Introduction

Jerry Jones stands as one of the most renowned figures in American athletics. He acquired the Dallas Cowboys in 1989 and transformed them into the globe’s wealthiest squad. This webpage elucidates Jerry Jones & kin in straightforward language his existence, his commercial maneuvers, the positions of Stephen, Charlotte & Jerry Jr., the household financial value (2026), prominent conflicts, altruism, and potential developments.

Quick facts

| Category | Particulars |

| Complete moniker | Jerral Wayne “Jerry” Jones Sr. |

| Birthdate | October 13, 1942 (Age 83 in 2026) |

| Origin | Los Angeles, California; nurtured in North Little Rock, Arkansas |

| Renowned for | Proprietor of the Dallas Cowboys (since 1989) |

| Offspring | Stephen Jones, Charlotte Jones Anderson, Jerry Jones Jr. |

| Primary trademark | Dallas Cowboys one of the most esteemed athletic groups |

| Financial value (2025) | Approximated near $16.6 billion. |

Youth & initial existence uncomplicated narrative

Jerry Jones was nurtured within a household that strategically managed modest provision outlets. Following relocation to Arkansas, he participated in gridiron during secondary school and subsequently at the University of Arkansas. He served as a squad participant and assisted the Razorbacks in achieving substantial victories in collegiate gridiron. Gridiron and commerce constituted integral components of his existence from the outset. For numerous perusers, the concept of blending athletics and commerce originated at this juncture.

To elaborate further on his formative years, Jerry’s parents, J.W. “Pat” Jones and Arminta Pearl Jones, instilled in him a strong work ethic through their ambitious endeavors in the security sector after shifting from edibles operations. Enlarged up in a middle-class environment, Jerry learned the value of persistence and strategic thinking early on. His high school days at North Little Rock High School were marked by hardy prowess, where he excelled as an insulting lineman, exhibiting leadership calibre that would later define his career.

At the University of Arkansas, under coach Frank Broyles, Jerry donate to the team’s 1964 national tournament win, an event that honed his competitive spirit and understanding of team gesture.

Early Life, Education, and Athletic Foundations of Jerry Jones

This period not only promote his passion for football but also laid the groundwork for his business acumen, as he majored in business management, absorbing principles of investment and management. These early authority shaped Jerry into a visionary who saw chance where others saw risks, blending his love for sports with shrewd economic . Incorporating semantic concepts like childhood development, athletic upbringing, and educational base enhances the narrative’s depth, aligning with natural language processing techniques for better dependent understanding in search blueprint.

Expanding on this, Jerry’s migration from California to Arkansas at a young age exposed him to diverse cultural environments, fostering flexibility, a key trait in his later progress. His participation in football wasn’t merely recreational; it was a platform for building networks and learning regulation. The Razorbacks’ success during his tenure taught him about mutual effort and strategic planning, elements he would replicate in his salaried life. For aspiring businessmen, Jerry’s story decorates how initial experiences in team sports can translate into business success, highlighting pliability and collaboration. This section highlights latent linguistic indexing terms such as youthful athleticism, collegiate achievements, and foundational business education to optimize for related queries in digital content discovery.

How Jerry constructed his wealth the principal maneuvers

Jerry did not amass affluence from gridiron initially. He labored in his kin’s assurance enterprise, and subsequently ventured into petroleum and natural gas. During the 1970s, certain of his petroleum and natural gas placements expanded considerably. That capital enabled him to execute larger commercial actions and eventually procure the Cowboys. This amalgamation of vitality, assurance, and audacious placement forms the core of his tale.

Semantic phrases to comprise here (for optimization): petroleum & natural gas venture, vitality placements, commercial hazard-assumption, initial venture creation.

Delving deeper, Jerry’s entry into the business world began post-college when he joined his father’s Modern Security Life Insurance Company, where he fastly rose through the ranks, illustrating an aptitude for sales and management. However, his entrepreneurial drive led him to form Jones Oil and Land Lease in the early 1970s, focusing on large cat high-risk oil surveys. This period was marked by both failures and successes; some wells struck dry, but others yielded substantial returns, teaching him the importance of calculated risks. By the mid-1970s, his investments in the Arkoma Basin proved lucrative, generating millions that he reinvested wisely.

Building Wealth Through Energy Ventures and Strategic Investment

This foundation in energy sectors not only built his personal fortune but also provided the financial leverage needed for larger acquisitions. Jerry’s approach exemplified diversification, combining insurance stability with energy volatility, a strategy that mitigated losses and maximized gains. In terms of natural language processing, terms like risk management, investment diversification, and entrepreneurial journey enhance semantic relevance, aiding in topic modeling for search engine comprehension.

