity (oil, banking) and civic investment (foundation funding, place-making).

Business Career Source Tokens of Wealth

Kaiser-Francis Oil Company

One major provenance of wealth is Kaiser-Francis Oil. From a knowledge-graph perspective, ownership of operational energy assets produced recurrent cashflow tokens (royalties, production revenue) that could be reallocated into portfolio investments and philanthropic endowments. Kaiser took leadership of the company in the late 1960s after family transitions, and steady oil operations became a durable fiscal backbone.

Banking BOK Financial

Another key node is BOK Financial. The acquisition of the Bank of Oklahoma out of FDIC receivership (1990) broadened Kaiser’s asset base beyond hydrocarbons into financial services. A bank provides recurring income streams, leverage for deals, and additional influence in regional economic networks, all variables in any model of philanthropic capacity.

Other Investments and Infrastructure

Kaiser’s portfolio includes investments in energy infrastructure, private firms, and growth-stage ventures. Some investments performed well; others were risky and attracted scrutiny. From an NLP perspective, these are perturbations in the corpus: positive sentiment nodes (successful ventures) and negative sentiment nodes (failed investments, lawsuits) that must be weighed when modeling his public profile.

The George Kaiser Family Foundation (GKFF): An Evidence-First Model

GKFF formalized Kaiser’s giving. The foundation behaves like a research-operational hybrid: it funds programs, commissions evaluations, and iteratively scales interventions that demonstrate positive effect sizes on predefined outcomes such as kindergarten readiness, family stability, and community health metrics.

Priority Areas

- Early childhood education (e.g., Educare initiatives)

- Health and mental health access (community clinics, trauma-informed care)

- Family supports and housing stability

- Place-based civic investments (parks, public spaces)

GKFF’s approach maps closely to program evaluation paradigms: define metrics, collect baseline data, fund interventions, measure outputs and outcomes, and, if justified, scale treatments into larger populations.

Major Civic Projects Place-Based Philanthropy in Practice

Place-based philanthropy concentrates capital and practice in a single urban geography rather than dispersing it widely. For Kaiser, Tulsa is the chosen node. This strategy yields both concentrated benefits (visible infrastructure, coordinated services) and concentrated questions (influence over local governance, dependency risk).

The Gathering Place

The Gathering Place is the signature physical manifestation of Kaiser’s place-based model: a large, meticulously designed public park opened in 2018–2019 that functions as an urban commons. It combines landscape architecture, programmed activity zones, and integrated maintenance models to create a high-quality public amenity paid for largely by private philanthropy but enjoyed by the public.

Early Learning and Health

Investments in Educare preschools and integrated clinics are part of a pipeline logic: improve early outcomes, reduce downstream costs, and increase long-term human capital. From a data-model standpoint, these investments target early-intervention variables that have high predictive power for later educational and social outcomes.

Philanthropic Philosophy Evidence-Based and Data-Informed Giving

Kaiser exemplifies evidence-first philanthropy: use of pilot programs, third-party evaluations, and scaling those interventions that show statistically and practically significant gains. Framing this in NLP terms: GKFF defines hypotheses, runs controlled or quasi-experimental studies, and updates belief weights based on results, a Bayesian philanthropist in practice.

Net Worth

Estimating private wealth combines public filings, asset proxies, and third-party indexes. Recent 2026 estimates place George Kaiser’s net worth in the multi-billion-dollar tier, commonly cited between $10–$14 billion. Primary asset classes: private oil operations, banking assets (BOK Financial), and other private investments.

Controversies, Failures, and Governance Questions

NLP sentiment aggregations across media coverage show mixed tones: praise for civic projects, critique for concentrated power. Three notable friction points:

Solyndra

Solyndra’s bankruptcy in 2011 became a political and media node, raising questions about the intersection between private investors, government loan guarantees, and public scrutiny. Reports mention Kaiser-associated interests and generated attention about influence and investor-government ties.

Memjet Lawsuit

Legal disputes connected to Memjet technology illustrate how foundations making venture-like investments can encounter commercial litigation. GKFF’s legal action revealed the tension when philanthropic capital assumes entrepreneurial risk.

