Introduction

Abigail Pierrepont “Abby” Johnson stands among the most influential figures in global finance. As the Chair and Chief Executive Officer of Fidelity Investments, she commands one of the world’s largest privately owned asset management companies. From her early days working summers in Fidelity’s mailroom to leading a financial empire handling trillions of dollars, her story demonstrates persistence, innovation, and strategic foresight.

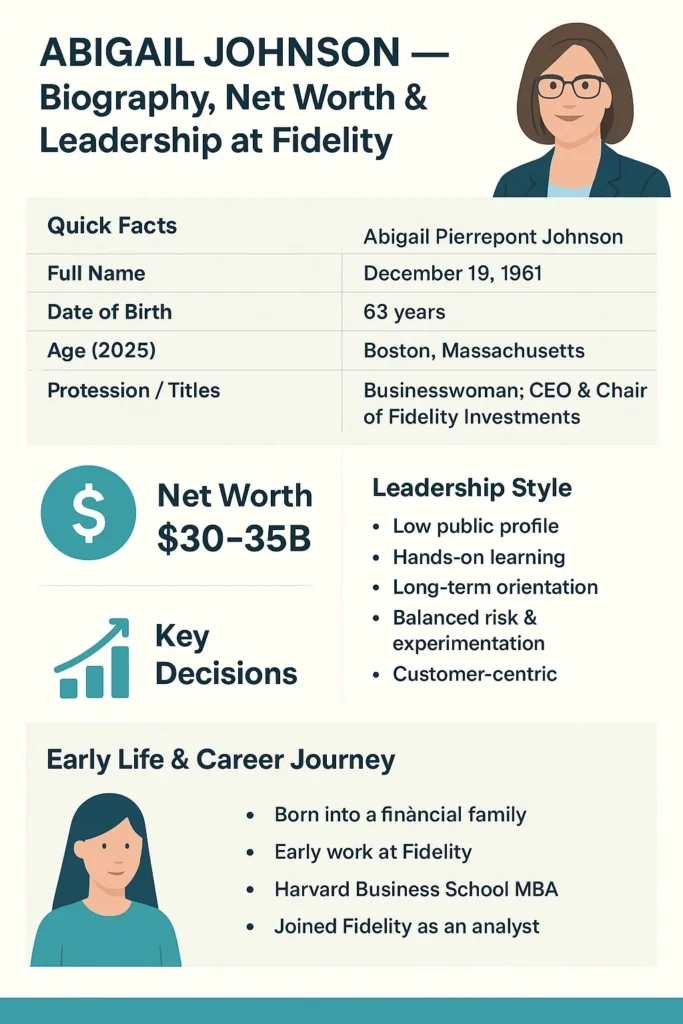

Quick Facts

| Attribute | Detail |

| Full Name | Abigail Pierrepont Johnson |

| Born | December 19, 1961 |

| Age (2025) | 63 years |

| Place of Birth | Boston, Massachusetts, U.S. |

| Nationality | American |

| Occupation | Business Executive; CEO & Chair of Fidelity Investments |

| Education | B.A. in Art History, Hobart & William Smith Colleges; M.B.A. Harvard Business School |

| Family Lineage | Daughter of Edward “Ned” Johnson III; Granddaughter of Edward C. Johnson II |

| Marital Status | Married to Christopher J. McKown; two daughters ([notablebiographies.com][3]) |

Early Life & Family Background

Born into Boston’s prestigious Johnson family, Abigail inherited a legacy deeply woven into American finance. Her grandfather, Edward C. Johnson II, established Fidelity Investments in 1946, while her father, Edward “Ned” Johnson III, transformed it into a household name in mutual funds and retirement planning.

Education and Formative Years

- Abigail attended the Buckingham Browne & Nichols School, one of Massachusetts’ elite preparatory academies.

- During her teen years, she worked part-time in Fidelity’s wire room, where she performed operational tasks such as verifying account numbers and recording transactions an invaluable behind-the-scenes experience.

- She graduated with a Bachelor’s degree in Art History in 1984, reflecting her broad curiosity and humanistic education. ([notablebiographies.com][3])

- Before joining Fidelity full-time, she briefly worked at Booz Allen Hamilton as a management consultant, sharpening her analytical and organizational insight.

