Introduction

David Sun’s journey is a remarkable example of how technical skill, disciplined thinking, and quiet determination can build one of the world’s most respected technology companies. Born in Taiwan and later immigrating to the United States, Sun combined engineering expertise with a sharp sense of market timing to co-found Kingston Technology, a company that reshaped the global memory industry. His career reflects a rare blend of precision and resilience: rebuilding after setbacks, innovating in highly competitive markets, and prioritizing quality at a time when consistency in computer hardware was far from guaranteed. Beyond Kingston’s growth into a multibillion-dollar enterprise, Sun’s story is also one of personal integrity, long-term planning, and a deep commitment to philanthropy. It is a biography of a builder, someone who saw opportunity in complexity and transformed it into lasting impact

Quick embeddings

Think of this as the embedding layer for David Sun’s profile: a compact vector that encodes key metadata. These are the stable features you’d use for downstream tasks (e.g., summarization, classification).

- Name (token): David Sun

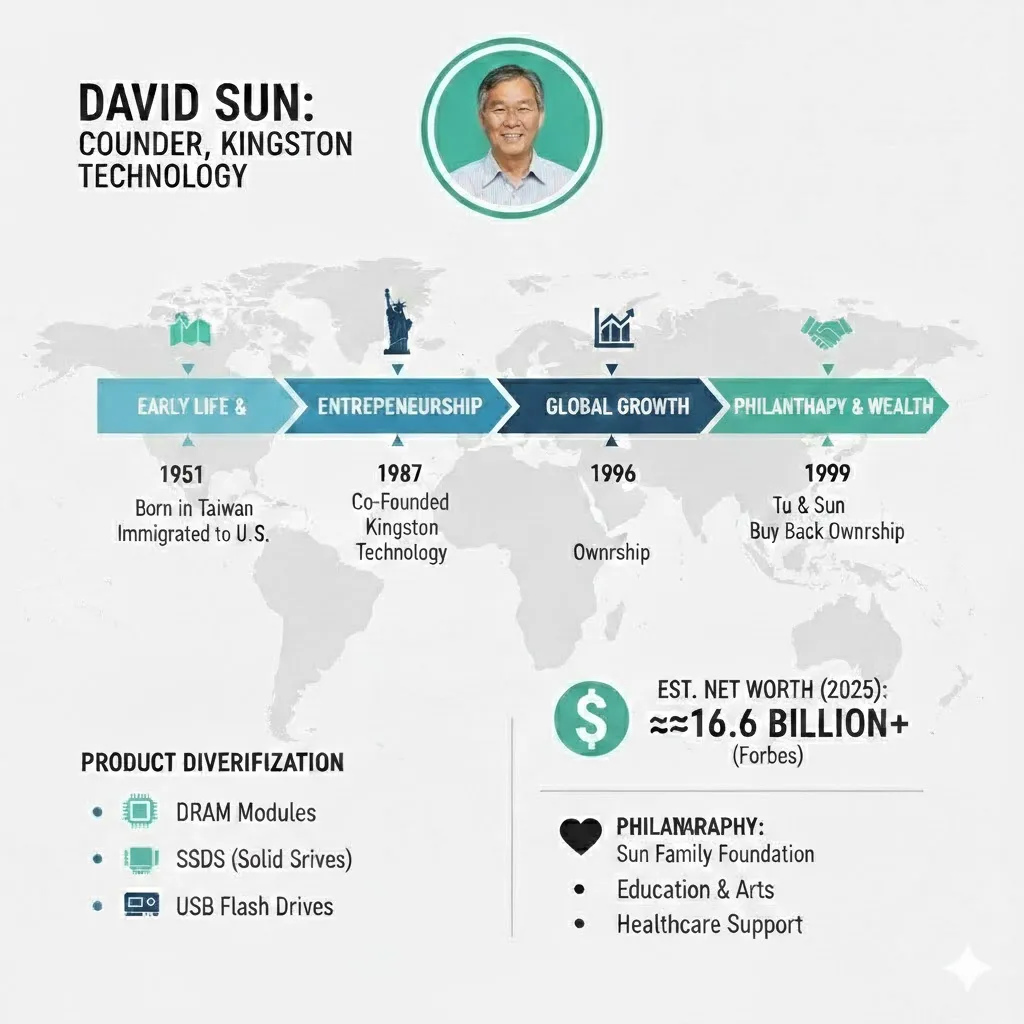

- DOB (feature): October 12, 1951

- Origin (feature): Taiwan → migrated to U.S. (1977)

