Introduction

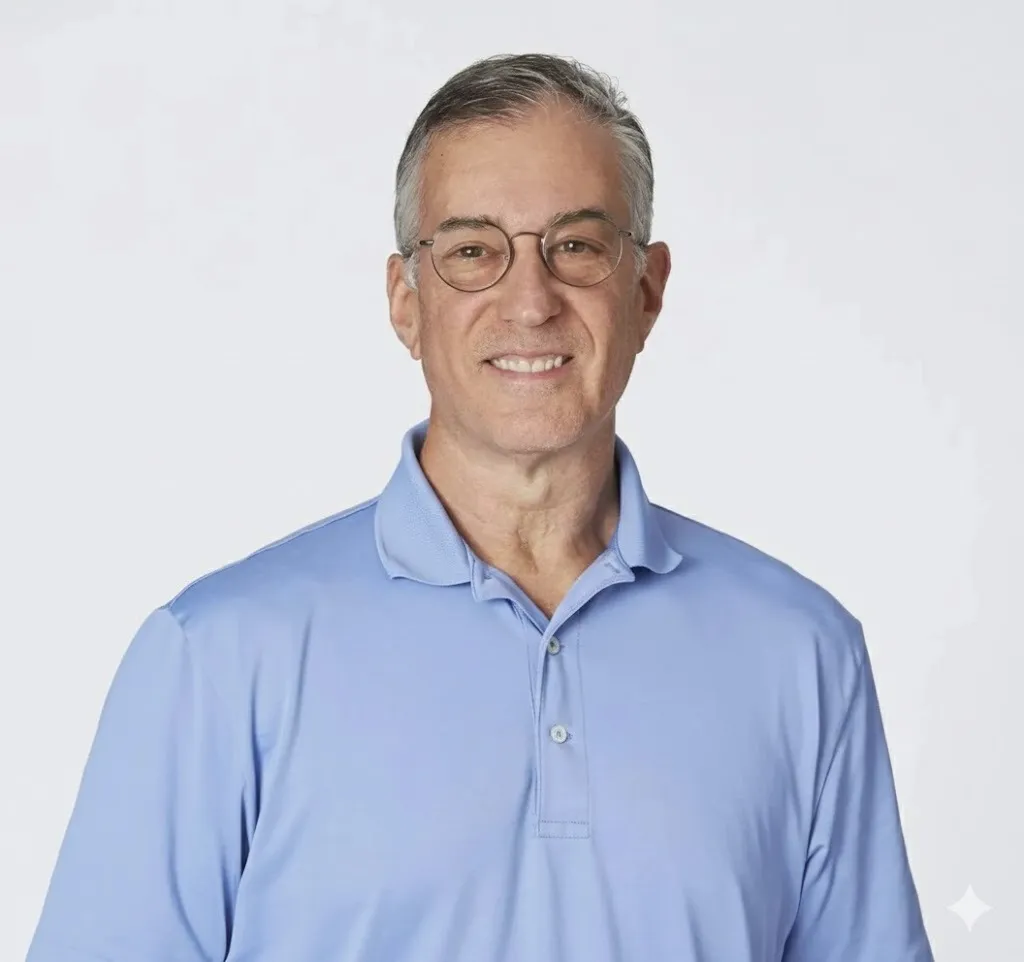

When you say Arthur Dantchik, you’re talking about one of the quiet powerhouses behind modern quantitative trading. He is co-founder of Susquehanna International Group (SIG) and a long-time architect of one of Wall Street’s most methodical, probability-driven firms. Dantchik’s path, rooted in analytical games, experimental gambling, and a formal interest in sciences, helped create a trading culture that values skill, testing, and risk control.

In 2026, Arthur Dantchik’s wealth reflects decades of private-market bets and the growth of SIG itself. His name appears in billionaire lists, yet he keeps a low public profile and prefers impact over headlines. This long-form profile covers his early years, the founding of SIG, key investments (notably ByteDance), philanthropic choices through the CLAWS Foundation, controversies, and what lessons entrepreneurs and traders can draw from his career.

Quick Facts

- Full name: Arthur Dantchik

- Born: circa 1957 (Queens, New York)

- Nationality: American

- Primary roles: Co-founder and managing director (executive committee), Susquehanna International Group (SIG)

- Known for: Quantitative trading, options market-making, major private investments (including early ByteDance exposure)

- Philanthropy: CLAWS Foundation (gifts to education, Jewish causes, and policy groups)

- Residence: Gladwyne, Pennsylvania (private)

- Primary SEO keywords: Arthur Dantchik, Arthur Dantchik net worth, Susquehanna International Group, ByteDance, quantitative trading, CLAWS Foundation

- LSI terms: trader training, options market-making, venture investing, proprietary trading, probability strategy, SIG Asia Investments

Childhood and education : he early pattern of thinking

Born around 1957 and raised in Queens, New York, Dantchik developed an analytical bent early on. Friends and classmates remember him as someone who enjoyed puzzles, games of chance, and tests of reasoning interests that later shaped his professional approach. This was a generation when math contests, gaming clubs, and hands-on experimentation often served as informal training grounds for future quants.

