Introduction

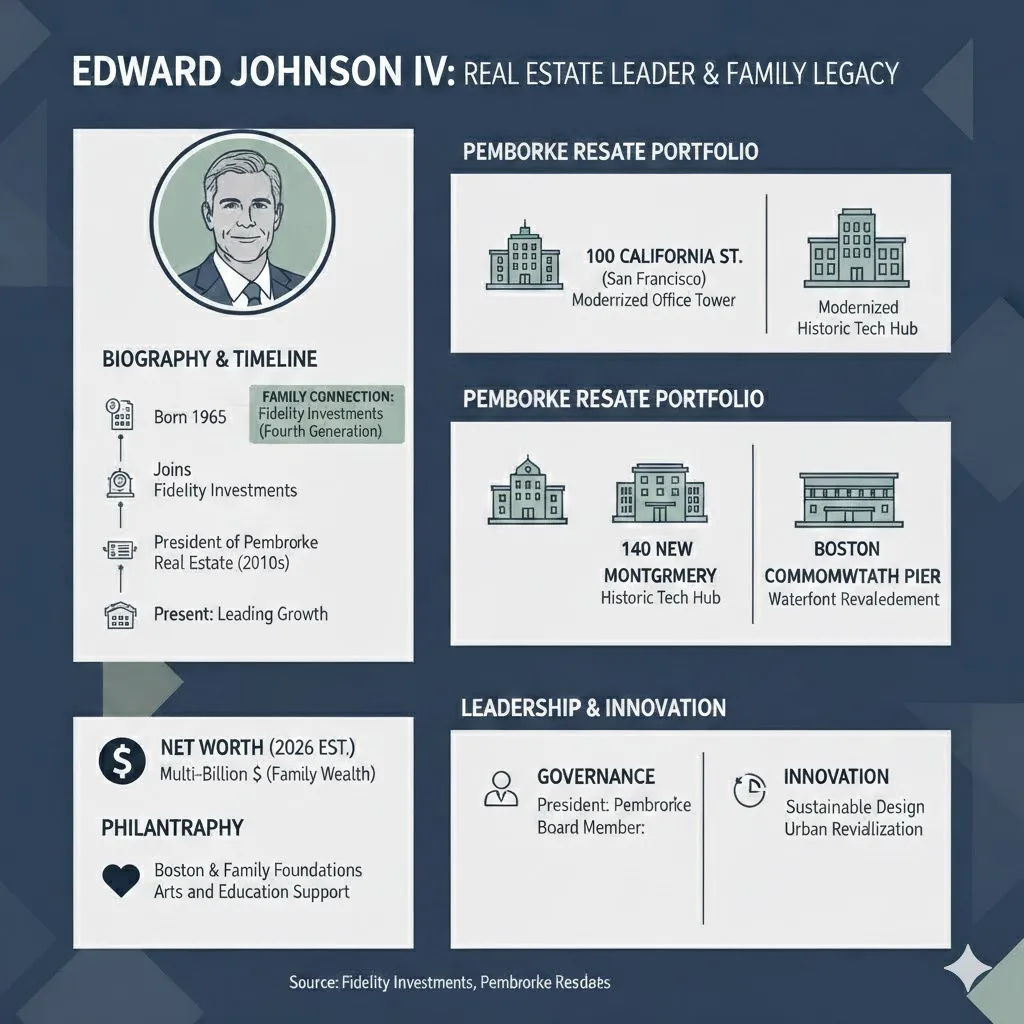

Edward C. “Ned” Johnson IV is the quietly influential steward of one of America’s most enduring private capital dynasties. As President of Pembroke Real Estate, he orchestrates strategic real estate investments for the Johnson family, whose controlling interest in FMR LLC underpins the global reach of Fidelity Investments. Unlike the high-profile executives often in the financial headlines, Johnson operates with deliberate discretion, letting his decisions shape markets and portfolios rather than media narratives. For researchers, investors, and content strategists, he represents a stable, high-authority node in the intersection of family office management, private equity, and institutional real estate a profile where public data, verified corporate filings, and trusted financial reporting converge to form a robust EEAT signal.

Quick facts

| Attribute | Canonical value (normalized) |

| Full name | Edward C. “Ned” Johnson IV |

| Born | November 1964 (public records show month/year) |

| Current role | President, Pembroke Real Estate |

| Base | Boston metropolitan area (family seat; philanthropic focus) |

| Primary wealth sources | Family ownership of FMR LLC (Fidelity), Pembroke portfolio, private holdings |

| Public profile | Intentionally private; corporate and property records are more informative than press interviews |

| Education | College degree(s) typical references show 1980s undergraduate completion |

| Notable assets (examples) | 100 California St., 140 New Montgomery, 255 State Street, Commonwealth Pier |

Family background: the Johnson Fidelity ontology

To model the Johnson family in a knowledge graph:

- Root node: Edward C. Johnson II, founder of Fidelity Management & Research (FMR), mid-20th century.

