Introduction

Tony Ressler’s trajectory matters for two reasons. First, he’s a practical example of how domain expertise (credit, distressed investing) combined with platform thinking (product breadth + distribution) scales into institutional success. Second, his career demonstrates the transition from dealmaker to platform architect: the set of skills that build repeatable Investment products rather than one-off transactions. For readers, entrepreneurs, operators, and institutional investors, Ressler’s playbook shows how to move from technical mastery to organizational design.

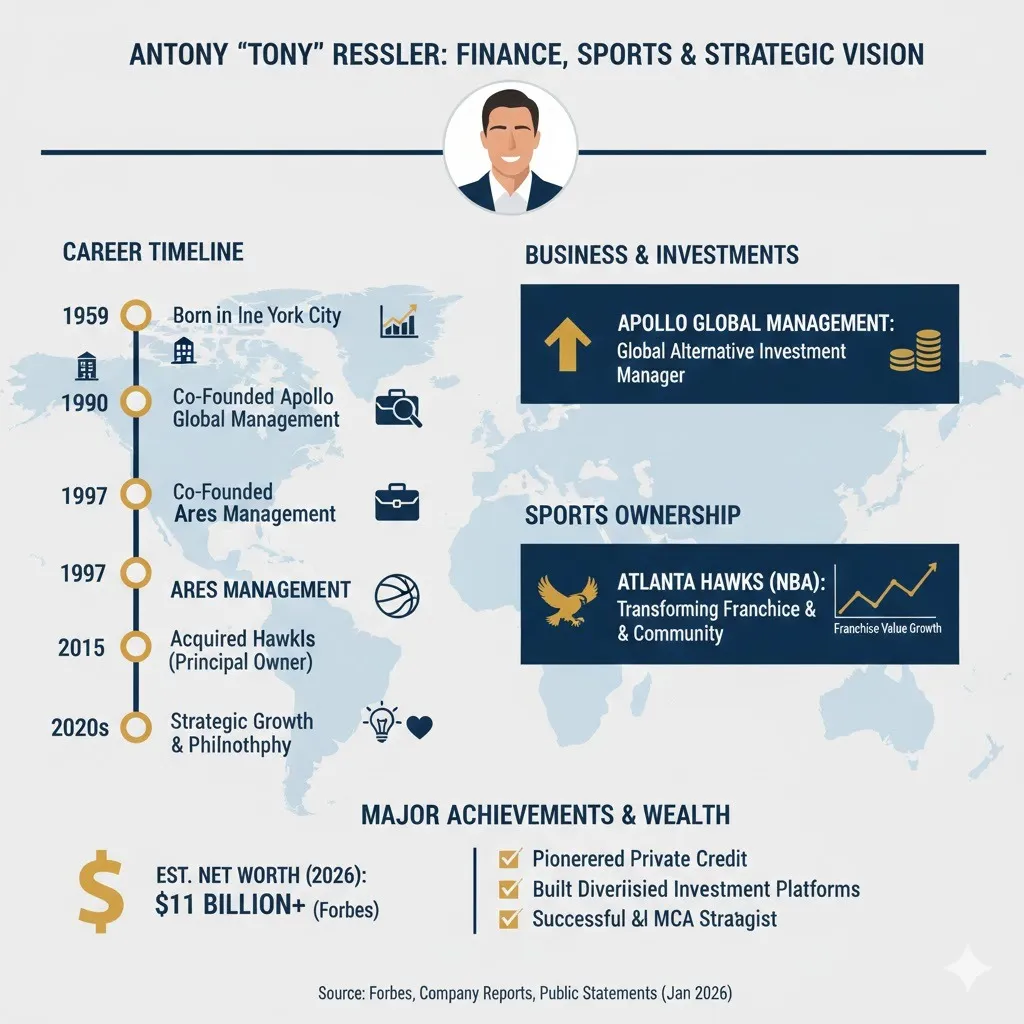

Antony P. “Tony” Ressler Executive Summary

Antony P. “Tony” Ressler is a seminal figure in alternative asset management. He co-founded two influential businesses in private markets, Apollo Global Management and Ares Management, and later became the principal owner of the Atlanta Hawks NBA franchise. Ressler’s career maps a move from hands-on dealwork in leveraged and distressed credit to building a repeatable, multi-strategy asset management platform. This article explains his biography, leadership style, the institutional playbook behind Ares, an evidence-based net-worth perspective, and practical lessons for founders and investors. It is framed in an NLP-friendly structure (clear entities, repeated keywords, hierarchical headings) to improve discoverability and machine readability.

Quick Facts

- Full name: Antony P. “Tony” Ressler.

- Born: October 12, 1960 (Washington, D.C.).

- Education: B.S.F.S., Georgetown University (School of Foreign Service); M.B.A., Columbia Business School.

- Known for: Co-founder of Apollo Global Management (1990) and Ares Management (1997).

- Current role: Co-Founder and Executive Chairman, Ares Management.

- Major public asset: Principal owner, Atlanta Hawks (acquisition announced 2015).