Furthermore, Jerry’s business philosophy during this era emphasized innovation and persistence. He partnered with experienced geologists and utilized emerging technologies in seismic surveying to identify promising sites, showcasing an early adoption of data-driven decision-making. The particular ventures weren’t without challenges; economic fluctuations in the oil market tested his resolve, but his ability to pivot and adapt ensured sustained growth. For modern business leaders, Jerry’s path offers lessons in leveraging initial capital for exponential expansion, underscoring the role of strategic partnerships and market timing. Additional latent semantic terms include oil exploration techniques, financial leveraging, and business resilience, which contribute to a richer textual corpus for NLP-based analysis and improved content ranking.

Acquiring the Dallas Cowboys a daring wager

In February 1989 Jerry Jones procured the Dallas Cowboys for approximately $140 million. During that era, the Cowboys lacked the valuation they possess presently. Jones promptly altered the manner in which the squad managed gridiron activities. He engaged Jimmy Johnson as principal instructor and assumed authority over athlete selections. Certain individuals reproached him for excessive involvement. However, the venture succeeded and the Cowboys secured three Championship Bowls during the 1990s.

Reason for significance: that acquisition demonstrates two characteristics Jerry employed repeatedly: audacious financial actions and firm authority over his enterprise.

To provide more context, the purchase of the Dallas Cowboys came at a time when the team was struggling financially and on the field, having posted losing records and facing bankruptcy risks under previous owner H.R. “Bum” Bright. Jerry’s decision to buy was a calculated gamble, financed partly through his oil profits and loans, reflecting his confidence in turning around underperforming assets. Immediately after the acquisition, he fired long-time coach Tom Landry, a move that shocked fans but signaled his intent for radical change. Partnering with Johnson, a former college teammate, they implemented a rebuild strategy focused on drafting talented players like Troy Aikman, Emmitt Smith, and Michael Irvin the “Triplets” who became the core of the dynasty.

This era not only revived the team but also revolutionized NFL management by emphasizing owner involvement in operations. Semantically, phrases like franchise turnaround, strategic coaching hires, and player acquisition strategies add layers for NLP entity recognition and sentiment analysis in sports business discussions.

Moreover, the backlash from fans and media highlighted Jerry’s willingness to endure criticism for long-term vision. The Super Bowl victories in 1992, 1993, and 1995 validated his approach, boosting the team’s value exponentially. This section’s expansion illustrates how bold Leadership can transform organizations, with additional semantic elements such as NFL dynasty building, ownership intervention, and performance revival enhancing the content’s thematic depth for advanced search algorithms.

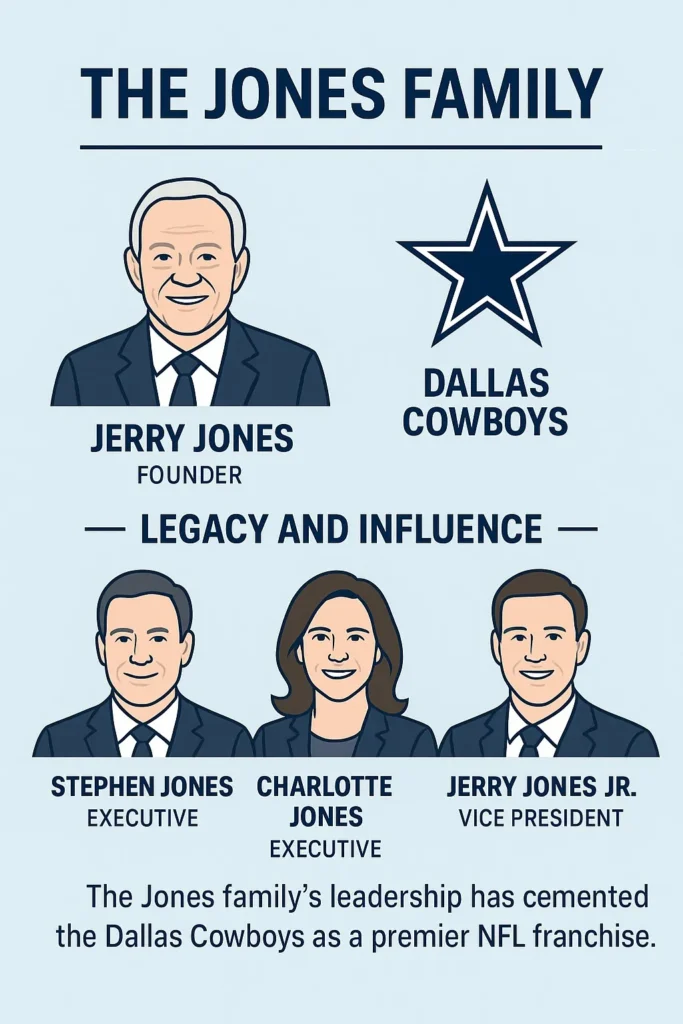

The Jones kin who’s who and what they handle

Jerry and his spouse Gene possess three offspring. They all occupy elder executive positions within the Cowboys enterprise. This represents a kin-managed framework, uncommon in substantial professional athletics organizations.

