Introduction

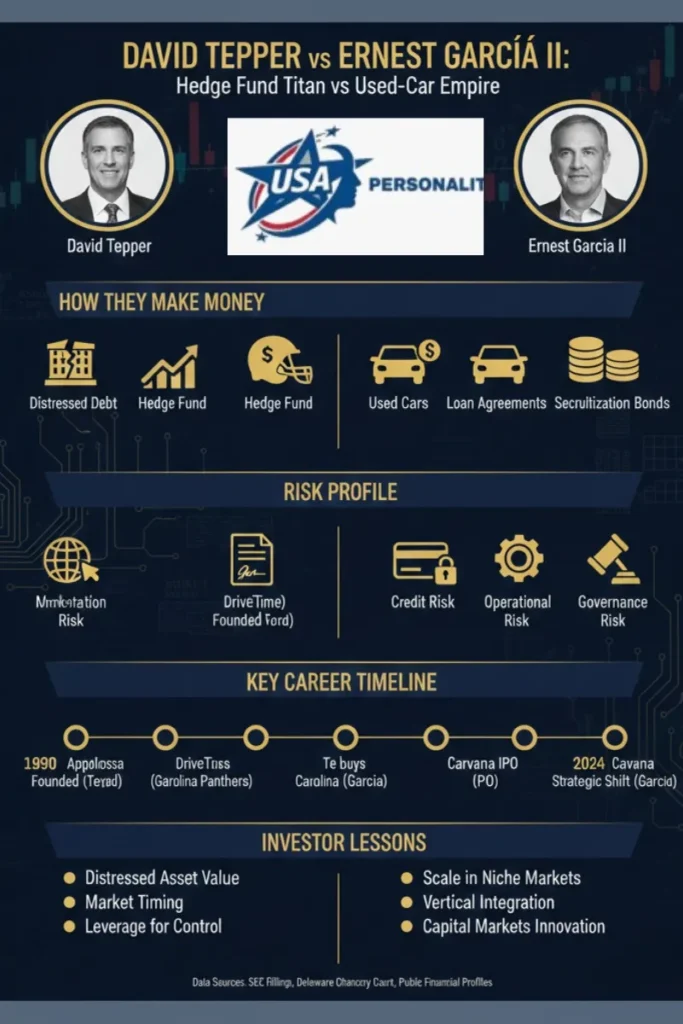

In the language of finance-as-language-models, David Tepper and Ernest García II are two very different architectures whose training datasets, optimization objectives, and inference-time behaviors illustrate different ways to extract value from economic data. Tepper’s Appaloosa Management is a high-velocity attention mechanism that amplifies signals from distressed debt, crisis dislocations, and event-driven catalysts; he monetizes volatility by taking concentrated positions and timing recoveries. García’s enterprises, historically DriveTime and later large equity positions in Carvana via family-controlled vehicles, are operationally oriented pipelines: data flows from point-of-sale to underwriting to collections to securitization, and profits are harvested across each stage. Tepper’s returns primarily derive from alpha capture and fund fee arbitrage; García’s from spread compression across retail margins and subprime lending yields, plus balance-sheet engineering.

Both men have been high-profile to different audiences: one in institutional markets and sports ownership, the other in retail, securitization, and, lately, headline governance battles. This analysis maps biographies to model metaphors, dissects revenue generators as objective functions, contrasts failure modes as risk profiles, and extracts lessons for investors, boards, and journalists who must evaluate human-driven systems that behave like complex models in production.

Quick facts

- Full name: David Alan Tepper Ernest García II

- Born: Sept 11, 1957 — May 1, 1957

- Main business: Hedge fund manager (Appaloosa); sports owner, Used-car retail & captive finance (DriveTime); major Carvana shareholder

- Notable holdings: Appaloosa Management; Carolina Panthers; Charlotte FC DriveTime (founder); large Carvana stake; family holding companies

- Known controversies: Outspoken comments; concentrated bets (reputational risk) 1990 bank-fraud guilty plea; Carvana related-party & governance litigation

- Sources (examples): Public filings and mainstream financial reporting (Forbes, Bloomberg, SEC filings) Public filings, Delaware Chancery opinions, SEC disclosures, major outlets

Childhood & Early Life Two training corpora

David Tepper From Pittsburgh to Wall Street

Tepper’s early environment provided the raw corpus: a working-class upbringing in Pittsburgh, undergraduate study in economics, and an MBA that added structured features. Early roles at institutional banks and trading desks functioned like supervised pretraining: he learned risk-management primitives, credit-analysis encoders, and execution patterns. Founding Appaloosa Management in 1993 was Tepper’s move to instantiate a custom architecture optimized for distressed-asset prediction and event-driven amplification.

