Introduction

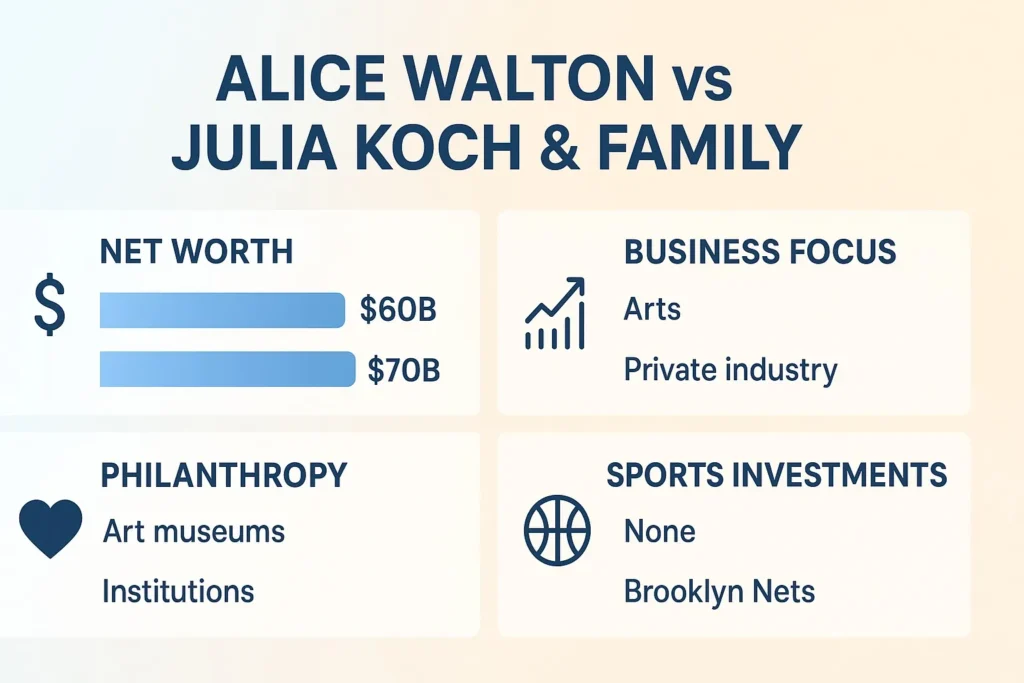

Alice Walton and Julia Koch & Family are two of America’s most prominent wealthy women whose capital and choices shape public life and do so very differently. Both appear in the uppermost tiers of billionaire rankings, yet their public footprints diverge: Alice Walton is best known for building visitor-facing cultural infrastructure, most visibly the Crystal Bridges Museum of American Art in Bentonville, Arkansas; Julia Koch & family preside over one of the largest private industrial fortunes (Koch Industries) and have in recent years mixed institutional philanthropy with high-profile private investments, including minority stakes in major sports franchises.

Quick facts

- Top-tier wealth: Alice Walton and Julia Koch & family consistently rank among the world’s richest individuals or families on major wealth trackers (Forbes/Bloomberg).

- Different asset structures: Walton’s wealth is largely connected to publicly traded Walmart stock and family trusts; Koch family wealth is concentrated in private Koch Industries, which requires valuation modeling and creates wider net-worth ranges.

- Philanthropic focus: Walton’s public brand centers on arts patronage and place-based cultural funding the Koch family’s visible activity blends institutional grants and family-office investing, with recent trophy assets such as sports franchise stakes.

- Sports investments (2024–2025): Reports show the Koch family acquired a reported ~15% stake in BSE Global (owner of the Brooklyn Nets and New York Liberty) in June 2024, and 2025 coverage noted approvals for NFL minority ownership activity (a reported ~10% stake in the New York Giants).

- Public footprint difference: Walton’s legacy is intentionally visitor-facing and civic; Koch family influence mixes behind-the-scenes industrial control with high-visibility consumer assets.

Who controls the money governance & family structure

Alice Walton & the Waltons’ structure and public posture

- Origin of fortune: Wealth originates from Sam Walton’s founding of Walmart; Walton family trusts and holdings retain significant Walmart equity.

- Governance: Family trusts, public filings where applicable, and named foundations (Alice L. Walton Foundation, Walton Family Foundation) form the backbone of philanthropic and capital deployment. Alice is not a Walmart executive; her public investments center on cultural capital.