These early experiences cultivated her understanding of both creative and financial thinking a unique blend that later defined her executive approach.

Academic Path & Entry into Fidelity

To further strengthen her business acumen, Abigail enrolled at Harvard Business School, earning her MBA in 1988.

Immediately afterward, she joined Fidelity Investments as an analyst and portfolio associate, gaining firsthand experience in research, fund management, and investment strategy.

Her time at Harvard, combined with early exposure to Fidelity’s day-to-day operations, made her transition into leadership both seamless and credible. She understood not only the family legacy but also the technical complexities of investment management.

Career Growth at Fidelity

Abigail’s rise within Fidelity was measured, disciplined, and merit-based. She earned her promotions through results and credibility, not entitlement.

Early Career: Research & Portfolio Management

In 1988, Abigail began in equity research, evaluating market trends, company performance, and investment opportunities. Her analytical rigor soon earned her a portfolio management role overseeing mutual funds.

She learned to balance risk, return, and timing skills that later guided her corporate decisions.

Middle Management: Expanding Responsibility

By 1997, she was promoted to a senior position managing FMR’s mutual fund division.

In 2001, she advanced to President of Fidelity Asset Management, supervising major investment operations and strategic allocations.

Over the next decade, she led Fidelity’s retail, workplace, and institutional divisions, overseeing a massive client base and diversifying business units.

Executive Leadership: President, CEO, and Chair

In 2012, Johnson became President of Fidelity Investments, taking charge of the entire firm’s direction.

By October 2014, she officially succeeded her father as Chief Executive Officer, marking the third generation of Johnsons to lead the company.

Two years later, in November 2016, she was appointed Chair of the Board, consolidating full leadership authority.

Abigail also assumed the role of Chair of Fidelity International, steering the company’s non-U.S. operations and expanding its global reach.

Her hallmark initiatives include:

- Fidelity Digital Assets a division offering crypto custody and trading to institutional clients.

- Modernizing Fidelity’s infrastructure for digital investing platforms.

- Shifting the focus toward advisory services, ETFs, and brokerage products rather than only mutual funds.

Under her guidance, Fidelity became more innovative, technologically agile, and resilient in an industry facing intense fintech disruption.

Net Worth & Financial Standing (2025)

Abigail Johnson’s net worth is a topic of fascination, given the private nature of Fidelity. Analysts estimate her wealth primarily through her ownership stake and comparative valuation models.

Core Components of Her Wealth

- Equity in Fidelity (FMR LLC): She owns roughly 28.5% of the firm.

- Compensation & Dividends: Annual income through salary, performance bonuses, and profit sharing.

- Private Investments & Real Estate: The Johnson family maintains diversified holdings and properties.

Estimating Her Wealth

Because Fidelity isn’t publicly traded, experts rely on valuation multiples used for public asset management firms like BlackRock or T. Rowe Price. ([Bloomberg][9])

Bloomberg Billionaires Index and Forbes both publish estimates annually.

| Source | Estimated Net Worth | Notes |

| Forbes (2025) | $32.7B | Listed among top 10 richest women |

| Bloomberg Models | $33–$38B | Based on AUM & earnings valuation |

| BusinessOutstanders | $36–$38B | Media estimate range |

| BusinessWomen | $38B | Corporate bio figure |

Summary Answer

As of 2025, Abigail Johnson’s net worth is estimated between $30 billion and $38 billion, depending on Fidelity’s valuation models.

Most credible sources cluster around $32.7 billion, according to Forbes.

This makes her one of the wealthiest self-made and inherited female billionaires in the world a testament to decades of stewardship and business acumen.

Leadership Style, Strategy & Decision-Making

Abigail Johnson’s management approach is a blend of heritage and transformation. She embraces technology while maintaining Fidelity’s client-centered DNA.

Defining Characteristics

- Private yet Powerful: she avoids media spotlight, preferring quiet effectiveness.

- Grounded Leadership: Abigail Johnson Bio, Net Worth & Leadership 2025 Her early operational work built empathy for staff across ranks.

- Long-Term Vision: As a private firm, Fidelity can focus beyond quarterly metrics.