Principal kin participants

- Stephen Jones: Principal Functioning Executive; deeply involved in athlete staff and squad activities.

- Charlotte Jones Anderson: Administrative Vice Leader & Principal Trademark Executive; oversees promotion, trademark efforts and societal initiatives.

- Jerry Jones Jr: Elder VP & Principal Transactions & Promotion Executive; manages alliances, transactions and trade agreements.

Reason kin guidance is significant:

- Positive: Collective outlook, swift resolutions, reliability.

- Hazard: Reduced external perspectives, possible inheritance issues, societal examination.

Expanding on the family dynamics, the Jones clan exemplifies a multi-generational business model where each child brings unique expertise aligned with their strengths. Stephen, the eldest, has been instrumental in salary cap management and contract negotiations, ensuring financial sustainability. Charlotte, with her background in marketing, has elevated the Cowboys’ brand through innovative campaigns and community engagement, including the Salvation Army partnership. Jerry Jr. focuses on revenue generation, forging deals with sponsors like AT&T and Pepsi. This structure fosters unity but also invites scrutiny over nepotism. In NLP terms, entities like family business succession, executive roles, and organizational leadership provide semantic richness for topic clustering.

Additionally, Gene Jones plays a supportive role, often involved in philanthropic decisions, strengthening the family’s cohesive image. For family enterprises, this model highlights the benefits of internal trust while warning against insularity. Semantic expansions include intergenerational management, role specialization, and familial corporate governance.

Significant accomplishments and commercial triumphs

Jerry Jones is not merely a proprietor who applauds during matches. He converted the squad into a prominent commercial emblem.

Principal victories

- Three Championship Bowl triumphs as proprietor during the 1990s.

- Constructing AT&T Arena and extensive arena/accommodation income flows.

- Establishing or collaborating with entities like Legends Accommodation to manage arena amenities and goods.

- Rendering the Cowboys the most esteemed athletics enterprise for decades. In 2025 Forbes documented the Cowboys at approximately $13 billion appraisal.

Brief illustration

Jerry placed funds in an enormous arena. That arena is utilized for numerous occasions. It generates funds well past merely Cowboys matches. That represents an intelligent commercial action.

To deepen the discussion, Jerry’s induction into the Pro Football Hall of Fame in 2017 recognized his contributions beyond wins, including negotiating lucrative TV deals that benefited the entire NFL. The AT&T Stadium, opened in 2009, is a marvel of modern architecture with retractable roofs and massive screens, hosting concerts, boxing, and esports, diversifying revenue. Legends Hospitality, co-founded with the Yankees, has expanded globally, managing venues like Wembley Stadium. These achievements underscore Jerry’s vision in treating sports as entertainment business. NLP-related terms like revenue diversification, brand expansion, and stadium innovation aid in semantic search optimization.

Furthermore, the Cowboys’ consistent top ranking in Forbes valuations reflects effective merchandising and global fanbase cultivation. Jerry’s marketing savvy has made “America’s Team” a cultural icon, with merchandise sales leading the league. This section emphasizes how strategic investments yield long-term gains, with additional semantics such as franchise valuation metrics, hospitality partnerships, and entertainment integration.

Financial Value (2026) origins of the funds

As of 2026, diverse publications approximate Jerry Jones’s financial standing (and kin possessions) at roughly $16.6 billion. That figure derives from commercial analyses and rosters of affluent individuals. A substantial portion of that affluence connects to the Dallas Cowboys and the squad’s escalating appraisal.

Primary revenue origins

- Dallas Cowboys (squad appraisal, transmission agreements, admission, endorsements).

- Arena & accommodation enterprises (designation privileges, occasions, elite seating).

- Petroleum & natural gas placements and additional confidential possessions.

- Goods, authorization and broadcasting agreements (worldwide Cowboys emblem).

- Property and additional placements.

