Introduction

Elaine Tettemer Marshall occupies a distinctive place among the United States’ quietly influential heirs. A private individual by temperament and strategy, her public footprint is small while her economic footprint is very large. Her life and financial identity are bound up with intergenerational trusts, private equity interests, and a series of litigation episodes that helped define the modern boundary between probate, bankruptcy, and federal jurisdiction. The Marshall litigation, culminating in decisions such as Marshall v. Marshall and Stern v. Marshal,l is as much a story about legal doctrine as it is about a family fortune.

Quick Facts

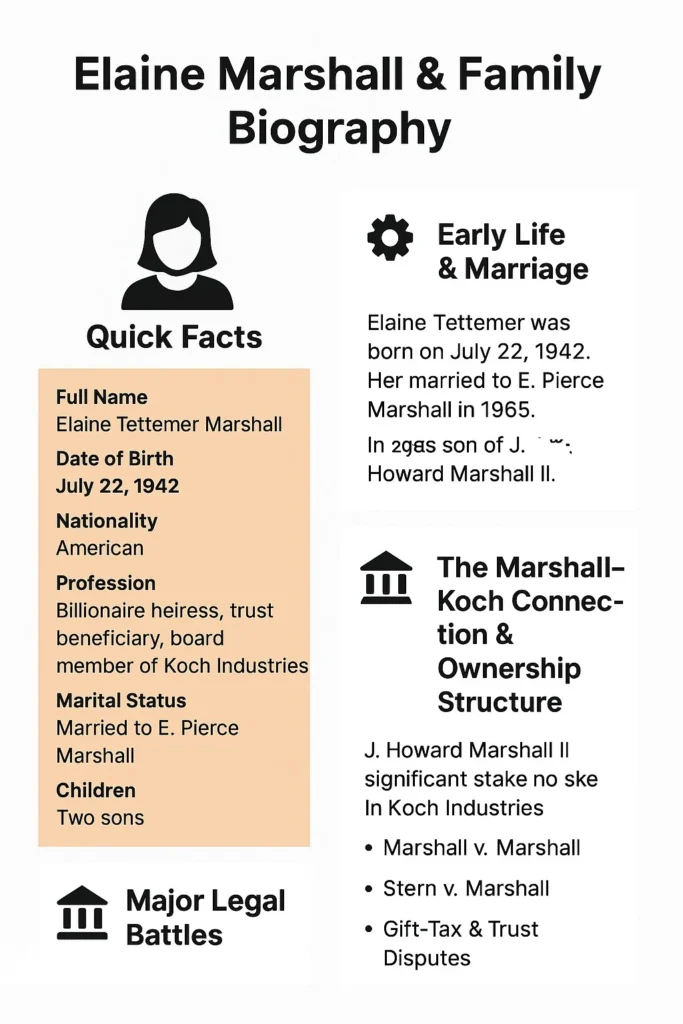

| Fact | Detail |

| Full Name | Elaine Tettemer Marshall |

| Date of Birth | July 22, 1942 |

| Age (2025) | 83 years |

| Nationality | American |

| Role | Heiress, trust beneficiary, member of the governance structure tied to Koch Industries |

| Marital Status | Widow of E. Pierce Marshall (d. 2006) |

| Children | Two sons (names largely private/low public profile) |

| Known For | Holding an estimated ~16% beneficial interest in Koch Industries via Marshall-family trusts |

| Public Role | Trustee-beneficiary representative, participant in board/oversight functions related to the stake |

Early Life & Marriage

Early Life & Background

Elaine Tettemer was born on July 22, 1942. Public records and standard biographical repositories offer only sparse detail about her childhood, parents, or formal education; her public biography begins to materialize in earnest after her marriage into the Marshall family. Some less authoritative sources suggest a Dallas, Texas, connection, but this is not universally corroborated in primary public records. Elaine’s profile is notable for its discretion: she is an heir whose personal narrative is intentionally understated.

