Introduction

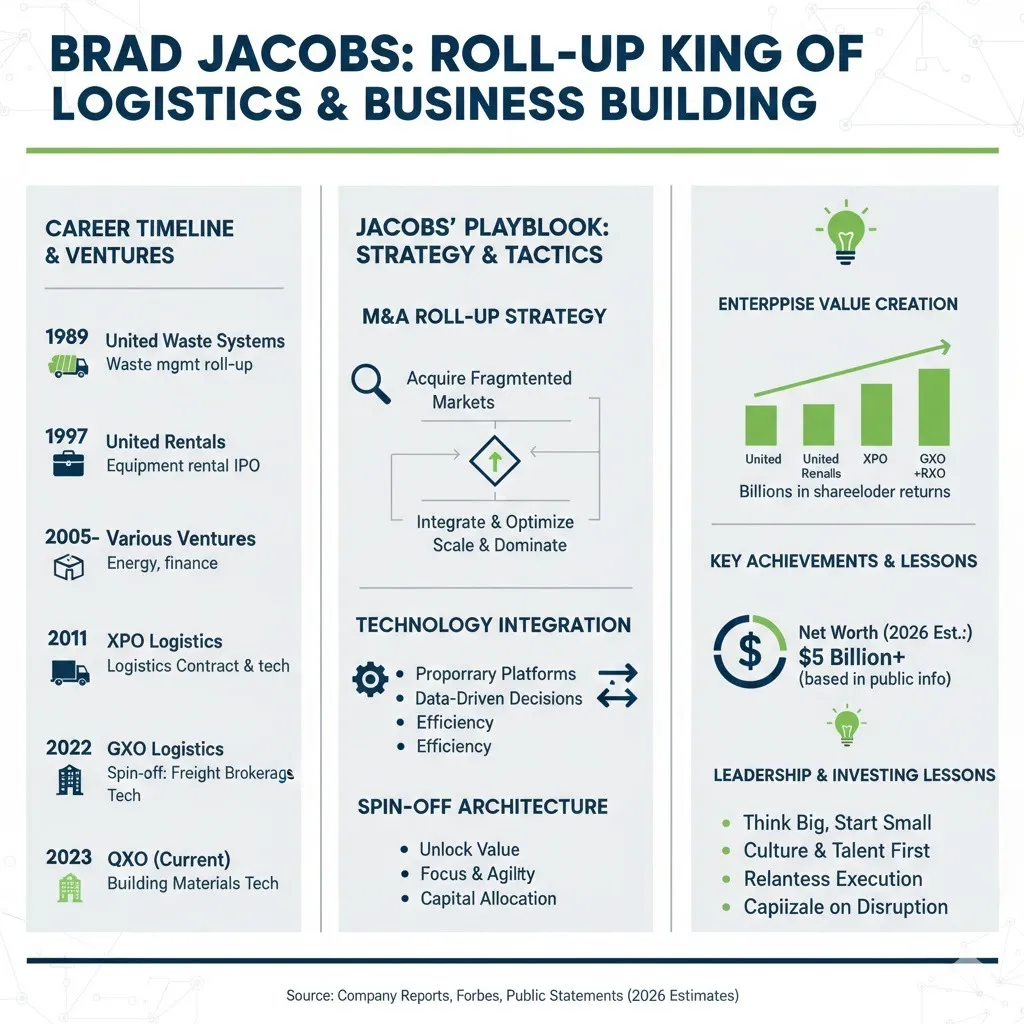

Think of Brad Jacobs as a generative model for consolidation: he ingests a fragmented industry (many noisy, local tokens), runs multiple acquisition epochs, fine-tunes the resulting network with centralized weights (procurement, tech, shared services), and then decodes value through spin-offs and public listings. Over three decades Jacobs has repeatedly trained the same architecture on different datasets — waste hauling, equipment rental, freight logistics, and now building-products distribution producing multiple billion-dollar public networks (United Waste, United Rentals, XPO and its offshoots GXO/RXO, and the new QXO vehicle).