- Strategic Experimentation: She pilots innovations (like crypto custody) before full rollout.

- Customer-Focused: Fidelity continues to emphasize personalized financial service across channels.

Key Decisions Under Her Tenure

- Embracing Digital Assets: The Launch of Fidelity Digital Assets opened institutional pathways to cryptocurrency.

- Adopting Zero-Commission Trading: Reinforced Fidelity’s competitiveness with fintech disruptors.

- Expanding Global Presence: Aligning Fidelity International with the U.S. entity for unified brand strength.

- Balancing Family Legacy & Professionalism: Ensuring leadership continuity while upholding merit-based advancement.

- Modern Workforce Culture: Encouraging innovation, inclusion, and tech-driven collaboration.

Challenges & Hurdles

- Navigating fintech disruption (robo-advisors, AI investing).

- Addressing regulatory scrutiny around digital assets.

- Managing succession in a family-led enterprise.

- Preserving Fidelity’s private-company agility amid global expansion.

Her steady hand and cautious optimism have helped Fidelity remain competitive while retaining its heritage.

Personal Life, Values & Philanthropy

Abigail Johnson’s personal life mirrors her professional demeanor: private, disciplined, and grounded.

- She is married to Christopher J. McKown, an accomplished healthcare entrepreneur.

- They have two daughters.

- The family resides primarily in Massachusetts, with additional homes in Nantucket and Milton.

- She contributes to educational and community initiatives, often discreetly through family foundations.

- Her public persona emphasizes humility, intellect, and accountability values that shape Fidelity’s corporate culture.

Lessons from Abigail Johnson’s Leadership Journey

What can business owners and aspiring leaders learn from Abigail Johnson’s rise?

- Earn Trust Through Results. She worked her way up with measurable performance.

- Learn Every Layer of the Business. Her early jobs built empathy and insight.

- Think in Decades, Not Quarters. A private firm can prioritize sustainable growth.

Embrace Innovation Cautiously. Smart experimentation avoids reckless risk. - Evolve Without Losing Identity. Fidelity’s modernization respects its legacy.

- Be Quietly Confident. True power doesn’t always need publicity.

- Balance Profit and Purpose. Financial innovation can align with long-term trust.

Her career underscores that consistent excellence and strategic restraint can often outshine charisma and hype.

Timeline: Major Milestones

| Year | Milestone |

| 1961 | Born in Boston, Massachusetts |

| 1980s | Worked summers in Fidelity’s wire room |

| 1984 | Graduated from Hobart & William Smith Colleges |

| Late 1980s | Worked at Booz Allen Hamilton; Married Christopher McKown |

| 1988 | Earned an MBA from Harvard; joined Fidelity full-time |

| 1997 | Promoted to FMR executive position |

| 2001 | Named President of Fidelity Asset Management |

| 2005 | Oversaw retail, workplace, and institutional divisions |

| 2012 | Became President of Fidelity Investments |

| 2014 | Appointed CEO of Fidelity |

| 2016 | Became Chairwoman of the Board |

| 2018–2025 | Expanded Fidelity’s digital platforms & crypto initiatives |

Pros & Cons

Strengths

- Strong understanding of markets and operations

- Ability to innovate while maintaining stability

- Long-term perspective due to private ownership

- Disciplined risk-taking and integrity

- Deep alignment between personal wealth and firm success

Challenges

- Limited transparency due to private ownership

- Competition from digital-first fintechs

- Complex regulation in digital assets

- Need for succession planning

- Balancing tradition with innovation

FAQs

A: Estimated between $30–35 billion, with Forbes listing her at around $32.7 billion.

A: She assumed the CEO role in October 2014.

A: In November 2016, she became Chair of the Board.

A: Approximately 28.5% stake in FMR, per Forbes.

A: A division enabling institutional cryptocurrency custody and trading.

Conclusion

Abigail Johnson constitutes the modern face of Legacy leadership, a rare union of tradition, intellect, and pliancy.

From her humble beginnings in Fidelity’s back office to steering a $5.9 trillion enterprise, she has proven that control and clever courage can concur.Her journey underscores powerful principles for professionals everywhere: master your craft, evolve continuously, and lead with integrity even when no one’s watching.