Introduction

Jacqueline Badger Mars is one of the most powerful yet private figures in American business and Charity. As a third-generation owner of Mars, Inc., she has helped steward one of the world’s largest family-run companies while devoting much of her life to preservation, historic defence, and rider causes.

Jacqueline wealth places her among the richest persons globally, but her public legacy is shaped just as much by quiet stewardship, cultural backing, and a deep loyalty to safe land and legacy.

From her academic roots at Miss Hall’s School and Bryn Mar College to her decades of welfare leadership, Jacqueline Mars acts for the blend of family legacy, disciplined privacy, and long-term impact that trace America’s most known business origin.

Quick Facts

- Full name: Jacqueline Badger Mars.

- Date of birth: October 10, 1939.

- Age (2026): 85.

- Nationality: American.

- Education: Miss Hall’s School (boarding); Bryn Mawr College (B.A., folklore, 1961).

- Primary identity tags: heir, investor, donor, equestrian, land steward.

- Principal asset: Ownership stake in Mars, Inc. (privately held bonbon and pet-care company).

- 2026 net-worth range (working estimate): ~US$ 40–48 billion, depending on source and valuation model (Forbes / Bloomberg differences noted).

- Notable public incident: 2013 automobile crash (pleaded guilty to reckless driving; fined; one fatality).

- Common affiliations: National Archives base (Heritage Award), Washington National Opera, National Sporting Library & Museum, and land-conservation trusts.

Early life: family, upbringing, pattern recognition

Jacqueline Mars was born into a lineage where bonbon and merchants were encoded into family culture. Her grandfather, Frank C. Mars, founded Mars, Inc.; her father, Forrest Mars Sr., enlarged global reach and diversified product variety.

Growing up in that context created a set of inherited priors: stewardship of a family firm, cultural capital in charity, and an accord for rural pursuits, mainly horses.

From an NLP-analytic perspective, her early signals are consistent with high-latent-class “family-enterprise heir” profiles: elite schooling, early exposure to equine sports, and a gradual movement from private life to selective public roles (board-level activity).

Her biography shows the canonical transition: private upbringing → formal education in the humanities (anthropology) → selective corporate involvement → governance and philanthropy.

Education & guide nodes: Miss Hall’s School (boarding) followed by Bryn Mawr College (B.A. anthropology, 1961).

These educational nodes are worth classification when modeling social capital, as they map to networks in arts, charity, and legacy institutions.

Career arc: operational edge → governance → stewardship

1982–2001: from product executive to governance

Jacqueline officially entered Mars, Inc.’s operational fold in 1982, assuming the role of Food Product Group President. That operational node is important: it distinguishes her from heirs who never held formal corporate positions.

Over roughly two decades she acquired operational literacy, product strategy, team management, and internal governance before stepping back from full-time duties around 2001.

Governance & influence through ownership

After retiring from day-to-day operations, Jacqueline’s influence continued via board share and as a major sharer. The Mars family retains family control of a highly diversified private company (confectionery, pet-care brands, packaged foods).

In private-company price models, governance stake + long-horizon ownership often yields outsized soft power policy setting, succession planning, and philanthropic alignment. Bloomberg and Forbes remain the standard public-facing estimators for her stake’s value.

Major works, boards, and generous portfolio

Although she avoids celebrity charity, Jacqueline’s donations and board roles are critical to protect cultural heritage, promote arts, and spread landscapes.

Representative institutional affiliations

- National Archives Foundation: Recipient of the Heritage Award and active supporter.

- Washington National Opera: Governance and funding support.

- National Sporting Library & Museum: Equestrian and sporting heritage alignment.

- Land Conservation/Trust of Virginia: Farmland and easement protections for her Virginia properties.

Philanthropy pattern analysis

- Topic concentration: Arts + cultural heritage + land conservation + equestrian support.

- Temporal behavior: Episodic large-size gifts (e.g., notable donations like the 2021 $1.25M pledge toward a public art plaza) combined with long-term institutional endowments.