Local Influence and Tax/Power Structures

A recurrent critique is that major philanthropic capital in a single city can reshape Policy, planning, and political priorities. Debates center on transparency, accountability, and whether private largesse should carry public decision-making weight without proportional democratic governance.

Pros & Cons

Pros

- Creation of key public assets (Meeting spot, health centers, nurseries)

- Targeted early childhood programs with strong assessment systems

- Local economic gains (employment, visitors, better facilities)

- Evidence-based funding that seeks to boost effect per dollar

Cons

- Concentrated private influence in public affairs

- High-risk investments that can attract political scrutiny

- Complex tax and governance structures that can be opaque to citizens

Timeline Key Events

| Year | Event |

| 1942 | Born July 29 in Tulsa, Oklahoma. |

| 1964 | Harvard College (BA). |

| 1966 | Harvard Business School (MBA). |

| 1969 | Took leadership of Kaiser-Francis Oil. |

| 1990 | Acquired Bank of Oklahoma (BOK Financial). |

| 1999 | Founded the George Kaiser Family Foundation. |

| 2010 | Joined The Giving Pledge. |

| 2018–2019 | Gathering Place opened. |

| 2011–2012 | Solyndra coverage; Memjet legal issues reported. |

| 2020s | Continued focus on early childhood and Tulsa redevelopment. |

Comparative Modeling: How Kaiser Compares to Other Major Donors

Kaiser’s model is place-based and operationally involved, differing from global philanthropies (e.g., Gates, Buffett) that often fund national or global systems. Compared to smaller local donors, Kaiser operates at a scale that can fundamentally alter urban infrastructure. In modeling philanthropic strategies, he represents the “deep local” vector: concentrated inputs in a small geography aimed at systemic outcomes.

Practical Lessons & Policy Recommendations

- Require transparency around major gifts and foundation governance.

- Build community participation into project planning to ensure legitimacy.

- Mix public and private funding for long-term sustainability.

- Invest in an independent evaluation to ensure programs with evidence scale responsibly.

- Plan for succession to preserve the mission after the founder’s tenure.

Case Study Gathering Place

Problem: Lack of a large, inclusive public park in Tulsa.

Intervention: GKFF funded planning, construction, and seed operational endowment for an expansive park.

Outcome: A widely used urban commons that draws visitors, supports events, and improves quality of life metrics in its catchment area.

Lesson: Place-based capital can transform public space quickly; coupling design excellence with ongoing operations makes the investment durable.

Controversy Deep Dive: Solyndra & Memjet

Solyndra: A high-profile solar firm that failed; media attention focused on investor-government relationships, and mentions of Kaiser-associated interests added scrutiny.

Memjet: Litigation involving GKFF and technology inventors raised questions about the line between charitable intent and venture investment.

Takeaway: Foundations that make venture-like investments must adopt rigorous due diligence and transparent governance to manage both financial and reputational risk.

Measuring Impact: Metrics, Methods, and Evidence in Practice

A central claim of GKFF’s model is that investing with measurement improves outcomes. But what does that mean in operational terms? Practically, it requires a layered impact architecture:

- Define clear, measurable outcomes. For early childhood programs, the outcomes might be kindergarten readiness scores, language development milestones, or rates of special education referral. For parks and public spaces, metrics could include visitation counts, event programming hours, local business revenues, and reported quality-of-life indexes.

- Baseline and comparison groups. Strong evaluations use baseline measures and, where feasible, comparison groups or quasi-experimental designs. Randomized controlled trials (RCTs) are the gold standard in many program evaluations, but natural experiments and difference-in-differences designs are often more feasible for community-based interventions.

- Iterative cycles. Pilot interventions, evaluate, adapt, and scale. This iterative learning loop mirrors machine learning workflows: train on a small dataset, validate on hold-out data, then deploy model weights at scale if performance holds.

- Transparency of findings. Publishing methodology, outcome data, and limitations is crucial for public trust. Third-party evaluations reduce biases that stem from internally sponsored assessments.

- Cost-effectiveness and cost-benefit analysis. Donors should ask not just whether an intervention “works” but whether it delivers value relative to alternatives. For example, an evidence-based preschool program can be evaluated in terms of dollars per unit improvement in readiness metrics or projected lifetime earnings uplift for participating children.