- Education (feature): Engineering, Tatung University

- Primary role (label): Co-founder & executive (COO) at Kingston Technology

- Residence (context): Orange County / Irvine, California

- Family (context): Married to Diana Sun; two children

- Philanthropy (signal): Sun Family Foundation/education & community giving

- 2026 net worth (estimate): ~US$16.6 billion (Forbes estimate)

These are the canonical signals we’ll use repeatedly as we generate the full narrative.

Tokenization: early life and preprocessing

David Sun’s input stream begins in Taiwan (1951) and later passes through a major tokenizer event: emigration to the United States in 1977. That migration functions like a domain shift moving from a Taiwanese dataset to a U.S. production environment. The engineering education at Tatung University served as foundational embeddings technical weights that later allowed Sun to construct reliable engineering solutions when supply-chain noise and market volatility presented adversarial examples.

Early ventures: preliminary models and the crash

Before the main architecture (Kingston) emerged, Sun and his co-founder John Tu trained a smaller model: Camintonn (1982). In ensemble terms, Camintonn was an early model variant that provided crucial gradient updates: manufacturing experience, board design know-how, and exposure to sales/marketing dynamics. They sold Camintonn to AST Research in 1986 for a nontrivial sum (≈US$6M), which produced an initial liquidity event, a checkpoint with a positive reward signal.

But then the market experienced a catastrophic noise injection: the 1987 stock-market collapse (Black Monday). This was like a sudden domain shift with adversarial perturbations; the duo’s investments and savings were decimated. Instead of overfitting to prior success or collapsing under negative log-likelihood, Sun and Tu treated the crash as a regularization step. They did not stop training; they adjusted hyperparameters and prepared a new model: Kingston Technology.

Founding Kingston (1987): clever feature engineering

In late 1987, the memory-chip market exhibited a scarcity of 1-megabit surface-mount memory devices. This scarcity was a bottleneck in the production pipeline for PC manufacturers — a missing feature in many downstream products. Sun’s engineering intuition produced a practical feature engineering solution: design a memory module that used through-hole, more available components to implement Single In-Line Memory Module (SIMM) functionality. The cleverness is in the mapping of an absent feature (available chips) to an alternate representation (through-hole modules) that preserved performance while relying on accessible resources.

From an NLP perspective: when the dataset loses a dominant token type, create alternate token representations so the downstream model (PC manufacturers) can continue to be trained and deployed. Kingston’s early modules were high-quality, exhaustively tested units — akin to ensuring your training data is clean, validated, and labeled accurately. Because the output quality was high and the module solved an urgent problem, Kingston’s sales rapidly increased (US$40M by 1989). The initial model achieved strong generalization across OEMs and retailers.

Growth in the 1990s: evaluation metrics and model scaling

Scaling a model requires both computational resources and careful evaluation. Kingston scaled by institutionalizing rigorous testing (unit testing every memory module), embedding quality assurance into production, and committing to reliability as a primary objective function. These choices are optimized for low error rates (returns, defects) and high customer lifetime value (retention).

Key performance indicators during the 1990s:

- Rapid revenue scaling: early double- and triple-digit growth rates leading to >US$1.3B by mid-1990s.

- Recognition (validation): Inc. Magazine acknowledged Kingston as the fastest-growing privately held company in the U.S., a strong external validation metric.

- Globalization: opening the first European branch (Munich), equivalent to deploying production nodes in new regions to reduce latency and increase market coverage.

