Introduction

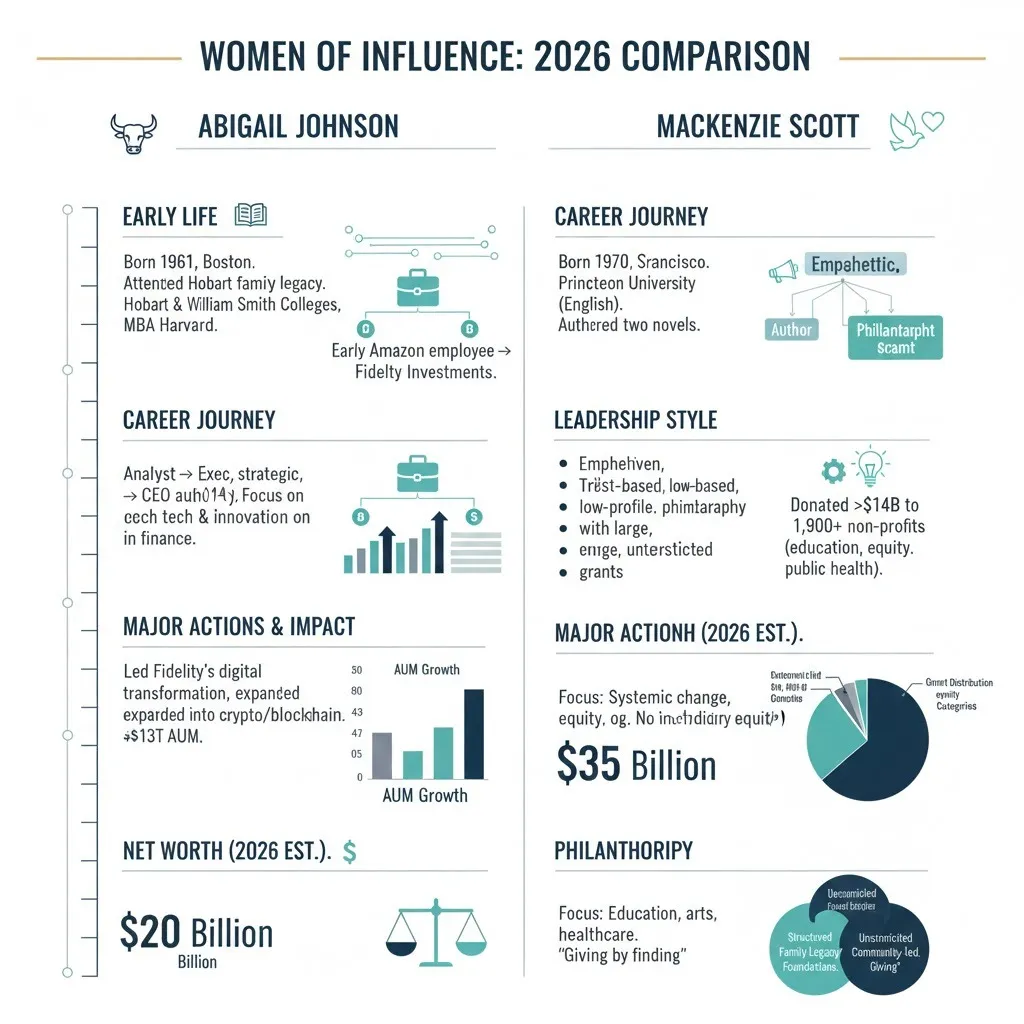

In 2026, Abigail Johnson and Mackenzie Scott represented two distinct, powerful models of influence. Both are highly wealthy and widely discussed, but they exercise their influence in fundamentally different ways. Abigail Johnson operates inside the machinery of global finance steering products, platforms, and policies that touch millions of investors. Mackenzie Scott has reimagined large-scale giving moving money fast, with few strings attached, to organizations often overlooked by traditional philanthropy.

