Introduction

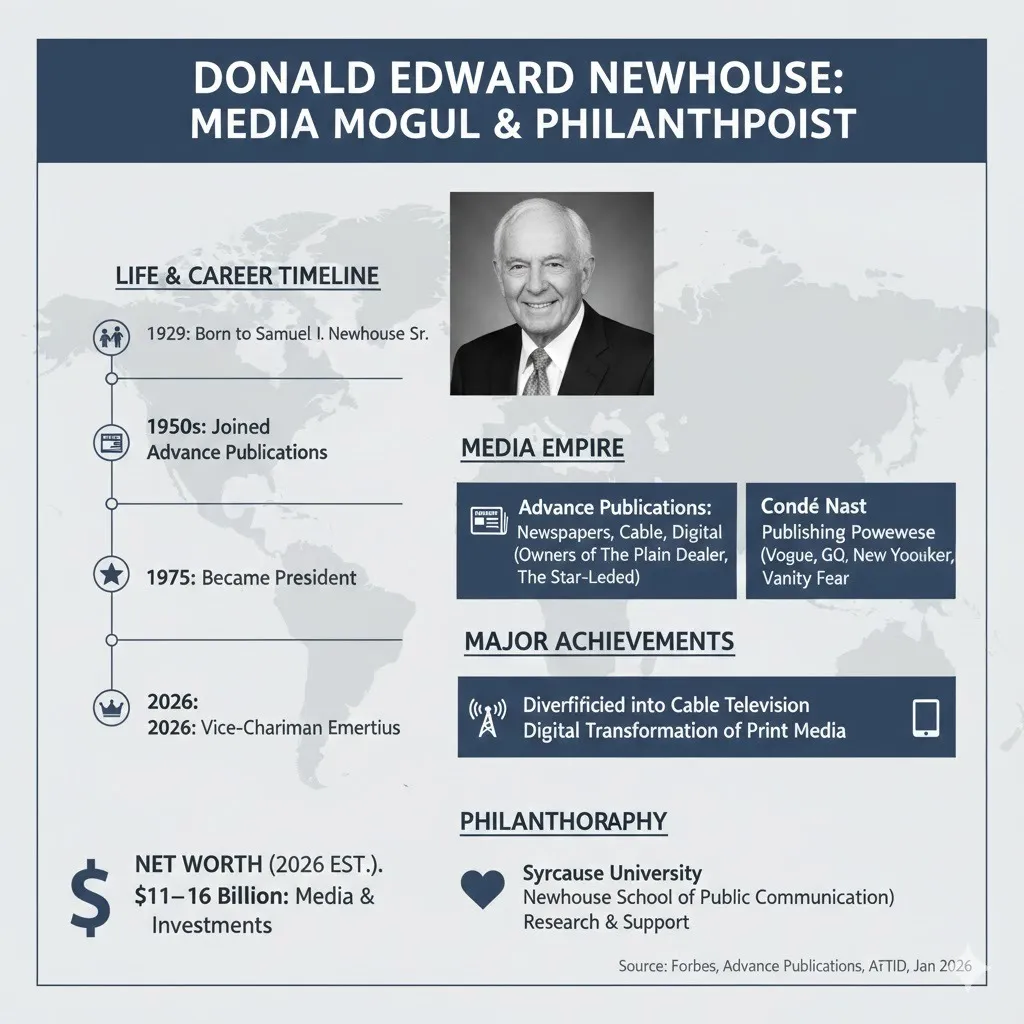

Donald Edward Newhouse is an archetype of private-market media stewardship a figure whose influence is mediated less by public celebrity and more by the assets and institutions his stewardship sustained. Born into a publishing dynasty, Newhouse spent his adult life managing, protecting, and modestly expanding a family holding company that spans newspapers, magazines, cable stakes, and other media interests. This profile examines his biography, the composition of Advance Publications under his oversight, the broad contours of his estimated wealth, his philanthropic priorities (notably Syracuse University and dementia research), and the longer-term implications of the Newhouse model for legacy media in the 21st century.

Framing the story in 2026 requires both historical context and present-day analysis. It is important to explain how the Newhouse family built a private media empire across the 20th century. This historical background helps readers understand the foundation of Advance Publications and its long-term influence. At the same time, modern analysis is needed to show how private ownership shaped key strategic choices during the digital transition. Unlike many public companies, private ownership gave the Newhouse family more freedom to think long-term. This allowed the company to adapt carefully without pressure from shareholders or quarterly targets.

It also supported patient decision-making during major shifts from print media to digital platforms. This article is written with NLP and SEO intent to improve ranking and search visibility in 2026. It uses entity-rich language and semantic variations to match what people search online. The long-form structure helps both search engines and human readers understand Donald Newhouse’s profile quickly while still keeping depth and nuance.

