Introduction

When you look at Southern California’s scenery of planned section, open-space preservation, and successful business corridors, few names loom larger than Donald L. Bren. As chairman and sole owner of the Irvine Company, Bren has for decades operated not just as a designer, but as a master-planner, land steward, and charitable leader. His story matters because it offers a rare blend: the mixture of real-estate scale and a deep commitment to legacy, conservancy and education.

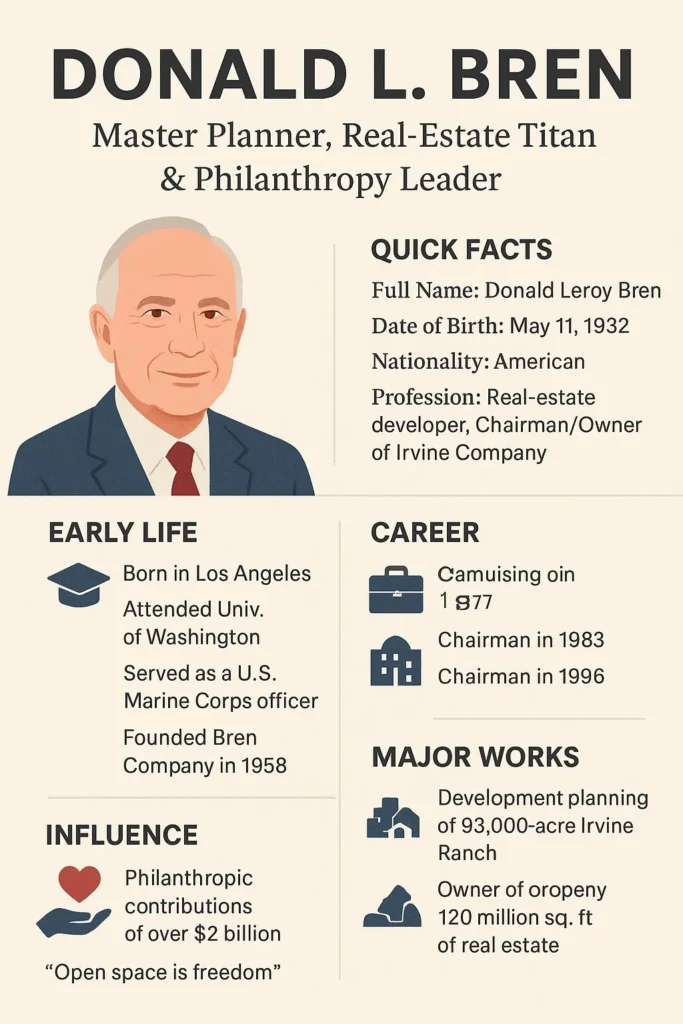

Quick Facts

| Item | Detail |

| Full Name | Donald Leroy Bren |

| Date of Birth | May 11, 1932 |

| Age (2026) | 93 |

| Birthplace | Los Angeles, California, USA |

| Nationality | American |

| Profession | Real-estate developer; Chairman & sole owner, The Irvine Company |

| Core Assets | Irvine Ranch (land holdings), office campuses, multifamily, retail, resort & marina properties |

| Philanthropic Focus | Education, research, open-space conservation |

| Recognition | UC Presidential Medal (2004); Fellow, American Academy of Arts & Sciences (2007) |

| Notable Net Worth (2025 est.) | ≈ US $18 billion |

Childhood, Education & Formative Years

Donald Bren was born in Los Angeles in 1932 to Marion Newbert and Milton H. Bren. His family background merge elements of civic espousal and entertainment-industry ties; his father’s career included roles in film production and talent presentation. Bren attended the University of Washington, where he completed a bachelor’s degree in business management and lucrative. After college, he served as an officer in the U.S. Marine Corps, an early incident that many spectator link to his disciplined, patient, and ranked approach to undertaking.

In 1958 Bren built his first house in Newport Beach and formed the Bren Company. These early, modest residential projects were developmental: designing and conveying homes taught him construction foundational, supply-chain rhythms, and the value of report Over time those early lessons scaled into community-wide planning and supervision.

Career Trajectory: From Builder to Master Planner

The Early Builder (1958–1967)

Bren’s first era was practical and entrepreneurial. He founded the Bren Company (a homebuilding business), demonstrated product and process competence, and co-founded the Mission Viejo Company in 1963 to develop a new city built on 10,000 acres. Mission Viejo was a formative master-planning experience: infrastructure sequencing, amenity placement, and civic fabric integrations that would later inform Irvine.

Corporate Growth and Reacquisition (1970–1976)

The Bren Company was sold to International Paper in 1970 for a significant sum; when the 1970s recession followed, Bren reacquired the company in 1972. This period taught countercyclical opportunity: attractive assets can be secured during downturns, and long-term holding unlocks upside as cycles normalize.