He attended SUNY-Binghamton, where he studied biology and formed important friendships, most notably with Jeff Yass, who would become a long-term business partner. Later, Dantchik pursued graduate work in psychology at Arizona State University. That combination of biology and psychology helped him approach markets with a mix of modeling, empirical testing, and human-behavior awareness.

A lesser-told but instructive chapter is the group’s period in Las Vegas. Some founders used card tables as laboratories for probability and risk management. Those practical experiments in assessing odds, managing bankrolls, and measuring variance became informal training for options and market-making strategies.

Founding Susquehanna International Group (SIG) a different trading playbook

From classmates to co-founders

In 1987, a group of SUNY-Binghamton alumni, including Arthur Dantchik, formed Susquehanna International Group in Bala Cynwyd, Pennsylvania. Unlike merchant banks built around broad capital or public reputation, SIG started as a focused, quantitative market-making firm. It emphasized edge discovery through empirical testing and training.

Culture and methodology

SIG’s approach was not to rely on ego or anecdotes; it built systems. The firm became known for:

- A rigorous selection and training process for traders (including simulation and game-based testing).

- Probability-driven decision-making,g i.e., quantifying edge, luck, and risk.

- Options market-making and fast execution are core strengths.\

- A meritocratic internal culture where results and process mattered more than headline visibility.

Those foundations allowed SIG to scale from a boutique trading desk to a global operations and private-investment platform.

How poker and games informed a trading philosophy

It’s worth pausing on the role of games. For Dantchik and his co-founders, poker and probability games were not mere hobbies. They taught:

- Assessing expected value under uncertainty.

- Bankroll & position sizing discipline.

- Reading patterns and extracting statistical edges.

This game-to-market translation is part of SIG’s lore and part of Dantchik’s personal intellectual story: take experiments seriously, learn fast, and design systems that amplify small, repeatable advantages.

SIG’s growth: trading, global expansion, and the move into private investing

Starting as an options market-maker, SIG gradually broadened its scope:

- Proprietary trading desks across assets.

- Market-making that leveraged fast execution and pricing models.

- Trader training programs to scaleskillsl.

- Private market activity and venture investing, including the creation of SIG Asia Investments (to expand exposure to Asian tech and growth companies).

Under the firm’s growth, Dantchik served on the executive committe, focusing on private equity, venture strategies, and global expansion. The firm opened offices in financial centers and invested in both public and private opportunities.

The ByteDance story: why it matters

One of the most consequential private investments connected to SIG’s Asia arm was an early stake in ByteDance, the Chinese parent of TikTok. SIG’s early exposure to ByteDance is widely reported as a major catalyst for balance-sheet growth among early SIG investors.

Key points:

- Early timing and conviction mattered. SIG’s Asia team Invested at a stage when ByteDance was still scaling.

- That stake later appreciated dramatically as ByteDance grew into one of the world’s most valuable private tech companies.

- Private holdings like this one are a core reason why estimates of Arthur Dantchik’s net worth rose sharply in the 2020s.

This kind of private-market exposure creates high concentration, big upside if the company succeeds, and valuation uncertainty because private stakes are not traded publicly.

Major achievements

- Establishing robust trader training and selection systems that turned trading into a repeatable, testable craft.

- Expanding SIG into private investments, including early stakes in major tech companies.

- Playing a quiet but decisive role in philanthropic and civic giving through the CLAWS Foundation and other vehicles.

- Sustained wealth creation reflected in billionaire rankings and private net-worth estimates in 2026.

Dantchik’s style is not about awards or press cycles; it’s influence through capital allocation, institutional design, and long-term bets.

Net worth and holdings a practical breakdown (2026)

Note: Private holdings make precise calculations difficult. Public trackers approximate Dantchik’s wealth based on reported ownership in SIG, stakes in private companies (ByteDance), and other known positions. Figures below are estimates compiled from public reporting and wealth indexes (2026).

Estimated net worth (2026)

- Approximate range: $14–16 billion (commonly cited estimates put him near $14.6 billion in 2026).

- Drivers: SIG ownership stake, realized and unrealized private investments (e.g., ByteDance), reinvested trading profits, and other personal holdings.