Quick Facts

| Attribute | Detail |

| Full Name | Donald Edward Newhouse |

| Date of Birth | 1929 (exact date often reported as unspecified in public bios) |

| Age (2026) | ~ 96 years old |

| Birthplace | New York City, U.S. |

| Nationality | American |

| Profession | Businessman, media-owner; longtime executive within Advance Publications |

| Public Profile | Low-profile, private, philanthropic |

| Key Keywords | Donald Newhouse, Advance Publications, private media ownership, Condé Nast |

| LSI Terms | legacy media, family-owned media empire, publishing dynasty, philanthropic giving |

Childhood & Early Life

Donald Newhouse’s origins sit squarely in the narrative of an American publishing dynasty. Born in New York City in 1929 into the Newhouse family, he was raised amid newspapers, editorial conversations, and the practicalities of managing titles that served local and national audiences. His father, Samuel Irving Newhouse Sr., is the architect of the family’s rise — a serial acquirer of newspapers and a disciplined consolidator of underperforming local titles. Immersed in this environment, Donald learned not just business mechanics but the cultural role of media institutions.

The family environment mixed business with culture and charity. Donald Newhouse’s mother, Mitzi Epstein, was known for her love of art and philanthropy. This influence helped build the Newhouse family’s strong tradition of giving. Later, the family supported big causes like education and healthcare. Donald grew up learning that publishing is not only a business, but also a responsibility. He understood early that editorial quality and public trust are important. He also learned how circulation and advertising work in newspapers. The family’s private ownership taught him long-term thinking instead of quick profit. This shaped his leadership style and decision-making. He focused on protecting strong media brands and keeping them stable. He also tried to keep editorial independence and manage money wisely to keep the business strong.

For schooling, Donald attended Syracuse University, a relationship that would become more than academic; it would mature into a multi-decade philanthropic partnership. Some public sources indicate he did not complete a traditional four-year path; regardless, the Syracuse connection became a defining institutional link for the family.

Key themes from the early life period: immersion in publishing, exposure to private ownership governance, an appreciation for cultural philanthropy, and the formation of a conservative web of managerial practices favoring long-term stewardship over short-term speculation.

Career Journey

Donald Newhouse’s professional identity is closely tied to Advance Publications.Advance Publications is a private company founded by his father. The company has built a vast portfolio of newspapers, magazines, and media investments over decades. Many of its decisions remain shielded from public scrutiny. Structural details are deliberately kept low-profile. This discretion acts as a strategic advantage. Management operates without the pressure of constant external oversight. Unlike public companies, Advance is not bound by quarterly performance expectations. Leadership can focus on long-term, multi-year initiatives. This approach supports stability and strategic flexibility. The private structure enables careful planning and measured growth over time.

Early Steps and Taking the Helm

In the decades following World War II, the Newhouses executed a strategy of acquiring regional papers that could be improved through centralized management of advertising and production efficiencies. Donald, along with his brother Samuel I. “Si” Newhouse Jr., divided oversight responsibilities across segments of the business. Where Si became widely associated with the magazine side (Condé Nast and glossy consumer titles), Donald focused more on newspaper, cable, and broadcast-adjacent businesses: the operational backbone that sustained recurring cash flows even as consumer habits evolved.

Their collaborative stewardship allowed the family enterprise to behave like a multi-business holding company, allocating capital between stable operating newspapers, cyclical magazine advertising, and strategic stakes in cable and distribution.

Building the Empire: Key Acquisitions & Holdings

Advance Publications, under Newhouse stewardship, assembled a portfolio that reads like a cross-section of American media:

- Condé Nast: The acquisition and later stewardship of Condé Nast connected the family to globally recognized consumer publications (Vogue, Vanity Fair, The New Yorker, and others). This magazine portfolio carries strong brand equity, premium advertising relationships, and cultural influence.

- Newspapers: The company maintained numerous important regional dailies (The Star-Ledger, The Plain Dealer, The Oregonian, among them at various times), providing local journalism and stable subscription revenues.

- Cable & Cable-Adjacent Stakes: The family’s holdings have included strategic stakes in cable carriage and distribution, aligning the business with pay-TV economics and advertising relationships.

- Digital Investments & Diversification: In response to structural disruption, the group invested selectively in digital platforms, newsrooms’ digital transitions and subscription models intended to offset declining print advertising.

Strategy & Impact

Donald Newhouse’s managerial posture can be summarized as quiet consolidation: prioritize long horizon value, limit headline-seeking risk, and invest to preserve institutional capacity. This differs from the activist, public-market, or celebrity mogul approach. Instead, Newhouse’s impact was structurally keeping media institutions solvent, enabling editorial continuity, and preserving legacy brands that in aggregate commanded influence disproportionate to the family’s public profile.