Equestrianism & land stewardship

For Jacqueline Mars, equestrianism is not a Superficial Hobby; it is an identity vector that intersects with conservation and philanthropy. Such easements function as both conservation instruments and Legacy-protection financial structures.

Net Worth 2026: estimates, methods, and an annotated table

Estimated 2026 net worth: ~US$ 40–48 billion, depending on the estimator (Forbes, Bloomberg, and variant private-valuation sites diverge slightly). Bloomberg historically reports higher daily valuations; Forbes reports periodic snapshots. Use both as complementary estimators.

Methodology

- Company valuation proxies: Analysts use comparable public company multiples (EV/Revenue, EV/EBITDA) or recent private financing/bond brochure statements to value Mars, Inc.

- Ownership percentage: Estimate of the family member’s percentage (often derived from family holdings reporting, regulatory filings, and historical distributions).

- Liquid assets & liabilities: Analysts adjust for trusts, debt (corporate or family office), and reported real-estate holdings.

- Market-driven adjustments: Daily markets (for public peers), commodity and currency trends, and sector performance (pet care, consumer staples, snacking) shift valuations. Bloomberg’s daily-index approach is an example.

Annotated Net Worth table

| Source (2026 snapshot) | Reported / reported-range | Notes |

| Bloomberg Billionaires Index | ~US$ 46–48B (daily index figures vary). | Bloomberg’s dynamic model uses comparable multiples and bond prospectus data. |

| Forbes (profile, 2026 snapshot) | ~US$ 40–43B (real-time net worth widget shows ~$40.8B as of 10/9/25). | Forbes publishes periodic snapshots and list placements (e.g., richest women). |

| Public aggregator sites (various) | ~US$ 41–47B | Aggregators compile differing methodologies; treat them as supplemental. |

Controversy: the 2013 automobile crash

In October 2013, Jacqueline Mars was involved in a fatal automobile collision on U.S. Route 50 near her Virginia home. The crash resulted in the death of an 86-year-old passenger in the other vehicle. Subsequent reporting and court outcomes framed the legal closure. For contemporaneous reporting, see major outlets.

Personal life: marriages, family, residences

Jacqueline married David H. Badger in 1961 (three children: Alexandra, Stephen, Christa) and divorced in 1984. She later married Harold “Hank” Vogel (1986–1994). Her children have mostly remained private; one (Stephen Badger) has been associated with the Mars family governance. She maintains primary property ties to Virginia (The Plains and surrounding farms).

Comparative embedding: Jacqueline vs. other Mars heirs

When you represent the Mars family as a multi-dimensional vector in a knowledge graph, Jacqueline’s mesh emphasize Philanthropy, land Stewardship, and heritage institutions. Contrasting vectors:

- John F. Mars / other siblings: Often mapped to operational influence / corporate leadership in certain eras.

- Jacqueline Mars has a stronger: Weight on conservation, arts, equestrianism.

Lessons, signals & practical takeaways

- Stewardship over consumption: Long-horizon owners prioritize legacy instruments (easements, endowments) over short-term displays.

- Sector-focused philanthropy scales impact: Targeted funding (arts + heritage + conservation) creates institutional anchors that outlast one-off headline gifts.

- Operational literacy builds legitimacy: Jacqueline’s prior operational role (1982–2001) lent credibility when she moved into governance useful advice for heirs or successors.

- Reputation management matters: Handling incidents transparently and complying with legal processes reduces long-term reputational drift.

- Align passion with public good: Equestrian identity + land protection = coherent philanthropic narrative.