Marriage to E. Pierce Marshall

In 1965, Elaine married E. Pierce Marshall (1939–2006), whose paternal lineage links directly to J. Howard Marshall II, a prominent oil-and-refining entrepreneur with a historic stake in Koch Industries. That marital alliance altered Elaine’s financial trajectory: through estate-planning instruments and trust vehicles established by J. Howard, Pierce became a central beneficiary and, later, those interests were allocated or partitioned into trusts benefiting Elaine and the couple’s sons. Marriage, in this context, functioned as the legal and familial axis through which beneficial ownership and succession planning flowed.

The Marshall Koch Connection & Ownership Structure

Understanding Elaine Marshall’s wealth requires parsing a multi-layered architecture of trusts, beneficiary designations, and private-company ownership. This section summarizes the ownership mechanics and the legal logic that separates legal title from beneficial entitlement.

The Koch Industries Stake

J. Howard Marshall II was a significant shareholder in Koch Industries, a privately held conglomerate whose operations span refining, chemicals, pipelines, fertilizer, commodities, and diversified industrial services. During his lifetime, J. Howard implemented estate planning that used inter vivos trusts and other vehicles to hold and administer his assets, including the Koch stake. Those trust instruments allocated beneficial interests (i.e., rights to distributions and economic benefit) independently from formal legal title or voting control.

Legal filings and appellate opinions document representations that the Marshall family’s various trusts collectively corresponded to a sizeable aggregate ownership interest (historically described in filings as in the mid-teens percentage range). Because Koch is privately held, these percentages are expressed as beneficial ownership through trust mechanisms rather than as publicly traded share counts.

Transfer to Pierce & Subsequent Allocation to Elaine & Sons

Upon J. Howard’s death, the disposition of trust interests and other estate documentation made Pierce a principal beneficiary. Over the ensuing years, estate planning strategies, gifts, and trust restructurings resulted in beneficial allocations to Pierce’s immediate family, chiefly Elaine and their two sons. Some beneficial interests were set in separate irrevocable trusts for Elaine and the children as part of tax planning and asset protection strategies. After Pierce’s death in 2006, trust mechanics and testamentary instruments governed the flow of benefits to Elaine and the next generation.

Crucially, the family’s position reflects beneficiary status rather than free-floating, public shareholding, meaning liquidity, voting rights, and transferability are constrained by trust terms and private-company governance.

Role & Influence at Koch Industries

Although Elaine is not widely recognized as an operational C-suite executive, her role within the governance architecture tied to the Marshall interest affords her indirect influence.

Board, Governance, and Oversight

Following Pierce’s death, Elaine’s position within the family’s ownership structure made her a key representative of the Marshall beneficial interest. In private-company governance models like Koch’s, a minority but sizable interest when held by aligned trusts and heirs can command board representation, oversight rights, and influence over strategic direction through negotiated governance agreements and fiduciary engagement.

Her involvement is better described as fiduciary stewardship than day-to-day management. She and the trust trustees oversee asset protection, monitor distributions, and participate in periodic governance decisions all consistent with the behavior of trust beneficiaries who are simultaneously stakeholders and custodians of family capital.

Constraints & Practical Considerations

The power conferred by beneficial interest depends on the written trust terms: whether beneficiaries possess voting proxies, consent rights, information rights, or veto power on major corporate actions. As with many large private holdings, privacy, limited disclosure, and internal covenants mean that public observers must infer influence from board seats, litigation posture, and public filings where they exist.

Key constraints include

- Illiquidity: Beneficial interest cannot be sold on public markets without breaching trust terms or triggering transfer restrictions.

- Tax & administrative encumbrances: Trusts are subject to tax rules, valuation scrutiny, and fiduciary duties.

- Governance arrangements: Negotiated agreements among family owners determine practical control, not simply percentage figures.

Thus Elaine’s influence is structural and stewardship-oriented rather than headline-driven.

Major Legal Battles

Much of the public record connected to Elaine and her Family centers on litigation about inheritance, jurisdictional authority, and valuation. The disputes are both fact-heavy (who was promised what) and doctrine-shaping (what courts may decide).