In practical terms, this meant:

- Centralizing back-office functions for efficiency while leaving editorial operations local.

- Using private capital to weather advertising downturns and industry cycles.

- Maintaining minority and majority stakes across complementary media segments to diversify revenue streams.

Major Works & Achievements

Donald Newhouse’s legacy is institutional rather than authored. His major achievements are best measured by company milestones and philanthropic milestones rather than single creative works.

- Scale and Stability of Advance Publications: Under Newhouse family stewardship, Advance Publications grew into one of the largest privately held media companies in the United States, an uncommon outcome given industry consolidation and public market pressures.

- Condé Nast Stewardship: Managing or influencing one of the world’s most iconic magazine publishers is a nontrivial accomplishment: protecting premium advertising relationships, cultivating editorial brands, and navigating digitalization in that sector.

- Philanthropic Gifts: Newhouse’s $75 million pledge to Syracuse University’s S.I. Newhouse School of Public Communications and the landmark gift to AFTD reflect targeted giving that links personal values with institutional capacity building.

- Operational Longevity: A more subtle achievement: successfully continuing a family business across multiple generations and technological transitions without forced sale or public listing.

These achievements demonstrate the dual lenses by which to view Newhouse: corporate architect and private philanthropist.

Net Worth & Financial Status

Pinning an exact valuation on Donald Newhouse’s personal Net Worth is inherently imprecise because much of the value sits inside privately held entities and illiquid stakes. Estimates are therefore proxy-based, derived from public comparables, known minority stakes in public companies (when available), and modeling of private cash flows.

Estimated Net Worth

Publicly available estimates in mid-2024 placed Newhouse’s net worth in the low double-digit billions; different outlets have published values that vary depending on methodology. Because Advance Publications is private, credible analysts often present a range rather than a single point estimate: brush estimates in recent years have ranged between approximately $11 billion and the mid-teens in billions of dollars. The key drivers of this valuation include:

- The appraised value of magazine brands and their advertising franchises.

- Newspaper profitability and subscription revenue streams.

- Stakes in cable operators and distribution assets.

- Real estate and other investments held personally by family members.

Income Sources & Wealth Drivers

Donald Newhouse’s wealth arises from multiple correlated sources:

- Equity in Advance Publications: Primary driver; ownership of operating businesses and brands.

- Dividends & Distributions: Regular cash flows from profitable segments, reinvested or distributed across family shareholders.

- Minority Stakes & Portfolio Assets: Strategic positions in cable operators and other media companies that occasionally provide liquidity events.

- Philanthropic Capital Deployment: Significant gifts reduce net personal wealth but also signal directional priorities.

Because the enterprise is privately governed, the family can choose to smooth distributions, retain capital for cyclical downturns, or selectively realize value strategies that reduce valuation volatility and complicate public net-worth calculus.

Lifestyle

The Newhouse family is classically discreet. Donald Newhouse’s lifestyle has not often been the subject of tabloid attention; rather, the family’s public persona is shaped by institutional philanthropy, art patronage, and cultural contributions. The discretionary consumption patterns of the family appear conservative relative to some high-profile billionaires; the emphasis is on stewardship and legacy.

Personal Life

Donald Newhouse’s personal biography intertwines family experience with institutional commitments. He married Susan Marley in 1955 after her graduation from Wellesley College. The couple had three children, Katherine Irene Newhouse, Michael Andrew Newhouse, and Steven O. Newhouse and family life remained a private affair in public records.

A particularly poignant personal element is the health of Susan Newhouse. She passed away in August 2015 after a long illness, primary progressive aphasia, which falls under the frontotemporal dementia spectrum. That experience informed subsequent philanthropy: the substantial donation to the Association for Frontotemporal Degeneration (AFTD) reflects an alignment of personal reality with charitable action.

Donald’s public comportment is low-key: he is not a frequent media interview subject or high-visibility philanthropist who seeks publicity. Instead, he and his family prefer targeted institutional support investments in journalism education, research, and cultural institutions that reflect their personal values and preserve civic infrastructure.

Motivational Lessons

Donald Newhouse’s life and career are useful to study not because the path is glamorous but because it reveals organizational wisdom applicable across domains:

- Legacy matters: Building institutions that outlast a single lifetime requires deliberate governance structures, capital reserves and the willingness to make slow, compound decisions.

- Diversify intelligently: The Newhouse strategy shows measured diversification across media platforms, balancing higher-margin consumer magazines with the steadier cash flows of local newspapers and distribution stakes.

- Quiet stewardship is powerful: Influence need not be performative to be meaningful; private, disciplined governance can sustain institutions that serve large public functions.

