Introduction

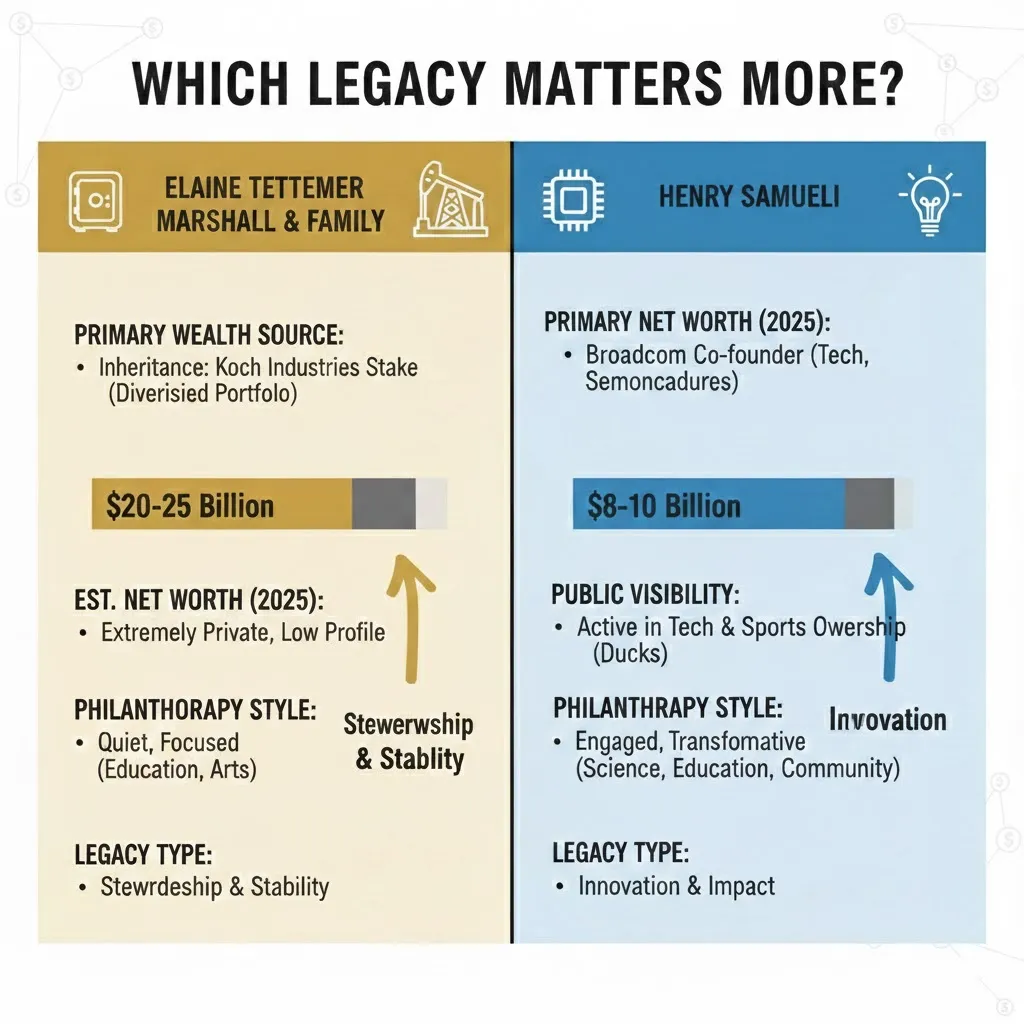

In today’s world, billionaires do more than collect wealth they shape industries, politics, universities, and even the future of technology. But not all billionaire power looks the same. Some fortunes are built quietly over generations through private ownership and family trusts. Others are created in public markets through innovation, patents, and fast-growing companies. That’s why the comparison between Elaine Tettemer Marshall & family and Henry Samueli is so interesting because it shows two completely different models of American influence.

Elaine Tettemer Marshall & family have deep and long-term wealth. Their fortune is connected to Koch Industries, one of the biggest private companies in the USA. Since Koch is not listed on the stock market, its value is not shown daily, but the company is very powerful in energy, chemicals, manufacturing, and industrial services. Elaine is not a public celebrity billionaire. Her role is more about family control, trusts, inheritance planning, and protecting the family legacy. Her influence is strong, but mostly hidden.

Henry Samueli’s story is different but equally important. He is a tech founder and engineer who helped build a global semiconductor company. As the co-founder of Broadcom, he created chips used in Wi-Fi, broadband, and communication devices worldwide.