This long-form, NLP-friendly guide compares them side-by-side. It uses clear headings (H1/H2/H3), short paragraphs, lists, and FAQs so human readers and search engines can quickly find the signal in the detail. Where numbers appear (net worth, donation totals, assets under administration), they’re presented as ranges tied to reputable reporting periods (late 2026 / early 2026) because those figures change with markets and new gifts.

Quick Facts: Abigail Johnson vs Mackenzie Scott

| Attribute | Abigail Johnson | MacKenzie Scott |

| Full name | Abigail Pierrepont Johnson | MacKenzie Scott (formerly Bezos) |

| Born | Dec 19, 1961 (Boston, MA) | Apr 7, 1970 (San Francisco, CA) |

| Primary role | CEO & Chairman, Fidelity Investments | Philanthropist, Author |

| Known for | Leading a major private financial firm; product & platform strategy | Trust-based, unrestricted philanthropy at scale |

| Estimated net worth (late 2026) | ~$32–36B (estimates vary) | ~$30–34B (declining as she gives away funds) |

| Major public action | Expanded Fidelity into retirement tech and digital assets | Donated ~$7.1B in 2026; ~$26B+ since 2019 |

Who is Abigail Johnson?

Early life & background

Abigail Johnson is an heir to the Fidelity Investments legacy. She studied art history as an undergraduate and then earned an MBA. She joined Fidelity in 1988 and progressed through product and management roles over decades, learning the business from inside.

Career journey key milestones

- 1988: Joined Fidelity as an analyst.

- 1997: Managed a Fidelity fund (example roles in active product teams).

- 2001–2013: Took on growing leadership of asset management and product teams.

- 2014: Became CEO of Fidelity Investments.

- 2016: Became Chairman as well.

Johnson’s path is a classic corporate progression: steep learning curve, increasingly large spans of control, and stewardship of a family-founded company.

Leadership style plain summary

- Data-first. Decisions emphasize quantitative analysis.

- Long-horizon focus. Strategy looks beyond the next quarter.

- Operational discipline. Executes through systems, talent, and governance.

- Private posture. Public statements are measured; the focus is running the business.

Major actions & influence

Johnson has guided Fidelity’s move into new product areas — ETFs, retirement technology, and institutional digital asset custody. Fidelity Digital Assets (a separate arm launched in the late 2010s) is a notable example of institutionalizing crypto custody and services.

Net worth & personal life

Estimates in late 2026 put Johnson’s net worth in the low-to-mid tens of billions. Much of her wealth is tied to Fidelity ownership and family holdings. She maintains privacy around personal life and philanthropic efforts.

Who is MacKenzie Scott?

Early life & background

MacKenzie Scott studied English at Princeton and worked as an author and researcher early in her career. She became well known through her marriage to and later divorce from Amazon’s founder, which resulted in a substantial transfer of Amazon shares to her. After 2019, Scott shifted public attention to her giving.

Shift to philanthropy

After 2019, Scott committed to large-scale giving. Her approach is intentionally different from classical foundations: she gives fast, at scale, often unrestricted, and typically without a lengthy application process. Scott’s public notes summarize many of her gifts, though she often chooses privacy regarding specifics.

Philanthropic philosophy in plain terms

- Trust-based giving. She trusts organizations to determine priorities.

- Unrestricted funds. Grants come without burdensome reporting requirements.

- Scale and speed. Money is distributed quickly to meet immediate needs.

- Equity focus. A meaningful portion of gifts has gone to historically underserved communities and organizations.

Major actions & impact

Scott has announced multi-billion-dollar giving rounds. In 2026, she publicly disclosed roughly $7.1 billion in donations that year alone, pushing the total since 2019 above approximately $26 billion. Her gifts have gone to colleges, community organizations, racial equity groups, and small nonprofits.

Net worth & personal life

Public trackers in late 2026 put Scott’s net worth in a similar band to Johnson’s, but her wealth is actively declining as she donates significant portions. She remains private about family life and cites an intention to give away most of her wealth.