The Irvine Company Era (1977–1996 and beyond)

In 1977 Bren and investors acquire the Irvine Company from the Irvine base. Over the next two decades, Bren combine ownership and control, becoming chairman (1983) and later sole holder (by the mid-1990s). Under his leadership the Irvine Company develop into a vertically desegregate, privately held real-estate enterprise managing residential community, office campuses, retail corridors, marinas, resorts, and vast acreage of conserve open space.

Strategic Philosophy & Distinctive Approach

Donald Bren’s development philosophy can be summarized in a few interlocking principles:

- Master-planning over parcel-by-parcel opportunism. Large, coherent plans allow infrastructure economies and long-term place value creation.

- Hold for the long term. Value accrues when supply is managed, amenities are curated, and ownership horizons are multigenerational.

- Integrate conservation and development. Protecting open space increases desirability and secures ecological services.

- Invest in quality infrastructure and design. Roads, transit interfaces, parks, and civic amenities materially influence rents and prices.

- Philanthropy as legacy and leverage. Strategic giving to education and research fosters institutional partnerships and community goodwill.

These principles are expressed operationally via capital discipline, architectural standards, and a preference for private ownership structures that facilitate long-range decision-making free from quarterly market pressures.

Major Works & Achievements

Irvine Ranch Scale, Stewardship, and Spatial Design

- Scale: The Irvine Ranch length tens of thousands of acres (the commonly cited figure is roughly 93,000 acres in historical references), which allowed Bren to choreograph land use over a geographical scale: residential villages, employment centers, retail nodes, and conserve ridgelines.

- Stewardship: Bren prioritized conservation tens of thousands of acres were set aside as indefinite open space and habitat corridors. This action both preserved paleobiodiversity and created long-term amenity value for residents and businesses.

- Design: Irvine’s village model clustered neighborhoods with local commercial cores, school sites, and parks created replicable, human-scaled environments inside a larger planned framework.

Mission Viejo The Proto Master-Plan

Mission Viejo (1960s onward) became a template for suburban planning: sequential infrastructure delivery, amenity placement, and homeowner services that tied quality and value together. It was a training ground where the techniques of large-scale planning were refined.

Urban Mixed-Use and Office Campuses

Over the years, the Irvine Company built world-class office property and mixed-use areas that attracted major employers, thereby creating jobs approaching to housing and reinforce local tax bases. These assets provided high-quality, long-term cash flows.

Conservation & Philanthropy

Bren’s Philanthropic focus is concentrated in education (notably major gifts to the University of California), research initiatives, and conservation projects. He has endowed a large number of distinguished chairs and funded institutional facilities actions that align long-run social returns with his private investments.

Net Worth, Financial Structure and Portfolio Dynamics

Key financial features include:

- Highly concentrated land ownership in a high-demand coastal region of California.

- Diversified asset types (multifamily, office, retail, resorts) within a single geographic footprint allowing cross-subsidy and strategic repositioning.

- Long-duration leases and institutional tenants in corporate campuses, producing stable NOI (net operating income).

- Disciplined capital deployment and selective disposition of non-core parcels to fund reinvestment or conservation.

An investor reading Bren’s model should note the trade-offs: concentration increases local exposure but also consolidates control over supply, which can be a powerful scarcity amplifier when demand remains robust.

Governance, Succession, and Organizational Design

Bren’s governance style has been characterized by strong centralized control and top-level decision authority. For private companies with a single controlling owner, governance tends to be nimble but can raise questions about long-term succession planning. Observers have focused on:

- Succession clarity: As Bren ages, market watchers ask who will control the Irvine Company and how stewardship values will be preserved.

- Board and management continuity: The organization has professional management but historically has functioned under Bren’s strategic vision.

- Transparency tradeoffs: Private ownership reduces public regulatory-like scrutiny, yielding both operational discretion and questions about accountability at scale.

Succession frameworks for single-owner empires typically include staged leadership transition, trusts/holding vehicles, and governance commitments that enshrine stewardship principles. How the Irvine Company aligns its future board and executive incentives with Bren’s legacy will shape the region’s next several decades.

Conservation, Ecosystem Services & ESG Lens

Bren’s model offers an instructive case for Environmental, Social, and Governance (ESG) practitioners:

- Environmental: Large tracts preserved for biodiversity and watershed protection; active habitat restoration programs in parts of the ranch; greenbelt creation that buffers development footprints.

- Social: Investment in educational institutions, local parks, and civic assets; criticisms remain around inclusion and affordability within premium master-planned zones.

Governance: Private governance allows for long-term planning but reduces public input; accountability mechanisms and community engagement strategies influence legitimacy.

The Irvine Company’s blending of conservation with development can be used as a template for balancing economic returns with ecological resilience but subject to critique about regional housing affordability and public access models.