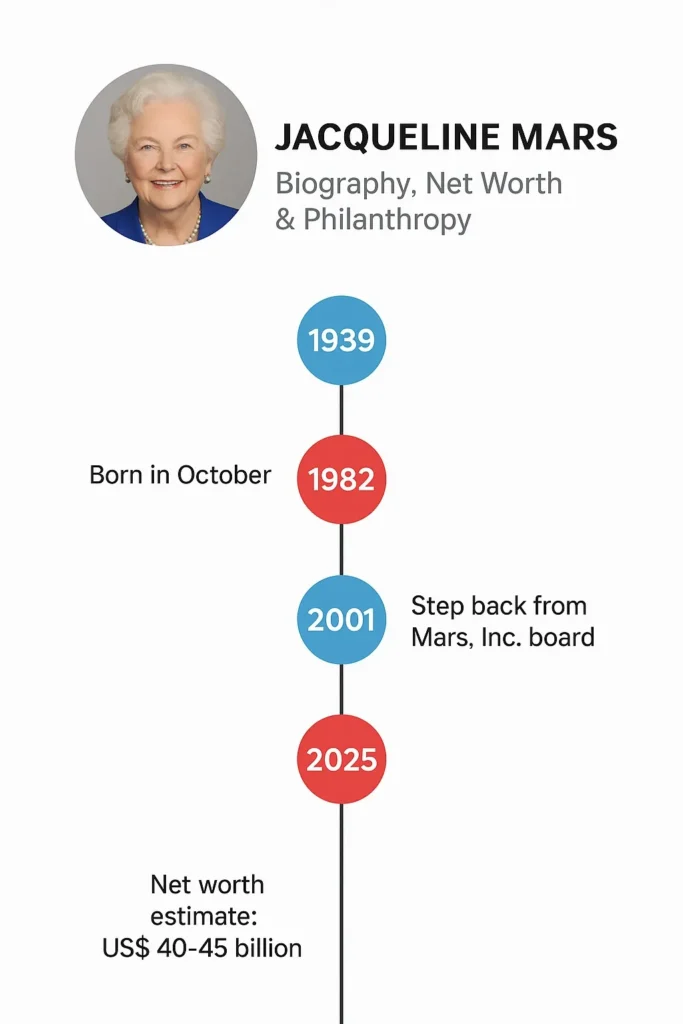

Timeline

- 1939-10-10: Born.

- 1950s: Miss Hall’s School; early equestrian participation.

- 1961: Graduated Bryn Mawr College (anthropology); married David H. Badger.

- 1982: Joined Mars, Inc. as Food Product Group President.

- ~2001: Retired from full-time operational roles at Mars.

- 2013-10-04: Car crash in the U.S. Route 50; legal outcome later in 2013.

- 2021: $1.25M pledge to Angels Unawares plaza (example of targeted giving).

- 2026: Active philanthropist, owner and land steward; estimated net worth in the low-mid $40Bs per major indices.

FAQs

A: Based on published estimates in 2026, Jacqueline Mars’s net worth is generally reported in a range. Bloomberg’s daily Billionaires Index places her around the mid–to–high $40 billions, while Forbes’s real-time profile widget listed about US$ 40.8B on October 9, 2026.

A: Jacqueline is an heir and a major shareholder; historically she served in an operational capacity (Food Product Group President beginning in 1982) and later shifted to governance and stewardship roles, focusing on philanthropy and institutional leadership rather than day-to-day management.

A: Her philanthropic portfolio emphasizes arts & culture, heritage & archives, land conservation, and equestrian support she serves or has served on boards for institutions aligned with those fields.

A: Yes. In October 2013 her vehicle was involved in a collision that killed an 86-year-old passenger in the other vehicle. Jacqueline pleaded guilty to reckless driving and was fined; major news outlets covered the incident.

A: The bulk of her wealth is tied to her ownership share in Mars, Inc., a private multinational with major lines in confectionery, pet care, and packaged foods. Estimates adjust for private company valuation assumptions, real-estate holdings (Virginia farms), and likely non-public investments.

Conclusion

Jacqueline Mars stands as a rare example of wealth used with restraint, intelligence, and Purpose. Her influence is not measured by social media followers or media aspects, but by the lasting institutions and protected landscapes she supports.

Throughout decades of careful control, she has ensured that Mars, Inc. remains a private, family-led achiever, while using her wealth to fund cultural, educational, and care initiatives. Even if through land safety, arts patronage, or rider excellence, she blends legacy with modern impact.

Her story teaches that Authority Doesn’t Require Noise. True influence lies in discipline, focus, and continuity. In a world of short-term clarity, Jacqueline Marc’s long-term legacy, a cue that the most powerful often speak in silence.