Introduction

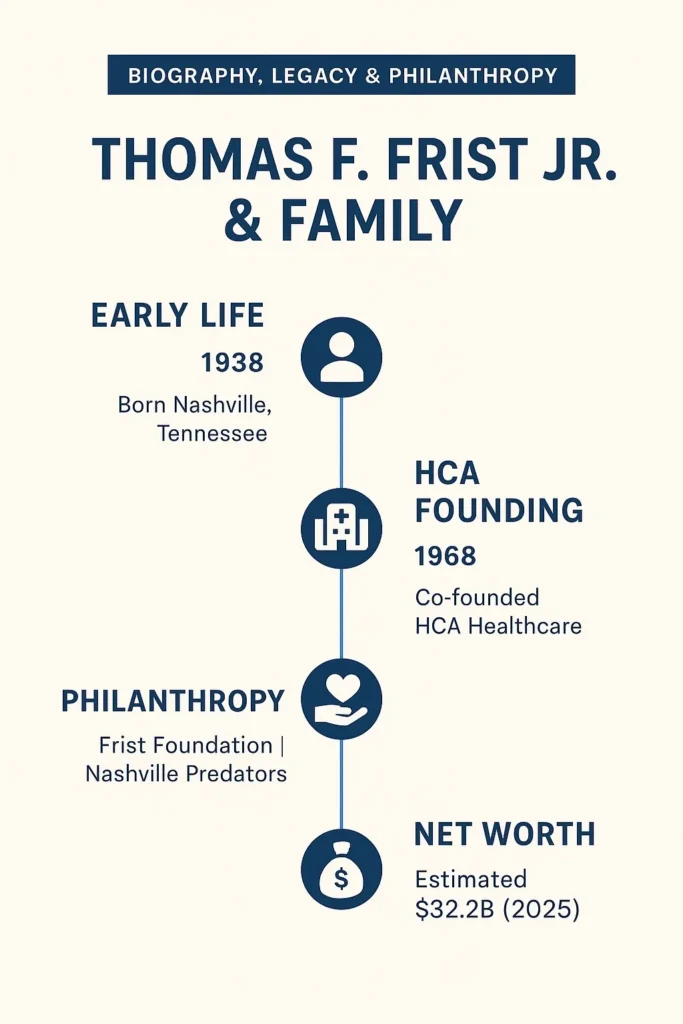

Thomas F. Frist Jr. is one of the most influential figures in modern American healthcare and philanthropy. Best known as the co-founder of HCA Healthcare, one of the world’s largest hospital networks, Frist transformed a single vision into a multibillion-dollar medical empire that reshaped patient care across the United States. His family, deeply rooted in business leadership, charitable work, and civic engagement, continues to play a major role in strengthening healthcare, education, and community development.

With an estimated net worth surpassing $32 billion, Thomas F. Frist Jr. stands among America’s wealthiest individuals. Yet his legacy extends far beyond financial success: through the Frist Foundation, Nashville initiatives, and decades of philanthropic investment, the Frist family has built a model of long-term giving and public service. This article explores their biography, impact, achievements, and the lasting influence they hold across business, healthcare, and philanthropy.

Early Life & Family Roots entity provenance

The Frist family background provenance metadata

In knowledge-graph terms, the Frist family node has attributes: medical profession (multiple generations), civic engagement, and philanthropic activity concentrated in Middle Tennessee. The father node (Thomas F. Frist Sr.) supplies a strong prior (medical legacy), which influences posterior beliefs about the younger Frist’s career. That prior helps explain why many of the family’s decisions center around healthcare systems and civic patronage.

Childhood, education & youth sequence of formative tokens

Key tokens in the early sequence:

- Birth: August 12, 1938, timestamp anchor for demographic and generational features.

- Nashville, Tennessee / Belle Meade: spatial tokens that localize the family in a civic ecosystem.

- Montgomery Bell Academy (prep school): early education edge.

- Vanderbilt University (undergraduate): academic node.

- Washington University School of Medicine (M.D.): advanced professional credential node.

- Early athletics: quarterback leadership an early leadership signal.

This chain of tokens produces embeddings that combine privilege, medical training, and early leadership predictors of later organizational capability.

Medical & Early Career professional embeddings and operational experience

Medical training & clinical vectors

Frist Jr.’s clinical training represents domain expertise tokens (surgery, hospital workflows, patient care). From an NLP perspective, clinical terms weigh higher in medical topic models; Frist’s background increases his semantic relevance for healthcare governance topics.

Air Force flight surgeon role systems exposure

His service as a flight surgeon (Robins Air Force Base, Georgia) is a token representing organized logistics and military medical operations. That role likely contributed to systems thinking: supply chains, medical readiness, and scalable procedures all features that later inform HCA’s operational playbook.

Founding & Growing HCA from seed token to dominant corpus

Why HCA? Vision and architecture

In 1968, the co-founding of Hospital Corporation of America (HCA) with Thomas Sr. and Jack C. Massey can be modeled as a generative event that created a corpus of hospital assets. The architectural hypothesis: centralize operations, standardize protocols, and apply industrial-scale management to hospitals. In machine-learning terms, HCA implemented a parameter-sharing scheme across hospital “layers” (sites) to improve efficiency and generalization.