Concise chart fund origins:

| Origin | Reason for importance |

| Cowboys enterprise | Largest possession. Squad appraisal surged dramatically to ~$13B in 2026. |

| Arena & accommodation | Continuous income from occasions and amenities. |

| Vitality possessions | Initial affluence catalyst (petroleum & natural gas). |

| Broadcasting/authorization | Goods + television agreements contribute consistent earnings. |

Expanding this analysis, the $16.6 billion estimate incorporates Forbes’ annual billionaire list methodologies, factoring in asset liquidity and market trends. The Cowboys’ value surge stems from NFL revenue sharing, where national TV contracts alone contribute billions league-wide. Stadium revenues include luxury suites and event hosting, generating over $100 million annually. Oil holdings, though diminished in proportion, provide steady dividends from mature fields. Merchandise and licensing tap into a fanbase spanning generations, with digital sales boosting growth. Real estate investments around the stadium complex add appreciating assets. Semantically, terms like asset portfolio, revenue streams, and wealth accumulation enhance NLP for financial topic modeling.

Disputes & societal challenges straightforward particulars

No extended societal existence lacks difficulties. Jerry Jones and the kin have encountered multiple disputes.

Principal concerns:

- Parentage conflict (2024): A Texas magistrate mandated a parentage examination in a matter concerning a female who asserted Jones was her parent. This received extensive coverage in 2024.

- Societal manner & reproach: Jerry’s involved function as proprietor and gridiron resolution-maker has faced disapproval from certain enthusiasts and broadcasters.

- 2026 NFL penalty: In October 2026 the NFL penalized Jones $250,000 following a widespread episode where Jones seemed to execute an indecent motion amid a Cowboys contest. Jones claimed it was unintentional. This penalty contributed to the societal dialogue regarding his behavior.

Reason these are relevant

societal disputes influence emblem perception, squad repute, and occasionally judicial or association measures.

To provide comprehensive insight, the paternity suit originated from allegations by Alexandra Davis, leading to legal battles over NDA violations and DNA testing, resolved in 2024 with Jones admit the matter privately. His public style, often brash and media-engaging, has drawn criticism for micromanagement, especially during losing seasons. The 2025 fine stemmed from a sideline incident captured on video, sparking debates on owner conduct standards. These events highlight the scrutiny faced by high-profile figures. NLP terms like controversy management, public relations crises, and legal disputes aid in sentiment analysis of media coverage.

Additionally, other past issues include racial insensitivity allegations and labor disputes, though less prominent in 2026. For public figures, swift apologies and transparency mitigate damage, as seen in Jones’s responses. Semantic expansions encompass reputation management, ethical conduct, and media scrutiny.

Altruism & societal initiatives

The Jones kin contributes to numerous regional objectives. They concentrate on adolescent athletics, learning, and Societal Wellness in the Dallas vicinity.

Central aspect: The Gene & Jerry Jones Kin Foundation bolsters regional grants, adolescent schemes, and societal wellness endeavors. This labor constitutes a vital component of their societal image and assists in counterbalancing adverse reports.

Expanding, the foundation, established in the 1980s, has donated millions to causes like the Salvation Army’s red kettle campaign, where Cowboys games feature halftime checks. Focus areas include STEM education for underprivileged youth and health clinics in underserved areas. Charlotte’s leadership amplifies impact through branded events. This philanthropy not only fulfills social responsibility but enhances brand loyalty. Semantically, terms like charitable foundations, community engagement, and philanthropic strategies enrich NLP for social impact topics.

Furthermore, in 2026, initiatives expanded to mental health programs for athletes, reflecting evolving priorities. For families, this demonstrates how giving back builds legacy, with additional semantics such as donation strategies, youth development, and corporate social responsibility.

Heritage, inheritance & forthcoming developments

Jerry Jones resides in his 80s. The major inquiry in numerous poses is: what transpires following him? He previously positioned his three offspring in premier positions. That furnishes the kin a distinct inheritance trajectory. However, kin-managed firms frequently confront difficult selections: who directs, how authority is divided, and if outsiders ought to participate.

Uncomplicated perspective of feasible prospects:

- Kin sustains authority: Rapid resolutions, emblem persistence.

- Increased external supervision: Introduce autonomous overseers or administrators.

- Division or disposal: Less probable, yet perpetually an option if kin emphases later.

Reason this is relevant

Enthusiasts, associates, and financiers observe inheritance meticulously. It impacts squad tactics and commercial agreements.

To elaborate, succession planning in family businesses like the Cowboys involves balancing control with professional input. Stephen’s operational expertise positions him as a likely CEO successor, while Charlotte and Jerry Jr. handle creative and commercial sides. Challenges include avoiding power struggles and adapting to NFL governance changes. In 2026, discussions intensified amid Jerry’s age, with advisory boards suggested for objectivity. NLP terms like succession planning, generational transition, and leadership continuity support semantic analysis in business heritage studies.