Case Studies: Two Deep Dives

Case Study A Irvine Ranch: Village Model, Schools, Jobs, and Transit Integration

This section analyzes the village model: how sequencing of school construction, retail nodes, and transit access in each village created self-contained neighborhoods. It examines infrastructure financing strategies, land use sequencing, and community governance (HOAs and municipal relations). We dissect success factors: clarity of land use allocation, investment in public realm, and long-term restraint on supply to preserve premium pricing.

Case Study B Mission Viejo: From Instrumental Acquisition to Completed City

A retrospective on Mission Viejo uncovers how the Mission Viejo Company integrated sales modelling, marketing narratives, and phasing strategies to accelerate absorption rates. The case highlights lessons for suburban expansion and the interplay of regional amenities, commuting patterns, and community identity.

Critiques & Counterarguments

No developer’s legacy is uncontroversial. Key critiques include:

- Geographic concentration risk: Large submission to one region makes the container permit to localized downturns, legislative changes, or climate risks.

- Affordability and inclusion issues: Master-planned, comfort-rich communities often come at a surcharge; availability for lower-income households can be extraordinary.

- Transparency and public voice: Private ownership of large landholds centralize decision-making power and can reduce public failure.

- Shifting economic contexts: Remote work, retail disturbance, and climate change test accepted demand drivers for offices, retail, and suburban domesticl models.

Weighing these critiques against Bren’s strengths, long holding horizons, preservation strong institutional cooperation yields a nuanced legacy rather than a simple judgment.

Motivational Lessons & Actionable Takeaways

- Horizon matters. Multi-decadal ownership allows compounding benefits both financial and social.

- Design the supply chain of place. Infrastructure, schools, open space and local retail must be sequenced thoughtfully.

- Preserve ecological capital. Conservation can be an asset that enhances property values and resilience.

- Align philanthropy with institutional partners. Educational and research investments can stabilize civic ecosystems and provide long-term reputational returns.

- Institutionalize quality control. Architectural standards and disciplined asset management produce durable brand equity.

These lessons are both strategic and operational useful at the portfolio level and at the block-by-block design scale.

Timeline: Expanded

- 1932: Born May 11 in Los Angeles.

- 1950s: University education (University of Washington). Military service as a Marine officer.

- 1958: First house built in Newport Beach; founding of the Bren Company.

- 1963: Co-founded Mission Viejo Company; led large-scale community development.

- 1970: Sold the Bren Company to International Paper (sale later reversed).

- 1972: Reacquired assets during recession; learned value of countercyclical buying.

- 1977: Participated in purchase of the Irvine Company from the Irvine Foundation.

- 1983: Became chairman of the Irvine Company.

- 1990s: Consolidated ownership; became sole owner by mid-1990s.

- 2004: UC Presidential Medal (recognition for philanthropy).

- 2007: Elected Fellow, American Academy of Arts & Sciences.

- 2020s: Continued philanthropy and conservation efforts; public estimates of net worth around $18B (subject to market and property reappraisals).

Pros & Cons

Pros

- Master-planner mindset and control of supply.

- Long-term holding strategy that compounds value.

- Significant conservation legacy and environmental stewardship.

- Strategic philanthropic investments in education and research.

Cons

- Large geographic concentration in Southern California.

- Questions about housing affordability and inclusion.

- Private governance reduces public visibility into decision processes.

- Exposure to climate-related risks (sea level, wildfire, water supply).

FAQs

A: Donald Bren’s net worth is estimated in the tens of billions, often cited near $18 billion. Estimates vary because the Irvine Company is private, and analysts rely on assumptions, market comparables, capitalization rates, and the scarcity of coastal California land.

A: The Irvine Company is a private California real-estate firm led by Donald Bren, known for master-planned communities, diversified assets, and a long-term stewardship approach.

A: Donald Bren’s philanthropy focuses on education, research, and land conservation, emphasizing major institutional gifts, endowed chairs, scholarships, and preserved open spaces rather than small, scattered donations.

A: Bren pioneered master-planned communities, long-term land ownership, open-space integration, and built one of the largest private U.S. real-estate portfolios.

A: Key lessons from Bren: plan long-term, integrate infrastructure, uphold design standards, leverage conservation for value, view philanthropy as legacy, sequence development, preserve land, and prioritize responsible stewardship.

Conclusion

Donald L. Bren’s life and career represent a study in scale, patience, and stewardship. From building a first house in Newport Beach to shaping an entire regional landscape, Bren’s approach exemplifies a model of real-estate that blends financial discipline with ecological and institutional Investment. While critics rightly point to concentration risk and questions of equity, Bren’s stewardship framework if adapted thoughtfully offers actionable lessons for developers, planners, policymakers, and investors aiming to design resilient, high-quality places that last.