Marshall v. Marshall

Often known in the popular press as the litigation involving Anna Nicole Smith (Vickie Lynn Marshall), Marshall v. Marshall is the broader family-of-cases that encompassed competing claims to wealth and allegations of undue influence and tortious interference.

Anna Nicole alleged that J. Howard had promised her an estate or trust benefits; Pierce (and by extension, the Marshall-related trusts) defended the testamentary instruments and trust documents that allocated assets to family beneficiaries. What began as state probate contests soon migrated through bankruptcy filings and federal court proceedings, producing complex jurisdictional fights over whether federal courts, including bankruptcy courts, could resolve disputes traditionally handled by state probate tribunals. That friction generated appellate rulings and ultimately a Supreme Court pathway in matters that followed.

The litigation’s mixed outcomes, victories, reversals, and remands demonstrate the complexity of overlapping probate, bankruptcy, and tort law when large private fortunes are contested.

Stern v. Marshall

Stern v. Marshall is the marquee constitutional decision that emerged from the litigation thicket. It addressed whether a U.S. bankruptcy court, which is not an Article III federal court, may enter final judgment on a state-law counterclaim submitted in the course of bankruptcy proceedings.

Anna Nicole (via her bankruptcy filings) brought a tortious-interference counterclaim; the bankruptcy court entered judgment; the counterclaim’s constitutional status was then litigated up to the U.S. Supreme Court. In 2011, the Court held that even if a statute classifies certain proceedings as “core” to bankruptcy, the Constitution still limits a non-Article III tribunal from adjudicating final determinations on purely state-law claims that are not necessarily part of the bankruptcy’s core adjudicative tasks.

The Stern decision tightened the constitutional boundaries around bankruptcy court adjudicatory power, compelled certain remands to Article III district courts, and reaffirmed the importance of the “probate exception,” a doctrine restraining federal courts from intruding into state probate matters. The case’s doctrinal ripple effects extend beyond the Marshalls: it altered bankruptcy practice, jurisdictional strategy, and the architecture of federal adjudication for related claims nationwide.

Gift-Tax & Trust / IRS Disputes

A further strand of dispute involves tax administration and the IRS. At issue was whether transfers or gifts into trusts, including transfers of beneficial interests in Koch exposed recipients to gift-tax liability, and how to value those transfers when the asset is a large, illiquid, privately held operating company.

Key contested points included

- Timing of the gift: When was the taxable transfer effectively made?

- Fair-market valuation: Determining enterprise value for a private company involves comparables, multiples, discount rates, and judgments about minority vs. control premiums.

- Discounts for illiquidity and lack of marketability: The IRS and taxpayers often diverge on the size of such discounts.

The result is a complex litigation posture that demonstrates how private-company wealth structures attract tax scrutiny and require sophisticated valuation experts and appellate strategy. Elaine’s status as a beneficiary placed her and her family within the scope of that controversy.

Net Worth & Financial Analysis

Estimating the net worth of a trust-beneficiary in a private conglomerate requires constructing an enterprise valuation, apportioning that value to the beneficial stake, and then applying appropriate discounts and tax assumptions. Below, we summarize mainstream estimates, the methodology behind them, and the caveats that attach to each figure.

Public Estimates & Sources

| Source | Approximate Estimate (2025 context) | Notes / Rationale |

| Celebrity Net Worth | ~$24 billion | Public wealth-site estimate based on ~15–16% beneficial ownership assumptions |

| GoodReturns / Wealth Sites | ~$30.9 billion | Uses assumed company multiples and proportionate stake to produce higher totals |

| Aggregate Wealth Trackers | $20–$30+ billion | Range reflects variance in valuation assumptions and discounting methodology |

These numbers are proxies: they attempt to translate a beneficial share of a private company into a headline net-worth figure. Different aggregators use different multiples, discount assumptions, and treatment of control premiums to derive their outputs.