Ernest García II From Arizona to the used-car stack

García’s experiential dataset came from retail operations and consumer lending. He learned to engineer processes (vehicle acquisition, refurbishment, retail optimization) and to build a captive finance function that internalized underwriting and collections. These operational competencies are like solid feature engineering that reduces variance in an otherwise noisy subprime credit domain. García’s work scaling DriveTime (formerly UglyDuckling) and later movements into online-centric Carvana exposure are analogous to moving from on-prem pipelines to cloud-native distribution.

How They Make Money Career journeys & objective functions

David Tepper The Investment Playbook

Core hypothesis: Distressed assets are mispriced when panic overwhelms fundamentals; buy when the posterior probability of recovery is higher than market implied. Tepper’s architecture magnifies contrarian signals, allocating large weights to assets with mean-reversion potential.

Key tactics

- Acquire discounted bank bonds, convertible debt, or distressed equity during liquidity crises.

- Place high-conviction, concentrated equity bets that dominate portfolio attention (large position sizes = high attention weight).

- Deploy macro overlays — interest rate forecasts, credit spread expansions — to modulate exposure.

Monetization

- Management and performance fees when investors allocate capital.

- Personal capital allocations that compound when proprietary risk taking succeeds.

- Alternative asset purchases (sports franchises) that diversify sources of return and generate asymmetric upside via franchise appreciation and ancillary revenue streams.

Operationally, Tepper’s approach reads like a small, Powerful Model that occasionally writes large gradient steps capable of rapid performance improvement when the training signal (crisis) is strong, but sensitive to catastrophic update risk if the signal is wrong.

Ernest García II Operator, lender, consolidator

Core hypothesis: Subprime demand is persistent; combine retail distribution with captive finance to capture both originator margins and credit-spread income. Adding securitization layers provides leverage and funding scale.

Key mechanics

- Originate and underwrite higher-risk auto loans with pricing collars that reward yield but aim to offset expected loss.

- Hold portfolios to collect interest and fees; tranche or securitize receivables to recycle capital and expand inventory funding.

- Leverage scale, proprietary remarketing, and in-house refurbishment to preserve used-car margins during churn cycles.

Monetization

- Revenue from vehicle sales and add-on products.

- Net interest income from subprime finance receivables.

- Gains and liquidity through securitizations that transform illiquid receivables into tradable instruments.

This model behaves like an industrialized prediction and fulfillment stack: if underwriting generalizes (good features), the loss function is minimized; if macro shocks spike default rates, the loss function explodes.

Risk profile & public exposure Side-by-side

Tepper Market & concentration risk (overfitting to crisis signals)

- Concentration risk: Big positions act like overfitted weights — extreme wins or outsized losses.

- Market sensitivity: Alpha depends on liquidity and credit spread behavior; sudden regime shifts (e.g., a persistent rise in rates or liquidity freezes) are adversarial attacks.

- Public voice: Tepper’s public comments can act as input perturbations, moving markets and altering model outputs (market prices).

Mitigation heuristics for stakeholders

- Stress-test concentrated bets against multiple adverse macro trajectories.

- Use governance and disclosure to contextualize large personal allocations, especially as Appaloosa shifted to more personal capital management.

García Operational, legal & governance risk

- Underwriting risk: Subprime portfolios are data-sensitive; poor signals (incomplete borrower data, optimistic loss assumptions) produce biased predictions (higher realized defaults).

- Financing/market access: The securitization market is the funding backbone; if it seizes, liquidity constraints can force fire sales.

- Governance & related-party risk: High founder control and related transactions create principal-agent frictions and legal attack surface (shareholder lawsuits, Chancery scrutiny).

Mitigation heuristics

- Strengthen independent governance layers and transparent, arm’s-length documentation for related-party deals.