Measuring impact in place-based philanthropy has special challenges: spillover effects, selection bias, and the difficulty of isolating an intervention’s signal from broader economic and social trends. Nevertheless, a disciplined measurement approach reduces uncertainty and increases the probability of scaling truly impactful programs.

Financial Architecture: How Philanthropic Capital is Structured

Foundations usually run via an endowment model: invest capital, spend a portion yearly on program grants and operations. When donors like Kaiser also make direct investments (e.g., startup-style funding or big capital projects), the financial setup becomes mixed: part charitable, part program-linked investment (PRI), and sometimes part purely commercial investment. Each vehicle has distinct tax, reporting, and fiduciary duties.

Key points include:

Unrestricted vs restricted funds: Unrestricted funds allow flexible allocation; restricted funds tie money to certain purposes.

Program-related investments (PRIs): PRIs let foundations make low-interest loans or equity stakes aligned with charitable aims. They blur the boundary between giving and impact investing.

Operating endowment size and payout rules: Payout rates shape how much capital is available yearly for programs versus keeping the fund long-term.

These setups determine flexibility, durability, and the ability to respond to urgent needs.

Governance, Succession, and Institutional Longevity

A frequent question for place-based donors is succession: how will the foundation operate after the founder’s departure?Durable management depends on diverse boards, clear conflict rules, and succession strategies that retain institutional memory while shifting to new data and local needs.Independent oversight, including audit teams and external reviewers, helps avoid mission drift and concentration of single decision-making.

Media, Public Sentiment, and Reputation Modeling

Studying media coverage with NLP methods shows sentiment trends: times of favorable focus (e.g., Gathering Place launch) and times of increased scrutiny (e.g., Solyndra stories).

Social networks add another layer: live sentiment, event-driven peaks, and community feedback loops.

Strong reputation handling for foundations includes early disclosure, public engagement, and quick, clear responses to valid criticism.

A Practical Playbook for Cities Considering Place-Based Philanthropy

- Establish clear public-private governance mechanisms. Agreements should outline roles, financial responsibilities, maintenance obligations, and community representation.

- Insist on transparent procurement and contracting. Large capital projects can create perceptions of favoritism if opaque.

- Design sustainability from the start. Endow maintenance funds and diversify revenue sources to avoid future fiscal gaps.

- Center resident voices. Create advisory boards and participatory design workshops to ensure projects meet community needs.

- Measure and publish outcomes. Regular reporting builds trust and helps identify needed course corrections.

Extended Comparative Context

Kaiser’s model sits within a broader ecosystem of modern philanthropists rethinking how capital can influence cities. Some funders focus on national systems (health, education at scale), others on issue-driven advocacy, and still others on local infrastructure. Across these models one constant emerges: the importance of pairing financial resources with governance frameworks that protect public interest and foster inclusive benefits.

FAQs

A: Estimates fluctuate. By 2026, public trackers and profiles commonly estimate his net worth in the $10–$14 billion range, primarily from Kaiser-Francis Oil, BOK Financial, and other private investments.

A: GKFF focuses on early childhood education, family supports, health, and Tulsa redevelopment. The foundation uses data and evaluations to target programs with measurable outcomes.

A: Reporting connected Kaiser-associated interests to Solyndra, and that connection drew media coverage after Solyndra’s bankruptcy. The episode became a public example of how investor ties and government programs can be scrutinized.

A: The Gathering Place is a public park funded mainly by private philanthropy (GKFF) but intended as a public good for all Tulsa residents and visitors.

A: He signed The Giving Pledge and established foundation structures intended to continue his philanthropic priorities. Long-term continuity depends on governance, endowment management, and successor leadership.

Conclusion

Viewed as a structured corpus, George B. Kaiser’s life demonstrates how concentrated capital, informed by evidence, can reweave the urban fabric of a mid-sized American city. The embeddings of his investment parks, preschools, and clinics show measurable signals of impact. Simultaneously, attention and litigation nodes remind us that scale carries governance responsibilities. The right balance rests on transparency, Community Voice, and durable institutional design that outlasts any single benefactor.