Simplified holdings table

| Holding type | Description | Rough contribution to wealth (qualitative) |

| SIG equity | Ownership stake in Susquehanna | High large, core asset |

| ByteDance stake | SIG Asia’s stake in ByteDance (private) | Very high major value driver |

| Proprietary trading profits | Reinvested earnings and capital | Medium ongoing income generator |

| Private equity & venture stakes | A wide set of private investments globally | Medium–High variable by company |

| Personal cash & other assets | Real estate, cash, smaller investments | Low Medium |

Why estimates vary

- Private company valuations (ByteDance) are not publicly traded; valuation depends on the latest financing/secondary trades.

- SIG is privately held, so public data is limited.

- Wealth indexes use different models and update cadences hence the range.

Lifestyle and public profile

Arthur Dantchik is a classic example of what some call an “invisible billionaire.” He prefers privacy to publicity. Observations about his life include:

- Residence: Gladwyne, Pennsylvania.

- Public persona: Very low media profile; few interviews or public speeches.

- Family: Very little public information; he is generally reported as private about personal life.

- Philanthropy: Active through the CLAWS Foundation and other donations targeted at education, Jewish institutions, and policy-oriented groups.

Philanthropy CLAWS Foundation and priorities

Dantchik channels through a private foundation often identified as CLAWS. Public records and third-party trackers show the foundation supports:

- Educational initiatives and scholarship programs.

- Jewish community institutions and cultural organizations.

- Policy or advocacy groups that align with libertarian or reform-minded causes.

Philanthropy is consistent with a pattern of private influence: strategic, targeted giving rather than broad public campaigns.

Controversies and public scrutiny

While Dantchik keeps a low profile, his philanthropic choices and the opacity of private trading firms have attracted scrutiny. Typical points of public discussion include:

- Donations to ideological organizations. This has drawn attention when those organizations are involved in contentious policy debates.

- Opacity of private markets. Large private stakes in companies like ByteDance invite questions about valuation, influence, and governance transparency.

- Political sensitivity. At times, Dantchik’s giving (or pauses in giving) have intersected with sensitive political developments in countries like Israel, which generated public comment.

Overall, controversy tends to focus on institutional matters (what big donors fund and why) rather than personal misconduct.

Timeline life and career milestones

| Year | Event |

| ~1957 | Born in Queens, New York |

| Late 1970s | Attends SUNY-Binghamton; meets future SIG co-founders |

| 1979 | Graduated with a BS (biology) from SUNY-Binghamton |

| Early 1980s | Graduate studies in psychology at Arizona State University |

| 1987 | Co-founds Susquehanna International Group (SIG) |

| 2000s | SIG expands globally; launches SIG Asia Investments |

| 2010s | Early SIG/Asia involvement leads to ByteDance stake growth |

| 2023 | Public pause or re-evaluations of some donations reported |

| 2026 | Frequently listed among top billionaires, with estimates ~ $14.6B |

Pros & Cons

Pros

- Deep expertise in probability and market structure.

- Long-term, patient capital allocation that produced outsized returns.

- Operational discipline and a highly selective culture at SIG.

- Measured philanthropic engagement aligned with personal values.

Cons

- Net worth reliance on private, illiquid holdings (valuations can change quickly).

- Low transparency can generate public questions about influence and oversight.

- Philanthropic alignment with contested policy groups can attract reputational scrutiny.

Motivational lessons from Dantchik’s career

Here are practical takeaways you can apply, whether you’re building a startup, a trading desk, or a career:

- Test and iterate. Convert hypotheses into repeatable experiments then scale what works.

- Value training and selection. Talent systems matter as much as technology.

- Think probabilistically. Make decisions in terms of expected value and tail risk.

- Be disciplined with position sizing. Protect capital to survive long enough to win.

- Prefer quiet competence to noisy ego. Influence and results can be more durable than public attention.

FAQs

A: Arthur Dantchik is a co-founder and long-time executive at Susquehanna International Group (SIG) a major quantitative trading and market-making firm.

A: Public estimators and media commonly put his 2026 net worth near $14.6 billion, though private holdings make exact figures approximate.

A: Primarily through SIG (trading profits and ownership) and early private investments—most notably an early stake connected to ByteDance.

A: Yes. He gives via entities such as the CLAWS Foundation, supporting education, Jewish institutions, and some policy organizations.

A: Reports indicate involvement with boards related to SIG’s investments, including links to ByteDance governance in some public sources.

Conclusion

Arthur Dantchik is an archetype of modern, disciplined private investing: someone who built a rigorous firm culture, applied probabilistic thinking to markets, and placed early, consequential private bets. His role at SIG demonstrates how group expertise, systematic training, and a patient capital mindset can create sustained advantage. While his large private holdings make public valuation estimates uncertain, the broad arc of his career from academic curiosity to market builder offers clear lessons in patience, testing, and quiet Leadership.

If you publish a profile like this, you’ll help readers understand the mechanics behind a huge fortune, not just the numbers, but the decisions and systems that make those numbers possible.