Valuation Methodology: How Analysts Reach Estimates

- Estimate Koch’s enterprise value using public-company comparables (e.g., industrials, energy, chemical firms), historical earnings, and media-reported metrics when available.

Apply an ownership percentage (public sources often cite a mid-teens beneficial interest for the Marshall-family trusts). - Apply discounts for minority interest, lack of marketability, and trust-based constraints that limit immediate liquidity.

- Calculate tax liabilities (estate and gift tax assumptions, which vary by jurisdiction and method).

- Subtract outstanding liabilities and consider ongoing legal costs that can erode net realizable value.

Key Assumptions & Caveats

- Private-company opacity: Without audited public filings, estimates must rely on comparables and second-order disclosures.

- Trust restrictions: Beneficial holders may not possess full decision-making or transfer rights; which reduces realizable value.

- Tax exposure: The outcome of gift-tax litigation, estate taxes, and ongoing disputes can materially affect net wealth.

- Market cyclicality: The underlying industries (energy, chemicals, manufacturing) are cyclical, affecting cash flows and multiples.

Working Range & Best Practical Estimate

Given these variables, an analytically defensible working range is $20–30+ billion, typically centered in public discussion around $25–28 billion, conditional on a mid-teens beneficial interest and moderate discounts. That said, headline net-worth figures should be understood as theoretical apportionments rather than fully liquid personal wealth.

Family & Personal Life

Children & Succession

Elaine and E. Pierce Marshall had two sons. Their identities are intentionally shielded from publicity in many public databases, reflecting the family’s overall preference for privacy. The trust structures in place indicate that those sons are principal heirs and beneficiaries of the Marshall-family trusts meaning future wealth transmission, fiduciary responsibilities, and governance roles are likely to pass along that familial line, subject to the trust terms and any future tax or legal developments.

Personal Presence & Public Lifestyle

Elaine maintains a notably private lifestyle. She is not an active public philanthropist in the way many other billionaires are, nor is she a frequent subject of media profiles. Her public persona is that of a steward and custodian of family capital: focused on managing trust relationships, navigating litigation, and safeguarding intergenerational wealth.

Risks & Ongoing Challenges

- Ongoing legal exposure: Legacy litigation and tax audits can persist for years and be materially costly.

- Valuation sensitivity: Private enterprise valuations are vulnerable to industry cycles and opaque accounting adjustments.

- Policy risk: Changes in U.S. tax law, estate exemptions, or trust regulation could alter future outcomes.

- Succession complexity: Passing large private holdings across generations is legally and administratively complex and often contested.

Legacy, Challenges & Lessons

Elaine’s story is not merely a personal biography; it is a prism through which to view how contemporary wealth management, trust law, and litigation interact at the highest wealth tiers.

Legacy & Influence

- Quiet stewardship over public spectacle: Elaine exemplifies how families preserve capital by minimizing public exposure and focusing on legal and fiduciary structures.

- Legal precedent: The litigation surrounding the Marshall estate (especially Stern v. Marshall) produced jurisprudential shifts affecting bankruptcy judges’ adjudicatory limits nationwide.

- Demonstration of trust utility: The Marshall case is a textbook illustration of how trusts can separate beneficial enjoyment from legal title, manage taxes, and provide continuity.

Challenges She Faces

- Balancing privacy and legal transparency: Defending substantial trusts often forces private families into public court records.

- Maintaining intergenerational cohesion: Trusts can reduce disputes but also provide flashpoints for intra-family litigation if not designed with clarity.

- Navigating a shifting tax landscape: Changes to gift, estate, and income taxes can upend long-term plans.

Practical Lessons

- Precise documentation: Meticulously drafted trust and testamentary documents reduce ambiguity and litigation risk.

- Jurisdictional foresight: Selection of forum (state probate vs. federal) matters hugely in contested estates.

- Valuation discipline: Private assets require defensible valuations and valuation experts prepared for IRS challenges.

- Mindful gifting: Large gifts into trusts call for careful tax planning and expert counsel.