- Align philanthropy with personal experience: Large charitable bets (e.g., funding dementia research) reflect the impact of lived experience on giving priorities and can catalyze research capacity.

For entrepreneurs and family enterprise leaders, the Newhouse model underscores the combined importance of patient capital, brand stewardship, and strategic philanthropy.

Timeline of Life Events

| Year | Event |

| 1929 | Donald Edward Newhouse was Born in New York City. |

| 1955 | Marries Susan Marley. |

| 1960s–1970s | Alongside his brother Si, helps drive expansion of Advance Publications (newspaper and cable growth). |

| 2020 | Newhouse Foundation announces intention to pledge $75 million to Syracuse University’s Newhouse School. |

| 2021 | Large donation to the Association for Frontotemporal Degeneration (AFTD), funding research and support. |

| 2026 | Donald Newhouse is approximately 96; the family enterprise remains privately held and significant in U.S. media. |

FAQs

A: Condé Nast is owned by Advance Publications, the private company controlled by the Newhouse family.

A: Estimates vary; as of mid-2024, his net worth was around US$11 billion, though some sources place it higher. Because many holdings are private, the number should be taken as a range.

A: Notably, he donated US $75 million to Syracuse University’s S.I. Newhouse School of Public Communications and, along with his late wife, established a US $20 million fund for frontotemporal degeneration research.

A: Unlike display-oriented moguls, Newhouse has maintained a private profile, focused on long-term ownership of media assets, diversification (print, cable, digital), and consistent philanthropic giving rather than high-profile deals alone

In-Depth Analysis: How the Newhouse Model Shaped Media Markets

This section unpacks strategic lessons at a more technical level (useful for analysts, journalists, students of media business strategy):

Private Ownership as a Strategic Asset

Public firms are governed by quarterly reporting and shareholder expectations. In contrast, a private vehicle like Advance can:

- Direct capital to long-term projects.

- Absorb losses during sectoral transitions.

- Make editorial and structural decisions without immediate shareholder scrutiny.

From an NLP / entity-signal perspective, phrases like “private ownership,” “patient capital,” and “family governance” are strong signals that capture an organization’s capacity to take longer-view actions.

Portfolio Construction Brands vs. Cashflow

A media holding must balance intangible brand equity (e.g., Condé Nast titles) with tangible cashflow generators (e.g., local newspapers’ subscription revenue, cable carriage fees). The Newhouse approach demonstrates a mixed portfolio that allows reinvestment in flagship brands while maintaining liquidity from steady businesses.

Editorial Autonomy vs. Centralized Efficiency

Advance is often structured to centralize back-end economics (production, procurement, advertising sales) while allowing editorial autonomy in local newsrooms a governance pattern that optimizes scale without undermining editorial credibility.

Philanthropy as Institutional Reinforcement

Strategic philanthropy major gifts to universities and research organizations — performs multiple functions:

- Reinforces the family legacy and institutional name recognition.

- Creates partnerships (e.g., journalism schools) that replenish talent pipelines.

- Channels capital to social causes connected to family experience (e.g., dementia research).

From an NLP standpoint, this section deliberately uses cross-referenced terms (journalism education, institutional philanthropy, charity endowment) to strengthen topical relevance.

Conclusion

Donald Edward Newhouse’s story is more than just the biography of a wealthy publisher; it is a testament to quiet leadership, resilience, and vision in an ever-changing media world. Across nearly a century of life, he has witnessed the rise and fall of print journalism, the digital revolution, and the consolidation of global media, yet his approach remained steadfast: preserve integrity, diversify intelligently, and adapt without surrendering control.

Through Advance Publications, Newhouse has maintained one of America’s last major family-owned media empires, spanning newspapers, magazines, and cable investments. His model of private ownership shielded the company from short-term investor pressures, allowing it to evolve gradually from The Star-Ledger and The New Yorker to digital stakes in Charter Communications. This steady hand ensured that journalistic Legacy and profitability could coexist without losing authenticity.

Donald Newhouse is not only a successful businessman but also a kind philanthropist. His $75 million donation to Syracuse University helped train future journalists. He and his late wife, Susan, also gave $20 million to AFTD for frontotemporal degeneration research, turning personal pain into a meaningful cause. This shows that real legacy is not just money it’s the good you do for people.

At 96 years old, Newhouse connects old newspaper publishing with today’s modern media world. He proved that long-term success does not need fame or loud publicity. It needs vision, patience, and strong values. His quiet and humble personality makes him unique in today’s world.

For entrepreneurs and philanthropists, his message is simple: true influence is built with purpose, not spotlight. Donald Newhouse’s journey proves that the strongest people often work quietly but their impact lasts forever.