Side-by-side comparison: core differences

| Feature | Abigail Johnson | MacKenzie Scott |

| Primary influence | Finance, Investment, retirement systems | Philanthropy, civil society |

| Leadership model | Institutional governance, product & service design | Rapid, decentralized grantmaking |

| Public presence | Private, corporate-focused | Public about gifts but personally private |

| Wealth strategy | Preserve and grow business-linked assets | Rapid distribution to nonprofits |

| Impact style | Systemic, indirect, long-term | Direct, immediate, community-centered |

| Transparency | Traditional corporate reporting | Public giving notes; limited operational reporting |

Interpretation: Johnson shapes systems and markets; Scott injects resources directly into organizations and communities. They operate at different leverage points.

Deep dive Leadership, Strategy & Influence

How Abigail Johnson wields power inside finance

Structural power

Johnson controls a large private firm that administers trillions in client assets. That control translates into:

- Influence over retirement product design and default options.

- Market signaling when Fidelity adopts new instruments or services.

- The capacity to test and scale financial technology inside an established brand.

Product influence

Fidelity’s product moves for example, expanding ETFs, retirement solutions, and institutional crypto custody services send signals across the industry. When an incumbent like Fidelity takes a cautious but decisive step into a new area, competitors and clients take note.

Strengths and constraints

- Strengths: Long-term capacity, deep institutional expertise, the ability to change wide swaths of investor behavior through product defaults and scale.

- Constraints: Large institutions move methodically. Change can be slow; public visibility is limited by corporate governance responsibilities.

How MacKenzie Scott wields power through giving

Speed + trust = a new philanthropic lever

Scott’s strategy is to transfer large sums quickly, with few strings attached. The result:

- Immediate liquidity for nonprofits.

- Reduced administrative burden for recipients.

- Support for under-resourced organizations that struggle with grant cycles.

Focus on equity and overlooked groups

A notable portion of Scott’s giving has prioritized racial equity, community organizations, and colleges with less access to wealthy donors. Her 2026 giving included sizeable investments in HBCUs and other educational institutions.

Strengths and trade-offs

- Strengths: Rapid impact, ability to fund organizations that rarely receive unrestricted large gifts, and a shift in philanthropic norms toward trust.

- Trade-offs: Rapid, private giving invites questions about selection criteria, long-term coordination, and whether such big gifts are always well-integrated into broader sector strategies.

Net worth, money flows & what the numbers mean

Important note: Net worth figures and donation totals vary daily with markets and new gifts. Below are ranges reported through late 2025 / early 2026.

Abigail Johnson money & scale

- Estimated net worth: ~$32–36 billion (late 2026 estimates).

- Wealth source: Family ownership stakes and executive control at Fidelity.

- Fidelity scale: Fidelity manages and administers trillions in client assets — a scale that makes organizational decisions consequential across markets.

MacKenzie Scott money & giving

- Estimated net worth: ~$30–34 billion (late 2026 estimates, depending on how quickly stock is donated or sold).

- Gifts: Public disclosures and reporting show multi-billion-dollar gift rounds (e.g., roughly $7.1B in 2026). Cumulative giving since 2019 exceeds $26B, per public notes and reporting.

- Wealth flow: Scott’s net worth declines as she gives away assets, which is part of her stated intention.

Why these numbers matter: Net worth is a snapshot; giving totals show the flow of philanthropic capital. Johnson’s influence is embedded in an institution that controls capital for others; Scott’s influence is immediate and discretionary.

Which model creates more “impact”?

There is no single correct answer. The best impact depends on the goal.

- Johnson’s model (institutional): Changes infrastructure. It affects millions indirectly through retirement plan design, product pricing, and market norms. Time horizon is long; impact accumulates via systems and behavior changes.

- Scott’s model (philanthropic): Changes capacity and opportunity. It helps organizations do more now, often those with urgent needs or few alternative funding sources. Impact can be direct and measurable in the short run.