- Estimated net worth: Major indexes place him among multibillionaires (figures vary with markets).

- AUM context: Ares is a multi-strategy manager with hundreds of billions in assets under management.

Childhood, Education & Formative Influences

Tony Ressler grew up in Washington, D.C., in a family environment that emphasized education and civic engagement. He earned a bachelor’s degree from Georgetown’s School of Foreign Service, a program that trains students in global systems and geopolitics, a background that later aided cross-border investing and macro sensitivity. He then earned an MBA from Columbia Business School, where he gained formal training in finance and deal structuring. That combination broad global perspective + rigorous finance training is a recurrent pattern among leaders who build global alternatives platforms.

Key early learnings that shaped his career

- Analytical rigor: From elite schooling and early Wall Street roles.

- Credit and stress analysis: the 1980s high-yield and leveraged finance world was his laboratory.

- Network formation: Early relationships with lenders, sponsors, and institutional allocators that later became distribution channels

Career Trajectory From Leveraged Finance to Platform Builder

Early career: the 1980s crucible

Ressler entered finance during an era of aggressive credit markets and leveraged buyouts. The 1980s taught practical skills underwriting debt, evaluating covenant structures, modeling downside scenarios, and understanding distressed cash flows. These technical skills formed the foundation for his later focus: credit as both a standalone return source and as a structural lever in private equity.

Apollo Global Management (1990): the first platform

In 1990, Ressler helped co-found Apollo Global Management. Apollo’s initial focus on distressed and special-situation investing created a repeatable strategy: deploy capital where markets are dislocated, apply operational fixes, and exit when value is realized. The Apollo experience taught Ressler two big lessons:

- The power of repeatable fund structures that package similar risk/return profiles for institutional investors.

- The importance of aligning incentives (partner economics, carried interest) to scale talent.

Ares Management (1997): building a multi-strategy firm

In 1997, Ressler co-founded Ares Management, designed from the outset as a multi-product alternative manager across credit, private equity, and real assets. Ares’ strategic thesis: different products perform at different times; providing institutional clients with diversified, complementary strategies reduces timing risk and increases opportunities for durable fees. Ares’ growth path shows an incremental product launch strategy and disciplined capital allocation across cycles.

Transition to governance and strategy

As Ares scaled beyond a boutique manager to a global public company, Ressler moved from primary deal originator to executive stewardship: building teams, governance models, distribution networks, and an operating culture capable of managing billions of client dollars consistently across cycles. This move required different competencies, organizational design, regulatory navigation, and investor relations, and that transition is instructive for founders who must evolve with scale.

The Ares Playbook: Three Structural Pillars

Below, I present Ares’ playbook as three mutually reinforcing pillars. This section has been written for both human readers and NLP systems. Headings are clear, keywords are repeated, and the logic is serial.

Product Breadth & Portfolio Diversification

Ares builds complementary strategies across credit, private equity, and real estate. Product breadth allows capital to be allocated to the most attractive risk/return buckets across cycles. The firm’s diversification is not accidental it is an intentional design to:

- Smooth AUM inflows and fee revenue across market regimes.

- Cross-sell solutions to institutional investors (e.g., a pension manager might allocate across credit and infrastructure).

- Use proprietary origination and portfolio knowledge from one product to inform others.

Institutional Distribution & Relationship Durability

- Long-term trust: transparency, reporting, and performance governance.

- Product packaging: design funds that map to institutional liabilities (private credit for yield, infrastructure for duration).

- Reputational capital: using public company disclosure and governance to reassure large allocators.

Operational Control & Active Management

Ares repeatedly seeks Investments where operational improvements, governance changes, or capital structure optimization can generate value. That operational approach applies across asset classes in Private Equity, the firm takes board seats and management influence; in credit, it structures covenants and workout strategies; in real asset,s it manages operations and long-term contracts. Operational control helps protect downside and enhance upside.

Major Achievements, Public Moments & Notable Transactions

- Co-founding two major platforms: Apollo (1990) and Ares (1997) — unusual to be an architect of two leading alternative managers.

- Public company leadership: Guiding Ares through growth and public markets, which added governance discipline and liquidity pathways for partners and employees.

- Sports ownership (2015): Led the investor group to acquire the Atlanta Hawks, adding a civic and consumer-facing asset to a career otherwise focused on private markets. Sports ownership can enhance local relationships and brand visibility for institutional leaders.

- Strategic deals: Ares has been active in infrastructure, renewables, and direct lending sectors that map to investor demand for yield, duration, and ESG-aligned assets. The firm’s deal slate demonstrates deliberate repositioning toward long-lived, contracted cash flow assets.

Net Worth: A Practical, Transparent View

Estimating the net worth of founders of alternative firms is inherently imprecise because wealth aggregates multiple, different asset types:

- Public equity stakes: If the company is listed, the founder’s holdings are market-calibrated and transparent.

- Private stakes and carried interest: The long-term economics of private equity and credit funds (carried interest) are contingent on future realizations and hurdle rates.