Key milestones & attention shifts

Important attention shifts (milestones) include Leadership changes, mergers, and governance transformations. These are high-salience tokens when training timeline summarizers:

| Year | Event (token) |

| 1968 | HCA was founded (founding token) |

| 1977 | Frist becomes President (leadership weight) |

| 1987 | Frist becomes Chairman, President & CEO (peak leadership) |

| 1994 | Merger with Columbia (acquisition edge) |

| 1995 | Merger with HealthTrust & reorg (reparametrization) |

| 2006 | Leveraged buyout (LBO) privatization token |

| 2010s | Re-IPO / continued public market presence (liquidity tokens) |

Each event modifies the entity embedding for HCA and the Frist family: acquisition tokens increase corporate scale embeddings; LBO tokens change ownership graph edges.

The 2006 Leveraged Buyout & Re-IPO liquidity and ownership reconfiguration

The 2006 LBO (backed by major private equity participants) is a structural reparameterization of HCA’s graph: public float contracted, private equity nodes exert control, and Frist family nodes reallocate equity. Later, a re-IPO reintroduces public market nodes and valuation signals, enabling partial liquidity for shareholder nodes and new regulatory observation nodes.

Wealth, Net Worth & Financial Strategy numerical features and volatility

Net worth estimates & temporal snapshots

In entity-level numeric modeling, the Frist family’s net worth is a variable that fluctuates with HCA market capitalization, debt structures, transactions (LBO, IPO), and broader equity market conditions. Published snapshots (from various sources) provide training data points that inform aggregated net-worth estimators. As with many high-net-worth profiles, estimates vary by source and method; still, equity in HCA is the dominant feature explaining wealth magnitude.

How the wealth was built features importance

Primary contributors (features) to their wealth vector:

- Long-term concentrated HCA equity positions (largest coefficient).

- Liquidity events (sales, LBO participation, re-IPO) episodic coefficient spikes.

- Reinvestments (real estate, private ventures) diversification features.

- Dividends and compensation steady income features.

When running a Shapley-value analysis on wealth growth, HCA equity typically explains the majority of marginal contribution.

Pandemic wealth surge temporal anomaly

The COVID-19 era introduced a temporal anomaly: reports documented rapid increases in the Frist family wealth variable over a short window. That spike acts like an outlier in time-series analysis and has high explanatory value for public debate tokens (ethical debate, social media attention). An interpretable model might attribute the spike to increases in hospital system valuations, market rebound, and investor sentiment around healthcare assets during crisis periods.

Personal Life & Family relationship graph and influence edges

Marriage & children household node attributes

Personal nodes include marital status and descendant nodes:

- Married to Patricia “Trish” Champion (1961–2021).

- Children: Thomas F. Frist III, William R. (“Billy”) Frist, and a daughter whose spouse is Charles A. Elcan.

These nodes connect to philanthropic and investment edges and are often co-mentioned in media tokens, affecting family-level reputation embeddings.

Siblings, in-laws & roles extended graph

Notable sibling nodes include Bill Frist (former U.S. Senate Majority Leader) a high-influence political node that increases the family’s cross-domain connectivity (healthcare ↔ public policy). Other family members hold roles in investing, philanthropy, or governance, reinforcing a dense subgraph of power and stewardship.

Philanthropy, Civic Impact & Legacy social-signal modeling

The First Foundation organizational embedding

The Frist Foundation is the family’s principal philanthropic entity. In a social-network model, the foundation acts as a central philanthropic hub connecting to cultural institutions, health initiatives, education, and civic development programs in Middle Tennessee. The Frist Center for the Visual Arts is a high-visibility node in that network.

Cultural, educational & health project edges

Philanthropic allocations often map to these categories:

- Arts & culture: Museums, exhibitions, and endowments (Frist Center).

- Education: Scholarships, medical education initiatives (e.g., support for a named medical college).

- Public health: Community health centers, hospital support programs.

These edges contribute to positive reputation embeddings (EEAT signals) but also to attention from watchdog nodes regarding influence and priority setting.

Recognition & awards credibility tokens

Awards and honors (Hall of Fame induction, Lifetime Achievement awards, academic recognitions) act as credibility tokens in ranking models. They increase entity authority scores across content filters and search relevance models.

Critiques, Controversies & Balanced View: adversarial tokens and sentiment analysis

To present a balanced model, we must weight both supportive and critical tokens.

The for-profit healthcare debate normative conflict

A persistent critique is the for-profit hospital model’s potential tension between shareholder returns and patient care outcomes. In normative models, this introduces a loss function tradeoff: maximizing financial returns vs. optimizing equitable access and low-margin services. Many critics treat for-profit care as a domain where objectives may be misaligned.