The QXO–Beacon episode (tender offer launched Jan 27, 2026; acquisition completed late April 2026 at roughly $124.35 per share) is a recent fine-tuning run that stress-tested his playbook in a sector where vendor relationships and retail channels carry outsized importance. This pillar article reframes Jacobs’s career and method in NLP-inspired language, unpacks a step-by-step M&A playbook that practitioners can adapt or defend against, analyzes the QXO–Beacon transaction, and closes with checklists, timelines, risk mitigation patterns, and FAQs that maintain the original questions intact for SEO and reader clarity.

Quick Facts

- Full name: Bradley W. Jacobs

- Date of birth: August 3, 1956

- Age (2026): 69

- Birthplace: Providence, Rhode Island, U.S.

- Nationality: American

- Profession: Serial entrepreneur, dealmaker, chairman & CEO (QXO)

- Key companies: United Waste Systems, United Rentals, XPO, GXO, RXO, QXO

- Famous for: Roll-up strategy and repeated creation of billion-dollar public companies

Who is Brad Jacobs and why does he matter

In machine-learning terms, Jacobs is a repeatable optimizer. He searches for datasets (industries) with high variance and low centralization — many small entities operating with local rules. Where others see fragmentation (noise), he sees signal. By acquiring and stitching together those local data points into a single architecture, he reduces variance, increases predictability, and exploits procurement leverage and operational synergies to improve margins. He then often performs an architectural surgery — splitting the larger network into purer, value-priced models (spin-offs). This approach has generated outsized returns historically and reshaped multiple industries. The QXO initiative applies the same template to building-products distribution — a space with strong vendor-retailer bonds where the success of scale depends as much on relationship-preservation as on back-office efficiency.

Childhood & Early Life

Jacobs’ architecture traces back to early life in Providence, Rhode Island. A curious blend of quantitative interest early aptitude in math — and the arts, music, and piano — gave him both pattern-sensing skills and the patience needed for long-form integration. He attended Bennington College and Brown University briefly before electing to learn in-market. His initial forays into oil brokerage and international trading served as real-world training runs: negotiating fragmented supply chains, pricing opaque commodities, and recognizing when local arbitrage could be aggregated into durable margins. Those experiences seeded his optimizer mindset: look for messy local markets, simulate consolidation, and act quickly if the projected gains exceed integration costs.

Career Journey step-by-step growth and playbook moments

Below, I reframe Jacobs’ major chapters as training phases and model updates.

Early consolidations: United Waste & United Rentals

United Waste Systems (1989) — Jacobs’ early roll-up in waste hauling operated like an ensemble approach: acquire many base models (local haulers), average performance, and reduce variance through centralized route planning and procurement. Small route owners became nodes within a larger, more efficient network.

United Rentals (1997) — The equipment rental roll-up followed the same template. Rapid acquisitions created market density and allowed centralized asset utilization optimization. By standardizing processes, Jacobs improved utilization rates and cut redundant fixed costs.

These early wins validated a hypothesis: fragmented industries with repeatable operational tasks can yield outsized returns when aggregated and optimized.

The XPO era: building a logistics giant

From the Express-1 investment through successive acquisitions, Jacobs turned a patchwork of freight and logistics businesses into XPO Logistics. Here the architecture grew: brokerage, last-mile delivery, contract logistics, and freight went from separate microservices into a single integrated stack. Crucially, he recognized when parts of the stack warranted independent valuation and executed spinoffs (GXO in 2021 for contract logistics; later RXO), crystallizing value that was previously embedded within a conglomerate discount.

The QXO chapter building products consolidation

QXO launched as a new aggregator focused on building products — a channel-heavy, regionalized market. Building-products distribution is different in three technical ways: (1) vendor relationships are high-bandwidth, (2) retail and installer networks are local and influence demand patterns, and (3) product SKUs have greater complexity and seasonality. Jacobs applied his template: identify fragmentation, deploy rapid bolt-ons, centralize procurement and tech, and attempt to preserve key customer and vendor relationships while extracting procurement savings and operational improvements. QXO’s marquee move was a tender offer for Beacon Roofing Supply that began January 27, 2026 and closed in late April 2026 at about $124.35 per share, valuing the deal near $11 billion including debt.

Major works & achievements

- United Waste Systems (1989): Consolidation of local waste haulers into a larger network.

- United Rentals (1997): Equipment rental roll-up and public listing.

- XPO Logistics (2011 onward): Aggressive acquisition strategy to build a global logistics and freight platform; subsequent spin-offs (GXO, RXO).