Samueli’s wealth comes mainly from Broadcom stock, so it changes with the market and is easy to track. What makes him stand out is how he turned his wealth into a public legacy through big donations, university support, and community projects.This guide compares both people in a simple side-by-side format. You will learn how they made their money, how they manage wealth, how they use influence, and what legacy they are building. It also includes a timeline, comparison table, FAQs, and trusted sources for verification.

Quick Portraits

Elaine Tettemer Marshall & Family

- Full name: Elaine Tettemer Marshall.

- Born: July 22, 1942.

- Role: Heiress; beneficiary and trustee of family trusts with a sizable beneficial interest in Koch Industries.

- Notable features: Private ownership (~16% beneficial interest reported), trust governance, low public profile, occasional legal visibility.

Henry Samueli

- Full name: Henry Samueli.

- Born: September 20, 1954.

- Profession: Electrical engineer, co-founder of Broadcom, philanthropist, investor, university donor.

- Notable features: Founder-driven wealth, public market exposure, named philanthropy, technical honors (including the IEEE Medal of Honor in 2026).

One-line embedding comparison:

- Type of wealth: Marshall private, dynastic; Samueli entrepreneur + public equity.

- Public visibility: Marshall low; Samueli high and institutionally visible.

- Legacy orientation: Marshall continuity and private control; Samueli innovation and named public institutions.

Why this comparison matters

From a systems perspective, comparing these two profiles illuminates how concentrated capital influences different nodes of the social graph: private industrial governance (supply chains, energy markets, boardrooms) vs public research, education, and technological diffusion (university programs, patents, product ecosystems). Policy, public perception, and academic research weigh these nodes differently, so mapping the differences helps analysts, journalists, and search engines place both profiles with correct intent signals.

Deep dive Childhood, early life & path to wealth

We can model each life story as a time-ordered token sequence where important tokens are events (birth, marriage, founding, IPO, death, legal case, gift). Below, we render those sequences and annotate salient tokens.

Career & business: how each is built influences

Marshall family

- Private stake in a major industrial conglomerate.

- Trust structures are designed for tax, succession, and control.

- Influence via board-level and trustee decisions rather than daily operations.

- Legal history that brought episodic attention to the family.

Samueli

- Technical inventions and patents leading to product-market fits.

- Building a public company (Broadcom) whose parts are in consumer and infrastructure hardware.

- Public philanthropic endowments and named programs at universities.

- Honors and civic involvement that reinforce public reputation.

Net worth & asset holding

Important caveat: Net Worth estimates vary over time and sources. Below are broadly reported 2025 ranges from public trackers and profiles; they are approximate and intended as anchor points only.

- Elaine Marshall & family (2026 estimate): Roughly $28–$31 billion (family aggregate), primarily derived from beneficial trust ownership of an estimated ~16% interest in Koch Industries. Koch is privately held, so valuations vary by methodology.

- Henry Samueli (2026 estimate): Often placed in a $20–$35 billion band depending on Broadcom’s market value, reported holdings, and recent stock sales/donations. Because much of Samueli’s wealth is tied to public equity, it’s sensitive to market moves and disclosed trades.

Key takeaway (vectorized): both occupy tens-of-billions magnitude in the wealth embedding space, but the covariance structure differs — Marshall wealth has lower daily volatility but higher valuation model uncertainty (private firm), while Samueli’s is higher volatility but fully observable.

Public presence & reputation

Model public presence as two signals: visibility (volume of media tokens) and sentiment (polarity of those tokens). We summarize qualitatively.

Elaine Marshall & Family

- Visibility: Low baseline; spikes tied to estate litigation or regulatory filings.

- Sentiment: Neutral-to-curious in most coverage (legal and inheritance angles dominate).

- Impact on reputation: Private stewardship narrative stability, sometimes controversy due to legal cases.

Henry Samueli

- Visibility: High and consistent awards, philanthropic announcements, university news, and occasional corporate filings.

- Sentiment: Largely positive in technical and civic contexts (honors, gifts), with occasional scrutiny related to corporate governance history.

Philanthropy, private discretion vs public naming

Using an intuitive topic-model lens:

Marshall cluster topics: private grants, trusts, anonymous giving, and estate tax issues. Impact shows up in quiet grants or institutional support, not necessarily carrying the family name.

Samueli cluster topics: university endowments, named engineering schools/centers, STEM education initiatives, foundation grants (Samueli Foundation), public announcements, and media coverage. High attribution (named buildings and programs) amplifies cultural legacy.