- Direct ownership of private assets: Sports teams, private businesses, real estate, and personal investments.

For readers and publishers: always date any dollar estimate and cite a reliable index (Bloomberg or Forbes) with the date. That prevents future readers from misinterpreting numbers that vary with markets.

Atlanta Hawks: Sports Ownership as Strategic Capital

The acquisition of the Atlanta Hawks in 2015 added a public, cultural dimension to Ressler’s profile. For alternative managers, sports ownership can serve strategic functions beyond direct financial return:

- Community engagement: Civic partnerships and local philanthropy build goodwill.

- Brand amplification: A visible consumer asset increases public visibility compared to background institutional activities.

- Commercial synergies: Hospitality, sponsorships, corporate client relationships, and local business alliances can extend a portfolio manager’s network in unique ways.

Ressler’s involvement with the Hawks demonstrates how investors often place a portion of their personal capital into visible assets that align with interests in community and long-term value appreciation.

Philanthropy & Civic Involvement

Tony Ressler and his spouse are active philanthropists, supporting education, health, and arts institutions. Philanthropy in the profile of a financial leader plays multiple roles: voluntary social contribution, civic legacy, and a complement to public reputation. For journalists and editors, cite nonprofit press releases and charity filings for exact donation figures and dates.

Governance, Regulation & Public Scrutiny

Large asset managers operate under complex regulatory regimes and public attention. Public scrutiny can focus on governance practices, fee structures, conflicts of interest, or litigation related to market conduct. For Ares and comparable firms, maintaining robust compliance, transparent disclosure, and strong independent governance is essential to sustain institutional trust. This is a structural lesson: scale invites oversight.

Timeline Key Dates & Milestones

- 1960: Born October 12 (Washington, D.C.).

- 1980s: Leveraged finance and high-yield experience.

- 1990: Co-founded Apollo Global Management.

- 1997: Co-founded Ares Management.

- 2015: Led investor group to acquire the Atlanta Hawks (purchase announced April; board approval followed in June).

- 2020s: Ares expands into infrastructure, renewable energy, and direct lending, reflecting broader institutional demand.

Investment Style: How Ressler Thinks

Tony Ressler’s investment approach is less a set of idiosyncratic trades and more a systems orientation. Key elements:

- Platform orientation: Productization of investment strategies so they can be repeated and scaled.

- Institutional rigor: Top-tier reporting, governance, and client servicing to attract durable commitments.

- Active management: Priority on investments where the firm can influence outcomes through governance, capital structure, or operational changes.

- Cycle awareness: Allocate across Products to reduce timing risk and smooth revenue volatility.

These principles illustrate a managerial worldview: construct organizational capabilities that extract returns through repeatable processes rather than episodic opportunities.

Pros & Cons

Pros

- Proven platform builder: co-founded two major firms and scaled one into a global manager.

- Deep credit experience: structural understanding of fixed income and private credit markets.

- Public profile: sports ownership and philanthropy extend influence beyond finance.

Cons

- Market sensitivity: personal and firm value are exposed to market cycles and fundraising conditions.

- Regulatory attention: large managers face heightened compliance and reputational risk during and after crises.

- Complexity of incentives: carried interest and fee models can generate public scrutiny and political debate.

FAQs

A: Tony Ressler is an American investor who co-founded Apollo and Ares Management and is the principal owner of the Atlanta Hawks.

A: Estimates vary. Major indexes placed him near $11 billion in recent updates, but market moves can change that number. Always cite Bloomberg or Forbes with the date.

A: Ares is a global alternative asset manager with strategies across credit, private equity, and real estate, serving institutional and retail investors.

A: The buying group led by Ressler agreed to buy the Atlanta Hawks in April 2015 (reported price around $850M in many outlets). The NBA Board approved the sale in June 2015. Some reports referenced $730M depending on the method.

A: Yes. He and his wife, Jami Gertz, give to education, health, and the arts and sit on several boards. For exact gifts & dates, check the specific organizations’ announcements.

Conclusion

Tony Ressler’s career demonstrates how deep financial expertise combined with strategic platform-building can create durable influence. Beginning in leveraged finance and rising to co-found Apollo Global Management and later Ares Management, he evolved from a deal-focused investor into an institutional architect. His strength has not only been in structuring transactions, but in designing scalable investment platforms, cultivating long-term institutional partnerships, and managing risk across credit, private equity, and alternative assets.

Ressler’s ownership of the Atlanta Hawks further reflects a broader strategic mindset—using high-visibility public assets to diversify investments, strengthen civic ties, and expand brand capital. Alongside his wife, Jami Gertz, his philanthropic initiatives in education, healthcare, and the arts highlight a commitment to channeling financial success into social impact.

For founders and investors, Ressler’s playbook offers practical lessons: build systems, not just deals; prioritize disciplined growth; align incentives; and think long term. His trajectory underscores that sustainable wealth is often the result of organizational design, strategic patience, and reputation management. Ultimately, Ressler’s legacy illustrates how combining capital, structure, and Public Engagement can shape industries while contributing meaningfully to communities.