- QXO & Beacon Roofing (2024–2026): Formation of QXO, launch of a high-profile tender and eventual acquisition of Beacon Roofing Supply, testing the roll-up playbook in a vendor-sensitive sector.

Net Worth & Financial Status

Estimating net worth for a private actor with sizeable public-equity holdings requires referencing market caps, stake sizes, and deal structures. Broadly, Jacobs is considered a billionaire in major public wealth trackers; much of his paper value is tied to stakes in companies he founded or helped scale. Market swings, the structure of deals, and the timing of sales or spin-offs create substantial volatility in headline net worth over short windows.

Brad Jacobs’ M&A Playbook Step-by-step

Below is an NLP-styled, actionable playbook — think of it as a model architecture for rapid consolidation.

Target identification

Objective: Find a dataset (industry) with High Fragmentation and a large addressable market.

Signals: Many small players, inconsistent pricing, fragmented inventory, customer loyalty local to the branch rather than the brand.

KPI: TAM > $5–10B; fragmentation index.

Rapid bolt-on acquisition strategy

Approach: Aggressive bolt-on buys to build density.

Execution: Make dozens of smaller deals to buy geographic and SKU coverage. Speed matters; it reduces integration cost per deal and prevents competitors from aggregating density. Typical initial cadence: 12–40 bolt-ons in 12–36 months.

Centralize back-office & procurement

Mechanics: Consolidate finance, procurement, HR, and admin into shared-service platforms. Centralized supplier contracts are a high-leverage source of margin uplift.

Layer technology

Tech stack: TMS/WMS, ERP, e-commerce, analytics dashboards, and route optimization. Think of these as model parameters: once standardized, they enable faster identification and remediation of underperforming nodes.

Optimize capital structure & financing

Instruments: Mix of bank/syndicated debt, equity, and PIPEs for speed and optionality. Pre-arranged financing is especially important for tender offers or hostile approaches.

Carve-outs & spin-offs

When: After synergies are achieved and margins are predictable, spin assets into pure-play companies to unlock multiple expansion.

Governance and people strategy

Policy: Retain local operators in commercial roles to preserve customer relationships; centralize KPIs, reporting cadence, and incentive structures.

Playbook checklist

| Playbook Step | Target KPI | Typical Timeline |

| Market selection | TAM > $5bn; fragmentation index | 1–3 months |

| Bolt-on acquisitions | 12–40 deals initially | 12–36 months |

| Centralize procurement | % spend under contract | 3–9 months after cluster |

| Tech integration | Single TMS/WMS adoption rate | 6–18 months |

| Spin/carve | EBITDA margin validation | 24–48 months |

How the QXO–Beacon deal played Jacobs’ playbook

QXO’s play followed a known recipe but had to account for unique constraints in building products:

- Target selection: Building-products distribution is fragmented and dominated by regional dealers and installers — fertile ground for roll-up.

- Speed and scale: QXO launched a cash tender at $124.25 per share on Jan 27, 2026; after a contested process, the deal closed in late April 2026 at roughly $124.35 per share, valuing Beacon at about $11 billion including debt.

- Hostile tactics: When Beacon’s board resisted, QXO pursued shareholder outreach and proxy positions, a tactic Jacobs has used previously to overcome defensive boards.

- Integration posture: QXO prioritized procurement integration, tech homogenization, and sales/channel reassurance to avoid vendor pushback.

Sector implications: What QXO must solve

Three distinct integration hurdles stand out in building-products:

- Channel power: Major retailers and specialty dealers have bargaining power; if consolidation threatens those partners, access and shelf placement can be at risk.

- Installer networks: Local installers shape demand and are sensitive to stockouts and prices; preserving installer goodwill is essential.

- Regulatory/antitrust scrutiny: As aggregates grow, regulators may examine market concentration and supplier access.

QXO’s success hinges on carefully balancing scale-driven procurement benefits with active vendor relationship management.

Integration playbook what QXO should (and likely did) prioritize

- Rapid procurement integration: Move branches to national supplier agreements, while honoring transition windows to preserve relationships.

- Technology roll-out: Implement a standardized ERP/TMS and a unified e-commerce platform to synchronize inventory and pricing.