Legal & governance notes

Marshall family: estate disputes and tax litigation have historically been salient tokens that affect public records and sometimes policy conversations. Trust structures are complex and create legal pathways (and occasionally litigation pathways) for claimants.

Samueli: As a public company founder, corporate governance and prior regulatory issues have emerged historically (e.g., past options-related settlements). These are typical for founder-driven public firms and have been resolved over time, while philanthropic and technical honors now dominate public discourse.

Head-to-head comparison table

| Feature | Elaine Marshall & Family | Henry Samueli |

| Primary wealth source | Private stake in Koch Industries (held via trusts). | Broadcom semiconductor company (founder equity + other holdings). |

| Estimated net worth (2026) | ~$28–31B (private valuation). | ~$20–35B (market-dependent). |

| Public visibility | Low–moderate (legal filings cause spikes). | High (founder story, named gifts, awards). |

| Philanthropy style | Private, trustee-managed giving. | Public, institutionally named donations (Samueli Foundation, UCLA, UCI). |

| Legacy type | Dynastic control, long-term industrial influence. | Innovation-driven, visible public institutions. |

| Risk exposure | Low daily market risk; valuation model uncertainty. | High market sensitivity and public scrutiny. |

Pros & Cons

Elaine Marshall & Family

Pros

- Structural stability is designed for long-term intergenerational transfer.

- Defensive governance via tusts

Cons

- Lower public recognition; intangible social capital may be muted.

- Liquidity constraints (private company) make public valuation models variable.

Henry Samueli

Pros

1. Visible, measurable public impacts (named centers, awards).

2. Liquidity via public markets enables large philanthropic gifts.

Cons:

- Market volatility can materially change net worth.

2. Public founders face regulatory and reputational risks in the spotlight.

Timeline important dates

Elaine Tettemer Marshall

- 1942: Born (July 22).

- 1965: Married E. Pierce Marshall.

- 2006: E. Pierce Marshall passes trust succession becomes prominent.

- 2006–2026: Trustee/board roles and legal filings appear periodically.

Henry Samueli

- 1954: Born (Sept 20).

- 1970s–1980: Advanced degrees at UCLA (BS, MS, PhD).

- 1991: Co-founded Broadcom.

- 1998–2016: Growth, IPO, corporate evolution.

- 2017–2026: Significant philanthropic gifts; 2026 IEEE Medal of Honor.

Who leaves the bigger legacy verdict

This is not an objective single-number judgment. Instead, consider two different legacy axes:

- Dynastic economic legacy (Marshall model): Long-run influence over industrial assets, continuity of control, and private sector power. Significant for corporate governance, long-term investment strategy, and policy influence behind the scenes.

- Public institutional legacy (Samueli model): Tangible, named contributions to research, education, and civic life; technical inventions that propagate through products; awards and public honors that secure a visible cultural footprint.

Which matters more depends on value orientation: continuity and private influence vs visible, named public contributions. Both affect different institutional ecosystems, so both matter.

Practical lessons & leadership takeaways

- Stewardship matters: Clear governance (trusts, boards) helps preserve wealth and impact across generations. The Marshall family profile highlights this.

- Innovation scales impact: Technical breakthroughs that achieve product-market fit (Broadcom-era inventions) generate both wealth and public utility.

- Public giving amplifies reputation: Naming and visible gifts translate private wealth into public social capital (Samueli’s university gifts).

- Governance is double-edged: Private dynasties avoid daily market noise but face legal/testamentary risk; public founders enjoy visibility but face regulatory scrutiny.

FAQs

A: Both are in the tens of billions. Numbers move with stock markets and private company valuations. Recent tracker estimates often put them in similar ranges.

A: Elaine’s wealth comes from private holdings and trusts. The family keeps a low public profile. Samueli built a public tech company and gives visible gifts, so people know his name.

A: Yes. He and his wife have given large donations to UCLA and UC Irvine and created visible programs. He also joined the Giving Pledge.

A: Public reporting and profiles list the family trusts as owning around 16% of Koch Industries, but exact valuations vary.

A: For Elaine Marshall, legal rulings or tax changes could affect intergenerational wealth. For Henry Samueli, public market swings and regulatory issues can change net worth and reputation.

Conclusion

Elaine Tettemer Marshall & family and Henry Samueli show two very different paths to billionaire influence. Marshall represents quiet, private, generational power, while Samueli demonstrates public, innovation-driven impact through technology and philanthropy. Both legacies are important, but in different ways: one shapes industries behind the scenes, the other shapes education, research, and society visibly. Which matters more depends on whether you value stability and stewardship or innovation and Public Contribution.