- Public posture: Alice’s activity is transparent in the sense that museum projects and major gifts are visible, visitor-facing, and frequently documented by the institution itself.

Julia Koch & family private control and family office design

- Origin of fortune: Julia Koch inherited a significant stake in Koch Industries following David Koch’s death; Koch Industries remains a vast, privately held conglomerate.

- Governance: Wealth is managed through private family offices and foundations. The opaque nature of private-company valuations means public trackers show ranges rather than precise daily tallies.

- Public posture: The family can operate quietly through institutional grants or strategically through headline-grabbing private acquisitions (trophy assets).

Why governance matters: The architecture of ownership, public equity vs. private conglomerate, shapes transparency, valuation, and the kinds of public goods each actor is likely to fund. Public holdings allow precise market-based valuation and make regular net-worth snapshots straightforward; private holdings require estimation and can hide the timing and scale of transactions, producing wider reported ranges.

Net worth, valuation methods, and why numbers differ

Estimating the net worth of ultra-high-net-worth individuals and families is methodological work, not just a single number:

- Publicly traded assets: For people with significant stock in public companies (e.g., Walmart), valuation is straightforward using share counts and quoted prices. Alice Walton’s reported net worth is computed this way primarily, adjusted for trusts and known holdings.

- Private-company valuations: For owners of private conglomerates (Koch Industries), valuation relies on EBITDA multiples, comparable deals, partial stake sale benchmarks, and any leaked or reported transactions. Partial sales, such as the family’s minority sports acquisitions, create new market signals that analysts can use to refine valuations.

- Family office liquidity vs. embedded value: Wealth embedded in illiquid private businesses or tied to governance constraints may not reflect readily realizable cash. That affects public perception and media-reported ranges.

Business holdings & investment strategies where they put their money

Alice Walton arts-first, place-based capital deployment

Alice Walton’s public role is that of a cultural patron who builds and maintains noticeable cultural institutions. Crystal Bridges opened in 2011 and has a continuing endowment and active acquisition program. Walton’s investments emphasize:

- Cultural infrastructure (museum buildings, satellite projects such as The Momentary),

- Art acquisitions that populate museum collections, and

- Visitor programs (education, free admission, community outreach).

This strategy creates a direct public good, tangible places that people visit, and anchors her legacy locally and culturally.

Julia Koch & family industrial stewardship plus trophy assets

The Koch family’s principal longer-term holdings are in Koch Industries. Alongside this, the family office and foundations direct capital into institutional philanthropy (research centers, medical and academic gifts) and, more recently, into public-facing trophy assets such as sports franchises and related enterprises. Recent moves include the reported ~15% stake in BSE Global (June 2024) and reported NFL minority ownership activity in 2025. These investments serve multiple strategic aims:

- Portfolio diversification and potential capital appreciation (franchise values rise over time),

- Elevated public visibility and branding, and

- Access to new social and commercial networks (league events, branding deals, global reach).

Philanthropy, public legacy & institutional impact

Alice Walton’s place-based cultural legacy

- Crystal Bridges: A permanent, physical institution with free admission, educational programs, and an endowment to sustain operations. The museum creates immediate public experiences and civic identity.

- Philanthropic style: Transparent and visitor-facing; impact is observed through attendance, exhibitions, and program reach.

Julia Koch & family institutional grants and strategic funding

- Institutional focus: Historically, the Koch family supports research, medical centers, academic initiatives, and institutional capacity-building through foundations and large grants.

- Philanthropic style: Frequently quieter and less visitor-facing; impact often appears through institutional advancement, the growth of research centers, and targeted large-scale grants.

- Combined effect: More recently, the family has mixed institutional giving with trophy investments (sports stakes) that expand public awareness.

Recent moves that matter (2024–2025): sports, visibility, and strategic acquisitions

Koch family sports and profile building

- June 2024: Reported purchase of ~15% of BSE Global (owner of the Brooklyn Nets and New York Liberty). The transaction provided a contemporary market signal for valuing BSE Global and illustrated the family’s willingness to take minority positions in consumer-facing sports enterprises.

- 2025: Media coverage reported family approvals for NFL minority stakes, including reports about a ~10% interest in the New York Giants. Such moves represent a marked increase in public-facing investments and dramatically expand visibility beyond the private-industrial sphere.