Kingston’s product portfolio also diversified (USB drives, flash memory cards, SSDs). From an engineering design perspective, this is transfer learning: the core competency in DRAM and memory design was fine-tuned and applied to neighboring tasks (flash storage, embedded memory). Maintaining product quality while expanding required robust processes — version control for manufacturing, strong test harnesses, and a culture that prioritized reliability over speculative scaling.

1996 sale to SoftBank and the $100M employee bonus: a liquidity event and reward signal

In August 1996, Kingston sold 80% of its equity to SoftBank for a headline valuation (≈US$1.5B). In model terms, this was a monetization checkpoint, an opportunity to realize accumulated gains and to change the company’s capital structure. The strategic choice the founders made after the sale was unusual and important: they allocated roughly US$100 million to a bonus pool to reward employees, dividing that across the then ≈550 employees (≈US$130,000 each on average).

This decision is interpretable in ML terms as an Investment in the model’s human capital: by broadcasting a strong positive reward signal to the internal dataset (the workforce), the founders reinforced loyalty, decreased churn (analogous to reducing catastrophic forgetting), and improved long-term performance. It also shaped the company’s narrative — Kingston was not merely a profit-maximizing black box but a system that cared for the agents who had contributed to its success.

1999 buyback: re-acquiring control and model autonomy

Markets are nonstationary. Following shifts in memory-chip prices and strategic direction, SoftBank decided to divest its stake. In 1999 Sun and Tu repurchased the 80% stake for a much lower figure (≈US$450M) than the 1996 sale price. In reinforcement-learning parlance, this is an exercised option they had earlier chosen to sell while maintaining operational control; when the market offered a favorable buying opportunity, they executed a buyback, reasserting independence.

This move restored full decision-making autonomy to the original architecture (the founders) and allowed Kingston to pursue strategic directions without constraints imposed by majority external ownership. It exemplifies optionality: preserving rights to act later and choosing the action that maximizes expected long-term reward.

Product diversification, transfer learning, and domain adaptation

Once control was restored, Kingston continued to diversify: flash drives, SSDs, embedded memories, and enterprise storage. Each product line draws on a core shared representation (memory engineering expertise) while adapting to new input distributions (consumer vs enterprise markets, embedded device constraints). This is classic transfer learning and domain adaptation.

Operationally, Kingston expanded manufacturing footprints across Asia and established a global distribution network akin to deploying inference servers in multiple regions to minimize latency and increase throughput.

Evaluation: metrics, risks, and robustness

Every system has failure modes. For Kingston, the structural risks included:

- Market cyclicality: Memory markets swing dramatically; prices and margins can be volatile.

- Supply chain dependency: Access to components, fab capacity, and geopolitical risks can affect throughput.

- Opaque valuation: As a private company, Kingston’s public valuation signals are estimates, not market prices.

Yet the company’s robustness stems from disciplined QA, conservative management, and a long-horizon perspective. In ML terms, Kingston favored models that generalize well across data regimes rather than overfitting to short-term arbitrage.

Net worth & wealth embedding (2026 snapshot)

Media estimates (e.g., Forbes) place David Sun’s net worth in 2026 at roughly US$16.6 billion. This number is an inferred metric based on private-company valuations, public comparables, and reported stake estimates. As with any private valuation, the posterior distribution of true net worth is broad, but the central tendency reflects substantial wealth tied primarily to Kingston’s sustained cash flows and market position.

Personal life & philanthropic fine-tuning

Sun and his spouse,e Diana, operate philanthropic institutions (Sun Family Foundation) that predominantly support education and community causes in the U.S. and Taiwan. This philanthropic fine-tuning functions as a transfer of societal utility: redirecting private wealth into public good to improve social generalization (opportunity, education) for future generations.

Timeline

Consider this a timeline log a chronological event list that could be fed into a sequence model for training or summarization tasks.

- 1951 (Oct 12): Birth in Taiwan.

- 1977: Emigration to the United States domain shift.