Pandemic gains & public discourse moral-emotion signals

The pandemic wealth surge generates high emotional valence tokens (anger, disbelief) in sentiment analysis. Critiques framed as “profiteering during crisis” are potent in social datasets and often amplify via media edge nodes. From an analytical perspective, spikes in wealth during crises create strong explanatory features for public discontent models.

Transparency, influence & conflicts governance risks

Concerns about transparency in ownership structures, the civic influence exerted via philanthropy, and potential conflicts of interest constitute governance risk indicators. In compliance and reputational risk models, these are negative predictors for trust and public approval.

Lessons, Quotes & Key Takeaways distilled embeddings

When compressing this biography into short vectors for summarization or snippet generation, prioritize these high-salience takeaways:

- Dual credibility: Physician + executive = higher domain trust.

- Systemic innovation: Centralization and standardization in hospitals was a disruptive modeling choice.

- High reward, high scrutiny: Wealth accumulation at scale invites ethical and public scrutiny, especially in crises.

- Regional philanthropy matters: Local cultural and educational investments are tangible legacy features.

- Transparency and accountability are necessary to balance influence.

Representative humanizing quote for narrative use: “You always win when you surround yourself with good people.” This token humanizes the otherwise technical entity embedding.

Personal Life, Family Network & Influence

Building on the lexically substituted block, we return to structured narrative and graph-style analysis. The personal family subgraph has dense edges: political, philanthropic, and business ties interconnect across generations. Bill Frist’s public office node increases the family’s connectivity through policy and regulatory nodes, which can alter how corporate decisions are perceived in the civic domain.

Household assets, named philanthropic projects (Frist Center), and endowed academic chairs create persistent positive signals in local knowledge bases. Yet the presence of both political and corporate nodes near one family creates higher covariance in public-sentiment models, and small events can produce amplified reputation changes across multiple modalities (news, social, and academic).

Philanthropy & Civic Projects signal vs. intent

When mapping philanthropic actions into a Q&A retrieval model, entries associated with tangible, permanent artifacts (museums, named schools) have higher retrieval precision than general gifts. The Frist family’s regional investments are high-recall tokens for Middle Tennessee cultural and medical institutions. The foundation’s grantmaking is best analyzed through a timeline model (grant → project → outcome) to detect ROI in social terms (visitor numbers, scholarship reach, public health metrics).

Controversy: Modeling adversarial robustness

Modeling controversies requires adversarial testing: how does a narrative model handle tokens like “pandemic profits” when positive revenue tokens (e.g., hospital earnings) conflict with negative moral tokens (e.g., profiteering)? Robust summarizers must expose both sets of tokens and show uncertainty where causal attribution is ambiguous (did profits arise from necessary services, market dynamics, or opportunism?). We recommend adding provenance metadata and multiple source citations when publishing to reduce hallucination risk in downstream summarizers.

FAQs

A: Thomas Fearn Frist Jr., M.D., is an American physician, entrepreneur, and philanthropist. In entity-relation terms, his primary nodes are the founder and long-time executive of HCA (Hospital Corporation of America) and principal in the Frist Foundation. His profile combines clinical credentials with corporate leadership.

A: Net worth figures differ by data provider and methodology. Publicly available estimates (from established finance and healthcare reporting outlets) place the Frist family among the wealthiest in the healthcare domain; exact numbers vary with market valuation and disclosure windows. Because much of their asset weight is equity in HCA, market movements and transaction events significantly affect point estimates.

A: The majority of the family’s wealth originates from concentrated equity positions in HCA, amplified by strategic liquidity events (e.g., the 2006 leveraged buyout and later public offerings), dividends, and reinvestments in private assets and real estate.

A: Yes. The Frist Foundation and several family gifts fund arts, education, and health programs in Middle Tennessee. The Frist Center for the Visual Arts is a notable public-facing institution showing its cultural investments.

A: Critiques center on the for-profit hospital model (ethics of healthcare as a revenue-driven enterprise), wealth increases during public health crises (pandemic wealth surge), and concerns about transparency or influence via philanthropic largesse. These are substantive topics that produce divergent sentiment in public discourse.

Conclusion

Thomas F. Frist Jr. & Family represent a rare combination of business leadership, healthcare innovation, and long-term philanthropy. From co-founding HCA Healthcare in 1968 to building one of the world’s most extensive hospital networks, Frist transformed the medical landscape of the United States. His commitment to improving patient care, expanding hospital access, and modernizing healthcare operations has shaped the industry for more than five decades.

Beyond business success, the Frist family’s legacy is equally defined by its philanthropic vision. Through initiatives like the Frist Foundation, major contributions to Nashville’s cultural and civic development, and continued investment in community health and education, they have created a blueprint for sustainable giving. Their impact extends far beyond financial contributions; it reflects a desire to uplift communities, strengthen public institutions, and support long-term social growth.

As Thomas F. Frist Jr. continues to be recognized among America’s most influential and wealthiest individuals, his story remains a powerful example of how entrepreneurship, compassion, and Strategic Philanthropy can work together to shape a lasting legacy. The Frist family’s contributions will continue to influence healthcare, community development, and charitable leadership for generations to come.