- Sales & channel management: Establish dedicated vendor liaison teams to reassure national manufacturers and big-box partners.

- People & culture: Flatten redundant layers, centralize decision rights but preserve local sales autonomy where it preserves customer trust.

Risks & criticisms of the Jacobs model

- Execution risk: Rapid roll-ups can create under-integrated estates where expected synergies fail to materialize.

- Leverage risk: Heavy debt loads amplify downside if integration is delayed.

- Vendor pushback: Suppliers may respond poorly to consolidated buyers threatening established dynamics.

- Governance optics: Hostile offers and fast changes can trigger reputational and governance backlash.

The Beacon episode highlighted these risks — the board resistance and public proxy battle were predictable friction points.

Pros & Cons

Pros

- Fast market share gains.

- Procurement economies and centralized operating leverage.

- A proven track record of creating valuable, public pure-plays.

Cons

- Integration complexity at scale.

- High financial leverage at early stages.

- Potential channel and regulatory friction.

Comparison table “Jacobs Method” vs Traditional PE Roll-Up

| Feature | Jacobs Method | Traditional PE Roll-Up |

| Speed of acquisitions | Very fast (dozens quickly) | Slower, measured |

| Focus | Long-term operational integration + spin | Financial engineering + fund exit |

| Tech adoption | Aggressive (TMS/WMS, e-comm) | Varied |

| Exit approach | Spin-offs to public markets | Trade sale or IPO depending on fund |

| Risk tolerance | High (hostile bids allowed) | Medium |

Timeline of life & career milestones

- 1956: Born in Providence, Rhode Island.

- 1979–1983: Early oil brokerage ventures and international trading.

- 1989: Founds United Waste Systems and launches roll-up strategy.

- 1997: United Rentals established; public listing.

- 2011: Invests in Express-1; builds XPO Logistics through acquisitions.

- 2021: XPO spins off GXO (contract logistics).

- 2024–2026: Launches QXO and completes acquisition of Beacon Roofing Supply.

How to replicate

For founders who want to replicate

- Map fragmentation and quantify procurement upside.

- Build centralized onboarding playbooks.

- Secure financing lines in advance.

- Prioritize rapid ERP/TMS adoption.

- Keep local commercial teams engaged to preserve revenue continuity.

For incumbents who want to defend

- Strengthen exclusive vendor relationships.

- Form buying pools or co-ops to mimic scale advantages.

- Differentiate with service levels, vertical specialization, and faster innovation.

- Lock in long-term supplier contracts and preferred pricing.

FAQs

A: Brad Jacobs is an American dealmaker known for building companies by consolidating many small operators into centralized, scaled firms.

A: QXO is Brad Jacobs’s company, focused on consolidating building-products distribution. Itwas formed in 2024 and made a major move to buy Beacon Roofing Supply in 2026.

A: QXO launched an $11 billion tender offer (Jan 27, 2026) and, after a hostile phase and board resistance, completed the acquisition in late April 2026 for roughly $124.35 per share, valuing the deal at about $11 billion including debt.

A: Mostly through equity stakes in the companies he builds (QXO, XPO, GXO, RXO) and returns from sales or spin-offs.

A: Yes, major wealth trackers list him among billionaires, with most value tied to QXO and earlier public stakes. Numbers vary with market moves.

A: Yes. Rapid acquisitions carry integration and leverage risk. Channel pushback and regulatory scrutiny are additional concerns.

Conclusion

Brad Jacobs operates like a systematic consolidator: seek fragmentation, aggregate swiftly, standardize operations and tech, then separate to realize multiple valuation expansions. His template — target fragmented markets → bolt-on acquisitions → centralize procurement and technology → spin or list has delivered multiple billion-dollar outcomes and remains a Powerful Playbook for creating scale advantages. The QXO–Beacon transaction is a contemporary stress test of that model in a channel-sensitive sector. It demonstrates both the potency of scale (procurement leverage, logistics efficiency) and the frictions that arise when vendor and retail relationships matter deeply. For founders, the learning is concrete: consolidation can work if you have the integration engine, capital access, and a vendor-engagement strategy. For incumbents, the defense is equally clear: build your own scale advantages, cement vendor partnerships, and offer differentiated services that a consolidator would struggle to replicate quickly.