Conclusion: Both models are complementary. Systems-level change and direct resource flows operate on different timelines and levers both are necessary for a healthy ecosystem.

Practical tactics both leaders teach you

From Abigail Johnson

- Plan for the long-term. Think beyond quarterly cycles.

- Invest in systems. Build teams and platforms that can scale reliably.

- Use data as a north star. Prioritize measurable outcomes.

- Focus on execution. Good strategy without disciplined execution rarely moves markets.

From MacKenzie Scott

- Trust practitioners. Put resources in the hands of those closest to the problem.

- Cut bureaucracy. Simplify funding processes to reduce administrative drag.

- Act at scale when possible. Bold moves attract attention and catalyze further action.

- Value equity. Target resources to historically underserved communities.

Case studies & examples

Fidelity and digital assets

When Fidelity launched dedicated services for institutional digital asset custody, it did more than offer a product. It signaled to large investors that custody and support for digital assets could be treated like any other institutional service moving the conversation from speculative retail use to mainstream institutional consideration.

Scott funds HBCUs and local groups

Scott’s rounds of giving included substantial funds for Historically Black Colleges and Universities, along with many smaller community-based organizations. These gifts helped bolster endowments, provide immediate operating support, and offered flexibility to leaders to pursue urgent priorities.

Pros & Cons

Pros

- Institutional depth and operational experience.

- Ability to modernize systems and create long-term infrastructure.

- Influence across retirement and investment decisions affecting millions.

Cons

- Less public philanthropic footprint relative to large public givers.

- Institutional shifts can be slow and incremental.

Pros

- Rapidly moves capital where it’s needed.

- Reduces grant-making bureaucracy.

- Normalizes trust-based philanthropy.

Cons

- Private, fast giving can raise questions about selection and coordination.

- Large, unrestricted gifts may not always come with long-term integration plans (critics sometimes worry about sustainability and alignment).

Legacy How historians might view them 20 years from now

Abigail Johnson

Historians may remember her as a steward who modernized a legacy financial firm — bringing digital tools, broader product sets, and long-term governance. Her legacy is structural: shaping systems that millions rely on.

MacKenzie Scott

She may be seen as a disruptor who redefined philanthropic norms — proving that trust-based, large-scale giving has measurable benefits. Her legacy is social: shifting expectations about donor control and the speed of giving.

Both matter. One shapes infrastructure. The other forces attention to unmet needs. Together they reflect two faces of 21st-century power.

FAQs

A: Their net worth’s change with markets and gifts. In late 2026 estimates placed both in a similar band (roughly $30–$36 billion). Mackenzie Scott’s net worth decreases when she donates assets, so relative positions can change quickly. Trusted trackers (Forbes, Bloomberg) provide regular updates.

A: Yes, In 2026 she donated about $7.1 billion in a single year and has given more than $26 billion since 2019, according to major reporting. She continues to publish notes about her giving and occasionally shares totals for rounds of grants.

A: Yes, but usually more privately and through traditional channels. Her public profile emphasizes corporate leadership and institutional innovation rather than high-profile, unrestricted public gifts.

A: Because she gives large sums without the usual philanthropic restrictions (no lengthy applications, limited reporting), which changes norms in the nonprofit sector and speeds the flow of funds to grassroots groups.

A: There isn’t a single right model. Institutional investment (Johnson’s path) builds systems and economic capacity. Trust-based, rapid giving (Scott’s path) provides immediate resources to communities. A mix of both structural change plus direct resource flows is often most effective.

Conclusion

Abigail Johnson and Mackenzie Scott illustrate two powerful, different ways of exercising Wealth and Influence in the 21st century. Johnson’s work is systemic and infrastructural: she shapes markets and products that millions of people use. Scott’s approach is nimble and human-centered: she moves money quickly and trusts leaders to use it where it’s needed. Both models are essential; together they hint at a future where institutional strength and direct social investment coexist and reinforce each other.