- Build conservative liquidity buffers and credit loss reserves to withstand cyclical stress.

Controversies & legal background: Interpreting signals and noise

Ernest García II Historic conviction and modern litigation

- 1990 guilty plea: This fact is part of García’s public record; it shapes reputational priors that analysts and counsel incorporate into governance reviews.

- Carvana litigation: Shareholder suits over related-party transactions and capital raises raised questions of process integrity. Delaware Court of Chancery scrutiny examined whether special litigation committees and board processes met fiduciary standards; court opinions provided a legal model for evaluating founder-controlled companies and the sufficiency of independent investigation.

These legal events act like adversarial examples: they force reassessment of governance robustness and often lead to higher cost of capital via investor discounting.

David Tepper — High profile, mainly reputational noise

- Tepper’s controversies are less legal and more reputational: outspoken comments, aggressive trading, and opacity around shifting the fund’s capital structure. Sports ownership adds public visibility, bringing tax and accounting for franchise acquisitions into media focus. These are not criminal signals but do affect brand and counterparty perception.

Performance & Net-Worth snapshot

Important editorial note: Net worth estimates are volatile and should be published with date-stamped citations. Tepper’s public wealth tends to be more stable because it is diversified across funds and alternative assets; García’s is much more volatile because a large proportion is tied to Carvana’s equity price and the fluctuating valuation of subprime receivables.

Head-to-Head: Business Model, Strengths & Weaknesses

| Dimension | David Tepper | Ernest García II |

| Core activity | Hedge fund investing (distressed credit/equities); sports ownership | Used-car retail + captive finance; major Carvana shareholder |

| Revenue drivers | Fund fees, gains on concentrated bets, asset appreciation | Vehicle sales, net interest from loans, securitization |

| Time horizon | Short–medium event-driven; opportunistic long holds | Medium–long: operational scale & loan-book income |

| Leverage | Market leverage via derivatives and position sizing | Balance sheet & securitization financing for loans/inventory |

| Governance | Institutional structure; scrutiny over concentrated personal capital | Concentrated founder control; repeated related-party scrutiny |

| Public/legal risk | Reputational risk; commentary effects | Historic criminal plea (1990); governance litigation |

Major Works & Achievements

David Tepper

- Founded Appaloosa Management in 1993, a preeminent distressed-asset specialist.

- Purchased the Carolina Panthers (reported ~$2.2–$2.3B) in 2018, diversifying asset base and public profile.

- Noted for contrarian, high-conviction trades during stress events (e.g., post-2008 opportunities).

Ernest García II

- Scaled DriveTime from a small operator into a vertically integrated used-car retailer with captive finance.

- Through familial holding companies, became a major shareholder in Carvana and influenced the online used-car narrative.

- Built securitization and funding strategies to scale retail inventory procurement and loan origination.

Timeline

- 1957: Both David Tepper (Sept 11) and Ernest García II (May 1) are Born.1978–1982: Tepper completes BA and MBA and begins finance career.

- 1990: García pleads guilty in a bank-fraud probe (public record).

- 1993: Tepper founds Appaloosa Management.

- 2000s: García scales DriveTime and develops captive finance.

- 2017: Carvana IPO; García family holdings become large public shareholders.

- 2018: Tepper acquires the Carolina Panthers (~$2.3B).

- 2020–2024: Carvana faces shareholder suits and Delaware Chancery review of related-party transactions.

Lessons for Investors, Boards & Journalists

When viewing these business stories through a model-monitoring lens, the practical lessons map to standard ML-ops and governance playbooks.

From David Tepper Learnings on signal detection and risk control

- Master the cycle signal: Tepper demonstrates that alpha accrues to investors who can reliably identify solvency vs liquidity. Investors should build macro scenario analysis and probabilistic recovery frameworks.

- Size and explainability: Large, concentrated allocations need clear documentation and rationales analogous to model interpretability — explain why a big weight exists and how stop conditions work.

- Portfolio diversification of skillsets: Moving into sports ownership or private assets can diversify beta sources, but owners should calibrate illiquidity risk and disclosure practices.

Actionable investor checklist

- Test concentrated positions against adverse liquidity paths.

- Demand clear communications when fund structures shift toward significant personal capital.