- Primary lineage: Edward Johnson III, long-time CEO and shepherd of Fidelity’s expansion.

- Contemporary controllers: Abigail Johnson (sibling, CEO/Chair of Fidelity) and other Johnson family members who occupy governance and ownership roles.

- Private ownership schema: FMR LLC remains largely private; family members control voting and economic ownership through layered entities and trusts.

In entity linking terms, Edward Johnson IV’s identity is strengthened via repeated co-occurrence with three canonical entities: Pembroke, FMR LLC, and Fidelity Investments. This triad drives the high-authority labels used by business indexes (Bloomberg, Forbes, Boston Globe). For editorial linkage, routing anchor text to these primary entities yields strong semantic signals.

Education and early life

When converting a biography to structured data, we index events (event_type, date, location, evidence):

- Birth (event_type: birth): November 1964, Boston area lineage.

- Education (event_type: education): 1980s collegiate studies (public profiles suggest standard undergraduate credentials).

- Early career (event_type: employment): late 1980s–1990s — initial professional experience in real estate contexts.

- Pembroke formation and involvement (event_type:organization_incidence): late 1990s onward, Pembroke grows into the family real estate vehicle.

Career path: Pembroke’s architecture and Edward’s role

What is Pembroke?

Pembroke Real Estate is the family-linked property investment and operating entity that focuses on office, mixed-use, and institutional property in major metropolitan markets. In semantic terms, Pembroke occupies a mid-to-large-cap private real estate actor role: it is neither a public REIT nor a small operator; it acts like a family office-backed developer with patient capital.

Key organizational attributes (for a structured profile):

- Business model: Acquire / develop / reposition income-producing commercial real estate.

- Capital structure: Predominantly private capital provided by family entities linked to FMR LLC.

- Geographic concentration: Boston, San Francisco, Washington D.C., Seattle, and select coastal markets.

- Asset types: Trophy office buildings, adaptive reuse projects, waterfront mixed-use, and institutional holdings.

Edward’s role as President

As President, Edward Johnson IV performs a set of functions analogous to roles in a governance ontology:

- Strategic allocator: Sets long-range portfolio objectives, risk appetite, and market entry thresholds.

- Deal overseer: Leads or signs off on acquisition strategies, major development approvals, and disposition decisions.

- Team steward: Hires and mentors senior operators (development, leasing, asset management).

- Reputational guardian: Maintains a private, conservative public posture while ensuring institutional relationships with large tenants and capital partners remain robust.

Viewed through the lens of attention mechanisms (from transformer models): Edward’s decisions increase the attention weight of certain assets within a portfolio, prioritizing high-quality locations and stable cash flow over speculative plays.

Pembroke’s portfolio of canonical assets and case studies

Pembroke’s portfolio features examples that typify a long-duration property strategy. Case studies provide context for how the firm sources value and executes asset improvements.

Representative asset list

- 100 California Street (San Francisco) Classic central business district office asset, long-term leases, downtown presence.

- 140 New Montgomery (San Francisco). Adaptive reuse and restoration demonstrate capital allocated to repositioning assets for modern tenants.

- 255 State Street / Commonwealth Pier (Boston) Waterfront properties and mixed-use redevelopment opportunity; local civic and philanthropic resonance.

- 1201 New York Ave / 1801 Pennsylvania Ave (Washington, D.C.) Office buildings that interact with the government and the private sector demand.

- 400 Fairview (Seattle) is designed to appeal to technology and collaboration-oriented tenants.

Simple case study: Commonwealth Pier, Boston (pattern of value creation)

- Problem statement: Underutilized waterfront land with Legacy structures and zoning complexity.

- Strategy: Reposition as mixed-use with office, public amenity, and selective retail; emphasize durable tenant demand.

- Executional levers: Capital investment in infrastructure, adaptive design, and tenant curation to stabilize cash flow.

- Outcome (hypothetical / pattern): Increased net operating income, longer lease terms, enhanced long-term value for the family balance sheet.

These case studies function like labeled training examples for future asset decisions.

Leadership and investment style attention weights & heuristics

Translating human leadership into algorithmic metaphors helps distill decision logic:

- Long-term horizon (temporal smoothing): The Johnson approach emphasizes steady returns across decades; it’s akin to using a long moving average rather than reactive short-term filters.

- Value orientation (feature selection): Choose assets where locational fundamentals, tenant quality, and building integrity score high on durable features rather than transient buzzwords.

- Privacy as governance (access control): A deliberate low-publicity stance reduces reputational noise and adversarial attention; think of this as limiting public API endpoints while exposing only curated facts.