- 1982: Co-founding of Camintonn with John Tu, early model.

- 1986: Sale of Camintonn to AST Research (~US$6M).

- 1987: Stock-market crash; co-founding of Kingston Technology to address memory-chip shortage.

- 1989: Kingston reaches ≈US$40M in sales.

- 1992: Recognition by Inc. Magazine as fastest-growing privately held company.

- 1995: Sales exceed US$1.3B; expansion to Europe (Munich).

- 1996: Sale of 80% to SoftBank (~US$1.5B) and US$100M bonus for employees.

- 1999: Buyback of 80% stake from SoftBank (~US$450M), regain control.

- 2000s–2020s: Product line diversification (flash drives, SSDs), global operations.

- 2024: Kingston remains among the top private companies in the U.S.

- 2026: Forbes estimates Sun’s net worth ≈US$16.6B.

Strategic analysis: key choices as model design decisions

We can distill Sun and Tu’s key decisions as architectural and training decisions:

- Problem framing (1987): They framed a supply shock as an opportunity for an engineering solution rather than a defeat. That reframing ensured the creation of a product that solved a concrete need. (Design principle: task alignment.)

- Quality as loss function: By optimizing for low failure rates, Kingston built customer trust equivalent to optimizing for recall and precision rather than short-term throughput.

- Employee incentives as reward shaping: The US$100M bonus shaped agent behavior, promoting loyalty and retention that improved long-term model performance.

- Optionality via sale + buyback: Selling to SoftBank was a way to harvest gains while maintaining control; buying back was exploiting a favorable market reentry point. This is akin to keeping options in the policy space and acting when the expected Q-value is maximal.

- Diversification for out-of-distribution robustness: Expanding into flash, SSDs, and embedded memory reduced dependence on a single data distribution (DRAM cycles), improving resilience.

Pros & Cons

Pros

- Engineering-driven product design ensured core competence.

- Extremely low defect rates built durable customer trust.

- Generosity toward employees established cultural capital and reduced human-resource drift.

- Strategic liquidity moves preserved optionality and allowed later autonomy.

- Diversification increased robustness across market regimes.

Cons

- DRAM and flash markets have cyclical potential for margin compression and revenue volatility.

- As a private company, public market discipline is absent; valuations rely on private estimates.

- Heavy founder control centralizes risk succession and governance requires attention.

FAQs

A: David Sun is a Taiwanese-born engineer and businessman. He is co-founder and COO of Kingston Technology, one of the world’s largest independent makers of memory and storage products.

A: He co-founded Kingston Technology in 1987 amid a severe shortage of surface-mount memory chips after earlier ventures and a market crash.

A: Yes. After selling 80% of Kingston to SoftBank in 1996, the founders allocated about US$100 million in bonuses to their then ~550 employees, roughly US$130,000 per person on average.

A: According to Forbes, his estimated net worth in 2026 is approximately US$16.6 billion.

A: Kingston produces DRAM memory modules, SSDs, USB flash drives, flash memory cards, and other storage and memory solutions serving consumers, OEMs, data centers, and global distributors.

Conclusion

David Sun’s life and career stand as a powerful example of how discipline, technical mastery, and unwavering integrity can lead to extraordinary success. From his early years in Taiwan to his rise as the co-founder of Kingston Technology, Sun consistently chose a path rooted in precision, resilience, and long-term vision. His ability to recognize opportunity during moments of uncertainty, such as the 1987 memory shortage, reveals an entrepreneur who not only understood technology, but also understood people, markets, and timing.

Beyond building one of the world’s most trusted memory manufacturers, Sun’s leadership style set a benchmark for corporate culture: prioritize employees, guarantee product reliability, and operate with humility even at the peak of global influence. His philanthropic commitments further underscore a life devoted not only to innovation but also to giving back.

Ultimately, David Sun’s story reminds us that enduring success is not built on speed, luck, or noise it is built on consistency, clarity, and a deep respect for the craft. His legacy continues to shape the technology industry, offering lasting lessons.