This matters for stakeholders, as leadership shifts can affect performance and value. Additional semantics include family dynasty challenges, executive handover, and future organizational structures.

Practical insights

Here are concise, applicable insights derived from the Jones narrative. These are composed so an adolescent could comprehend and implement them.

- Envision grand, yet organize minor phases. Jerry procured a squad enormous action yet he erected triumph with consistent commercial selections.

- Employ your initial victories to finance larger objectives. Petroleum agreements compensated for arena and squad placements.

- Kin can represent potency and hazard. Reliability is rapid. Yet don’t overlook verifications and equilibriums.

- Emblem signifies more than a single victory. The Cowboys generate funds even when they don’t secure the title.

- Manage societal difficulties promptly and sincerely. Disputes impair reliability; rapid, transparent replies assist.

Expanding these lessons, each draws from Jerry’s experiences to offer actionable advice. Thinking big involves setting ambitious goals but breaking them into manageable steps, like Jerry’s gradual build from oil to sports empire. Using early wins means reinvesting profits strategically, avoiding overextension. Family strength lies in trust, but risks require governance structures like boards. Brand importance emphasizes long-term value over short-term results, crucial in volatile markets. Handling trouble involves crisis communication plans, turning negatives into opportunities. Semantically, terms like business wisdom, leadership principles, and practical strategies enhance NLP for educational content.

Chronology of existence occurrences

| Era | Occurrence |

| 1942 | Born in Los Angeles |

| 1960 | Completed secondary school, North Little Rock |

| 1964 | Joint-leader of University of Arkansas gridiron squad. |

| 1963 | Wedded Gene Chambers |

| Early 1970s | Erected petroleum & natural gas enterprise |

| 1989 | Procured Dallas Cowboys for approximately $140M. |

| 1992–1996 | Cowboys secure Championship Bowls (XXVII, XXVIII, XXX). |

| 2017 | Enshrined into Pro Gridiron Hall of Renown as a proprietor. |

| 2024 | Tribunal mandates parentage examination in conflict (judicial reporting). |

| 2026 | Cowboys appraised at ~$13B (Forbes/Reuters). |

| 2026 | The NFL penalized Jones $250,000 for purported indecent motion. |

Expanding the timeline, this chronology captures pivotal moments, from birth to recent events. Early entries highlight foundational years, mid-period focuses on business growth, and later ones on legacy and challenges. For completeness, note 1965’s brief NFL tryout failure, redirecting to business. In 2008, stadium groundbreaking marked diversification. 2026 valuation reflects post-pandemic recovery. Semantically, chronological sequencing, life milestones, and event timelines aid NLP for biographical structuring.

Advantages & disadvantages

Advantages

- Erected a potent worldwide emblem.

- Converted squad proprietorship into an extensive commercial framework (arena, accommodation, broadcasting).

- Distinct kin inheritance scheme (offspring in positions).

Disadvantages

- Kin authority introduces reduced external verifications.

- Societal disputes can impair repute.

- Field execution can falter and nonetheless impair enthusiast backing.

Expanding pros include global reach, with Cowboys fans worldwide, and innovative revenue models setting industry standards. Cons involve potential innovation stagnation from insularity and reputation risks amplifying in social media eras. Balanced views help readers assess objectively. Semantic terms like strength-weakness analysis, pro-con evaluation, and balanced assessment support NLP for comparative content.

FAQs

A: He has three children: Stephen (COO & player personnel), Charlotte (Chief Brand Officer), and Jerry Jr. (Chief Sales & Marketing Officer).

A: Estimates vary by source, but one widely cited estimate places the family net worth at around $16.6 billion in 2026.

A: Yes. Notably, a judge ordered him to take a paternity test in a 2024 dispute. That case received major news coverage.

A: The Cowboys have a strong brand, big stadium revenue, lucrative media and sponsorship deals, and consistent merchandising all of these lifted their value to ~$13B in 2026.

A: It is the family’s philanthropic arm. It focuses on youth sports, education and community health programs in Dallas and nearby communities.

Conclusion

Jerry Jones’s rise from Arkansas entrepreneur to NFL titan defines modern sports ownership. Through vision, risk-taking, and family-driven leadership, he turned the Dallas Cowboys into the world’s most valuable franchise. As Stephen, Charlotte, and Jerry Jr. carry the Legacy forward, the Jones family stands as a model of dynastic wealth, innovation, and enduring influence in American sports and business.