- Strategic privacy: Privacy is useful but cannot be absolute when legal rights are litigated in public courts.

Timeline of Key Events

| Year | Event |

| 1942 | Elaine Tettemer is born. |

| 1965 | Elaine marries E. Pierce Marshall. |

| 1974 | Reported allocations to J. Howard’s sons (historical family distributions referenced in public summaries). |

| 1994–1995 | J. Howard’s marriage to Anna Nicole Smith and the initial legal disputes that followed. |

| 1995 | Transfers and trust restructurings around Koch interests; subsequent disputes over timing and valuation of gifts. |

| 1995 (Aug 4) | Death of J. Howard Marshall II. |

| 1995 onward | Anna Nicole and others pursue claims; a complicated interplay of probate and federal litigation begins. |

| 2006 (June 20) | Death of E. Pierce Marshall. |

| 2006 | Elaine’s governance/trust representative role becomes more prominent. |

| 2011 | U.S. Supreme Court decision in Stern v. Marshall. |

| 2014 | IRS gift-tax disputes and valuation litigation involving transfers to trusts. |

| 2025 | Ongoing wealth estimates place Elaine & family within the $20–30+ billion range (public wealth sites). |

Pros & Cons

Pros

- Massive Long-Term Wealth

The family holds an estimated ~16% beneficial interest in Koch Industries, making them one of America’s most powerful private wealth holders. - Strong Trust & Estate Planning

Wealth is protected through complex trust structures, helping preserve assets across generations and reduce public exposure. - Quiet but Real Influence

Board-level involvement at Koch Industries allows influence over strategy without public scrutiny or media pressure. - Landmark Legal Impact

The Stern v. Marshall case reshaped U.S. bankruptcy and estate law, giving the family lasting legal significance beyond wealth.

Cons

- Constant Legal & Tax Scrutiny

Decades of lawsuits and IRS gift-tax disputes have created high legal risk and ongoing expenses. - Limited Liquidity

Most wealth is tied to private, non-tradable assets, meaning cash access is restricted despite high net worth. - Valuation Uncertainty

Because Koch Industries is private, net worth estimates vary widely and depend on assumptions and discounts. - Succession & Inheritance Risk

Passing wealth through trusts can still lead to future family disputes or legal challenges.

FAQs

A: The beneficial interest held via trusts is commonly estimated at ~16% of Koch Industries. However, this is not a directly tradable stock; it is trust-held, and effective control or liquidity may be restricted.

A: Stern v. Marshall is a U.S. Supreme Court case (2011) that held a bankruptcy court (a non-Article III court) lacks constitutional authority to issue final judgment on certain state-law claims (counterclaims) even when the statute says it may. It reshaped limits on bankruptcy court power and impacted estate litigation across the U.S.

A: Estimates vary. Many sources place her and her family’s net worth in the $20–30+ billion range, with some clustering around $25–28 billion. Because her wealth is in trusts and private shares, the exact figure depends on valuation assumptions and tax/liquidity adjustments.

A: No. She is not known for operating companies, running public ventures, or appearing in the media. Her primary role is as a trust beneficiary, board member, and asset steward.

A: Yes. There remain tax/gift disputes, valuation contests, and the risk that heirs or claimants could bring new litigation. Also, changes in U.S. trust/estate law could cause pressure on her structures.

Conclusion

Elaine Tettemer Marshall and her family exemplify how enormous private fortunes are held, defended, and transmitted across generations. Their story intersects fiduciary law, bankruptcy jurisdiction doctrine, tax policy, and Private-Company governance. Elaine’s role is that of a custodian: preserving wealth through legal architecture, participating in governance where necessary, and protecting family interests against competing claims.

This case also offers broader lessons for estate planners, family offices, and legal practitioners: the mechanics of trust drafting, the constitutional limits of non-Article III adjudication, and the scrutiny that accompanies sizeable private transfers. For readers and researchers, the Marshall narrative underscores that private wealth, while less visible on stock tickers, remains deeply consequential for the law and for public policy.