From Ernest García II — Learnings on governance and underwriting

- Governance matters: Founder control without strong independent checks invites litigation and discounting. Boards should be structured to enforce arm’s-length standards where related parties exist.

- Underwriting discipline: Subprime finance thrives when loss models are conservative and restructured quickly when realized defaults exceed projections.

- Disclosure & process: Related-party transactions are not inherently malevolent but must be defensible with documentation and competitive pricing evidence.

Actionable board checklist

- Insist on robust, independent valuation and fairness opinions for related transactions.

- Stress-test loan portfolios under severe macro scenarios and maintain liquidity contingencies.

Pros & Cons

David Tepper

Pros

- Proven record in crisis cycles and event-driven trades.

- Institutional pedigree and headline trades that can attract capital.

- Diversified into sports and alternative assets.

Cons

- Concentration risk can produce high volatility.

- Public commentary can amplify reputational noise.

- Shifts toward personal capital may reduce transparency.

Ernest García II

Pros

- Deep operational expertise in retail and captive finance.

- Scalable model if underwriting holds and securitization markets are open.

- Vertical integration gives control over remarketing and repossession processes.

Cons

- Historic legal conviction (1990) affects reputational priors.

- Governance scrutiny and related-party litigation create investor risk.

- Business exposed to credit cycles and funding market disruptions.

FAQs

A: It depends on the date and source. Net-worth trackers vary; Tepper is often placed in the low-to-mid-$20B area at times, while García’s figure swings widely because so much of his paper wealth is tied to Carvana’s stock price. Always cite provider and date.

A: Yes. He pleaded guilty in 1990 to a bank-fraud charge tied to Lincoln Savings & Loan, and more recently he was central in Carvana shareholder litigation over related-party deals and a March 2020 direct offering. Delaware courts have issued key opinions in these matters.

A: Appaloosa’s U.S. equity allocations are disclosed through SEC 13F filings each quarter; database aggregators and the SEC make those filings available for scrutiny.

A: David Tepper focuses on hedge fund investing, especially distressed debt and undervalued assets during economic downturns through Appaloosa Management. Ernest García II focuses on auto retail and subprime auto finance, primarily through DriveTime and Carvana. Tepper’s wealth depends largely on market investment performance, while García’s wealth is closely tied to consumer credit markets and Carvana’s stock price.

Governance, Disclosure & The Role of Independent Verification Model auditing parallels

An important lesson from both men’s stories is the value of independent verification and a robust audit trail this is the corporate equivalent of model validation. When a founder controls voting power or when a fund manager concentrates capital, external checks (auditors, independent directors, regulatory filings) act as model auditors that test for overfit, data leakage, or undisclosed conflicts.

Key governance practices for durable enterprises:

- Independent board members with real investigatory capacity.

- Clear written policies for related-party transactions with required fairness opinions.

- Transparency over off-balance-sheet or affiliate arrangements.

- Regular stress tests and investor reporting that show tail-risk scenarios.

Communication, Reputation & Social Amplification The attention mechanism

Both men demonstrate the role of attention (media, public statements) on valuation. Tepper’s statements can shift market sentiment a false positive in public speech can move prices. García’s legal history and family control attract scrutiny, which acts like a negative prior that markets price in. Organizations should treat PR and legal signals as part of their monitoring stack: attention spikes require rapid, credible disclosure to avoid persistent valuation discounts.

Conclusion

Viewed as production models, David Tepper and Ernest García II pursued divergent optimization strategies to achieve substantial wealth. Tepper’s architecture favors opportunistic, high-conviction weightings on distressed assets and macro events; his edge is in signal recognition and timely capital deployment. García’s system is more industrial: scale retail distribution, internalize credit, and use securitization as leverage to expand reach. Tepper’s principal fragility is concentrated market exposure and the need to justify large proprietary stakes to external observers; García’s is operational and governance exposure — underwriting assumptions, liquidity architecture, and related-party controls.

For investors, the takeaway is to align Investment approach with domain expertise: follow Tepper-like strategies only if you can credibly model macro cycles and manage tail risks; emulate García’s playbook only if you can underwrite subprime exposures, stress securitization funding, and build credible, independent governance. For boards and journalists, these cases reinforce core governance axioms: strong independent oversight, rigorous disclosure, and preemptive stress testing guard not only shareholder value but also public trust.