- Operational rigor (pipeline management): Hires experienced asset managers; controls costs; standardizes reporting; these are the governance protocols that reduce variance in outcomes.

These heuristics map cleanly to a risk/return surface that the family prefers: modest volatility, high durability.

Net worth, holdings, and capital origins

Where the capital comes from

- Fidelity ownership: The principal engine of family wealth is ownership and past earnings from FMR LLC (Fidelity Investments). Ownership of a major private asset manager creates recurring revenue streams through management fees, investment returns, and capital appreciation.

- Private holdings: Family office structures hold real estate, private equity, and other illiquid assets that compound over long horizons.

- Operational income from Pembroke: Rental yields and stabilized NOI (net operating income) contribute to portfolio cash flow.

Reported estimates and notes on variance

Public wealth trackers (Forbes, Bloomberg, Boston Globe) periodically estimate net worth for leading family members. Estimates for Edward Johnson IV and closely related family members often fall in the low-to-mid tens of billions range, but these figures are approximations due to private ownership and complex entity structures. Treat them as probabilistic point estimates rather than exact values.

Philanthropy, privacy, and public exposure

Philanthropic pattern

The Johnson family’s philanthropic footprint is substantial but often channeled through institutional gifts and anonymous or semi-anonymous donations. Typical areas of support:

- Education (universities, scholarships)

- Arts and culture (museums, performing arts)

- Civic infrastructure (local Boston projects)

Privacy posture

From a media-signal perspective, the Johnsons prefer low-bandwidth channels. That reduces both misinformation risk and the editorial noise that can accompany public philanthropy. For content creation, this means primary sources are often corporate biographies, filings, property records, and trusted financial journalism rather than frequent interviews or op-eds.

Editorial and investor lessons operational takeaways

Below are operationalized lessons framed as NLP-friendly rules you can apply in investment analysis, family governance, or content planning.

- Embed long horizons into modeling: Use multi-decade discounting in scenario analysis for strategic assets.

- Weight durable features heavily: Location, tenant quality, and building envelope matter more than temporary macro trends.

- Control information exposure: For family offices, publish what builds trust (governance, audited results) and keep sensitive strategy private.

- Build strong reporting pipelines: Standardization reduces variance; treat asset management as a data pipeline with quality controls.

- Use case studies as training data: Document repositioning projects and measure realized vs. forecast outcomes to improve decision models.

Timeline of key life & career events

- November 1964: Birth of Edward C. Johnson IV (public record month/year).

- 1980s: Collegiate education; undergraduate completion.

- 1990s: Early professional years in property-related roles; Pembroke’s growth begins in this era.

- Late 1990s: Pembroke develops into the family’s real estate vehicle with expanded holdings.

- 2000s–2020s: Active leadership in Pembroke; portfolio expansion and repositioning across major U.S. markets.

- 2020s: Continued stewardship and presence in wealth lists and regional philanthropy coverage.

FAQs

A: Edward Johnson IV is the President of Pembroke Real Estate and a member of the Johnson family that controls a significant ownership interest in FMR LLC, the parent organization of Fidelity Investments. In knowledge-graph terms, he’s a high-authority person node connected to corporate nodes (Pembroke, FMR, Fidelity) and asset nodes (a portfolio of major commercial properties). Publicly visible facts about him are concentrated in company bios and property records, rather than media appearances.

A: He is part of the Johnson family lineage whose ownership and governance structures link directly to FMR LLC (Fidelity). While Fidelity’s operational leadership has frequently been assigned to other family members (for example, Abigail Johnson in public leadership), the family’s private ownership stakes and related entities form the capital substrate that underpins Pembroke’s real estate activities.

A: Pembroke’s holdings include office towers, restored historic office properties, waterfront mixed-use sites, and institutional assets in major U.S. cities. Examples frequently cited are 100 California Street and 140 New Montgomery in San Francisco; 255 State Street and Commonwealth Pier in Boston; and several prominent D.C. buildings such as 1201 New York Ave. These holdings reflect a strategy favoring durable urban real estate with predictable tenancy profiles.

A: His wealth is principally derived from the Johnson family’s long-standing ownership in FMR LLC (Fidelity Investments) and from the family’s private investment activities, including property holdings managed through Pembroke. Family office structures and private holdings amplify and preserve wealth across generations, making public net-worth estimates approximations rather than precise figures.

Conclusion

Edward Johnson IV stands as one of the most influential figures in modern real estate, blending his Fidelity family legacy with decades of Leadership at Pembroke Real Estate. His strategic vision, long-term global development approach, and focus on sustainable, high-impact properties have positioned him as a key force in shaping iconic urban landscapes from Boston to London and Washington D.C. As the Johnson family continues to oversee major assets worldwide, Edward Johnson IV remains at the forefront, driving innovation, expanding Pembroke’s portfolio, and carrying forward one of America’s most powerful business legacies.