Alice Walton’s cultural consolidation and museum growth

- Museum expansions & collections: Continued capital into Crystal Bridges and related projects (exhibitions, acquisitions, and The Momentary satellite project) signal an ongoing strategy of consolidating cultural impact through institutional strength and access.

Why these moves are consequential now: Sports franchise ownership is a powerful accelerator of public attention and networking power. League meetings, media exposure, brand partnerships, and arenas provide platforms for corporate, philanthropic, and social influence. Museum-building, by contrast, shapes cultural life more slowly but yields a long-term civic and intellectual legacy.

Timeline: Key public milestones (2011–2025)

- 2011: Crystal Bridges Museum of American Art opens in Bentonville, Arkansas (Alice Walton).

- 2019: David Koch dies; Julia Koch becomes a principal heir to Koch family assets.

- June 2024: Koch family reportedly acquires ~15% of BSE Global (Brooklyn Nets / New York Liberty).

- 2025: Media coverage and league approvals reported for the Koch family’s NFL minority ownership activity (reported ~10% New York Giants stake and other minority purchases).

Pros & Cons

Alice Walton Pros

- Creates visible public goods: Museums, exhibitions, and free public programs deliver direct cultural value.

- Public transparency: Museum activities and endowments are well-documented and accessible.

- Cultural legacy: A visitor-facing footprint that endures across generations

Alice Walton Cons

- Narrower public investment focus: Heavy concentration in the arts may appear less diversified in financial terms.

- Potential reputational questions: As with any billionaire philanthropist, curatorial choices and the origins of wealth can invite scrutiny and public debate.

Julia Koch & family Pros

- Diversified private holdings: Koch Industries and family-office allocations provide financial resilience and optionality.

- Strategic public-facing assets: Sports stakes combine potential financial upside with increased brand visibility.

- Institutional giving: Large-scale grants can materially affect research capacity and infrastructure.

Julia Koch & family Cons

- Valuation opacity: Private-company holdings produce wider estimation ranges and less day-to-day transparency.

- Political legacy: The Koch name is historically associated with politically active networks; while Julia Koch’s current public posture is philanthropic and investment-focused, legacy associations can shape public perception.

Analysis: What each strategy signals about influence and legacy

- Alice Walton: Choosing cultural infrastructure reflects a long-range view of influence that privileges civic life and education. Museums create repeated, tangible encounters between the public and curated cultural material; they shape regional identity, tourism economies, and cultural capital.

- Julia Koch & family: The family combines stewardship of a massive private industrial enterprise with tactical, high-visibility purchases. Sports franchise minority ownership signals a willingness to translate private wealth into broad consumer visibility and social access. This portfolio approach marries discretion in industrial stewardship with high-profile assets that accelerate brand visibility.

Bottom line: Both approaches are durable, but they operate on different timelines and audiences. Walton’s museum model builds civic and cultural influence over generations; Koch family investments convert industrial capital into symbolic public platforms while continuing institutional forms of philanthropic leverage.

FAQs

A: Both are regularly listed among the world’s wealthiest individuals or families. Exact rankings shift with market movement and valuation approaches; Walton’s numbers are typically computed from public share prices (Walmart), while Julia Koch & family figures come from private-company valuation models and therefore are often reported as ranges.

A: Reporting in June 2024 covered a reported purchase of roughly ~15% of BSE Global (the parent company of the Brooklyn Nets and New York Liberty) by members of the Koch family. That purchase was widely reported in business media and used by analysts as an observable transaction to refine valuations.

A: Crystal Bridges Museum of American Art is a museum in Bentonville, Arkansas, founded and substantially funded by Alice Walton; it opened in 2011, offers free admission, and houses a significant and actively curated collection supported by endowment funding and ongoing acquisitions.

A: The Koch name is historically associated with politically active networks and public policy engagement. Julia Koch’s public-facing activities emphasize philanthropy and private investments, but the broader Koch legacy includes political involvement that shapes public perception.

Conclusion

Alice Walton and Julia Koch & family wield enormous resources and shape public life through different modalities. Walton primarily builds cultural institutions that the public visits and experiences. The Koch family capital blends industrial stewardship, institutional philanthropy, and increasingly visible trophy Investments such as sports franchises. Both approaches are forms of sustained influence, but they reach audiences differently. One through place and culture, the other through industry and public spectacle.